piranka/E+ via Getty Images

Preface

Global-e Online Ltd. (NASDAQ:GLBE) is a software company designed to help businesses manage the end-to end complexities of cross border e-commerce, solving what we are naming, as of today, the “complexity-chain.”

We share a nearly full establishing dossier below with several which include highlights from our expert channel interviews and highlights from our one-on-one conversation with the CEO:

- Warning and Perspective

- Snapshot

- Company

- Customers

- Thematics

- Expert Channel Check – Expert Opinions and Feedback

- Financials

- Recent Acquisitions Signal Winner Take-All Market

- Risks and Competition

- Highlights from Conversation with the CEO

- Conclusion

Warning and Perspective

We note that a capital raise is possible given the company’s recent acquisition of Borderfree (discussed below). We also note that, in slightly overstated terms, inflation is the “only” thing that matters in the short-term.

We quote “only” simply to note that of course there can be idiosyncratic news that matters, but roughly speaking, it’s about inflation for now.

It’s not apparent to us yet that there is an immediate catalyst for small to mid technology growth to rise, and we note that cross-border e-commerce could suffer from recessionary risks not just in the United States, but globally.

Finally, intellectual adults make their own decisions, and we write for intellectual adults.

Snapshot

GLBE operates at the forefront of global cross-border e-commerce, which is being transformed by technology, internet adoption and the rise of social networks connecting the world.

Its software works to solve what we have decided to call the “complexity chain” of cross-border e-commerce; it’s a difficult problem in an enormous market, which makes for an equally large opportunity with risk of failure.

We see the complexity-chain much like a supply chain – a hyper-reliant web of phenomena which can only work as a whole when each part works on its own.

From language, currency, and payment methods, to shipping, taxation, import duties, and returns, the complexity-chain is so tightly woven that a gold mine sits unfettered for the company that can solve it and present itself as a turn key solution.

GLBE has shown and is expected to continue to show hyper growth, with revenue growth in excess of 59% for 2022, 45% for 2023 and 50% in 2024.

The company is partially owned by Shopify (SHOP) through late-stage investments and warrants and has an exclusive deal such that Global-e and Global-e alone can act as Shopify’s all-in-one third-party cross border e-commerce solution.

GLBE has also partnered with Facebook (META) and its hundreds of thousands of merchants across the globe.

It’s a company that is founder-led, with a leadership team and board of directors that bring myriad skills and backgrounds from retail and fashion to logistics and commercial banking.

Our interactions with experts have substantiated our belief that conversion rates rise once GLBE is implemented, switching costs are high, it is easy to use, it is a company with high quality support and development resources, and that margins could improve.

The expert interaction also led us to understand that the greatest risk to GLBE long-term is in fact a simplifying of the complexity-chain by the World Trade organization (WTO), rendering GLBE’s solution less useful, but other than that, the other solutions on the market are both limited in number and in capability.

Expert feedback we sought was from the head of global eCommerce at Mark Jacobs, a GLBE customer of three-years, and GLBE’s first non-founder employee who acted as CIO.

Company

Global-e aims to and claims to be the world’s leading platform to enable and accelerate global, direct-to-consumer cross-border e-commerce growth.

The company operates from seven offices worldwide and is the chosen partner of hundreds of retailers and brands across the United States, Europe and Asia.

GLBE’s software is designed to help businesses manage the end-to end complexities around selling internationally solving problems like pricing, duties (calculation and remittance), shipping, logistics, and localized messaging.

We will dive into the difficulties surrounding cross-border e-commerce in rather more detail near the conclusion of this section and from here forward will give it our own name – the complexity-chain.

According to the company, this basket of functionality has helped GLBE deliver higher conversation rates to customers when addressing internationally shoppers and we have feedback from customers and its former CIO that this is true.

Fundamentally, GLBE claims its platform does this:

… makes selling internationally as simple as selling domestically.

The platform provides a mission-critical, integrated solution that creates a localized and frictionless shopper experience and is simple to manage, flexible to adjust and smart in its local market insights and best practices.

The vast capabilities of the end-to-end platform include interaction with shoppers in their native languages, market-adjusted pricing, payment options tailored to local market preferences, compliance with local consumer regulations, and requirements such as customs duties and taxes, shipping services, after-sales support and returns management.

We will touch on the ‘why this matters,’ near the conclusion of this section with hard numbers.

All of these elements are unified under the Global-e platform to enhance the shopper experience and enable merchants to capture the cross-border opportunity.

GLBE has shared that its churn is very low – less than 2% annually for the last three years. Low churn has been substantiated by our expert calls.

The company began its operations with merchants based in the UK, and then expanded across continental Europe and to North America.

The company has reported that the U.S. market is growing faster than the U.K. and Europe while at the same time noting that the world is a very big place in the realm of e-commerce.

The company has called out the Asia Pacific region (APAC) as a burgeoning market.

Two quarters ago the company launched its first APAC-based merchant, Theory Hong Kong which is part of the Fast Retailing group and also opened a new office in Tokyo.

So, let’s talk about the “complexities” of cross-border e-commerce and why those complexities matter to the bottom line for GLBE customers.

— The complexity-chain Many merchants are not able to convert their international traffic into actual sales.

This is because of the many structural barriers that stand between them and their international shoppers, who rightfully expect a seamless and localized shopping experience.

We can start with the rather obvious cross border complexity; language.

Shopify claims that localized language matters most, and further, when going native with a site’s language, it must go beyond Google Translate.

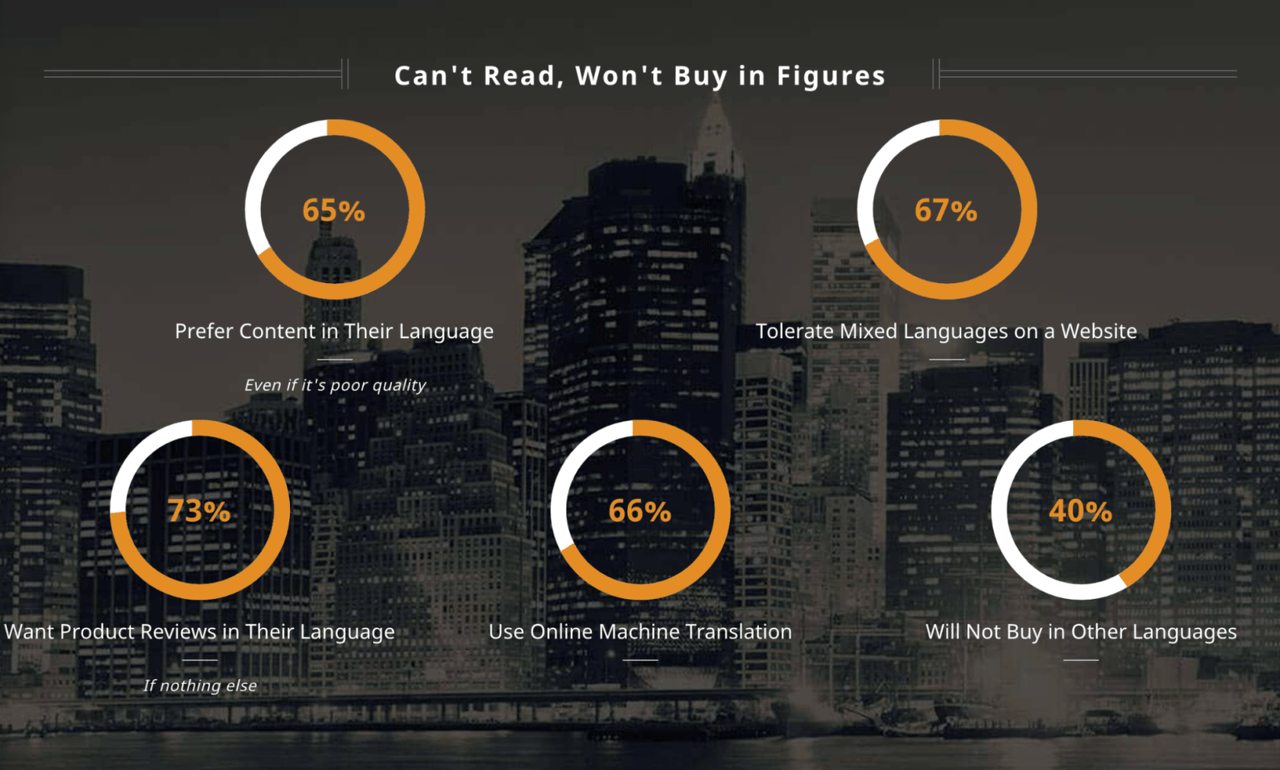

Based on a survey of 8,709 global consumers in 29 countries, CSA Research found that 65% of consumers prefer content in their language, even if it’s poor quality.

Moreover, 40% will not buy from websites in other languages.

Here are those numbers and few more in a graphic

Language Matters (Shopify)

(For those interested, here is an article entitled “20 Epic Fails in Global Branding” which shares how classic brand marketing blunders show that globalization isn’t always as easy it seems.)

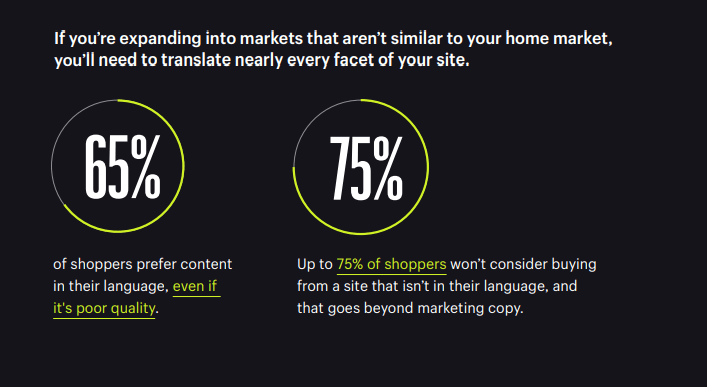

This is yet another graphic which gets to the importance of language, reading that 75% of shoppers will not consider buying from a site that isn’t in their language.

Language Matters (Shopify)

GLBE supports local messaging in over 25 languages.

But, while language is an obvious complexity, there are less obvious ones which are equally as crucial to solve.

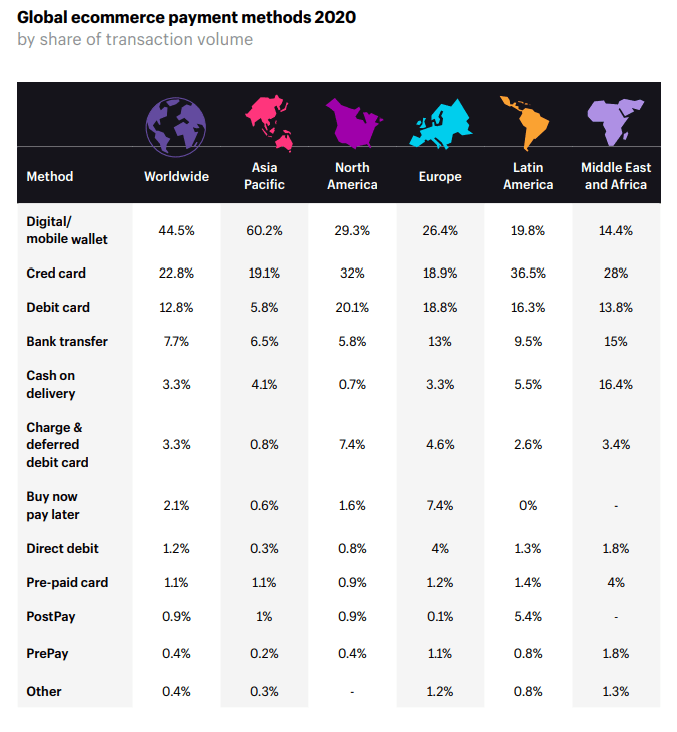

Every region still has its own preferred payment methods.

Ninety-two percent of shoppers prefer to make purchases on sites that price in their local currency.

But the workarounds, apps, or third-party gateways that enable businesses to sell in multiple currencies aren’t always reliable.

It’s no surprise that in North America, credit cards are number one while digital payment systems like PayPal and Apple Pay are a close second – but that isn’t true of the rest of the world.

A total of 60% of shoppers in APAC countries use e-wallets.

In Germany only 19% of online shoppers prefer to use debit or credit cards. But cash on delivery is a top choice in Eastern Europe, India, Africa, and throughout the Middle East.

Similarly, direct debit is a ‘must have’ if a company is targeting India, Africa, or Asia.

Here is a rather large image the dives into the preferences we touched on above.

Global e-commerce payment methods (Shopify)

Language and payments may seem complex enough, but there is more.

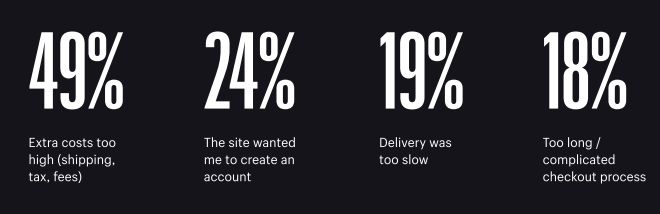

Shipping is a significant part of the customer experience. A total of 19% of shoppers will abandon cart if shipping is too slow, but almost half will abandon cart if additional fees like shipping and taxes are higher than expected.

Here is an image with those metrics and a few more.

Shipping is a significant part of the customer experience (Shopify)

Simplifying language, payments, and shipping still isn’t enough for cross border e-commerce to work.

Complying with laws and licenses is not only a complexity, it’s a full-blown non-starter if not addressed, but companies can encounter legal requirements that look different in each country.

Then there are customs or duties (the tariffs or taxes a government levies on the international sale of goods).

Duties are not a fixed percentage, but are determined by key information on customs forms and are calculated differently in each country.

Some key factors include quantity and value of the items being shipped, cost of shipping, class of goods, and insurance.

GLBE’s software addresses each of these issues.

The company also offers its “Smart Insights.”

The scale and sophistication of the GLBE platform relies on its data and its applications, which the company refers to as “Smart Insights.”

GLBE’s Smart Insights are country-, price-point- and vertical-specific and focus on shopper behavior.

These insights are deepened every time potential shoppers enter the merchants’ online stores, whether or not they make a purchase, allowing GLBE to gather additional data points along their journey.

The value of the company’s massive and fast-growing data asset is due to its depth and breadth.

This is the start of a moat.

Based on this data, GLBE enjoys both economies of scale and economies of skill, which enable the company to optimize merchants’ cross-border sales on a market-by-market basis.

The company believes that by leveraging its SmartInsights, merchants can provide highly-optimized experiences for shoppers, driving increased conversion and revenues.

When we actually list the complexities involved in cross border e-commerce and then note that every company must multiply these challenges by 50 or 100 markets, it becomes nearly impossible to overcome.

This is the Global-e pitch.

Finally, we can turn to the crucial partnerships GLBE has formed.

Shopify is a partner and a large shareholder of GLBE.

Several quarters ago the company noted that it was on track with the rollout of its newly established exclusive strategic partnership with Shopify and it would have a material impact on revenue starting in the second half of 2022.

The company is working together with Shopify on a new and deeper integration into the Shopify platform and checkout, which is expected to be finalized later this year

We also note that GLBE has partnered with Facebook:

Facebook and Global-e: A partnership to drive international online success.

This is the Global-e story.

Customers

Global-e operates from seven offices worldwide and is the chosen partner of hundreds of retailers and brands across the United States, Europe and Asia like Hugo Boss, Marc Jacobs, Tag Heuer, Sephora and Rimowa.

Expansion for GLBE into new verticals does require a certain fit, namely products that ship well, are lightweight, and have fewer regulations.

One category the company does address as a clear expansion opportunity is consumer electronics.

Diving into Shopify, GLBE has alluded to the fact that Shopify tried to go it alone and then realized that piecemealing integrations for larger merchants wasn’t working and turned an opportunity into a problem.

GLBE has noted that while its opportunity sits in the top 1% of Shopify’s customers, those same customers represent about 30% of Shopify’s cross-border GMV.

This partnership should bear fruit in the second half of 2022 once GLBE’s development work to integrate with Shopify’s backend is complete.

We view the warrants attached to the exclusive deal as a positive – assuring that the two entities are motivated to work together – what we might call ‘an optimized negotiation’ as opposed to a ‘tough negotiation.’

Thematics

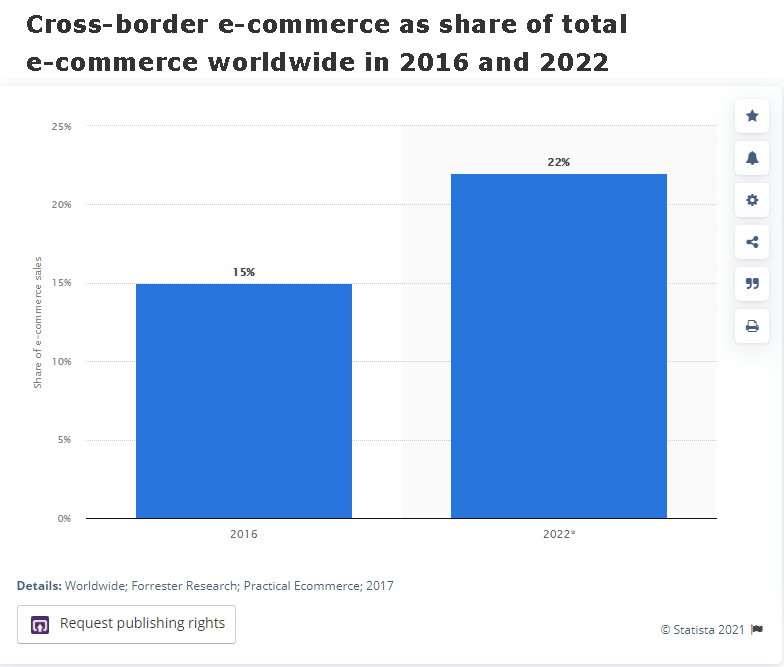

Let’s start with cross-border e-commerce as share of total e-commerce worldwide in 2016 and 2022.

cross-border e-commerce as share of total e-commerce worldwide in 2016 and 2022 (Statista)

This graph shows the cross-border e-commerce as percentage of total e-commerce worldwide.

In 2022, cross-border e-commerce is projected to account for 22 percent of e-commerce shipments of physical products. In 2016, the cross-border e-commerce market share was 15 percent.

But that’s a share of the total, so let’s turn to the total size of the opportunity.

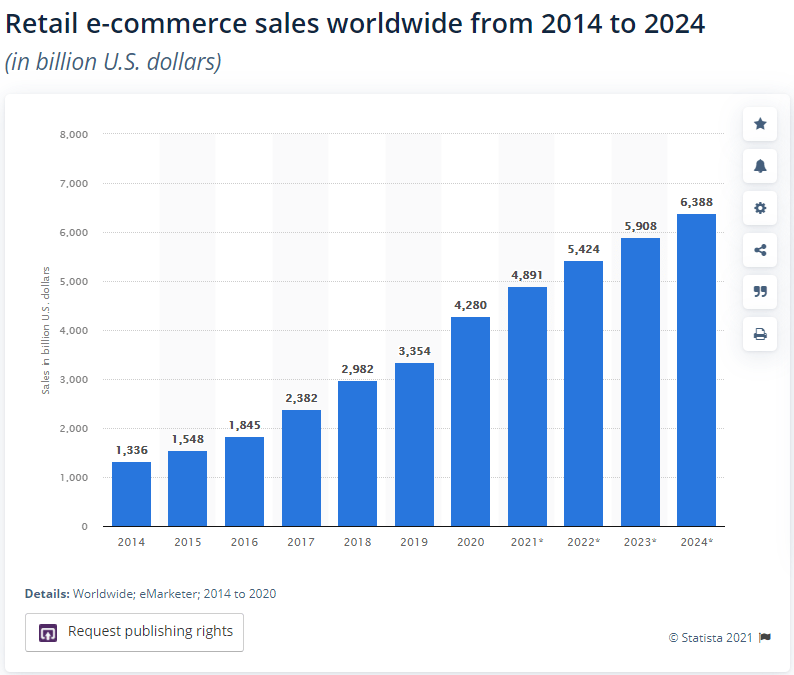

In 2020, retail e-commerce sales worldwide amounted to $4.28 trillion and e-retail revenues are projected to grow to $5.4 trillion in 2022.

Here are those words in a chart:

retail e-commerce sales worldwide (Statista)

We can turn to another source for some forecasts.

According to another source the global cross-border B2C e-commerce market was $780 billion in 2019 and is expected to grow at an annual CAGR of 27% and to reach $4.8 trillion by 2026.

And, according to eMarketer, online retail sales will reach $6.39 trillion, with ecommerce taking up 21.8% of total retail sales.

So, there we have it, from various sources. E-commerce is exploding and cross-border e-commerce is taking a larger share of an already exploding thematic.

Expert Channel Check – Expert Opinions and Feedback

In this section we will share what we learned from experts. This is a new section to CML Pro dossiers and will become a larger part of what we share explicitly to members, rather than rolling it into the analysis implicitly.

All text written with “[CML Analysis]” is our insight from expert responses.

First, we spoke with the Vice President E-commerce for Marc Jacobs, a GLBE customer since 2018.

Second, we had a chance to explore some feedback from GLBE’s former CIO, who was in fact GLBE’s first non-founder employee.

First Expert – Experience• Three and a half years running global eCommerce at Mark Jacobs; the platform and technology, the development resources, internally and externally; payments and fraud and customer service, logistics, warehousing.

First Expert – Takeaways• The alternative to GLBE would be (1) piecemeal approach, tying in various companies for payments, shipping, returns, customs, duties, etc. and (2) a completely managed site on top of the site where there’s a heavier solution like Borderfree.

• GLBE fits in between these two versions of the world, a sort of “Borderfree light.”

[CML Analysis: GLBE faces various forms of competition, but an all-in platform versus a piecemeal build is the real decision that needs to be made by enterprise.]

• Expert says that the best part of GLBE is “it works well.” It would take a lot of cost increases from GLBE to replace it. Expert’s favorite portion of the platform is their checkout – which is localized in 15 or 20 languages with hundreds of local payment options. He notes the vast differences in payment behaviors by geography, so there is no one-size fits all option — a solution must offer exactly what is used per geography.

• Expert also noted that he deeply appreciates that GLBE has great development resources and were committed to doing the onboarding with him. “They have great resources to help.”

[CML Analysis: GLBE sounds like it is easy to use, and that is an important part of the bullish thesis.]

• When implementing GLBE, almost overnight between the old solution and global-e he saw conversion rates rise by 40%.

[CML Analysis: Yet more evidence that GLBE’s claim to higher conversion rates is in fact true.]

• With respect to margin pressure we asked:

I think global-e has a two-tiered pricing system. Something like for professional and enterprises and other experts have said the largest enterprises are paying about 5% to global-E with a bit of negotiation. If we take out the largest part, which is the payment providers [about 3%] that means the rest of the complexity chain is not costing customers very much for quite a robust solution from global-e.

My question is actually in reverse.

As a customer, I can see why this is fantastic.

For Global-e, I’m not sure it is.

It looks as if the margins are tight and if Global-e tried to widen those margins, all of a sudden it could bring into the situation the possibility that a customer might say, “you know what, maybe we should piecemeal this.”

How do you see it?

• Expert noted that there is space between what GLBE charges and where he wants the headache. Even went so far to note that a doubling in GLBE price might spark an investigation into an alternative product, but even that would not be an automatic change of vendor.

[CML Analysis: This is not necessarily a race to the bottom on margins, which is absolutely crucial to the bullish thesis and in fact, there may be margin upside.]

• When asked about the frequency of reviewing GLBE as a vendor, and broadly how the industry looks at it, while noting that all good leaders review vendors every year, GLBE is far down the list in the roadmap of what to replace, again noting, because it works, he doesn’t want to fix it, and GLBE is responsive to requests.

[CML Analysis: Retention rates should be high, meaning customer growth is the most important metric going forward. GLBE has confirmed this with published retention rates.]

• When asked about the time and effort it would take to replace GLBE, expert noted 8-12 weeks of difficult work including development, price books, etc. It’s not the most difficult thing in the world, but not something that is fast and easy.

[CML Analysis: Switching costs aren’t astronomical but they are substantial.]

• Expert agrees that the Shopify partnership was good press for GLBE, even for non-Shopify customers (like him). There is increased visibility and trust that GLBE is not going out of business and Shopify has validated their quality of product.

• Expert noted that the greatest risk to GLBE is if the Word Trade organization (WTO) were to address the complexity chain head on to deal with unified taxes, and rules. Further noted a risk would be a consolidation in the shippers, like DHL / FedEx/ UPS, unifying shipping globally.

[CML Analysis: If the complexity chain is simplified, then the solution is less needed.]

• I asked:

Now let’s say I am a big European seller and I want to be in 150 countries, but the US is the US. Isn’t it possible that they would say, well, we’re going to keep our local business, obviously not on Global-e or some other provider, but we’re actually going to build our own thing piecemeal, but with inventories in the US, because the US is the US, it’s not worth giving up 5%.

And then the rest of the world, that’s kind of a little bit here, a little bit there. Maybe that would be for the GLBE platform.

Is that a reasonable way for a large player to think of it?

And that may mean that Global-e doesn’t have access to maybe the singular largest international markets because of that kind of analysis.

• Expert noted that, hypothetically yes, that is a fair way to look at the market. But, that even in areas like that, GLBE does have portions of its solution that could still be useful. Further the expert noted that building something piecemeal and building out local inventory is still a very difficult project, even for large enterprises, and is not necessarily worth the trouble.

Expert noted that GLBE is “sticky” once integrated.

[CML Analysis: There is a possible limit to GLBE’s success, but it does not read as material risk across the entire business, rather some very large customers once in a while. This does not prevent a firm from working with Global-e even in its best foreign market. It would just be a slightly less monetized integration.]

Second Expert – Experience• Former CIO of GLBE, first hire after the company founders; was responsible for building the architecture and the technology team, in capacities of VP R&D, CTO, and CIO.

This expert described their experience with GLBE quite fondly; even went so far as to say that when he joined, the company was more of a “word document” with bullet points than a fully formed software company, so he saw it blossom.

Second Expert – Expert Takeaways• The company was founded in the UK and its first customers were actually companies already doing significant cross-border e-commerce in Europe, and GLBE’s approach was to reach them with a better solution.

[CML Analysis: This reinforces the view that GLBE speaks of publicly — while gaining new customers by introducing cross-border e-commerce is on avenue for growth, there is still a large and easier opportunity to sell to companies that are already doing cross-border e-commerce and are open to a better way.]

• Expert notes that even in the early days, the fact that GLBE includes fraud protection with a guaranteed zero fraud impact, was a big selling point.

[CML Analysis: This is a reminder of the fact that an enterprise may not need to appreciate the full stack of GLBE’s platform to switch. Each part of the complexity-chain will have its own focus, depending on the enterprise, and GLBE serves many of those pain points.]

• Expert claims that a portion of the GLBE value comes from data-driven insights — namely the account manager (customer success manager) who proactively looks for the data insights and presents them to the customer. This is an enterprise only product.

[CML Analysis: Same as prior analytical conclusion above.]

• At least when this person was employed, the integration process requires some dev work and GLBE does not charge for this.

[CML Analysis: Easy to work with is a moat building practice. Global-e does differentiate itself as a full-service, white glove platform for on-boarding.]

• Expert claims that even now, GLBE is a start-up at heart and its development roadmap is a weekly push, making it difficult for competitors to catch up since its product is a moving target.

[CML Analysis: R&D expense should stay elevated for the foreseeable future and it might be a good sign. This will squeeze margins in the intermediate-term but should be seen as a long-term plan to improve margins.]

• When reflecting on the largest customer wins, expert said that for the most part it started with GLBE working on the worst markets (smallest markets) for that customer, proving its value, and then expanding to more core markets for that customer.

[CML Analysis: Software is software — land and expand is the business model.]

• Expert addressed the risk of customer graduation, where their most successful countries would then be taken back in house to save costs. Expert noted that doesn’t happen and further that wouldn’t make sense due to higher conversion rates with GLBE.

[CML Analysis: Confirms point of view of prior expert and it does help ease the concern that more success would breed smaller clients for GLBE.]

• Expert sees GLBE’s largest competition from Flow.io and eShopWorld, but does not see any obvious new market entrants in the near term.

[CML Analysis: Flow.io is a piecemeal workaround, also integrated into Shopify. This reinforces our view that GLBE is not competing with other all in one platforms, but rather simply the idea of doing cross-border e-commerce differently (piecemeal).]

• Expert reiterates the two tiers of GLBE. One is called professional the other enterprise, where professional is for smaller clients that would likely simply plug in from Shopify or Magento and get about 80% of the GLBE functionality — which would suffice. This is a higher cost platform. The enterprise tier is less expensive since the deals are larger (as measured by GMV) and that tier includes the data-driven analysis.

[CML Analysis: GLBE’s partnership with Shopify for the SMB world seems rather prescient and a rather big deal while allowing GLBE to go after the whales in the enterprise space.]

• Expert says that while GLBE is excellent at bettering conversion rates, he sees opportunity for the company to work with top of funnel — i.e. marketing — and offer that as a service.

[CML Analysis: Add-ons do appear to be the best chance for investors to see margin expansion and it is a natural fit for an all-encompassing platform. This is very much the land and expand version of the software world.]

• Expert believes that with newly found cash from IPO, that some acquisitions may be in play so GLBE can accelerate new services growth.

[CML Analysis: Smart acquisitions are… smart. Dumb acquisitions are… dumb. We look forward to margin expanding acquisitions.]

• Expert still sees the U.S. market as the largest, but does reiterate that Asia-Pacific (APAC) is a booming and wide-open market as well.

• Expert does not see Amazon (AMZN) as direct competition, and even, in the long-run, as a potential partner.

[CML Analysis: I wouldn’t hold my breath on a partnership with Amazon.]

Financials

While software sounds like a high margin business, it’s not quite that way for GLBE.

But due to the nature and complexity of the problem GLBE aims to solve, we see gross margins of 37.5% with analysts targeting a long-term goal of about 40%.

That means we will see operating margins far smaller than a standard software company which itself can be as high as 35%-40%.

With GLBE, we’re likely looking at a long-term operating margin of about 20% – 25%, so about 60% of a normal software company.

This implies that if we are going to use enterprise value (EV) to sales as a measure of valuation, we need to nearly double GLBE’s number to make it comparable with what our minds are used to computing.

And, since we’re on the subject of EV to sales, here we go:

At an $3 billion market cap (at a $19 stock price) with $250 million net cash, we get an EV of $2.75 billion.

GLBE delivered $245 million in revenue for 2021 (80% growth from 2020), and growing 59% in 2022, 45% in 2023, and 50% in 2024.

This leads to $858 million in revenue for 2024 per the consensus estimate.

Ultimately this yields an EV:sales of 10 in the trailing twelve months and 3.2 for 2024.

Again, this is a lower margin business relative to other software companies, so an apples-to-apples comp would price GLBE at 17x TTM sales and 5x 2024 sales.

We also note that the company delivered positive free cash flow in 2019, 2020, and 2021 of $6.8 million, $28.9 million, and $12.9 million for each year respectively and estimates call for $39.1 million in 2022.

The company just announced Q1 2022 results with guidance for the rest of the year.

Here are some highlights:

• GMV1 in the first quarter of 2022 was $455 million, an increase of 71% year over year

• Revenue in the first quarter of 2022 was $76.3 million, an increase of 65% year over year, of which service fees revenue was $31.9 million and fulfillment services revenue was $44.4 million.

• Non-GAAP gross profit in the first quarter of 2022 was $29.9 million, an increase of 94% year over year. GAAP gross profit in the first quarter of 2022 was $27.2 million

• Non-GAAP gross margin2in the first quarter of 2022 was 39.1%, an increase of 580 basis points from 33.3% in the first quarter of 2021. GAAP gross margin in the first quarter of 2022 was 35.6%

• Adjusted EBITDA in the first quarter of 2022 was $3.3 million compared to $5.2 million in the first quarter of 2021

• Net loss in the first quarter of 2022 was $53.6 million

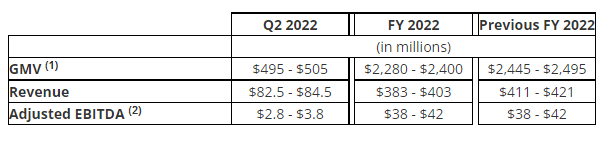

We share the guidance for full year 2022 as a table provided by the company”

GLBE guidance (Global-e)

Recent Acquisitions Signal Winner Take-All Market

On 11-24-2021 GLBE announced the acquisition of Flow Commerce.

The competition for GLBE comes from three sources:

• Other all-in-one platforms

• Piecemeal solutions that each address one part of the complexity chain, and when taken together, address the entire chain.

• The World Trade Organization (WTO) addressing cross-border taxes, duties, and rules and therefore simplifying the complexity-chain, would hypothetically make GLBE’s all in one solution less attractive. (We don’t have anything to add to this risk – we’re OK with it.)

Our expert channel (partially discussed above) showed us rather little issue with the first form of competition, for now.

The second form of competition was non-trivial, and the leader in this space was a company called Flow Commerce.

Yep. That Flow Commerce.

Ah, but it gets better.

The all-in-one solution from GLBE really fits enterprises best, because those firms face such an overwhelming multiplication of the complexity-chain, that going piecemeal is rather difficult (take the complexity-chain and multiply by it the number of countries an enterprise wants to sell in, and you have an absolute need for a plug and play solution).

But, for SMB e-commerce companies that want to reach maybe one or two larger markets, like a UK company looking to reach the U.S., the piecemeal solution isn’t that large of an undertaking (hypothetically).

Now, GLBE is both the solution for the enterprises and the solution for SMBs.

You can see what GLBE is trying to build — the “everything” solution.

On 6-21-2022 GLBE published this press release: Global-e to Acquire Borderfree Cross-Border ecommerce Service from Pitney Bowes.

The quick takeaways of that acquisition are the following:

• GLBE acquired the Pitney Bowes (PBI) Borderfree cross-border ecommerce solutions business.

• Borderfree helps retailers enter new global markets by localizing their domestic website in 200+ countries and territories, simplifying compliance and regulations processing.

• In addition, the companies will begin a strategic partnership and commercial relationship whereby Pitney Bowes will provide cross-border ecommerce logistics services to Global-e and its clients. In turn, Pitney Bowes clients will receive access to best-in-class cross-border solutions on the Global-e platform.

• Global-e will acquire Borderfree for approximately $100 million, financed with cash. Borderfree is expected to generate in excess of $40 million in revenues in calendar year 2022. The transaction is expected to close during Q3 2022, subject to customary conditions.

But that’s not the news, or as we are wont to write, that’s not the story.

On 5-15-2015, PBI acquired Borderfree for approximately $400 million in cash.

Now we see seven years later that PBI has sold that company to GLBE for just $100 million.

Pitney Bowes is a global shipping and mailing company that provides technology, logistics, and financial services to more than 90 percent of the Fortune 500.

This effort into cross-border e-commerce should have worked for PBI. (They are selling it at a loss.)

In fact, this is essentially a fire sale to GLBE, giving up on the software side and focusing solely on logistics.

Given that Flow sold to GLBE as well, we believe that this is starting look like a winner take all industry.

Keep in mind that in the presser for the GLBE acquisition of Borderfree, it was very clear that PBI still wants to do logistics, they just gave up on the software side.

Pitney Bowes is excited to form a strategic partnership with Global-e to further extend our suite of Designed™ Cross-Border services as Pitney Bowes continues to grow and invest in our advanced suite of ecommerce logistics services for delivery and returns.

Merchants will benefit from the combination of Global-e’s best-in-class cross-border localization technology and best-in-class ecommerce logistics capabilities from Pitney Bowes a strength we will continue to build globally.

It appears that scale is everything for this trillion-dollar segment of e-commerce, meaning that in order to solve “the complexity chain” as we have named it, substantial focused effort and resources are required.

Borderfree was a side project for logistics giant PBI.

If it was only “very difficult” for PBI to succeed with a software side to its scale logistics business, the company would have done so.

But it’s apparently more than “very difficult.”

While that isn’t a patent, it is a moat.

This thing, this cross-border e-commerce, this “complexity chain,” is so hard to solve that once done, we may have one runaway winner.

If this is a winner take all industry (on the software side,) it sure feels like GLBE is that winner.

Please note that an alternative view of these acquisitions is that a one-stop shop for cross-border e-commerce simply cannot stand on its own, and after a string of acquisitions GLBE will fail. That isn’t our view, but we’re writing it down. Intellectual adults make their own decisions and we write for intellectual adults.

Risks and Competition

For a recent IPO, risks are going to be substantial. For a recent IPO that works in cross border e-commerce, risk is going to be… substantially substantial.

The company lists Borderfree (Pitney Bowes), eShopWorld, and Flow.io as direct competitors, while noting that its top competition comes from in direct to consumer (D2C) offerings.

Flow is no longer a competitor – it’s a part of GLBE.

Borderfree (Pitney Bowes) is no longer a competitor – it’s a part of GLBE.

In this D2C realm, the company calls out merchants that do not yet have international operations and merchants that have established their own in-house solution.

Interestingly, the company also notes that this second group of companies is also an easier cohort to sell to because they realize the complexities of the undertaking and many times are now looking to hand it off.

The first group is difficult to sell to because GLBE must both introduce its brand and convey the complexity-chain.

• In the near-term, you could not have chosen a company likely more negatively impacted by worldwide supply chain issues as its entire business is in fact that supply chain. Yet, somehow, since it only relies on air freight, it has side steppe those risks for now.

• The growth of its business depends on its ability to attract new merchants while those same merchants may attempt to build out their own cross-border functionality.

• As worldwide commerce become more complex, so too does GLBE’s work to reduce that complexity. Any single part of the complexity-chain could derail the entire offering.

• To prove success in this field, GLBE has to deliver over 50% CAGR for the next two years (2022 and 2023) and then at least 35% CAGR for the foreseeable future, in our opinion.

• The company has a limited operating history, so we don’t really know where it goes after COVID because we don’t have a long enough history from which to extrapolate the future.

• From what I have read, sales cycles are rather lengthy, unlike the click and sign-up process of Shopify and BigCommerce. After all, we have visited the complexity of cross-border e-commerce, and that means the decision to select a vendor is also likely complex.

• An interesting thing to consider, much like BigCommerce but unlike Shopify, GLBE relies on third-party services, such as shipping partners and payment providers, and we imagine some of these are not as stable as western world investors are used to.

Failures at any point along the ‘complexity chain’ create a failure overall. The company has noted limited redundancy is many markets.

• At any time, if business looks too good, Google (GOOG, GOOGL) or Amazon could pull a… Google and Amazon, as they did on Roku, and suddenly disrupt GLBE’s growth with virtually unlimited resources and data.

Highlights from Conversation with the CEO

We now share a few of the highlights of our call with the CEO but reserve the full word-for-word transcription for CML Pro members.

• “The more important things for us [than the demand side], as we look at the long-term of building our business for the coming years, is actually the supply side. Is the merchant side.

“And on that, not only have we not seen any slowdown, we’ve actually seen an acceleration of the business, because if you look Q1 over Q1, our bookings of new merchant signings have doubled.”

• “We have onboarded twice the number of merchants than we have onboarded at the same period of last year.”

“And if you look at our pipeline, it’s never been stronger, and it’s also growing in terms of the, I would say, average size of the opportunities. So, we have larger and larger merchants, and I would say more and more meaningful-size deals advancing through the pipeline.”

• “From the supply side, we’re actually seeing no effect of what’s happening in the world, and also no real effect of COVID relief.”

• [With regard to free cash flow margin] “Honestly, they would’ve been higher now if it wasn’t for the Flow acquisition, which is — we knew when we modeled, to begin with, that it’s going to put a drag on our adjusted EBITDA for a year or for a little more, until we get Flow to break even, because we bought it at an earlier-stage business, and it was still burning cash.

“And we are making good progress in that, I would say even quicker progress than we anticipated.”

• “And we think our long-term target, as we said, that it’s going to be 20-plus percent adjusted EBITDA, which as I said, should be close to our free cashflow.”

• “[with regard to the acquisition of Flow] “They’ve built from the ground up a system that is very much what we were looking for, very much built with the needs of SMBs in mind.

“The other thing that Flow did, was, basically, they had already a contract with Shopify, to provide their service, their SMB-oriented service, in white label form, so that Shopify could offer that to the merchant of regular service to SMB merchants on Shopify, under the Shopify brand.

“And that was, again, a pretty nice fit with the fact that at that point in time, we already had a similar partnership with Shopify on the enterprise side, by which we are the exclusive — for a year and something now, we’ve been the exclusive provider of fraud order services for enterprise merchants on Shopify.”

• [with regard to lockdowns in China] “The lockdowns haven’t really affected tremendously… Quite a few questions, especially with the last quarter, but also a little bit this quarter, about supply chain challenges and whether that has any effect on the business, and the answer there again is no, because there is no downside effect on us whatsoever, because all the supply chain challenges have to do with sea freight, and really none with air freight, and everything that we sell, at least currently, flies.

“So, we don’t really have any disruptions in our own supply chains.

“The only potential effect is in the supply chains of our merchants and whether they can get the needed level of inventory in time for their sales, et cetera. And on that I must say that we have seen very little, if any, issues, because a lot of these brands, that’s what they do, that’s their business, so they need to know how to prepare in advance and pre-order stuff and preempt that.”

Conclusion

GLBE is attempting to solve the complexity-chain that surrounds cross-border e-commerce. If it does so, the very complexity of the endeavor itself stands as a moat.

The company is racing higher and cross-border transactions as a per cent of that global e-commerce are also racing higher yielding a total addressable market (“TAM”) that is growing on top of a growth spurt.

The risks are myriad but, if we look at the opportunity from forty thousand feet, we see a $2.75 billion enterprise attempting to lead in a one trillion-dollar TAM.

We’ll take the risk with an eye to a large cap if it can succeed and the commitment to profits is exactly what we want to hear – quite different than Shopify, for example.

The author is long GLBE at the time of this writing.

Please read the legal disclaimers below and as always, remember, CML Pro does not make recommendations or solicitations for the sale or purchase of any security ever. We are not licensed to do so, and wouldn’t do it even if we were. We share research and provide you the power to be knowledgeable to make your own decisions.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.

Be the first to comment