JacobH/iStock via Getty Images

Introduction

In August 2019, I wrote a bullish SA article about Global Atomic (OTCQX:GLATF) (GLO:CA) and this is among my best calls to date as the share price has soared more than 500% since then.

In my view, the Dasa uranium project looks more compelling than ever, but I think that Global Atomic looks overvalued at the moment despite the market valuation declining by almost half over the past few months. Let’s review.

Overview of the business and financials

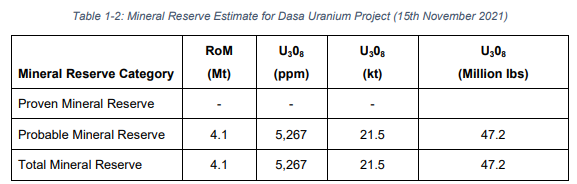

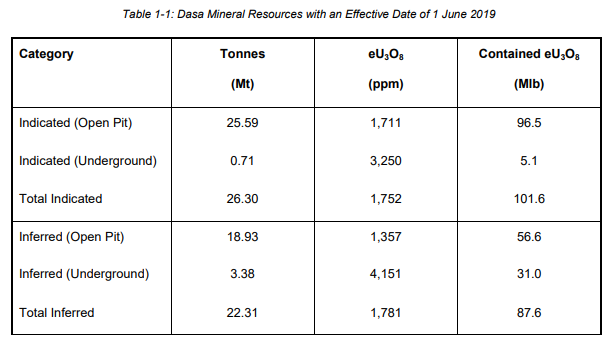

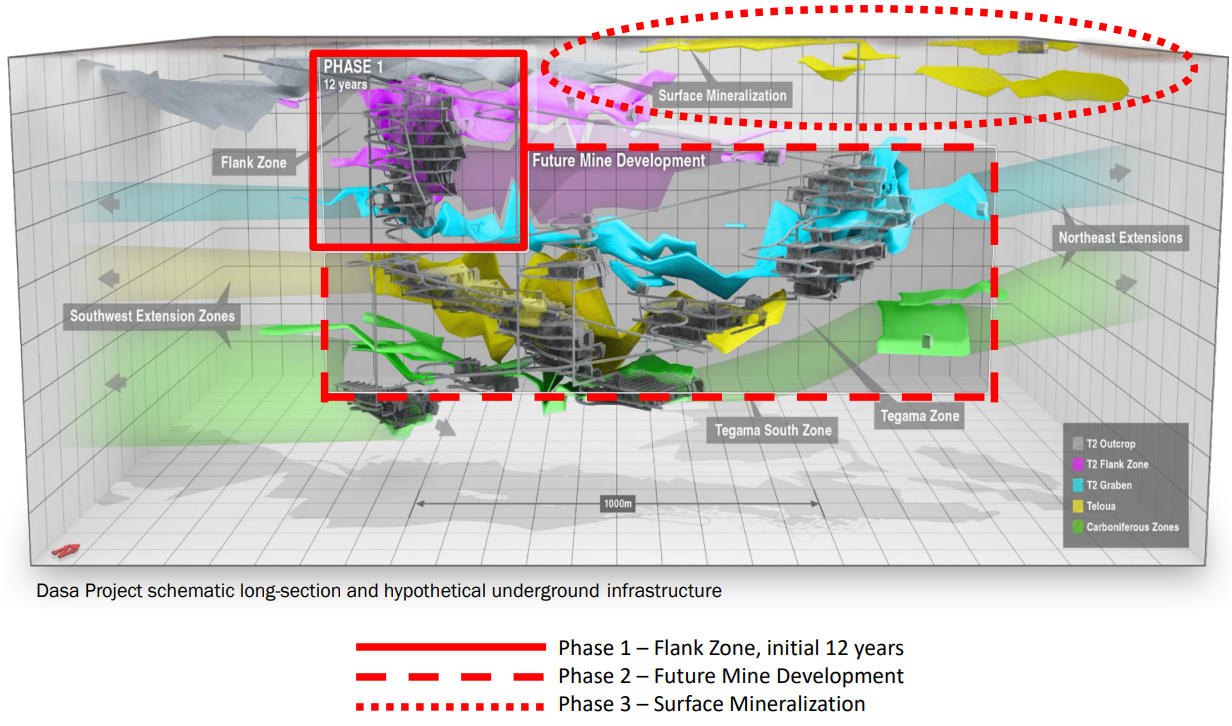

Global Atomic’s Dasa uranium project is located in Niger and was featured several times in my “Best Drill Interceptions In The Metals Mining Sector For The Week” series of articles back in 2019. It’s similar to many of the other uranium deposits in the country, with the expectation of an unusually high grade. Dasa is the highest-grade sandstone-hosted uranium deposit in the world as well as the largest high-grade discovery in Africa over the last 50 years. According to a feasibility study from 2021, the project has reserves of 47.2 million pounds of uranium at an average grade of 5,267 ppm. The indicated resources, in turn, stand at over 100 million pounds of uranium.

Global Atomic Global Atomic

I expect the reserves and resources to increase significantly in the near future as Dasa is embarking on a 15,000-meter drill program in 2022, which includes both in-fill and step-out drilling. Global Atomic should update the mine plan by the end of the year.

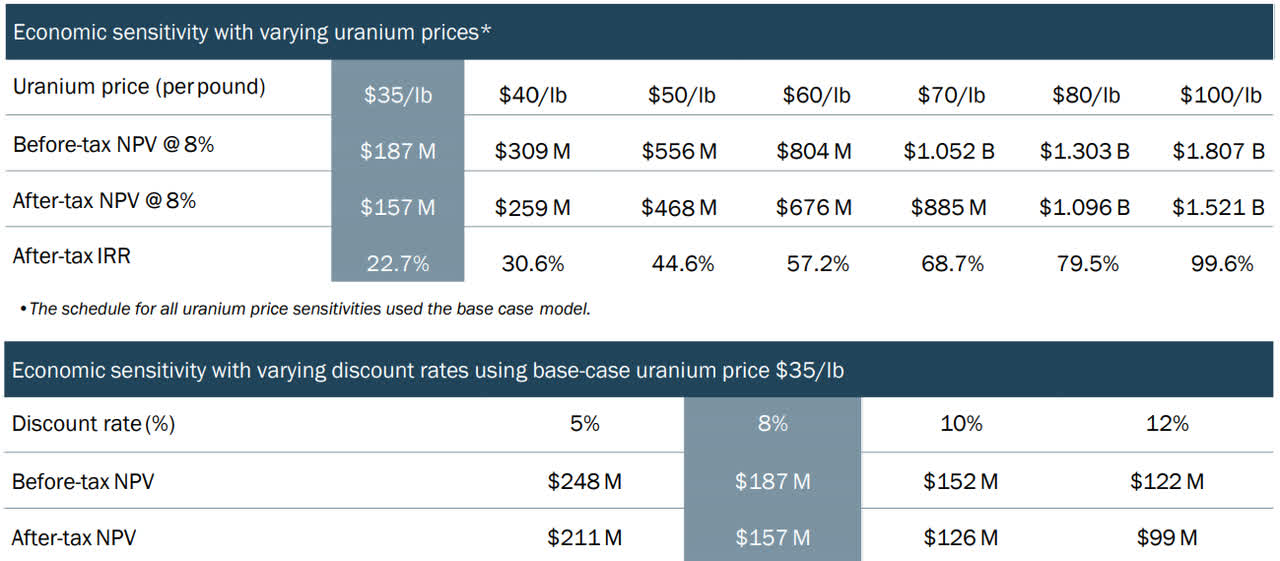

Turning our attention to the key financial figures for Dasa, the feasibility study showed once again that developing the project makes sense even at $30 per pound of uranium. Thanks to the high grades, Dasa is set to become one of the lowest cost uranium mines in the world. All-in sustaining costs (AISCs) are expected to stand at just $21.93 per pound over a mine life of 12 years.

Global Atomic

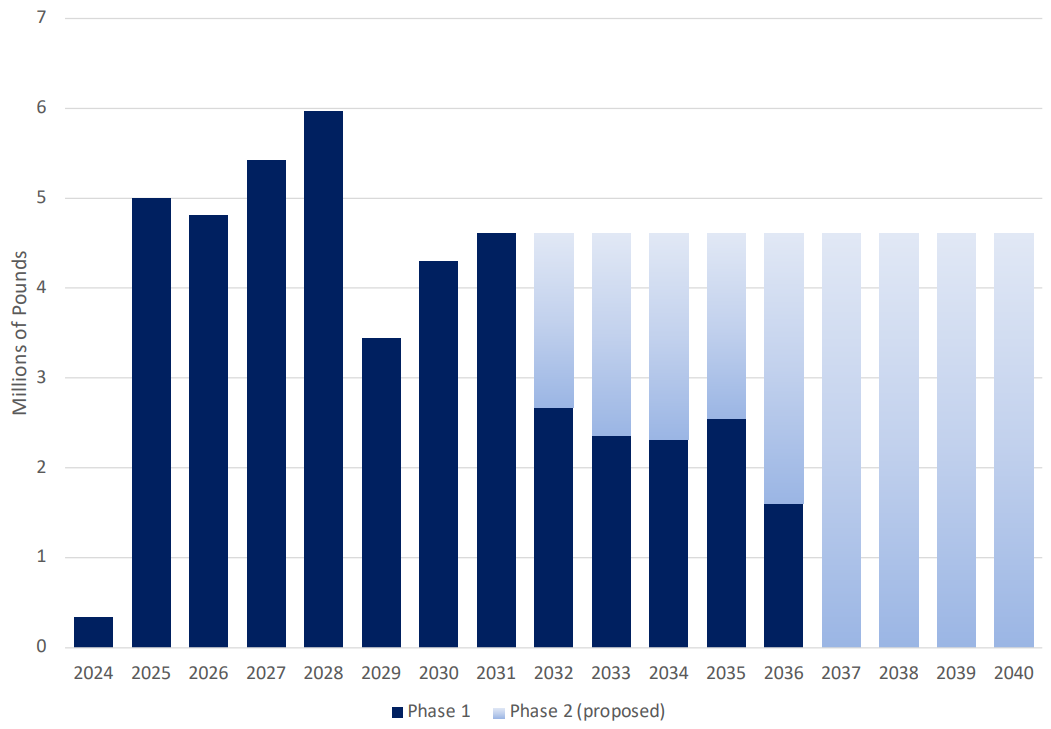

Dasa is forecast to produce a total of 45.4 million pounds of uranium during Phase 1, with the first four years of commercial production being particularly strong. Yet, the current mine plan represents just 20% of the current mineral resource and Global Atomic hopes that drilling and high uranium prices will help it keep annual production above 4.5 million pounds of uranium for the next two decades.

Global Atomic Global Atomic

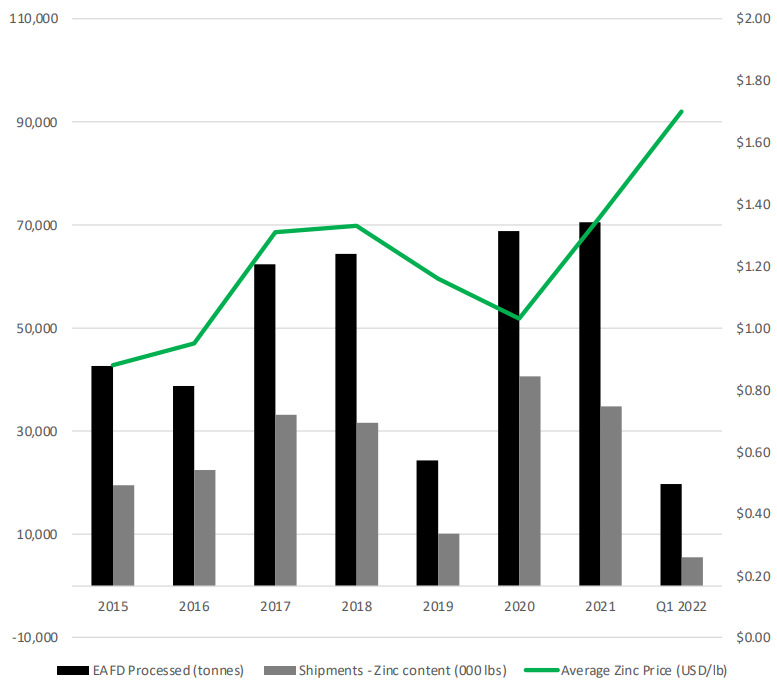

The initial capex required for Phase 1 of Dasa is $208 million, which includes $18 million of contingencies. I think this is a large amount for a company the size of Global Atomic but funding it shouldn’t be hard. You see, the company owns a 49% interest in a zinc oxide recovery plant in Iskenderun, Türkiye. The facility processes Electric Arc Furnace Dust (EAFD) containing 25% to 30% zinc sourced from local steel mills. It produces 70% zinc oxide concentrate that is sold to smelters.

In Q1 2022, the zinc recycling plant processed 19,785 tonnes of EAFD despite a 3-week maintenance shutdown and Global Atomic’s share of the EBITDA was C$3.4 million ($2.6 million).

Global Atomic

The facility is majority-owned by European industrial services firm Befesa and was shut down for the majority of 2019 for expansion and modernization. As of March 2022, the JV company operating the plant had to repay $2.65 million of a loan for the upgrade. This means that dividends to the shareholders should resume in the next few months, helping Global Atomic to fund its 2022 drill program. Revenues should increase in Q2 2022 as there are no maintenance shutdowns planned for this quarter.

In 2021, Global Atomic’s share of the EBITDA of the zinc plant was C$11.3 million ($8.7 million). Based on a conservative valuation of 8x EV/EBITDA, I think the company’s stake in the facility should be worth around $70 million. In my view, the ownership of this project sets Global Atomic apart from other development stage uranium miners and should help it secure debt funding. The company has already received a C$75 million ($58 million) letter of interest for project financing from Export Development Canada and it plans to complete the funding package for Dasa by the end of 2022.

Overall, I think that Global Atomic holds a piece of a valuable zinc business as well as one of the best undeveloped uranium projects in the world. However, the company looks overvalued at the moment. Development stage mining companies rarely trade above 0.5x net asset value (NAV), which would put Dasa’s valuation at C$234 million ($181 million) at uranium current spot price of $50 per pound. Add another $70 million for the 49% stake in the Iskenderun zinc plant and we get to $251 million. This translates to around $1.41 per share.

That being said, I think that short selling Global Atomic stock could be dangerous as uranium prices are notoriously volatile. Besides that, most uranium producers and developers are currently valued at above 1x NAV. So, my conclusion is that risk-averse investors should avoid Global Atomic unless the share price drops further.

Investor takeaway

Global Atomic owns one of the few uranium projects in the world that can be profitable even at $30 per pound and the exploration potential looks good. It also has a 49% stake in a profitable zinc plant that should resume dividend payments in a few months, helping Global Atomic fund its 2022 drill program.

However, I think that development stage mining companies are overvalued at above 0.5x NAV in almost all cases. Fortunately for potential investors, the share price of Global Atomic has been dropping rapidly since the middle of April and I think that the stock will look attractive below $1.40.

Be the first to comment