gorodenkoff/iStock via Getty Images

A Quick Take On GitLab

GitLab (NASDAQ:GTLB) went public in October 2021, raising approximately $801 million in gross proceeds from an IPO that was priced at $77.00 per share.

The firm operates a SaaS DevOps software platform for enterprises worldwide.

Given the firm’s slowing growth rate, uninspiring Rule of 40 performance, increasing operating losses, and high EV/Revenue multiple, I’m cautious on GTLB.

My outlook in the near term for GTLB is Hold.

GitLab Overview

San Francisco, California-based GitLab was founded to create a DevOps platform that enables businesses to combine different technical and business teams on a single system for improving their digital innovation efforts.

Management is headed by founder, Chairman and CEO Sytse Sijbrandij, who has been with the firm since inception and was previously a founder at Comcoaster, a software firm.

The company’s primary offerings for users by type include:

-

Business

-

Developers

-

Security

-

Operations

The company offers a free tier and two paid subscription tiers, all of which are offered as a self-managed solution.

GTLB also employs a direct sales force and utilizes partnerships with major tech firms that offer the company’s platform on their marketplaces. The firm also has relationships with resellers who deal with large enterprise clients, digital transformation specialists like consulting firms and volume resellers.

GitLab’s Market & Competition

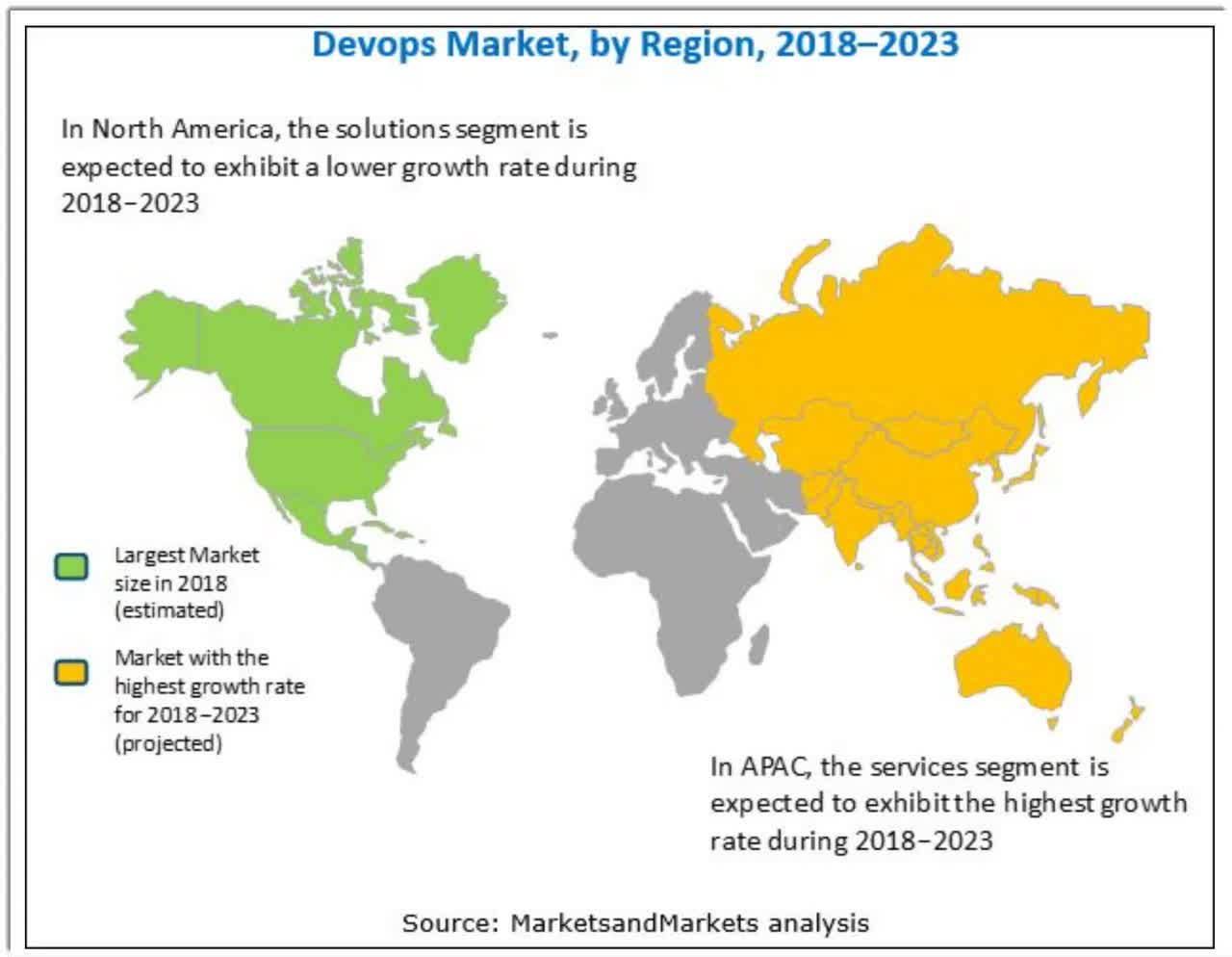

According to a 2018 market research report by MarketsAndMarkets, the global market for DevOps was an estimated $2.9 billion in 2017 and is forecast to reach $10.3 billion by 2023.

This represents a forecast CAGR (Compound Annual Growth Rate) of a very strong 24.7% from 2018 to 2023.

The main drivers for this expected growth are a strong demand from enterprises for faster application development and delivery as enterprises continue a historic transition from on-premises legacy systems to cloud-based applications.

Also, the Asia Pacific region is expected to grow at the fastest rate of growth through 2023, although the North American region will still represent the largest market size worldwide, as the chart shows below:

DevOps Market (MarketsAndMarkets)

Major competitive or other industry participants include:

-

Microsoft/GitHub (MSFT)

-

Atlassian (TEAM)

-

IBM (IBM)

-

Micro Focus (MFGP)

-

Puppet

-

AWS

-

Oracle (ORCL)

-

CollabNet

-

Rackspace (RXT)

-

Perforce

-

HashiCorp (HCP)

-

OpenMake

-

Others

GitLab’s Recent Financial Performance

-

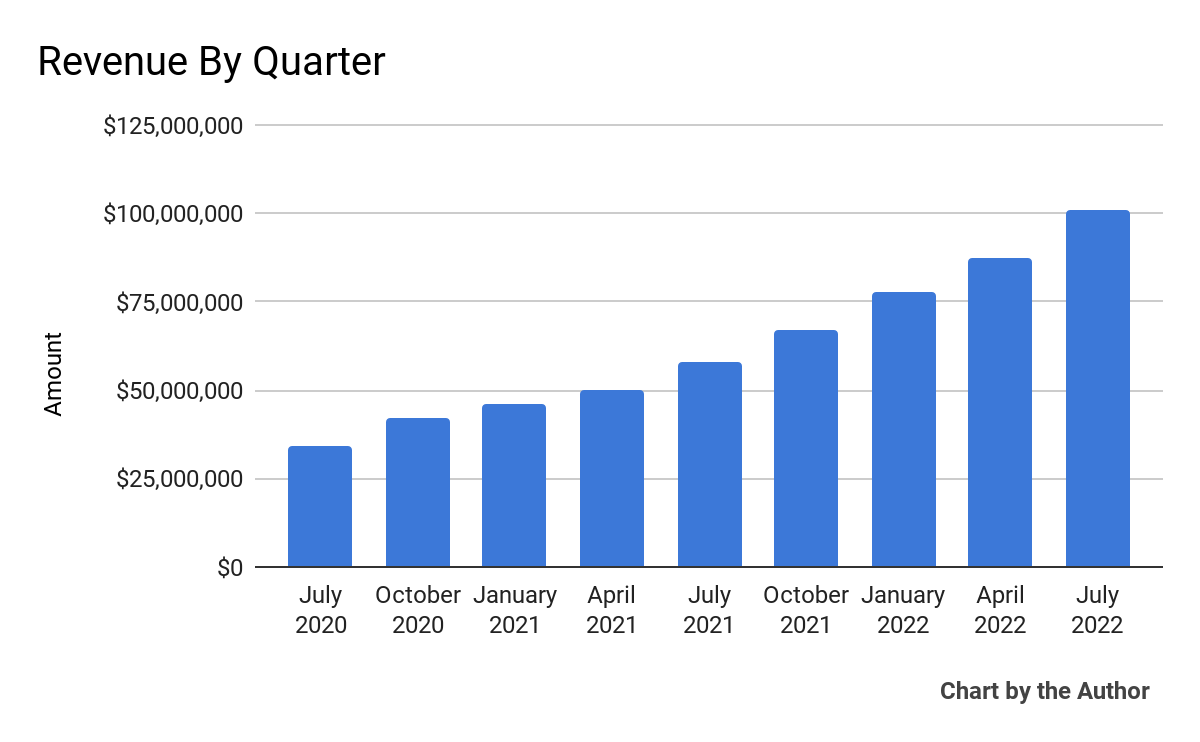

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

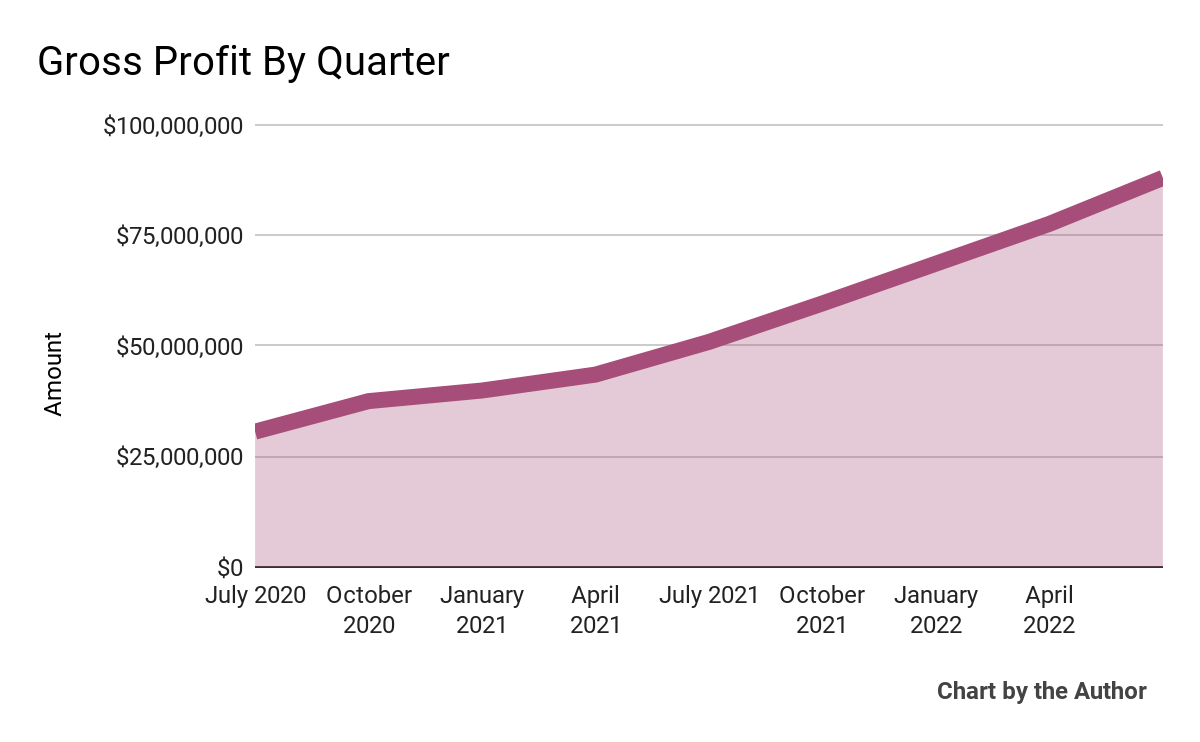

Gross profit by quarter has also risen impressively:

9 Quarter Gross Profit (Seeking Alpha)

-

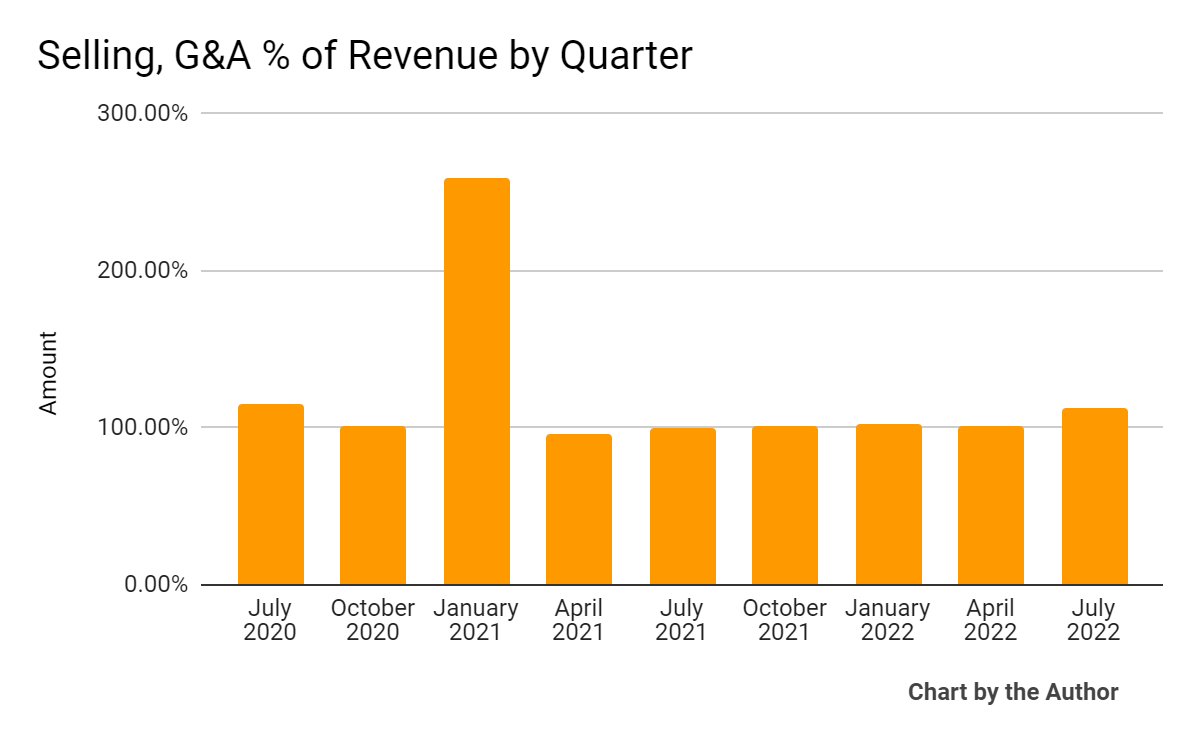

SG&A expenses as a percentage of total revenue by quarter have grown in the most recent quarter:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

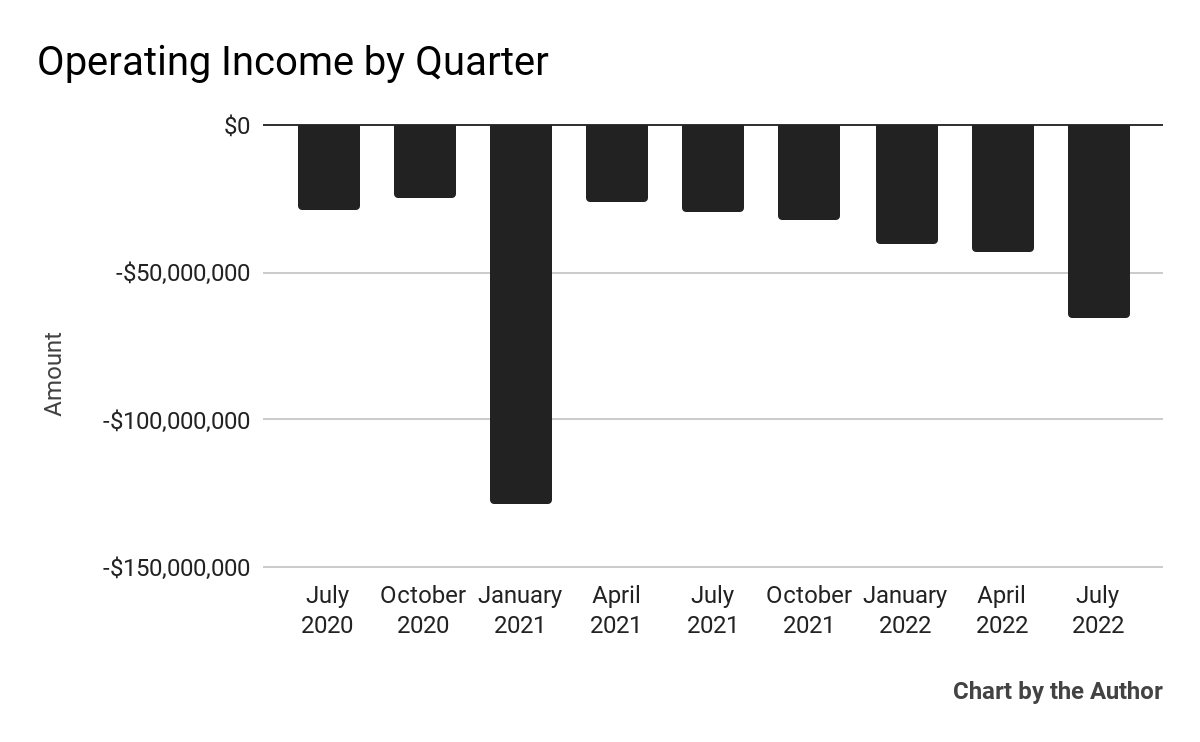

Operating losses by quarter have worsened in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

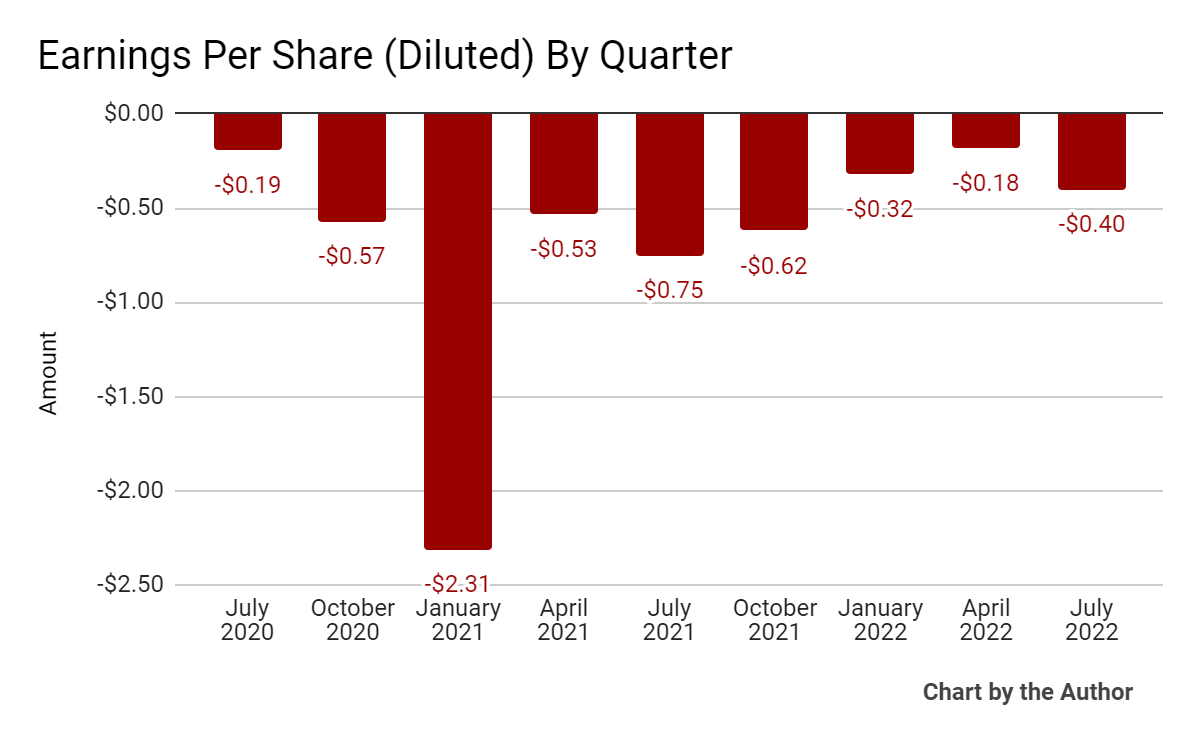

Earnings per share (Diluted) have also dropped further into negative territory in the most recent quarter:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

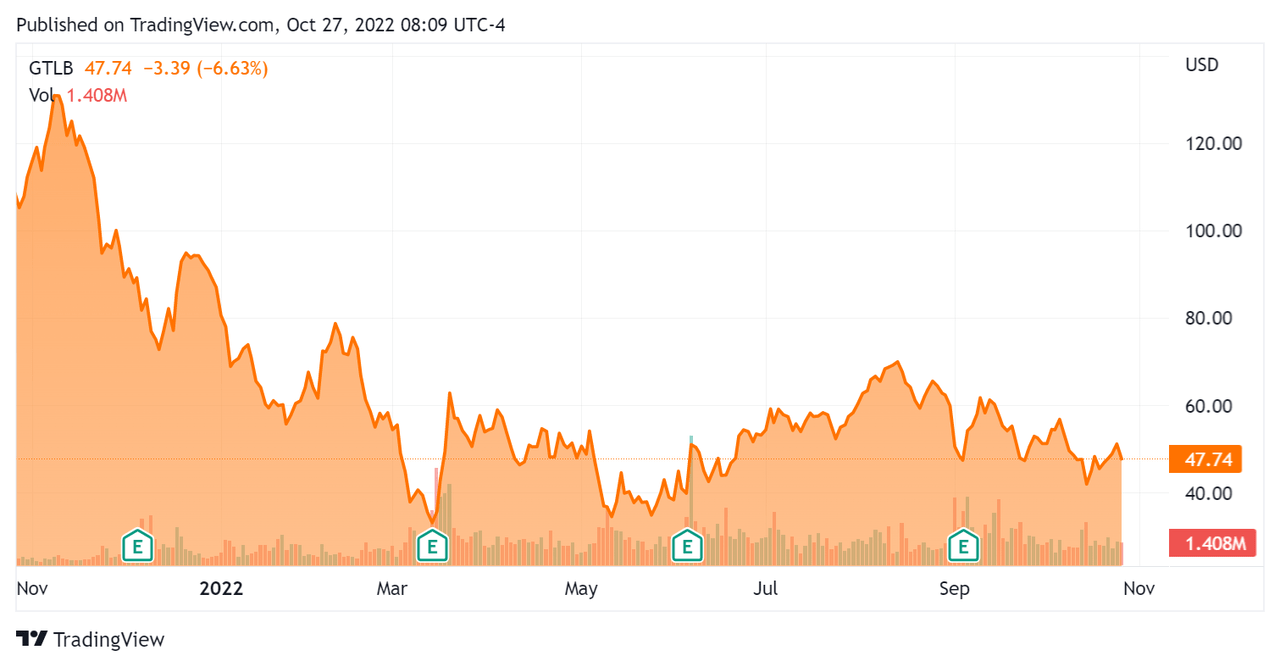

Since its IPO, GTLB’s stock price has fallen 56.2% vs. the U.S. S&P 500 Index’s drop of around 16.2%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For GitLab

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

20.20 |

|

Revenue Growth Rate |

69.6% |

|

Net Income Margin |

-51.7% |

|

GAAP EBITDA % |

-53.6% |

|

Market Capitalization |

$7,610,000,000 |

|

Enterprise Value |

$6,730,000,000 |

|

Operating Cash Flow |

-$75,660,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.52 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

GTLB’s most recent GAAP Rule of 40 calculation was only 16.0% as of FQ2 2023, so the firm is in need of significant improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

69.6% |

|

GAAP EBITDA % |

-53.6% |

|

Total |

16.0% |

(Source – Seeking Alpha)

Commentary On GitLab

In its last earnings call (Source – Seeking Alpha), covering FQ2 2023’s results, management highlighted its full-spectrum security offering, reducing the need for customers to ‘integrate with so many other security vendors.’

With its recent GitLab 15 launch, the company worked to improve user experience to better integrate planning with execution across the client organization.

The new system also uses machine learning to ‘suggest to developers who should review their code.’

As to its financial results, revenue rose 74% year-over-year.

The company’s net dollar retention rate was 130%, indicating very strong product/market fit and high sales & marketing efficiency.

However, the firm’s Rule of 40 results have been disappointing and in need of substantial improvement.

And, operating losses continue to worsen, as did loss per share.

For the balance sheet, the firm finished the quarter with $930.2 million in cash, equivalents, short-term investments, and no debt.

Over the trailing twelve months, free cash used was $82.5 million, of which $6.8 million was for CapEx. Stock-based compensation was a hefty $76.6 million.

Looking ahead, for full-year fiscal 2023, management expects topline revenue growth of 63.5% at the midpoint of the range, which if achieved would be a reduction in growth rate versus the trailing twelve-month period.

Regarding valuation, the market is valuing GTLB at an EV/Sales multiple of around 20.2x.

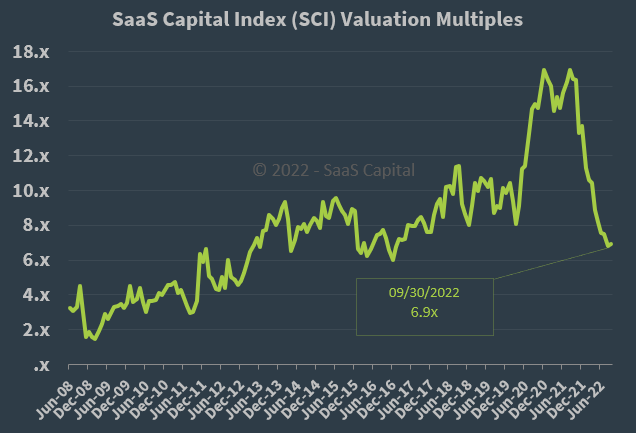

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.9x on September 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, GTLB is currently valued by the market at a high premium to the broader SaaS Capital Index, at least as of September 30, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may produce slower sales cycles and reduce its revenue growth trajectory.

Given the firm’s slowing growth rate, uninspiring Rule of 40 performance, increasing operating losses and high EV/Revenue multiple, I’m cautious on GTLB.

My outlook in the near term for GTLB is Hold.

Be the first to comment