peshkov/iStock via Getty Images

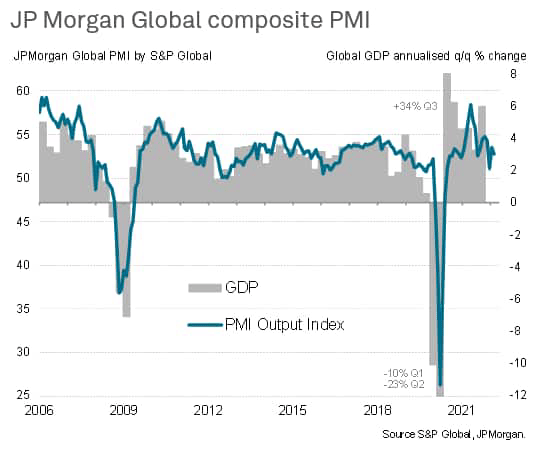

The pace of global economic growth slowed in March, according to the latest PMI data compiled for JPMorgan by S&P Global. The PMI survey data, based on panels of over 30,000 companies in 45 countries, showed output growth at its third-lowest for 18 months, with only August 2021 and January 2022 having recorded a weaker monthly expansion amid the initial spread of the Delta and Omicron variants.

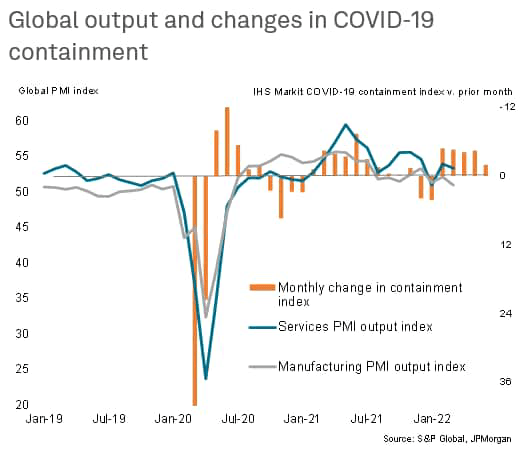

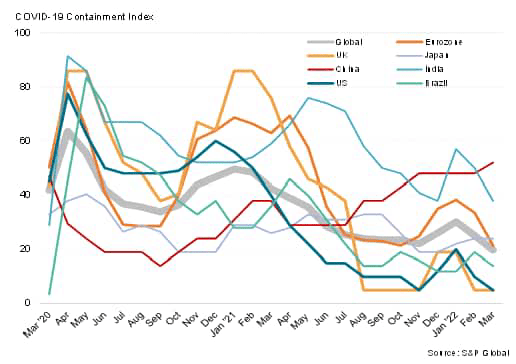

Whereas the start of 2022 had seen COVID-19 containment measures tightened globally to combat the spread of the Omicron variant, February and March have seen the overall degree of containment relaxed worldwide to the lowest since the pandemic began. This easing of containment has benefitted the service sector in particular, growth of which outpaced that of manufacturing.

However, there are marked variations in the degrees of containment around the world, which are driving divergences in economic growth, and it is evident that high levels of infections and health-related precautions are continuing to subdue global growth. The war in Ukraine has meanwhile compounded some of the supply chain and inflationary impacts of the pandemic and also hit business confidence, which adds to downside growth risks in the coming months.

S&P Global, JPMorgan

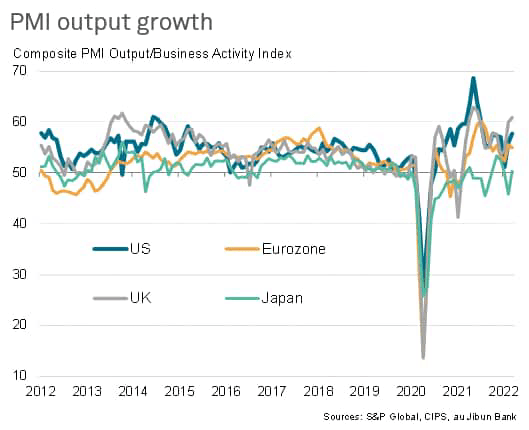

Output slows despite easing restrictions

The JPMorgan Manufacturing Purchasing Managers’ Index™ (PMI™), compiled by S&P Global, fell from 53.5 in February to 52.7 in March. The drop in the index signals the weakest pace of economic growth since September 2020 with the exception of the steep slowdowns in growth seen in August last year and at the start of 2022, when the Delta and Omicron waves led to new COVID-19 containment measures, most notably in the US, Europe, and India. While measures in these countries have since been relaxed again, boosting economic activity in the US, UK, Eurozone, and India (as well as in Brazil), the further spread of the Omicron wave has led to tighter restrictions elsewhere, in particular China.

S&P Global, JPMorgan S&P Global

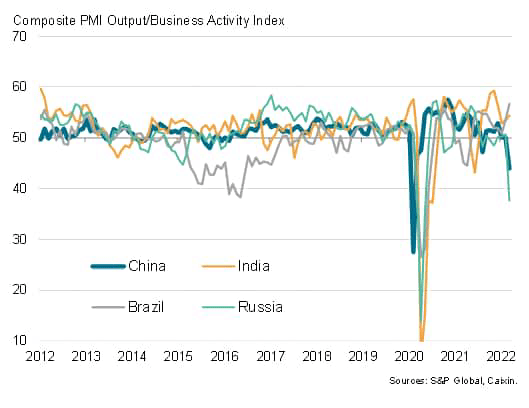

Thus, while PMI surveys indicated accelerating and strong growth in the US, UK, India, and Brazil in March – fueled in most instances by resurgent service sector growth as travel and other health-related restrictions were relaxed or removed, new lockdowns within mainland China led to a collapse of activity only exceeded in the survey’s 18-year history by that seen during the initial COVID-19 lockdowns in February 2020.

War hits Europe

The Ukraine invasion and resulting sanctions have meanwhile led to a steep downturn in the Russian economy. With the exception of the initial months of the pandemic, the contraction of business activity in Russia during March was the steepest since the height of the global financial crisis.

The Russia-Ukraine war also affected growth in the eurozone and neighbouring eastern European countries through a combination of aggravated supply bottlenecks, higher costs (notably for energy), and subdued spending due to increased risk aversion. Eurozone growth consequently lost a little momentum, with manufacturing especially disrupted by the impact of the war to register the weakest expansion so far in the pandemic recovery, offsetting an acceleration of service sector growth.

S&P Global, CIPS, au Jibun Bank S&P Global, Caixin

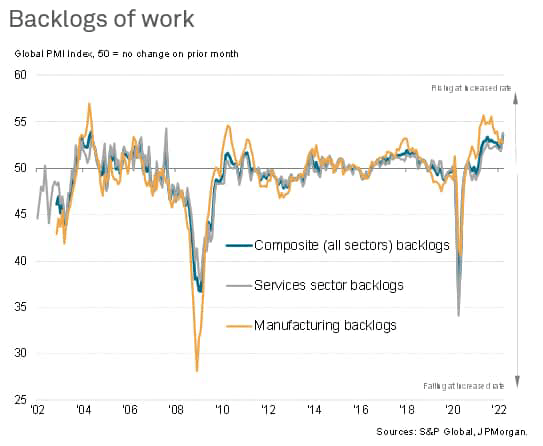

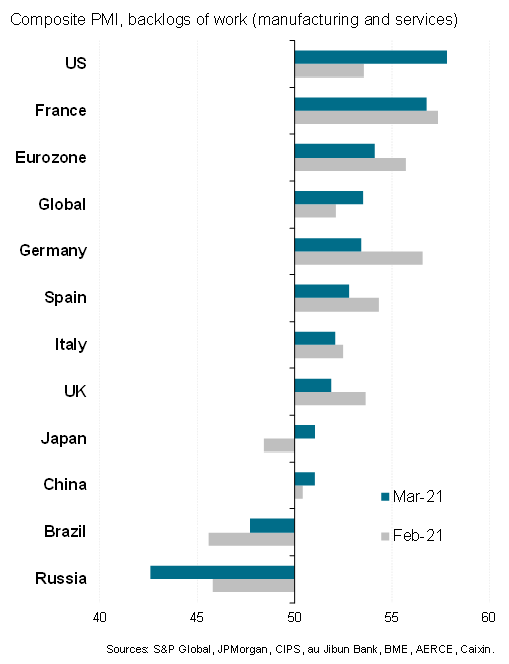

Near-record rise in backlogs of work

The March surveys also found backlogs of work to have risen globally at a rate not witnessed since May 2004, as service providers and manufacturers alike increasingly struggled to meet demand, in turn predominantly linked to materials or labour shortages.

Rising backlogs were most commonly reported in the US – where a record increase was associated with global supply shortages being exacerbated by domestic logistics issues – and across the Eurozone, where the war compounded existing supply bottlenecks.

S&P Global, JPMorgan S&P Global, JPMorgan, CIPS, au Jibun Bank, BME, AERCE, Caixin

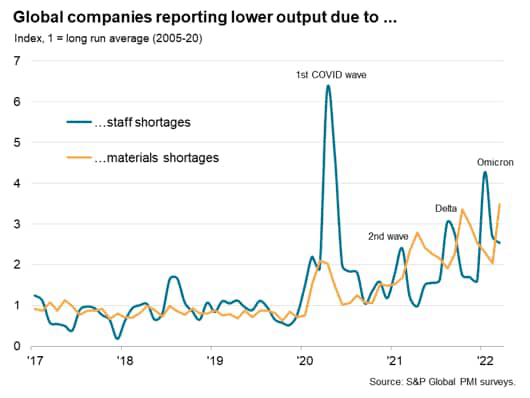

Unprecedented impact of supply bottlenecks

Although the number of companies reporting output to have been constrained by staff shortages has fallen globally since peaking in January at the height of the initial Omicron wave, labour constraints clearly remain elevated by historical standards. The number of companies reporting output to have fallen due to a lack of raw materials or other supplies has meanwhile risen to the highest in the 25-year history of the survey.

S&P Global, PMI Surveys

Prices rise as demand exceeds supply

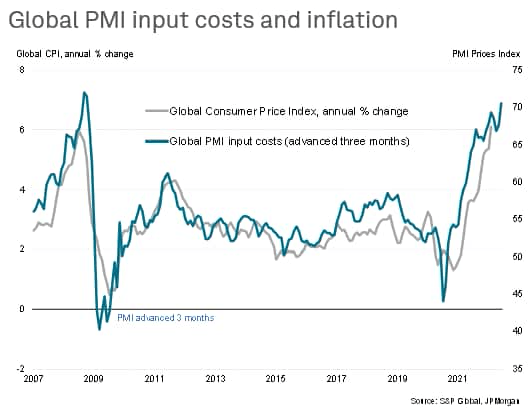

The combination of demand reviving, as many of the world’s major economies, continue to reopen from pandemic-related restrictions, and ongoing supply constraints, both in the form of labour and input supplies, led to further upward pressure on prices – with the Ukraine invasion aggravating the supply shock. Soaring energy prices, rising wages, and broader supplier-driven price hikes were widely reported. Average input costs across both manufacturing and services consequently rose globally at the steepest rate since July 2008. Average prices charged for goods and services also rose at the fastest rate recorded since comparable data were first available in 2009, signalling a further pass-through of higher costs to customers, with rates of inflation rising in both manufacturing and services.

S&P Global, JPMorgan

Optimism deteriorates

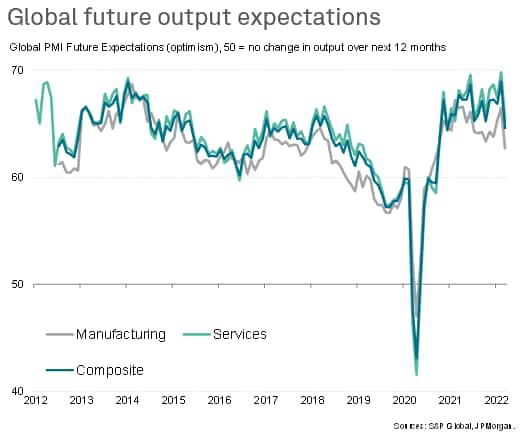

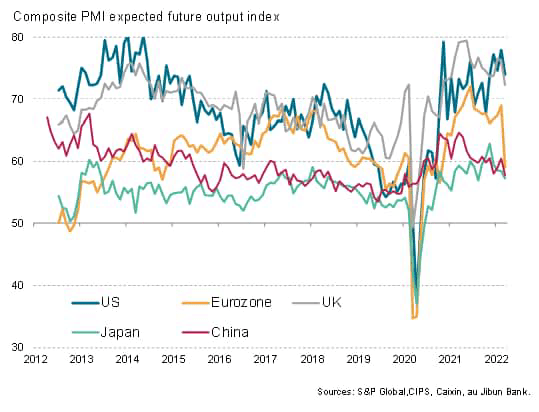

Russia’s invasion of Ukraine has also hit business confidence across much of the world, the impact spreading much further than Europe to represent a bigger jolt to worldwide business optimism than anything recorded over the last decade with the sole exception of the onset of the pandemic.

Of the 45 countries for which PMI data are available around the world, some 84% saw confidence about the outlook decline between February and March. While most of the largest downgrades to expectations were seen in European countries, where the economic links to Russia and Ukraine are strongest, downturns in business confidence were seen in the US and Japan as well as all four ‘BRIC’ emerging markets, with respondents commonly citing the escalating geopolitical uncertainty and the additional supply or price shocks emanating from the Ukraine invasion to have darkened the outlook.

S&P Global, JPMorgan S&P Global, CIPS, Caixin, au Jibun Bank

The survey data, therefore, point to global economic growth being buoyed by the further reopening of economies from the pandemic but reveal an overriding concern that the Ukraine war and ongoing impact of COVID-19 – most notably in China, which is pursuing a ‘zero-COVID’ policy, is subduing the overall pace of expansion while simultaneously adding to global inflationary pressures. The key question for the coming months will be the extent to which the fading effect of the pandemic will offset the headwinds from inflation and the effects of the Ukraine-Russia war, as well as the intensifying pressures for central banks to tighten monetary policy in order to restrain inflation expectations. At present, growth is proving encouragingly resilient, but the March survey data indicate that risks have tilted to the downside.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment