Gwengoat/iStock via Getty Images

Introduction

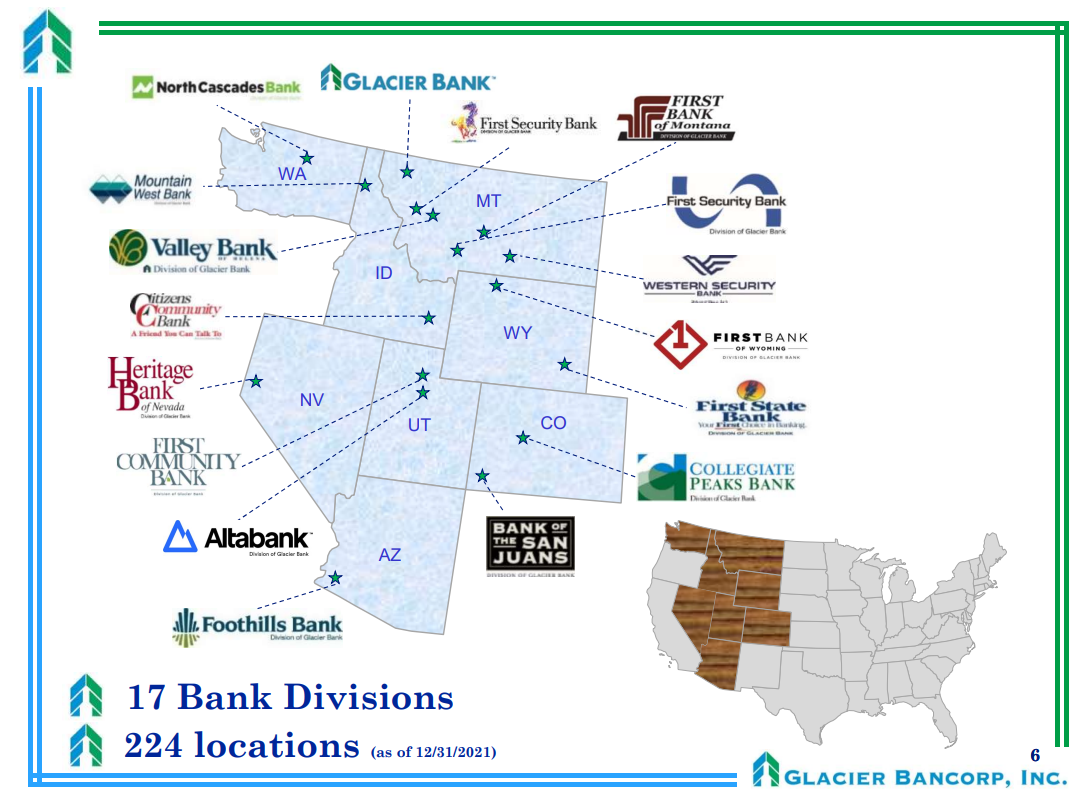

Glacier Bancorp (NYSE:GBCI) is the holding company of a myriad of banks focusing on Montana and the surrounding states. With a balance sheet size in excess of $26B, Glacier definitely is a large bank but with a dedicated focus on the communities it serves.

Glacier Bancorp Investor Relations

The bank has a history of excellent risk management with just a small fraction of its loan book defaulting on loans and this has helped the bank to earn a premium valuation on the market.

While the EPS appears low, Glacier’s lower risk balance sheet warrants a premium valuation

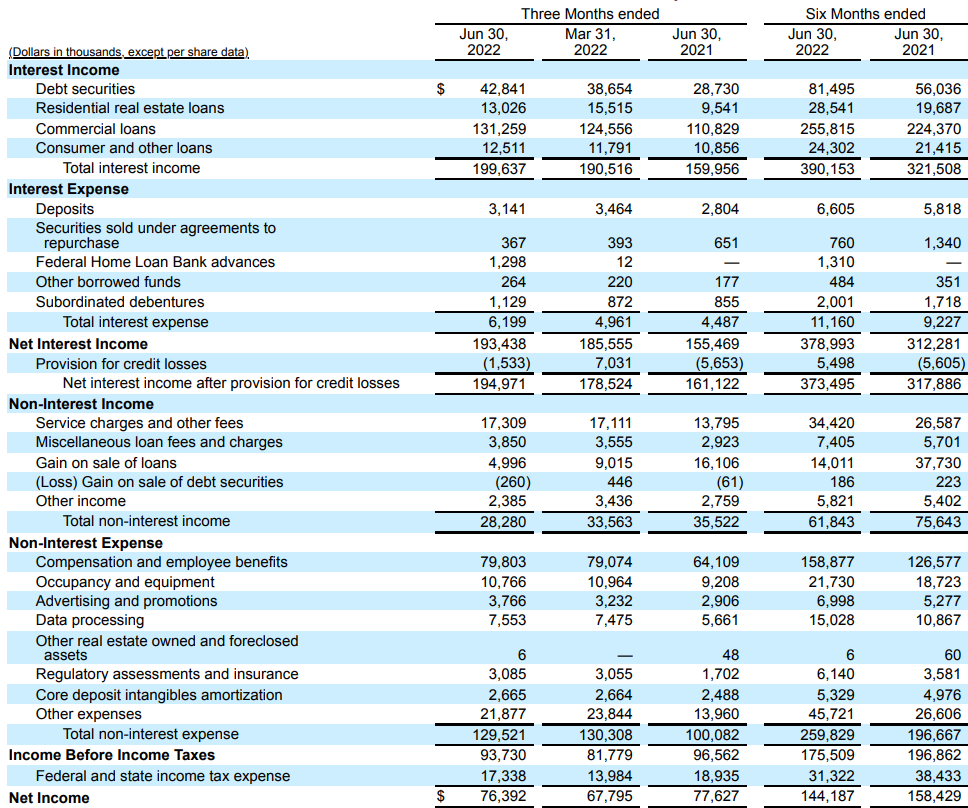

Glacier saw its net interest income increase as its total interest income increased by in excess of $9M while the interest expenses increased by just $1.2M. The combination of both elements helped to boost the net interest income to $193.4M, a substantial increase from the $186.6M in Q1 of this year and an even more impressive increase compared to the $155.5M in Q2 of last year (although this was obviously still excluding the impact of the Alta acquisition, which was only completed later in the year).

Glacier Bancorp Investor Relations

The total non-interest income came in at $28.3M while the non-interest expenses were approximately $129.5M resulting in a pre-tax and pre loan loss provision income of approximately $92M. Fortunately for Glacier, the bank was actually able to recoup some of the previously recorded provisions which added about $1.5M to the reported pre-tax income which was boosted to just under $94M. This resulted in a net income of $76.4M and considering there are approximately 110 million shares outstanding, the EPS was approximately $0.69. While that is substantially higher than in the first quarter of this year, investors need to keep in mind the bank recorded a $7M loan loss provision in that first quarter which obviously weighed on the results. But even comparing apples to apples, the pre-tax income excluding loan loss provisions would have increased from $88.8M to $92.2M thanks to the increased net interest income.

A good result for the bank, mainly thanks to the lack of loan loss provisions. And that’s remarkable on a $14.4B loan book.

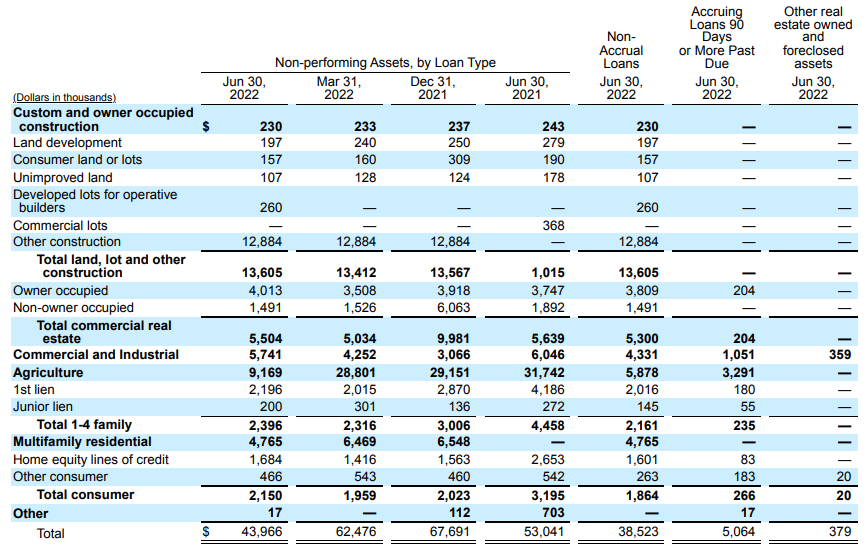

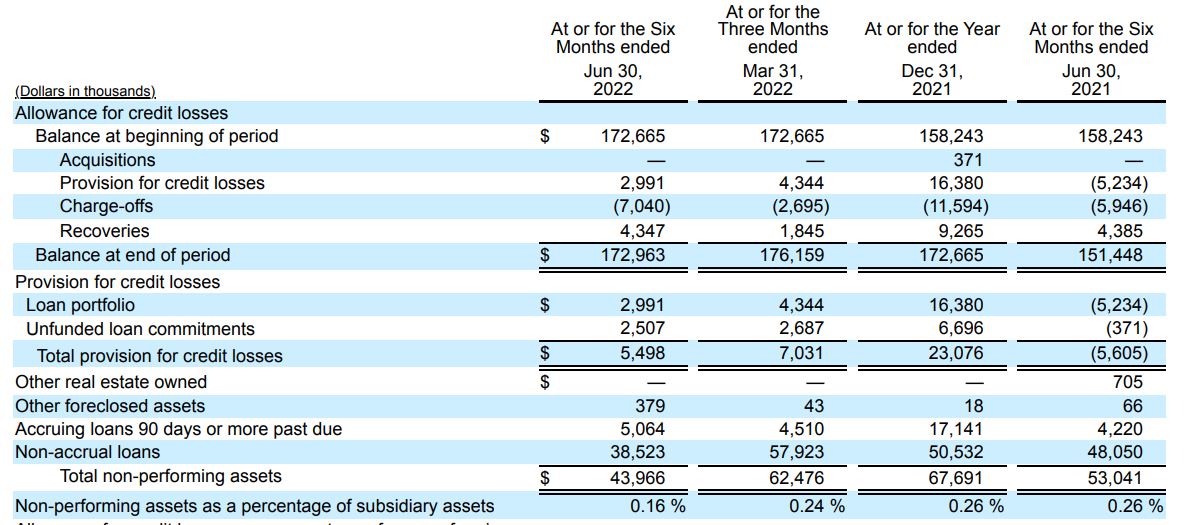

But when we look at the total amount of non-performing and non-accruing loans, it becomes clear the bank is doing an excellent job in risk management. As of the end of June, the total amount of non-performing assets came in at $44M consisting of about $38.5M in non-accrual loans and about $5.1M in accruing loans that are more than 90 days past due.

Glacier Bancorp Investor Relations

As you can see above, the total amount of non-performing assets is currently at its lowest level in a long time. And with a loan book of in excess of $14B, the NPA ratio is just around 0.3% while the NPA ratio based on total assets is less than 0.2% (0.16% to be exact).

This explains why Glacier didn’t have to record additional loan loss provisions. The total amount of provisions is already pretty high at $173M which provides a coverage ratio of almost 400%. And that would assume not a single dollar of the $44M in non-performing loans could be recovered. That’s extremely unlikely.

Glacier Bancorp Investor Relations

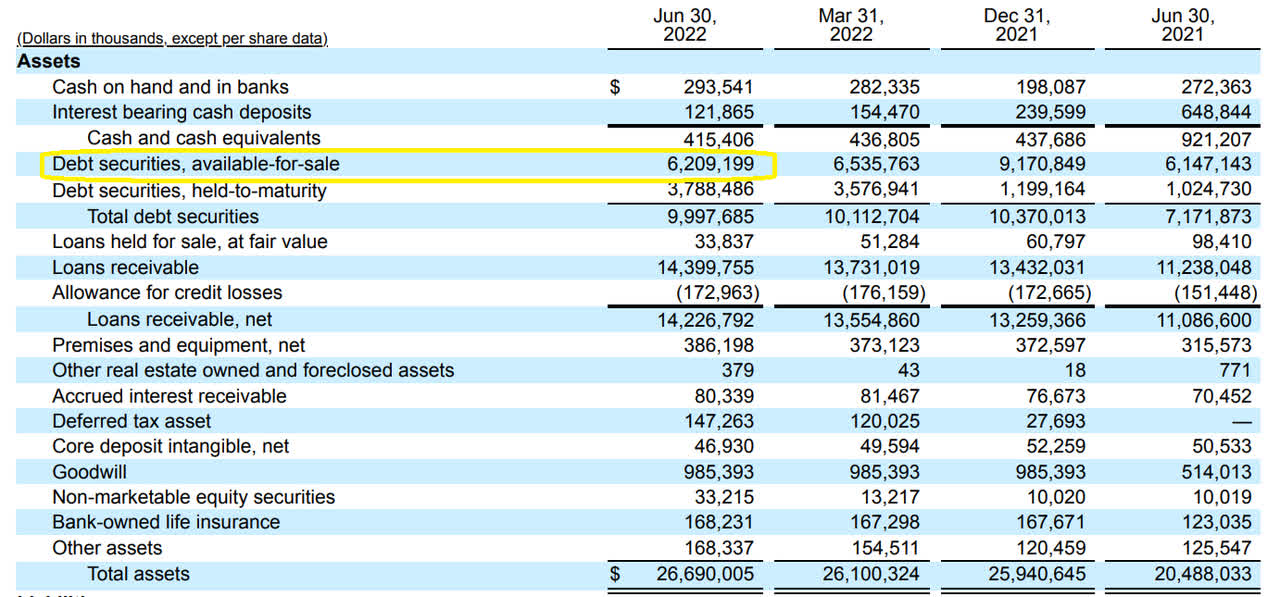

The bank is currently paying a quarterly dividend of $0.33 which means that $0.36/share or around $40M was retained on the balance sheet. While you would expect this would help fuel the book value and tangible book value per share, the increasing interest rates had a negative impact on the book value as the securities available for sale had to be marked down. This is now visible in the income statement but is processed as a correction of the equity value.

Looking at the asset side of the balance sheet, the bank had about $6.2B in securities for sale. I like the way Glacier is running its balance sheet as the total amount of cash and securities represents about 40% of the total assets, but the exposure to interest rates will have a continuous impact on the value of the AFS securities. Fortunately those tend to have short-term maturities and I think the worst should be behind us.

Glacier Bancorp Investor Relations

As of the end of June, the tangible book value per share had dropped from $17.15 to $16.83 despite adding about $0.36 per share in retained earnings. This decrease was more benign than the Q1 decrease of the TBV as Glacier saw its TBV per share drop by in excess of $2.

Investment thesis

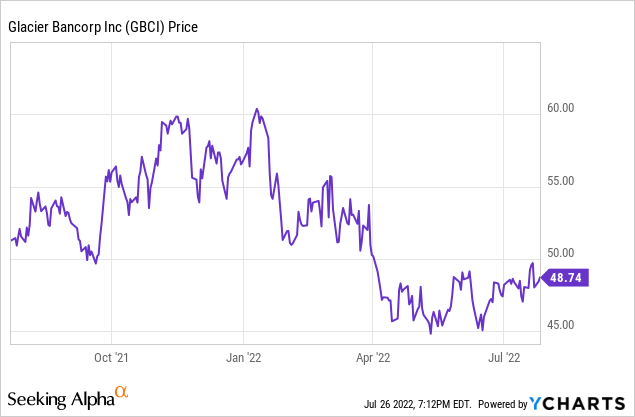

While I appreciate Glacier running a conservative balance sheet, I’m just not sure if I’m willing to pay a 200% premium to the tangible book value for the bank. Sure, safety has its price but while a premium of 100% would be a ‘maybe’, I think the current share price of close to $50/share is a little bit too rich for me.

I will keep an eye on Glacier Bancorp but seeing how the stock is trading at 17 times earnings and almost 3 times the tangible book value, it is unlikely I will initiate a long position anytime soon.

Be the first to comment