Geir Pettersen/DigitalVision via Getty Images

My most recent Gilead (NASDAQ:GILD) article “Gilead Reeling: Growth Assets On Hold” addressed FDA holds placed on two of Gilead’s most promising molecules, magrolimab and lenacapavir. These holds have since been lifted on both magrolimab and lenacapavir.

This article updates Gilead’s current investment merit with particular view to lenacapavir and magrolimab, and its other high potential molecule TRODELVY.

Gilead expects its lenacapavir to carry its HIV franchise forward.

Gilead’s Q1, 2022 10-Q (p. 9) reported aggregate quarterly product sale revenues of $6,534 billion. Its combined HIV therapies contributed $3,707 billion, making up ~57% of this total. Its lead HIV therapy was BIKTARVY with revenues of $2.15 billion.

VEKLURY, its treatment for COVID-19, is its second largest contributor to its quarterly product revenues. VEKLURY contributed $1.535 billion to overall quarterly product revenues, chipping in ~23.5%. The next biggest indication in terms of aggregate product sales was HCV, aggregating $0.399 billion in revenues.

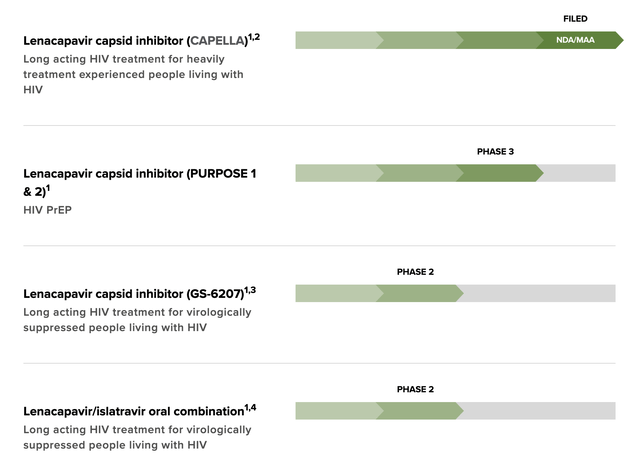

Investors interested in Gilead’s long-term prospects appropriately hone in on its HIV pipeline. Its late-stage HIV pipeline is made up primarily of its lenacapavir as shown below:

Gilead late stage HIV pipeline (Gilead)

In addition to its late stage lenacapavir trials it also has two additional phase 1 combination trials in process with more planned.

One question about lenacapavir that is unclear is the status of its 06/2021 NDA for heavily-treatment experienced people with multi-drug resistant HIV. In 03/2022 the FDA issued its CRL for this NDA based on:

…vials made of borosilicate glass and their compatibility with lenacapavir solution, which has resulted in a clinical hold for injectable lenacapavir.

As noted at the outset of this article, the FDA has removed its hold and has approved Gilead’s use of an alternative vial. However, there has been no announcement on the CRL nor the particular status of the NDA. Accordingly, it appears to be in limbo, awaiting resolution of ongoing talks between Gilead and the FDA. Its press release announcing the lifting of the hold quoted CMO Parsey:

…We look forward to discussing this further with FDA over the coming months so that we can make this investigational new therapy available to people living with multidrug-resistant HIV as soon as possible[.] People living with multidrug-resistant HIV need new treatment options and we will continue to pursue approval of lenacapavir to offer a much-needed new long-acting treatment option for this population.

Over the years, Gilead has excelled at advancing its HIV therapies to market without protracted delays. Accordingly, I expect it will get its marketing authorization for lenacapavir back before the FDA for a final resolution in due course.

Gilead is rejuvenating its troubled cancer portfolio with its TRODELVY acquisition.

As discussed in 10/2020’s “Gilead’s Cancer Follies” (“Follies”), Gilead has a lengthy track record of difficulties in developing a franchise of profitable cancer therapies. Its major cancer therapy deal to that point was its $11.9 billion 08/2017 Kite acquisition.

This Kite deal has been a therapeutic marvel with several remarkable Kite originated cell therapies having notched FDA approvals and more on the way. It has been disappointing for shareholders so far because Kite’s autologous cell therapy process has been so demanding of resources and has been unable to achieve an attractive scale of operations.

Its Q1, 2022 aggregate cell therapy revenues came in at $274 million. CFO Dickinson discussed cell therapy at length during the recent Bernstein Strategic Decisions Conference. He noted that cell therapy’s billion dollar run rate was expected to double and could grow from there.

He discussed the fluid cell therapy market where there were countless players innovating around the world. Gilead is carefully monitoring allogeneic cell therapies which provide an alternate approach with different risk/benefit parameters compared to its autologous processes.

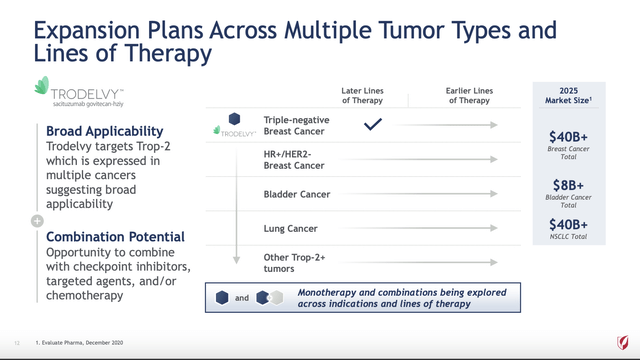

Follies did not discuss Gilead’s 09/13/2022 $21 billion Immunomedics (IMMU) deal which had been announced but not yet closed at the time of the article. Immunomedics brought TRODELVY (sacituzumab govitecan-hziy), a Trop-2-directed antibody and topoisomerase inhibitor drug conjugate, to Gilead. Gilead has high hopes for TRODELVY. The enormous market potential for it is revealed in its post-closing presentation slide below:

01/2021 JP Morgan Healthcare Conference (Seeking Alpha)

So far TRODELVY has shown mixed results. It has returned revenues of $146 million during Q1, 2022. As described by CCO Mercier during the Call these represented an increase of:

…103% year-over-year and 24% sequentially, as shown on [earnings call] Slide 13. We’re encouraged by adoption not just in the U.S., but notably, in Germany and France, and continue to work with health authorities and reimbursement bodies to extend Trodelvy’s reach to patients globally. We’ve completed the expansion of our field force to support the U.S. and Europe and believe we are now at right scale to support physicians and make Trodelvy available across all approved indications to patients who could benefit from it.

TRODELVY’s story will not be written with its early FDA approved indications. To the contrary Gilead has placed TRODELVY in a prominent role across its cancer pipeline. In Gilead’s 04/2022 148 slide Oncology Deep Dive presentation, TRODELVY featured prominently in 64 slides.

It has anticipated roles in multiple solid tumor therapies, listed below, with studies planned or in progress (9 – phase 3, 4 – phase 2, 1 – phase 1) (slides 18 and 32):

- Triple Negative Breast Cancer [TNBC];

- Urothelial Carcinoma [UC];

- Breast Cancer [HR+/HER2];

- Non-Small Cell Lung Cancer [NSCLC];

- Head and Neck Squamous Cell Carcinoma [HNSCC];

- Small Cell Lung Cancer [HNSCC];

- Other solid tumors.

It has several submissions and data readouts planned over the next several years (Oncology Deep Dive slides 21-24 and 32).

In Gilead’s Q1, 2022 10-Q it advised that it had taken a $2.7 billion partial impairment charge associated with its 2020 Immunomedics acquisition. It had allocated a portion of the purchase price to acquired intangible in-process research and development (“IPR&D”) assets.

Subsequently, it “… updated …[its] estimate of the fair value of …[its] HR+/HER2- IPR&D intangible asset to $6.1 billion [from $8.8 billion]. Gilead bulls must hope that this does not presage additional downward revaluations to come.

Magrolimab studies are resuming without modification on safety profile.

Gilead acquired magrolimab (monoclonal antibody against CD47 and a macrophage checkpoint inhibitor) in its 03/2020 $4.9 billion acquisition of Forty Seven. The FDA put its clinical trials on a partial clinical hold in 01/2022. It released the hold on 04/2022. Gilead noted:

During the partial clinical hold, patients already enrolled in the affected Gilead magrolimab studies, including the pivotal, Phase 3 ENHANCE study, continued receiving treatment. Prior to the trial hold, Gilead already met the pre-specified enrollment threshold required for the first interim analysis of the ENHANCE study. Based on this, Gilead is confident the readout for the first interim analysis remains on schedule for 2023.

The ENHANCE study (NCT04313881) is a phase 3 study. It evaluates magrolimab in combination with azacitidine compared to azacitidine plus placebo in previously untreated participants with intermediate/high/very high-risk myelodysplastic syndrome [MDS].

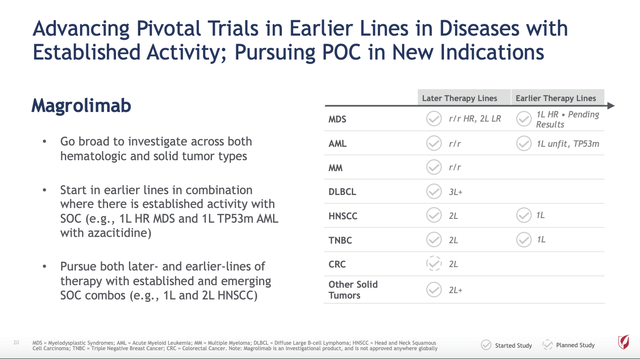

Like TRODELVY, Gilead has focused development of magrolimab as a pipeline in a product therapy. CFO Dickinson recently characterized it as a “higher risk” asset. A higher risk asset requires higher potential reward to balance it. Slide 20 from its Oncology Deep Dive Presentation shows the full scope of its hopes for this key molecule:

Gilead’s 04/2022 Oncology Deep Dive (Seeking Alpha)

Magrolimab is currently advancing in clinical trials for four hematological cancers and six solid tumor cancers per Oncology Deep Dive slide 23. Its partial readout for its ENHANCE study will be a big deal for Gilead giving a first phase 3 read on whether magrolimab deserves the high hopes it has inspired.

Conclusion

CEO O’Day responded as follows to closing 06/2022 Goldman Sachs Global Healthcare Conference question of what most excited him:

…if I had to pick the development portfolio, yes, it would be Trodelvy, magrolimab and Lenacapavir.

Gilead has a massive pipeline extending well beyond these three assets. However, these three are its most high profile by far. Gilead’s price performance will likely mirror their performance in upcoming years.

Be the first to comment