LumiNola

One thing we’ve learned is that it is not only the company’s particular characteristics that play a role in defining its financial performance, but also the economy of the country in which it operates, as well as its industry dynamics. There are some industries that are much more attractive than others, and one we particularly like is the flavors and fragrances industry.

There are a few reasons for this, including the fact that in this industry competition is focused on innovation, quality and service, not on price. Customers also tend to refrain from aggressive price negotiations given the importance that these ingredients have in the overall quality of the end product, while representing a small percentage of the input costs. In other words, scent and taste ingredients help determine consumer purchase decisions whilst representing only a minor fraction of costs. This is usually 0.5% to 2.0% of the total cost in flavors and consumer fragrances, and 4% to 6% in fine fragrances.

We have already covered some of the players in this industry before, such as Chr. Hansen Holding (OTCPK:CHYHY) and we also wrote an article on Royal DSM (OTCQX:RDSMY), which is in the process of merging with another company in this industry, Firmenich, currently private. This time we would like to bring investors’ attention to Givaudan (OTCPK:GVDBF), a Swiss company that is a leader in the production of flavors and fragrances for the food, beverage, and personal care industries. The company’s compounds and ingredients are used in a variety of consumer goods, including beverages, confectionery, dairy products, etc. The slide below shows some examples of products that depend on Givaudan’s ingredients. The quality and experience of all of these end products is significantly impacted by Givaudan.

Givaudan Investor Presentation

Competitive Moat

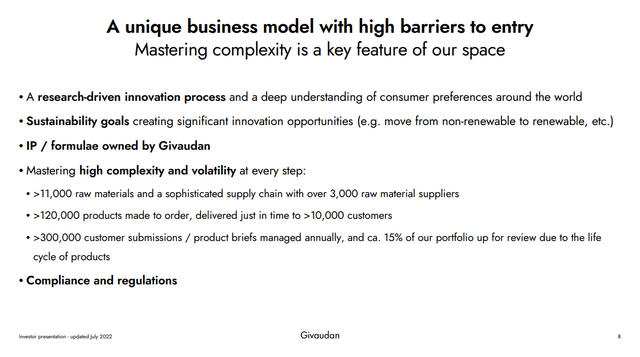

Givaudan’s competitive moat comes mostly from two sources, its intellectual property and the high switching costs for its customers. The industry also has high barriers to entry, including high upfront R&D investments necessary to participate, as well as significant regulatory requirements.

The company invests heavily in R&D and has a robust patent portfolio, with ~3,600 active patents. It has 69 creation and application centers with more than 550 science and technology employees, and invests more than half a billion dollars a year in research and development. Importantly, the IP and formulas are owned by Givaudan. Further increasing the barriers to entry for competitors are the complexity in the production process, with thousands of raw materials needed, products made to order and delivered just in time, and having to meet strict regulations.

Givaudan Investor Presentation

Competitors

Givaudan is one of the largest players in the flavors and fragrances industry, but there are several other companies that also compete in this space. Some of Givaudan’s main competitors include International Flavors & Fragrances (IFF), Firmenich which is also a Swiss company and is set to merge with Royal DSM, Symrise (OTCPK:SYIEY) which is a German company, Chr. Hansen Holdings a Danish company, and Wild Flavors and Specialty Ingredients which is a division of Archer-Daniels-Midland Company (ADM).

Diversification

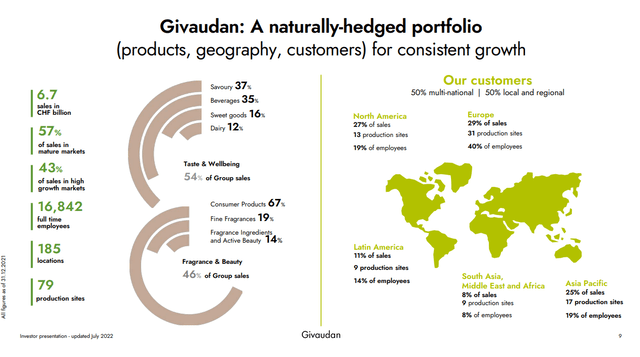

Givaudan has a very nice diversification in terms of product categories, customers, and geography. Approximately 54% of group sales come from Taste & Well-being, with the rest coming from Fragrance & Beauty. In terms of geographic diversification, ~27% of sales are from North America, ~29% from Europe, ~11% from Latin America, ~8% from South Asia the Middle East and Africa, and ~25% from Asia Pacific. Roughly half of sales go to multi-national companies, with the other half to local and regional customers.

Givaudan Investor Presentation

Financials

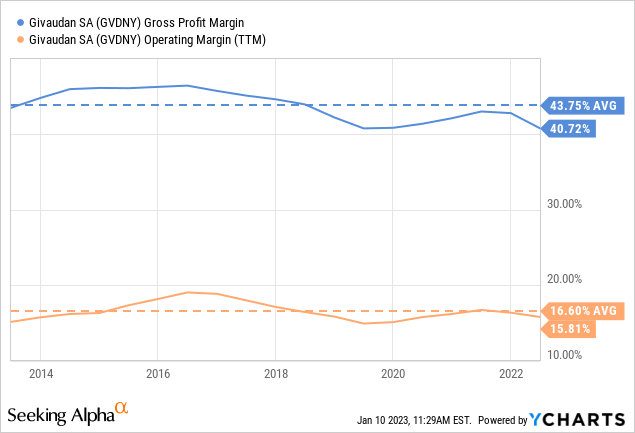

The company has committed to sales growth in the 2021 to 2025 period of between 4% and 5%, and to a free cash flow margin averaging >12% of sales. We believe these targets to be attainable, and the company in general has superb financials. For example, its operating margin has been very stable over the past ten years, and has averaged ~16.6%. Such a high operating margin is reflective of the company’s competitive moat and the favorable industry dynamics.

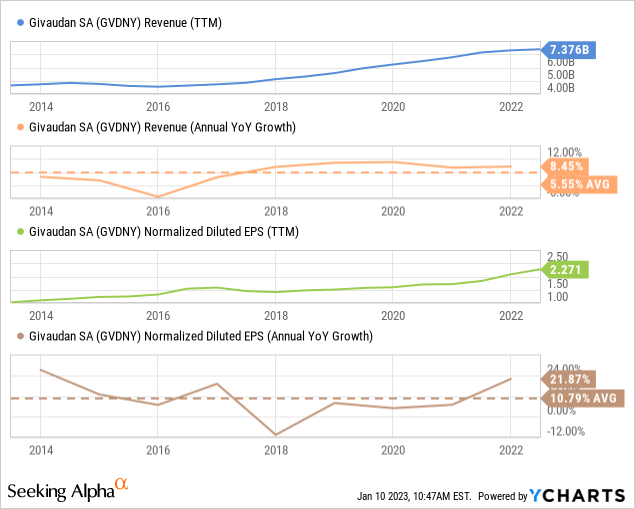

Growth

In the past ten years revenue has grown at a very respectable ~5.5% average, while earnings grew even faster at a ~10% average, which took normalized diluted EPS from roughly $1 per share to ~$2.2 per share for the trailing twelve months. Looking forward we believe the company has enough secular tailwinds to maintain something close to this level of revenue growth, and that it can continue to gain operating leverage and grow earnings somewhat faster than revenue.

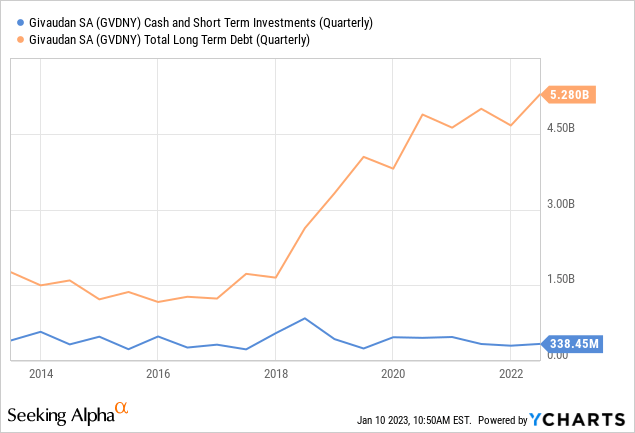

Balance Sheet

Over the past decade, the company has spent ~4.1 billion Swiss Franc, or ~$4.4 billion in acquisitions, which increased total long-term debt significantly. The company now has ~$5.2 billion in total long-term debt, and ~$338 million in cash and short-term investments.

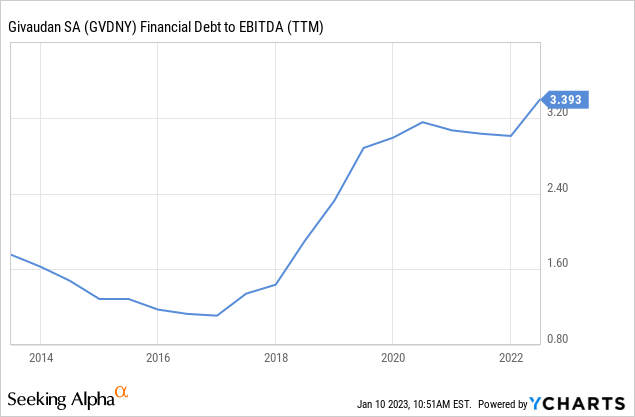

Given the stability of the business we are not overly concerned, but would like to see leverage start coming down. Currently financial debt to EBITDA is ~3.3x, which is still manageable but does add considerably to the potential risks.

ESG

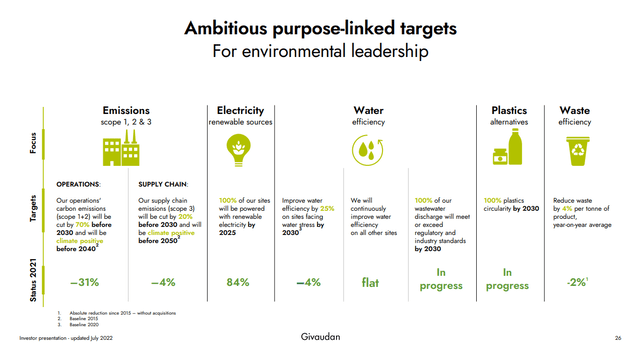

Givaudan has excellent ESG credentials, makes part of some ESG indexes such as the FTSE4Good and SIX Swiss Sustainability 25 Index, and is rated as low-risk by Sustainalytics. It has many ambitious ESG targets, such as having 100% of their sites powered by renewable energy by 2025. The company is in the process of becoming a B Corp. which would further bolster its ESG strategy.

Givaudan Investor Presentation

Valuation

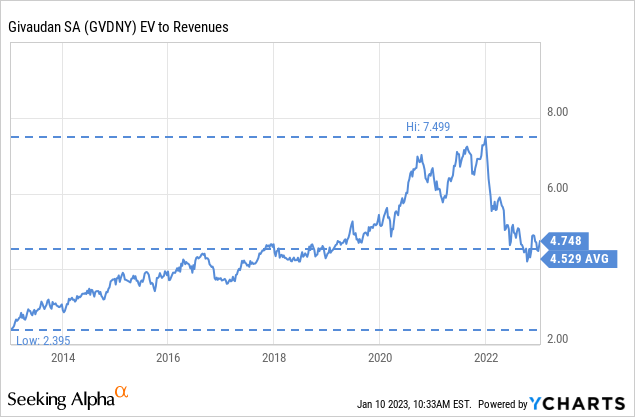

Shares are trading with a ~2.2% dividend yield, and an EV/Revenues multiple of ~4.7x, which is close to the ten year average. Interestingly, in the last ten years the company has completed around 4.1 billion Swiss Franc in acquisitions that brought roughly 1.6 billion Swiss Franc of incremental revenue, putting the average acquisition multiple at ~2.56x.

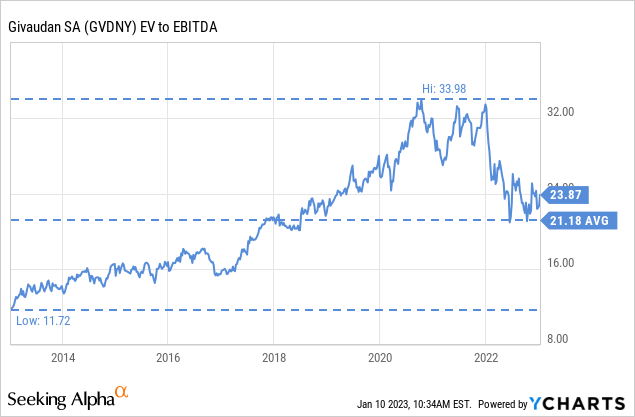

The EV/EBITDA multiple is quite high at roughly 23x, which is a little above the ten year average of ~21x. The company has many attractive characteristics, and investors appear willing to pay a high multiple for them.

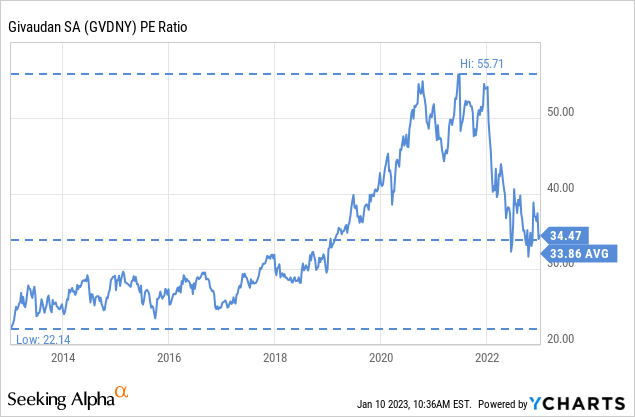

The price/earnings ratio at ~34x is also currently very close to the ten year average of ~33x. There has been significant multiple expansion, since shares were trading with a p/e of ~22x ten years ago.

Our preferred way to estimate fair value is by calculating the net present value of the future earnings stream. While this requires some assumptions that can prove incorrect, we still consider it one of the best approaches. We estimate fair value around $48 per share, which is lower compared to the current prices close to $65. We therefore believe shares to be somewhat overvalued, and will only be adding the shares to the watch list at the moment.

| EPS | Discounted @ 10% | |

| FY 23E | 2.25 | 2.05 |

| FY 24E | 2.45 | 1.86 |

| FY 25E | 2.67 | 1.84 |

| FY 26E | 2.91 | 1.83 |

| FY 27E | 3.18 | 1.81 |

| FY 28E | 3.46 | 1.79 |

| FY 29E | 3.77 | 1.78 |

| FY 30E | 4.11 | 1.76 |

| FY 31E | 4.48 | 1.74 |

| FY 32E | 4.89 | 1.73 |

| FY 33E | 5.33 | 1.71 |

| Terminal Value @ 4% terminal growth | 88.78 | 28.29 |

| NPV | $48.18 |

Risks

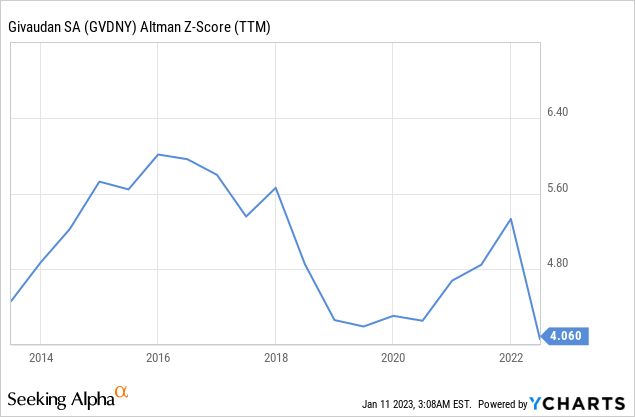

Givaudan is subject to a wide range of regulatory compliance requirements, particularly in the areas of food safety, environmental regulations and health and safety. The company is also exposed to price fluctuations of raw materials, and exchange rates, which can negatively impact the company’s financial performance. The main risk we see, however, is that of the significant debt the company carries. Still, the Altman Z-score remains above the critical 3.0 threshold, although it has been higher in the past.

Conclusion

We believe Givaudan is a company worth following because of its leadership position in a very attractive industry, and its excellent track record. The competition in the industry is focused on innovation, quality, and service rather than on price. As a result, Givaudan has attractive financials, such as excellent profit margins and solid revenue and earnings growth. Unfortunately, investors have bid up the shares to a point where they appear somewhat overvalued. We will therefore be adding the company to the watch list, while waiting for a more attractive valuation in the future.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment