Dr_Microbe

Ginkgo Bioworks (NYSE:DNA) is a leading synthetic biology company that went public through a SPAC in 2021. A large amount of hype has surrounded Ginkgo due to its ambitions and it managed to catch the tail end of a red-hot market, providing it with a relatively large market capitalization despite its modest achievements so far. While management has provided guidance to support a large market capitalization, its projections are aggressive and there is limited evidence to support the proposed economics. This does not necessarily mean the stock is currently overvalued, but is simply a reflection of the large amount of uncertainty involved in Ginkgo’s business and synthetic biology generally.

Market

Genetic engineering originated with the development of recombinant DNA, which utilizes special types of protein from bacteria to cut and paste DNA sequences from one organism to another. Many molecules require more complex cell programming though and are produced by a series of enzymes. These enzymes transform a feedstock like sugar into the desired product (typically a valuable small molecule). In each new synthetic biology program, a large number of sequences are designed, synthesized, and tested for each step of a pathway. Advances in synthesis, sequencing, genetic engineering and automation allow more of the biological design space to be explored and improvements in data science allow the design space to be explored more efficiently.

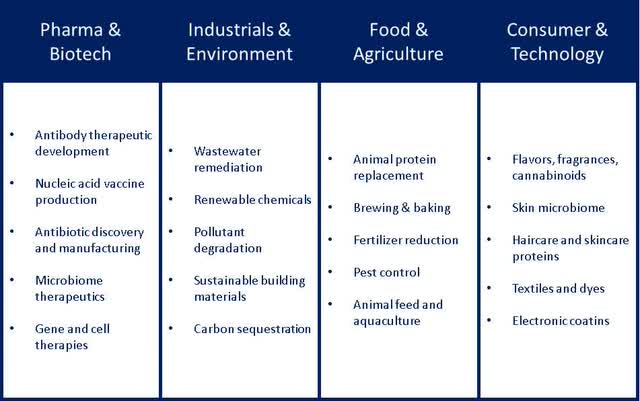

The flexibility of biology means that virtually every sector of the global economy is a potential target market, particularly as improvements in technology are leading to faster development cycles and lower production costs.

Figure 1: Ginkgo End Markets and Partners (source: Created by author using data from Ginkgo Bioworks)

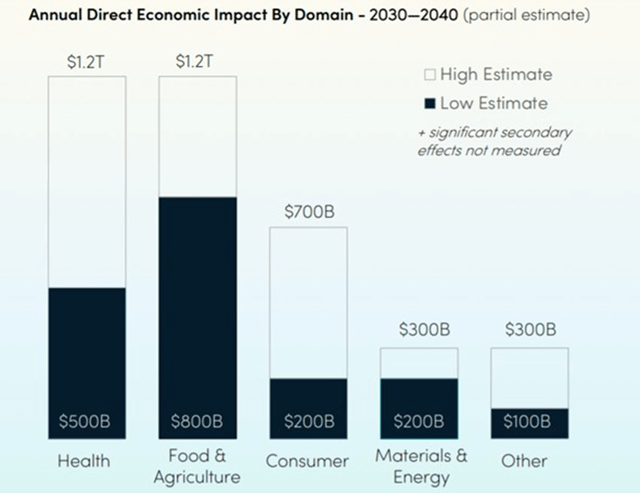

If synthetic biology lives up to its potential, bioengineered products could become ubiquitous and create enormous value. It has been estimated that the total market for bioengineered products could be 2-4 trillion USD in the next 10-20 years, across diverse end-markets like agriculture, energy, health and consumer products.

Figure 2: Estimates of Economic Impact of Synthetic Biology (source: Ginkgo Bioworks)

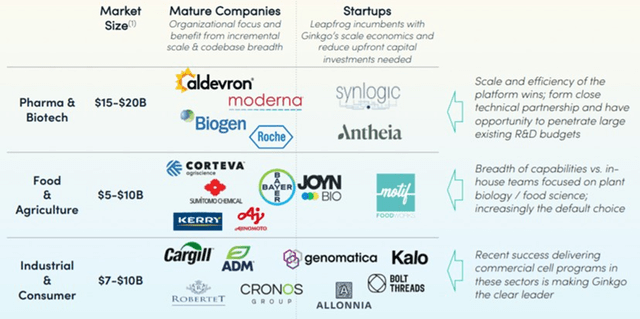

Ginkgo sees significant opportunity across end markets, with pharma & biotech and food & agriculture particularly important markets for them so far. Given Ginkgo’s reliance on downstream value, the size and profitability of these markets are important to Ginkgo’s value.

Figure 3: Market for Cell Programming R&D across Segments (source: Ginkgo Bioworks)

There are a number of strategies being used to capitalize on the growing capabilities of synthetic biology, including:

- Vertical integration from lab to market (Amyris (AMRS))

- Vertical integration with a focus on lab operations and outsourced manufacturing (Zymergen (ZY))

- Horizontal platform focused on strain engineering (Ginkgo Bioworks)

- Focus on product development and marketing with outsourced R&D and manufacturing

Ginkgo has chosen to develop a horizontal platform that can be used by other companies to develop products, touting themselves as the AWS of synthetic biology. The logic behind this strategy is that there are significant economies of scale, which potentially favor the development of a dominant platform. While the capability of companies like Ginkgo continues to improve, driven by advances from companies like Twist Bioscience (TWST) and Berkeley Lights (BLI), the commercial viability of scaled bioengineered products continues to be an issue.

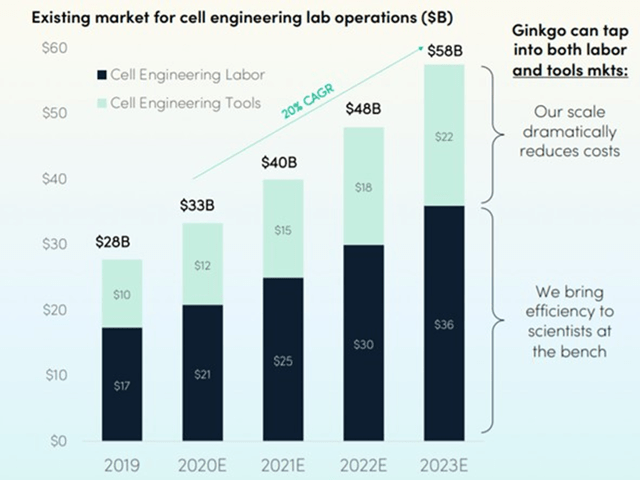

Cell programming is currently performed in thousands of biotech and academic labs, but is challenging because the iterative build and test cycle is time consuming, a problem that is exacerbated in more complex programs. In traditional labs approximately 60% of R&D expenses are labor, with the remaining 40% spent on equipment and inputs like DNA and reagents. Ginkgo aims to bring economies of scale to both of these elements and in the process stimulate demand for R&D services.

Figure 4: The Market for Cell Programming R&D (source: Ginkgo Bioworks)

Valuation

From a valuation perspective, Ginkgo’s business has three main components:

- Foundry services

- Downstream value

- Biosecurity

Foundry Services

Revenue from R&D services is not central to Ginkgo’s business model, as they plan to perform Foundry services near breakeven in order to capture downstream value. Cell engineering R&D is a potentially lucrative business in its own right, and is estimated to be worth approximately 40 billion USD in 2021, growing at an annual rate of 20% through to 2023. EBITDA margins of contract research organizations in the life sciences space are generally in the 20% to 30% range.

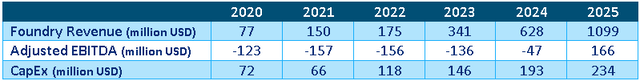

Ginkgo’s Foundry revenue in 2020 was only 59 million USD, from less than 100 cell programs, a small fraction of the total number of R&D projects being conducted globally. Ginkgo is projecting rapid growth in Foundry revenue, although this has not materialized in 2022 so far.

In the long run, Foundry revenue growth could be due to a failure to reduce the cost of lab operations or a failure to negotiate downstream value capture, and so is not necessarily an indicator of success for Ginkgo. Absent a pivot in business model, the number of cumulative programs is far more important than Foundry revenue.

Table 1: Ginkgo Foundry Projections (source: Created by author using data from Ginkgo Bioworks)

At the time of their listing, Ginkgo illustrated a valuation of their foundry business by comparing estimated foundry revenues with revenue multiples for a range of peer companies. Ginkgo applied a 17.5x multiple to their estimated 2024 foundry revenue to derive a foundry valuation of 11 billion USD. Given that they have a stated goal of operating the Foundry near breakeven and primarily capturing downstream value, it does not make sense to attribute a large value to the Foundry business.

Downstream Value

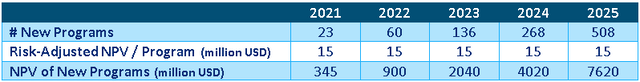

Unless there is a pivot in business model, the majority of Ginkgo’s value should come from downstream value capture. Ginkgo provided estimates of downstream value in presentations at the time they went public, although this seems to have been a case of justifying the desired price than a realistic calculation of value.

The estimated 15 million USD NPV for each program is based on the total NPV of each program and Ginkgo’s share of that value. There should also be some failure rate applied to the total number of active programs to capture the fact that not all programs will create downstream value. It is also unlikely that Ginkgo will achieve 100% margins on downstream value, as there may be significant sales and marketing costs associated with attracting customers. Ginkgo’s marketing material seems to imply that this 15 million USD NPV is based on historical data, but the figure is opaque and it is not clear what is included in the calculation. Ginkgo probably does not yet have enough data to accurately estimate an average NPV per program, and even if they did, this figure could change based on the competitive environment.

Table 2: Ginkgo Prediction New Program Downstream Value (source: Created by author using data from Ginkgo Bioworks)

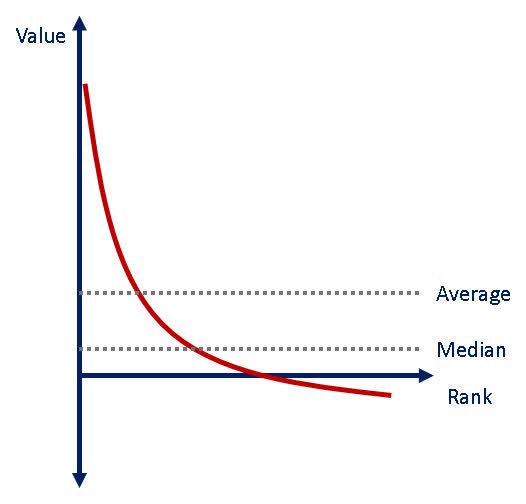

The estimated 15 million USD NPV per program is also likely to be highly heterogeneous, with most programs losing money and a relatively small number making a large amount of money. This introduces adverse selection risk, as customers who are confident of their program’s value will be reluctant to give away downstream value.

Figure 5: Potential Distribution of Program Values (source: Created by author)

Ginkgo plans to capture downstream value in the form of royalties, milestone payments or equity. The share of value that Ginkgo is able to negotiate will be highly dependent on the competitive environment. Ginkgo’s value proposition is likely to appeal to cash strapped start-ups, but larger customers may be reluctant to give away downstream value. If there are competitors with similar capabilities, Ginkgo’s ability to dictate terms will be limited.

There is also reason to be skeptical about Ginkgo’s ability to successfully complete 500 new programs every year, as this would place tremendous strain on fermentation capacity and could begin to saturate end markets. Fermentation capacity in the pharmaceutical industry is in the vicinity of 16.5 million liters, with approximately 62% of this dedicated to mammalian cell culture. Industrial CMO fermentation capacity is around 61 million liters, although the majority of this is already committed. It is difficult to generalize, as the required fermentation capacity could vary across orders of magnitude depending on what is being produced (e.g. antibodies versus biofuel), but it is entirely possible that within the next decade Ginkgo programs require tens of millions of liters of fermentation capacity. Similarly for the potential to saturate end markets, with 500 new programs annually, Ginkgo’s programs could soon be generating hundreds of billions of dollars of end market revenue. Given that synthetic biology has almost unlimited applications and fermentation capacity can be added, Ginkgo’s projections are not impossible, but are aggressive.

Biosecurity

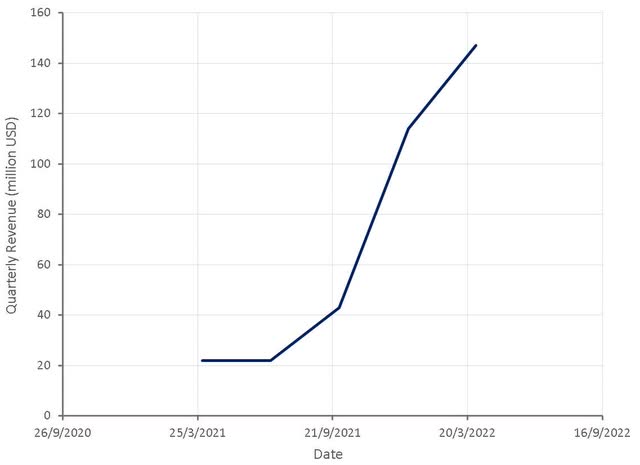

Ginkgo’s biosecurity business has grown rapidly over the past 12 months, but it is difficult to attribute significant value to this given the impact of the pandemic. Biosecurity could be extremely important in the future as the capabilities of biotechnology increase, but it seems probable that Ginkgo’s current biosecurity revenue will prove transitory as concerns regarding COVID diminish. The economics of this business are likely reasonable and if nothing else it should provide a source of cash to fund their main business.

Figure 7: Ginkgo Biosecurity Revenue (source: Created by author using data from Ginkgo Bioworks)

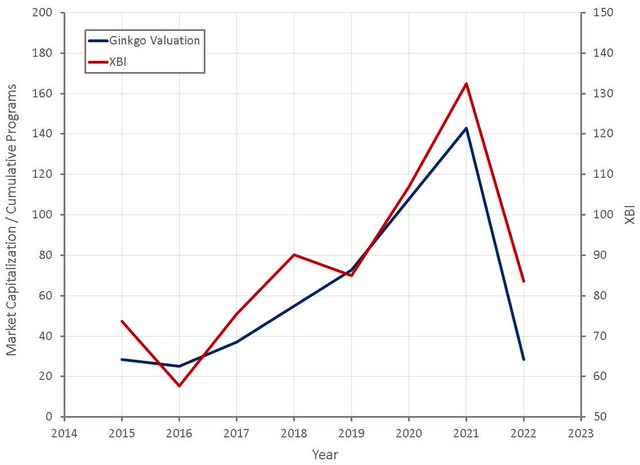

EV/S is a poor metric for Ginkgo because it does not account for downstream value creation. It is also a poor metric because Ginkgo’s current revenue quality is extremely poor (primarily from related parties) and potentially distorted by the biosecurity business. Given that Ginkgo is relying on downstream value it would make sense to value the business based on market capitalization relative to the cumulative number of major projects. This measure indicates that Ginkgo is now trading more in line with historical norms.

Figure 6: Ginkgo Valuation based on the Number of Cumulative Programs (source: Created by author using data from Ginkgo Bioworks and Yahoo Finance)

Conclusion

The failure of Ginkgo’s projects with Synlogic (SYBX) and Cronos (CRON) and the poor performance of the equity of these companies should give investors pause. Ginkgo has been able to sell investors a bold vision but so far there isn’t much evidence supporting its ability to fulfill that vision. Using more conservative estimates for the number of programs and the value of each program would dramatically reduce Ginkgo’s valuation. Ginkgo could currently be undervalued, but there are so many uncertainties in relation to what it is trying to achieve, it is difficult to estimate with any degree of accuracy. This potentially provides an opportunity for investors with insight into how the synthetic biology market will evolve through.

In the short term, Ginkgo’s share price is likely to be driven by the risk appetite of investors and could easily move significantly higher if inflation fears abate. Longer-term, Ginkgo will need to continue scaling its business and successfully transition more programs to commercial production to increase its share price.

Be the first to comment