joebelanger/iStock via Getty Images

Fundamentals

Today, March 15, 2022, the Russian invasion of Ukraine continues. Russia has asked China for military aid, probably financial aid and drones. The conflict may be spreading. China is under a lockdown for one city and some ports due to another wave of COVID infections. This is adding some additional supply chain constraints, which contribute to rising inflation. Inflation appears to be running at about 10 percent. If China and Russia start to act more in concert, the West could face severe impact in terms of food and energy supplies.

Interest Rates

The Fed will probably announce a quarter point increase. A surprise will be anything higher than a quarter point. The market is pricing in about 25 basis points.

We are watching the yield curve between the 2- and 10-Year Notes.

“The curve is beginning to invert,” Equity Management Academy CEO Patrick MontesDeOca said. “An inversion usually is a sign that a recession will follow a few months later.”

Supply Chain Restraints

The supply chain for many goods appears to be getting worse again, particularly food. Russia and Ukraine supply a significant percentage of the world’s wheat, about 30%, in part because the US shifted to producing corn due to subsidies for ethanol production. The Americas are also facing severe droughts, which is hurting production of wheat and grains. Russia is also the second largest oil producer in the world, and produces huge amounts of natural gas.

“For all the talk of green energy,” MontesDeOca said, “there is nothing that can replace crude oil and natural gas at this time. We are moving into a green economy, but for now, it is in the distant future.”

Crude oil went from -$37 to $130 a barrel in two years. The Ukraine conflict can be seen as a war over control of crude oil and natural gas, especially in the Sea of Azov region.

It begins to look like the 1970s when we had an oil embargo. Gas prices shot up and with it, inflation. In California, gas has already hit almost $7 a gallon.

Sanctions are collapsing the Russian economy and now China may get involved. The global economy is under great strain. This is leading to a lot of volatility in the markets. As traders, we try to see where opportunities lie in the current historic situation. There are historic opportunities unfolding.

Technical Perspective/ Standard Deviation

Gold

Gold is breaking down to $1,916. It is trading below the Variable Changing Price Momentum Indicator (VC PMI) Buy 2 level of $1,924. It is down $44. Gold made a high of $2,078 on March 8 on news of the Russian invasion of Ukraine before coming down from that high. Now it appears to be in an oversold condition. We want to see the market revert. It could come down to the Buy 2 level of $1,892, which has a 95 percent probability of a reversion back up from that level. A close above $1924 would activate a buy trigger.

Silver

Silver is holding steady at $24.90 at the Buy 1 daily level of $24.85. The VC PMI expects that a reversion should unfold from this level, back toward the mean. A close above $24.85 will activate a Buy trigger. If it does not activate the Buy signal, do not go short, since the market appears to be entering a major level of support. $24.85 is a major level of support. The Buy 2 level is at $24.44 on a daily basis and the weekly is at $24.36 – a strong harmonic relationship between the daily and weekly numbers. They indicate an area that is a major buying opportunity to go long.

The metals have come down to an extreme level below the mean. As we consolidate down here, there is a very high probability that buyers will come into the market. Silver and gold are at levels where it will be a great time to go long.

Bitcoin

Bitcoin (BTC-USD) is consolidating around the daily average of 38,502 and the weekly average of 39,577. It is in a neutral position and is building support. We are letting the market consolidate and build a foundation for a move to much higher prices.

SPECIAL SITUATION: Featuring Hecla Mining

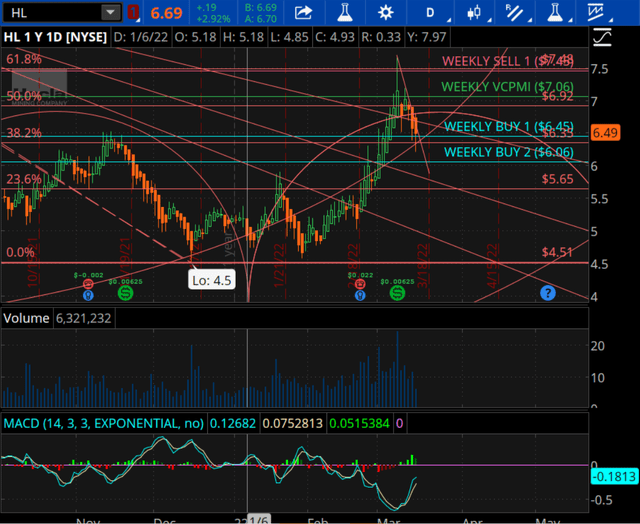

On January 15, 2022, we published a silver report on Seeking Alpha. We discussed buying Hecla Mining (NYSE:HL) shares. We believed then that it is an explosive stock, since Hecla produces about half of America’s silver production. It is the oldest silver mining company on the NYSE. Hecla was at about $5.08 in January when we made the recommendation.

For silver, we trade Hecla Mining. It is potentially an explosive stock. We are recommending to our subscribers to build a position in Hecla. Hecla produces nearly half of the US silver. It is operating North American mines and several pre-development projects for precious and base metals. It is the oldest precious metals mining company in North America listed on the NYSE (HL). We recommend buying and holding Hecla.

Hecla has gone through a 60% Fibonacci retracement since a low of $1.40. It rallied to $6.79 by August. We corrected into October 2020 and then rallied from that $4.48 to $9.44, which was made on May 31, 2021. Hecla has been in a corrective pattern to a low of $4.54 in October 2021. Our indicators show that the correction potentially has been completed. We are looking at a 38.2% correction using Fibonacci arcs. This is a long-term play that we believe you should buy and hold. The company has derivatives and options you can buy to build a position, but we are strongly recommending it as a buy and hold. We are looking at $8.29 as a target. You could almost double your investment in 2022. It is a great opportunity if you want to load up the truck in silver.

“This is a tremendous opportunity to buy the gold, silver and Bitcoin markets, if we do not see four interest rate hikes in 2022,” MontesDeOca said.

The stock then ran up to $7.66, which almost met the target the VC PMI predicted. It then came back down to a level of support. We saw that low as another buying opportunity. The new low was $4.58 before running back up to $7.66 on the first leg of a pattern. This is the first leg of a major move up for Hecla. We now see some profit taking and a move back down to another area of support. This is an area to add to your Hecla position.

We are buying Hecla because of the potential shortage in silver that is on the horizon.

“We have not yet seen the full effect of the supply constraints in precious metals yet,” MontesDeOca said. “I am focusing a great part of my portfolio in Hecla, since we are buying an undervalued silver mining company.”

This is a buy-and-hold stock. We recommend buying Hecla on the dips and holding it for the long term.

The prices of precious metals, gold and silver, still have not yet fully recovered to their real means based on standard deviation, world debt, interest rates, and inflation levels. Expect them all to run up significantly.

Be the first to comment