da-kuk

Introduction

I’ve covered Taiwanese electric scooter company Gogoro (NASDAQ:GGR) several times on SA so far, the latest of which was in October. Back then, I said that revenues and margins were continuing to grow despite a challenging market environment due to COVID-related restrictions and that I expected the situation to improve in the coming months as Taiwan was ending its quarantines for travelers in October.

Well, it seems that I was overly optimistic as Q3 2022 revenues inched up by just 1.5% year on year and the company slashed its full-year guidance once again. Gogoro complained about challenging macroeconomic conditions and almost all of its revenues for the year are expected to come from Taiwan. Let’s review.

Overview of the Q3 2022 financial results

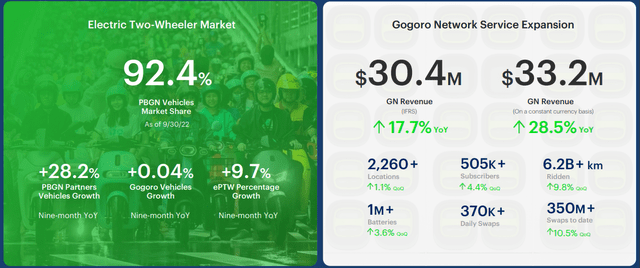

In case you haven’t read any of my previous articles about Gogoro, here’s a quick description of the business. The company was established in 2011 and is the largest seller of electric scooters and battery packs in Taiwan with a market share of over 90%. About a third of revenues come from services under a subscription-based model as Gogoro has built a network of over 2,260 battery swapping stations and 505,000 subscribers. In my view, the company has efficiently used its first-mover advantage in this market, and it seems that there isn’t any competitor that could challenge it in the near future.

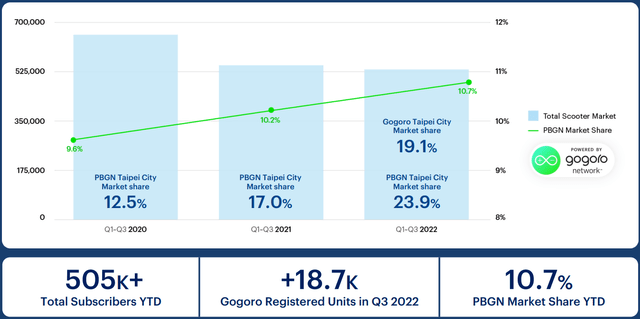

However, it seems that further growth could be challenging as the number of monthly subscribers for its battery swapping business has grown by less than 5,000 since August and the scooter market on the island has been shrinking since the COVID-19 lockdowns began. Scooter sales in Taiwan are down by just over 10% year on year for the first nine months of 2022. The decrease compared to the same period of 2020 is close to 20% and the penetration rate of electric scooters isn’t rising at a significant pace.

Gogoro said during its Q3 2022 earnings call that it’s working with several well-known international food chains to convert their delivery fleets in Taiwan, but I don’t expect this initiative to have a large impact on its sales.

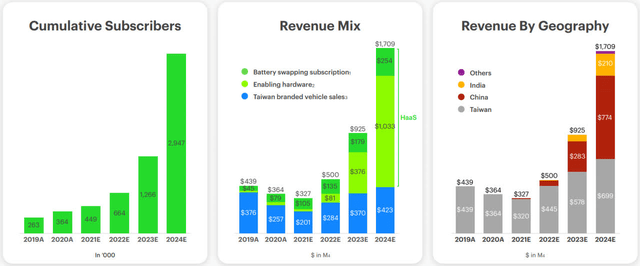

Back when I first wrote about Gogoro in May, the company expected a significant share of its 2022 revenues to come from China as it was accelerating its international expansion.

Unfortunately, the growth plans for China have been derailed by COVID-19 lockdowns as well as macroeconomic, and geopolitical factors and Gogoro now expects almost all of its revenues for this year to come from Taiwan. And it seems that I was too optimistic about the impact of the end of quarantines for travelers in Taiwan in October as Gogoro has slashed its revenue guidance for the full year to $370 million to $390 million compared with $380 million to $410 million three months ago. Looking at the operations in other markets, Gogoro has a small presence in Israel, South Korea, and Indonesia and is working with India’s largest dedicated EV B2B demand aggregator Zypp Electric on a battery swapping pilot in Delhi. However, there are no forecasts for how large international sales could be in 2023 or how much CAPEX the company is willing to commit to.

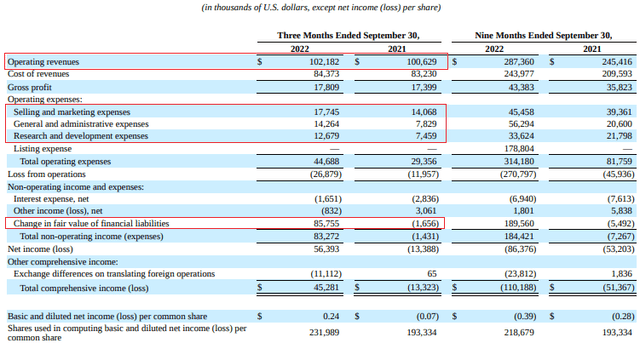

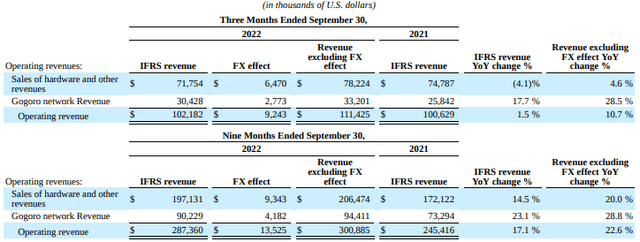

Turning our attention to the Q3 2022 financial results, we can see that revenues rose by just 1.5% to $102.2 million. The adjusted EBITDA slumped by 39.7% to $9.2 million primarily due to higher sales and marketing, G&A, and research and development expenses. The net income stood at $56.4 million but the reason behind this is a significant change in the fair value of financial liabilities, mainly due to a smaller liability on outstanding warrants as the share price has decreased significantly.

The weak New Taiwan dollar was a major headwind once again and revenues rose by 10.7% on a constant currency basis. However, this growth rate still seems underwhelming compared to the plans Gogoro had at the time of its listing. In my view, one of the few bright spots in the quarterly financials is that the revenues of the battery swapping business rose by 28.5% on a constant currency basis.

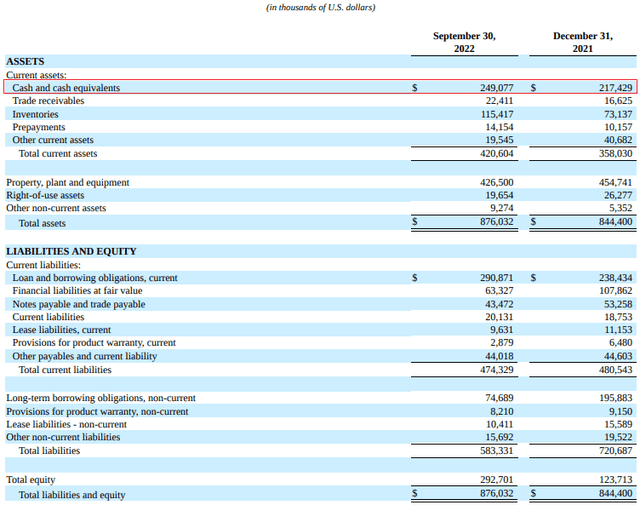

Turning our attention to the balance sheet, the situation looks good as Gogoro finished September with $249.1 million in cash thanks to a $345 million syndicated loan announced at the end of the month. In my view, the company is well positioned to weather a recession as the credit facility has a five-year term, with a two-year extension option. Net cash used in operating activities for the first nine months of 2022 was $69.1 million.

Overall, I think that the Q3 financial results of Gogoro were in line with expectations but I’m disappointed by the soft revenue guidance for the full year as the international expansion seems to have stalled, especially in China. With global macroeconomic indicators continuing to deteriorate, I’m changing my rating on Gogoro to neutral. That being said, I will continue to follow this company closely and I might become bullish once more depending on the updates about the international expansion plans.

Investor takeaway

In my view, Gogoro has developed a strong business in Taiwan, and I was optimistic about its financial performance in Q4 as COVID-19 lockdowns wind down. However, it seems that the effect will be muted by challenging macroeconomic conditions and weak scooter sales on the island. In addition, costs keep rising despite issues with the expansion in China and it seems that it could take a while for the company to resume its rapid growth.

In my view, Gogoro is an interesting company but sadly there are no catalysts on the horizon and there could be a tough year ahead. I think risk-averse investors should avoid this stock.

Be the first to comment