We Are

Even though Gladstone Investment Corporation (NASDAQ:GAIN) recently increased its monthly distribution by 6.7% and declared a special dividend, the stock is now fairly valued in my opinion, and the company’s refined focus on equity securities creates risk for the BDC and its investors if the market moves against the BDC.

Gladstone Investment covered its dividend with net investment income in the third quarter, but the premium to book value, however small, and the risk posed by the equity portion of the BDC’s portfolio are compelling reasons to avoid the stock.

Equity-Heavy Investment Portfolio

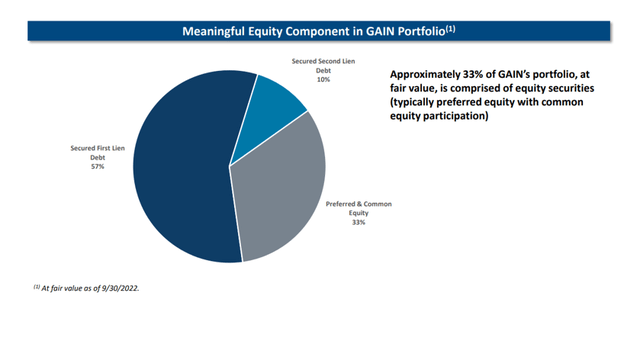

Gladstone Investment’s portfolio is made up of 57% first-lien debt, 10% second-lien debt, and a sizable portion of common and preferred equity (33%).

Despite the fact that the portfolio’s secured total percentage of investments is 67%, I believe the business development company has too much equity exposure, and therefore risk.

Most business development firms have a clear focus on First and Second Lien debt and only invest a small portion of their funds in high-risk equity securities.

A stock market correction and a slowing U.S. economy translate into an undesirable valuation risk for Gladstone Investment, and I would not be comfortable owning a BDC with such a high equity exposure unless a very substantial discount to net asset value was offered. Gladstone Investment’s portfolio was worth $737.9 million as of September 30, 2022.

Meaningful Equity Component In Portfolio (Gladstone Investment Corp)

Dividend Covered By Net Investment Income

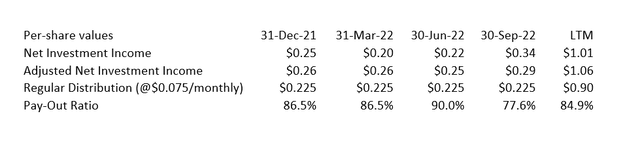

Gladstone Investment covered its monthly dividend payment of $0.225 per share with net investment income and adjusted net investment income in the third quarter.

The dividend pay-out ratio based on adjusted NII was 78% in the third quarter, compared to an 85% dividend pay-out ratio in the previous year.

Dividend And NII (Author Created Table Using Gladstone Investment’s Disclosures)

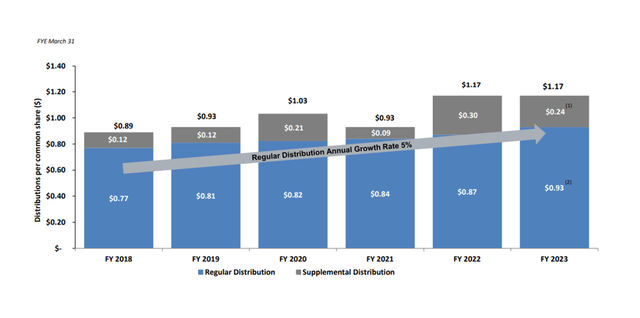

Between 2018 and 2023, Gladstone Investment increased its regular distribution by 5% per year. Recently, the business development firm increased its regular monthly distribution from $0.075 per share to $0.08 per share, a 6.7% increase. Management also declared a special dividend of $0.12 per share, payable on December 15, 2022. GAIN currently pays a stock yield of 7.8% when combined with the special dividend.

Regular Distribution Growth Rate (Gladstone Investment Corp)

Gladstone Investment Likely Fairly Valued Now

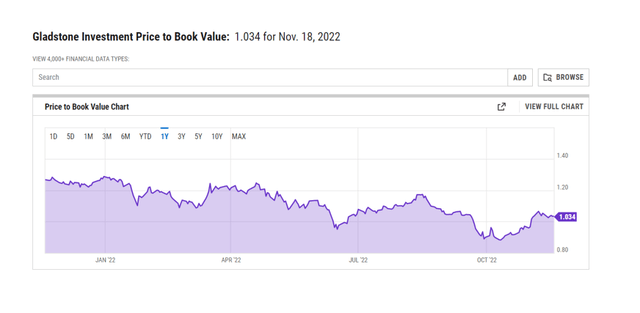

I was more bullish on GAIN when it was trading at a 9% discount to net asset value, but now that it is trading at a 3% premium to NAV, I believe the BDC is fairly valued.

Instead of Gladstone Investment, I recommend Oaktree Specialty Lending Corporation (OCSL), which is a strong BDC investment with excellent asset quality, a safety-oriented debt portfolio, limited equity exposure, and is run by a team with strong credit management experience.

Why Gladstone Investment Could See A Lower/Higher Valuation

Gladstone Investment is currently trading at a premium to net asset value, and the stock is now fully valued in my opinion. Having said that, an increase in non-accruals poses a risk to Gladstone Investment’s portfolio performance, potentially resulting in a decline in dividend coverage and the BDC trading at a discount to net asset value.

The BDC’s dividend pay-out is covered by NII, so an increase in non-accruals or an unexpected decline in portfolio income could result in a decrease in Gladstone Investment’s dividend pay-out.

Then there’s the risk that Gladstone Investment’s equity portfolio will under-perform during a recession, when investors rarely pay high multiples for equity exits.

Overall, I believe GAIN’s risks outweigh its potential upside, given that the stock is already trading at a premium to NAV.

My Conclusion

Gladstone Investment is a well-managed business development company, but its above-average portfolio risk is not properly reflected in the BDC’s valuation due to its large investments in Equity, which also represents a risk particularly in the next recession.

I am all for buying well-run business development companies at a discount to book value, but I believe the total return potential for passive income investors diminishes once the price exceeds net asset value.

In my opinion, Oaktree Specialty Lending is a much better choice for passive income investors seeking predictable dividend income from a well-run BDC with excellent credit quality.

Be the first to comment