zorazhuang

Investment Thesis

Glencore plc (OTCPK:GLNCY) is a commodity trading and mining company. The company has sold the royalty package of BaseCore Metals to Sandstorm Gold, which will boost the company’s earnings in the coming quarters. I believe this event will increase the company’s dividend yield with the expected announcement of the rise in regular dividends or special dividend in the company’s second-quarter results. I think this reason is enough to hold GLNCY.

About Glencore

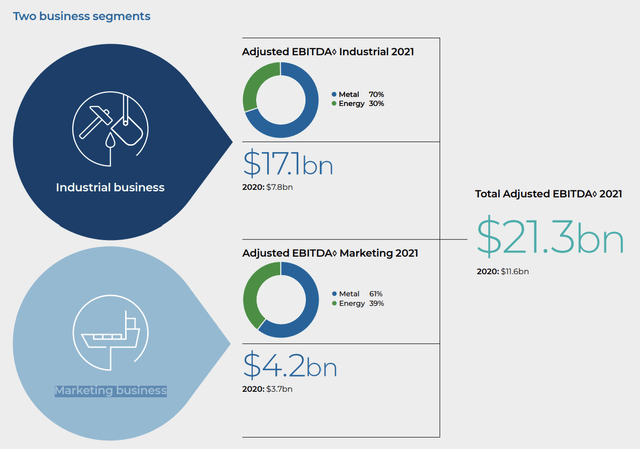

Glencore is Baar, Switzerland-based commodity trading and mining company. Glencore has numerous production bases and has served multinational clients in the automotive, steel production, power generation, and food processing industries with metals, minerals, crude oil, oil products, coal, and agricultural products. The manufacture, recycling, procurement, marketing, and distribution of the goods required by suppliers and customers to decarbonize are all covered by GLEN. The company operates in two business segments – Industrial Business and Marketing Business. 70% of the EBITDA of the industrial segment comes from metal products, and 30% is generated from energy products. Marketing Business’s 61% of the EBITDA is produced from metal commodities, and 39% is generated from energy-related commodities.

EBITDA Decomposition (FY2021 Annual Report)

Adjusted EBITDA of FY2021 increased by 84% to $21.3 billion, while net debt decreased by 62% to $6.0 billion. The company has $0.6 billion in fresh share buybacks, and shareholder rewards based on 2021 cash flows are $3.4 billion ($0.26/share) payable in 2022. The company has recently sold BaseCore Metals LP, which I believe this deal could act as an event arbitrage for the current quarter results.

Sale of BaseCore Metals LP

Recently, the company sold the royalty package of BaseCore Metals LP to Sandstorm Gold Ltd. BaseCore is equally owned by Glencore and Ontario Teachers’ Pension Plan Board. It was founded in 2017 as a partnership that will concentrate on metals streams and royalties. The deal is executed in exchange for the $425 million in cash and $100 million worth of common equity of Sandstorm (5% of the total market capitalization of Sandstorm). Glencore is expecting to receive $300 million in cash and Sandstorm shares. I believe this deal is very beneficial for Glencore as it will improve the company’s cash position and increase EPS in the coming quarterly results. I think after this one-time cash inflow, the shareholders can expect the announcement of a special dividend or an increase in the regular dividend payment from the company soon. After the news announcement, the share price has already grown by 2.5%, which shows the market has considered this deal as positive news for the firm.

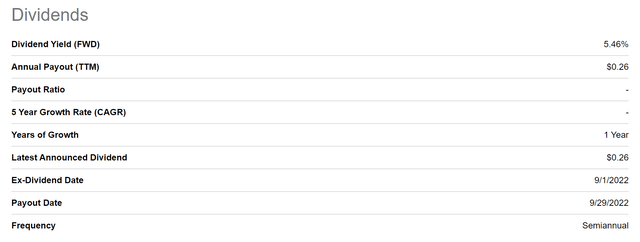

5.24% Forward Dividend Yield

Dividend Table (Seeking Alpha)

Currently, the company is paying a dividend of $0.26, and the company pays the dividend semi-annually, which is equivalent to a 5.24% forward dividend yield. The company also announced the share repurchase program of $550 million, intending to reduce the capital of the company. I believe the capital return policy of the company is very attractive, but it is facing some industrial headwinds.

The Main Risk for Glencore: Industrial Headwinds

The company generates its revenue from metal and oil mining, and currently, both industries are facing a serious headwind due to revolving concerns of the recession that could have adverse effects on demand. Patrick De Haan, head of petroleum analysis at GasBuddy, believes the national average price for gas might decline 25 to 50 cents per gallon in the coming weeks, and the same is expected in the metal industry due to the potential economic slowdown. I believe the USA and other countries can avoid the recession with the help of interest rates, but it might cause a temporary and mild economic slowdown in FY2022 and FY2023.

Fundamental Valuation

GLNCY currently has a share price of $9.92. I think BaseCore Metals’ recent sale of a royalty package might help the company’s EPS to rise in the following quarters. The company is trading at a forward P/E multiple of 3.28x with FY22 EPS projections of $3.02 (including the $300 million of the recent BaseCore transaction). Investors seeking a reliable dividend income would appreciate the prospective dividend yield of 5.24%. The company is experiencing industrial headwinds. Therefore, I am maintaining a conservative price target. With $3.02 EPS forecasts and a 4.3x P/E multiple, I anticipate a 31% price increase for the company, which gives the price target of $13.00.

Conclusion

The company should get an EPS boost with the recent sale of the royalty package of BaseCore Metals to Sandstorm Gold. I am expecting a special dividend or rise in regular dividend in the second quarter results of the company. The company has a forward dividend yield of 5.24%, which is very attractive for risk-averse investors. The company is also facing industrial headwinds, which can slow down the metal and oil business. I believe the company’s recent event-driven EPS growth can be attractive for the investors and an excellent reason to hold the shares in their portfolios. Despite the high EPS growth and expected dividend rise, starting a new position is not advisable because the industrial headwinds can slow the business down in the short term. That’s why I would assign a hold recommendation for the stock.

Be the first to comment