da-kuk/E+ via Getty Images

Thesis:

Gilead Sciences (NASDAQ:GILD) has been a roller coaster investment from the smooth ride of its highly profitable cure of Hepatitis C. Several acquisitions to the tune of roughly $40 billion have not met expectations, leaving investors with more concerns and less optimism. Gilead’s inflammatory developments have been hindered, drawing nothing but questions to the Galapagos collaboration. However, Gilead is building a robust HIV pipeline, as sales continue to produce double-digit growth. Viral and oncology marketable regimens are also beginning to generate revenue. The question is whether Gilead can deliver enough to earn investors’ approval and if the stock is worth consideration at current price levels.

Gilead’s HIV regimen sales are promising:

While investors were not thrilled with Gilead‘s $1.25 billion settlement with GlaxoSmithKline over patent infringement, I personally view this as a win. Gilead must also pay a 3% royalty to Glaxo until 2027, however, this settlement will work out in Gilead‘s favor over the long run.

Gilead produced $16.3 billion in sales from its HIV pipeline in FY21. The global market for HIV medications in FY21 was roughly $30.46 billion, giving Gilead control over 53% of the global HIV market. Of the top-ten leading medications for HIV on the market, Gilead produces six of them. The global HIV market is forecasted to be in the range of $45.5 billion by FY28. Should Gilead maintain a market share of 50% or more moving forward, it could produce roughly $23 billion in revenue from its HIV pipeline in FY28 alone.

Gilead‘s Biktarvy is currently the number one prescribed regimen in the U.S., with over 50% of patients beginning an HIV regimen starting on Biktarvy. Additionally, Biktarvy has produced impressive growth, with its FY21 sales up 19% from FY20. Keep in mind Gilead produces Genvoya, Descovy, Odefsey, and Truvada, all market-leading HIV medications.

Biktarvy Sales Growth (investors.gilead.com/financial-information/quarterly-earnings)

Gilead‘s oncology pipeline is on track to provide moderate revenue generation:

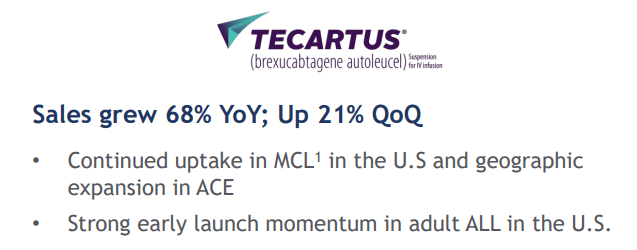

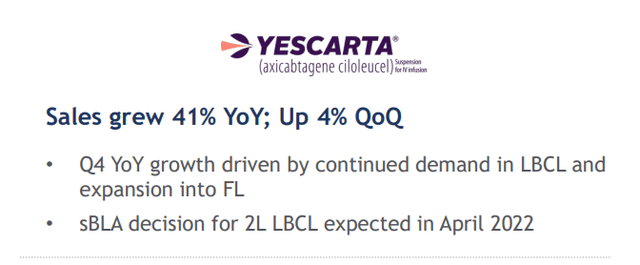

Gilead‘s oncology business is starting to generate revenue with promising growth figures. On April 1st, 2022, Gilead‘s Yescarta received FDA approval in the U.S. as the first CAR-T cell therapy for Large B-cell Lymphoma (LBCL). This is great news, as Tecartus (Mantle Cell Lymphoma treatment) has produced impressive sales figures since its FDA approval on October 1st, 2021, and because Yescarta‘s efficacy is significant compared to the current standard of care for LBCL. According to the press release, 40.5% of Yescarta patients were alive at two years without disease progression or the need for additional cancer treatment after a single infusion of Yescarta. This is 2.5x better than the current standard of care rate of 16.3%. Event-free survival rates were also substantially better with Yescarta, coming in at 8.3 months compared to 2 months with the current standard of care. Gilead‘s T-Cell therapies are groundbreaking science with undeniable efficacy rates. Now, let‘s look at the sales growth in Gilead‘s FDA approved T-Cell therapies and the respective market sizes.

From the data I‘ve found, the Mantle Cell Lymphoma market is estimated to be in the area of $7 billion. The MCL market is also expected to grow at a CAGR of roughly 7% per year through 2027. Gilead‘s FY21 Tecartus sales came in at $176 million, representing a 2.5% market share. However, Tecartus sales are up 68% on an annual basis, indicating Gilead is absorbing more MCL market share by the day. At current growth rates, Tecartus will be a billion-dollar regimen in under four years. It‘s worth noting that MCL is relatively rare, affecting 0.5 out of 100,000 people. Nevertheless, Gilead‘s Tecartus is on track to generate over $1 billion in revenue in the coming years.

Tecartus Sales Growth (investors.gilead.com/financial-information/quarterly-earnings)

Yescarta is even more promising, as the LBCL market is roughly 14x the size of the MCL market, affecting 7 out of 100,000 people per year. The LBCL market is expected to be roughly $4.3 billion in 2022 and grow at a CAGR of 15% from now until 2030. Yescarta generated $695 million revenue in FY21, representing a market share of 16.2%. Yescarta sales are up 41% from FY20. At the current growth rates of the LBCL market and Yescarta sales, Gilead could capture close to 50% of the LBCL market by FY27, demonstrating Yescarta has impressive revenue generating potential.

Yescarta Sales Growth (investors.gilead.com/financial-information/quarterly-earnings)

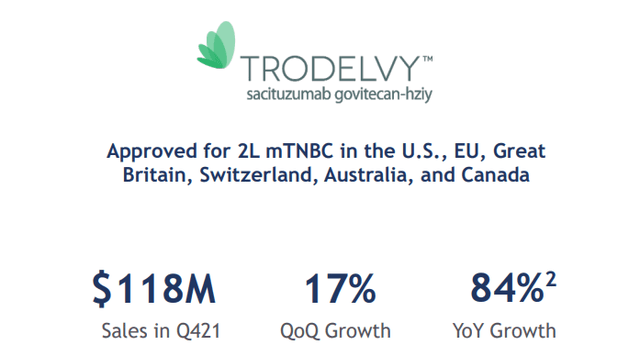

Another cancer regimen by Gilead worth mentioning is Trodelvy, a regimen for metastatic triple-negative breast cancer (MTNBC) and metastatic urothelial cancer (MUC). The MTNBC market as of 2022 is roughly $606 million and the MUC market size is roughly $1.189 billion. The expected CAGRs are 4.7% and 17.9%, respectively. Trodelvy produced FY21 revenue of $380 million, representing a market share of 21%. Trodelvy sales are up 84% from FY20, indicating Trodelvy is on track to be a billion-dollar regimen in under two years.

Trodelvy Sales Growth (investors.gilead.com/financial-information/quarterly-earnings)

While Gilead has numerous drugs in the works, these are the ones producing now. Gilead is on track to add $5-$6 billion in annual revenue generation between Tecartus, Yescarta, and Trodelvy within the next five years.

Inflammatory pipeline is hindered but has big market potential:

Gilead‘s inflammatory disease pipeline has been subpar. There is a ton of market potential with Filgotinib, as the drug can be used to treat Crohn‘s Disease (CD), Ulcerative Colitis (UC), and Rheumatoid Arthritis (RA), collectively generating a market worth $80.266 billion in 2022. Filgotinib is in the works with Galapagos, in which Gilead owns approximately 22% of. As of now Galapagos is operating at a loss and Filgotinib is only being marketed in Europe and Japan as Jyseleca. Jyseleca is used to treat Ulcerative Colitis and Rheumatoid Arthritis in Europe and Japan. Gilead is hopeful to receive FDA approval to treat Crohn‘s Disease and Ulcerative Colitis in the U.S. using Jyseleca but has withdrawn its U.S. application for the drugs treatment of rheumatoid arthritis. Gilead will still be pursuing FDA approval for Filgotinib‘s use in RA, but this is something to monitor as the MANTA and MANTA-RAy trials near conclusion. Gilead will control U.S. sales of Filgotinib as things move forward and Galapagos will control foreign sales. Gilead is set to receive royalties from foreign sales of Jyseleca beginning in FY24. Galapagos has stated that they hope to achieve sales of $545 million by FY25, representing a 10% market share of the CD, UC, and RA market in Europe and Japan. This would translate to roughly $120 million in royalties for Gilead. I won‘t begin to speculate the market Gilead could capture in treating CD, UC, and RA, however, the market is very large.

Gilead has a drug for Primary Sclerosing Cholangitis (PSC) in Phase 3 Clinical trials as well. PSC is forecasted to have a market size of more than $6 billion by FY25, presenting a solid market for Gilead to capitalize on, should its clinicals go well.

As of now Gilead‘s investment in Galapagos and its inflammatory disease pipeline is hindered. Galapagos posted an FY20 (most recent annual report available on investor relations) net loss of $333 million. The collaboration is close to penetrating the CD, UC, and RA markets, which would be a huge bonus considering the size of the respective markets. Developments in Filgotinib should be closely monitored, as there is a ton value at stake.

Is Gilead‘s viral disease pipeline (excluding HIV) dead money?

Gilead‘s viral disease pipeline isn‘t what it once was, but it still produces solid revenue. Hepatitis C (HCV) sales have and will continue to decline; however, Hepatitis B (HBV) and Hepatitis D (HDV) don‘t look too bad. Additionally, Veklury may not maintain the sales levels its seen in the heat of the Covid-19 pandemic, but I do believe it can maintain worthy sales volumes as Covid-19 is seemingly here to stay. While Gilead‘s viral disease pipeline might not be big money, I don‘t think it‘s dead money.

Gilead‘s HCV sales for FY21 came in at $1.881 billion, down 7% from FY20. While HCV sales have dissipated quickly, they‘re still generating a reasonable amount of revenue for Gilead. Gilead also cites that its HCV regimens are maintaining a 50% – 60% share across core markets. These sales will continue to decline, but the rate of decline hasn‘t been as substantial recently. There will continue to be new cases of HCV, and I believe Gilead has many more billions to squeeze out of its HCV regimens moving forward. I‘m not boasting HCV sales here, but there‘s still money on the table which is worth noting while it‘s still there.

Revenue generation from HBV and HDV don‘t look bad at all. Gilead‘s total HBV/HDV sales in FY21 came to $969 million, up 17% from FY20. The HBV market in 2022 was roughly $24 billion, giving Gilead a market share of 4%. At current growth rates Gilead could easily be generating over $2 billion from its HBV/HDV regimens within five years, which would represent close to a 10% market share. I think it‘s worth noting that Gilead could outperform competitors with its Hepatitis regimens due to its success with Hepatitis C. Either way, HBV/HDV regimen sales are growing at double-digit rates and regimens for HBV/HDV will have a longer product life as HBV/HDV aren’t curable.

Veklury has produced impressive revenue for Gilead amid the pandemic. Many believe these sales will vanish, but they likely won‘t. I don‘t believe Gilead will continue to produce the sales figures it currently has with Veklury; however, it will likely be a billion-dollar regimen moving forward. Experts have stated that Covid-19 will more than likely become endemic, meaning the virus will circulate forever. Vaccinations will build immunities and end the pandemic, but Covid-19 will still be contracted like any other virus. For those who still get ill from Covid-19, even with the vaccinations, they will need treatment. This is where Veklury will come in. Veklury is an injectable medication that is used to treat those suffering from the effects of Covid-19. As the pandemic comes to an end, people infected with Covid-19 will still benefit from treatment using Veklury. I believe sales will likely be 20% – 30% of the levels they‘re at now, but that still points to regimen producing roughly $1 – $1.5 billion in revenue. My estimates here are speculative, but I believe the virus will still be contracted at relatively high rates as the pandemic ends and masks/mandates become a thing of the past. Furthermore, there are many unvaccinated people, as there was much controversy surrounding the necessity of vaccinations and how quickly they were produced.

Is Gilead worth buying at current price levels?

Gilead admittedly has some hurdles to overcome. The pharma industry is very competitive, and the slightest thing can send a phase 3 drug back to the drawing board, as seen with Filgotinib. Nevertheless, Gilead does have a strong oncology and viral disease pipeline with promising prospects in its inflammatory disease pipeline. That said, I think Gilead looks good at current prices based on current figures, forward-looking figures, and it‘s a strong dividend income stock.

Gilead is currently trading at a P/E ratio of 12.12 and a P/FCF ratio of 6.98. Aside from Moderna and Pfizer, Gilead is well below valuation metrics compared to industry peers. I also don‘t like Moderna and Pfizer valuations as they‘ve benefitted substantially from the pandemic. While Gilead has benefitted from the pandemic as well, I believe Veklury will be more prevalent than vaccinations moving forward. If Gilead were trading at industry peer valuation levels, the stock price would be sitting around $90 per share based on P/E and $118 per share based on P/FCF. Gilead is also on track to payout $2.92 per share in annual dividends, yielding 4.79%. With TTM free cash flow per share of $8.56 the dividend is quite safe. Total liabilities are historically relatively high at $46.89 billion in FY21, however, they‘re down 7% from FY20‘s figure of $50.19 billion. Gilead is forecasting FY22 revenue of $24 billion, down roughly 11% from FY21. Although, when accounting for the 11% decrease Gilead is still undervalued compared to peers and the dividend is still safe.

It’s hard to speculate what Gilead‘s bottom line is going to look like much further than a year, as any developments in the pipeline can change forecasts. A new Covid-19 variant could spark the need for Veklury and completely change FY22 forecasts. I don‘t think Gilead‘s pipeline is in the best shape, but it is still producing and has an abundance of potential. When considering pipeline developments, current sales figures and growth rates in marketable regimens, industry peer valuation metrics, and the dividend, I think Gilead is worth consideration at current price levels.

Conclusion:

In conclusion, Gilead is walking a fine line. The company appears healthy and attractive at current price levels. I believe its HIV business has plenty of room to run and is very promising. Gilead‘s other viral regimens are so-so, as they‘re producing supplementary revenue but nothing significant enough to completely turn the tide for Gilead. The oncology pipeline appears strong in terms of bringing regimens to the market, but the markets that Yescarta and Tecartus serve aren‘t huge. Gilead certainly needs a catalyst to make a strong upswing. Whether it‘s crushing the market with HIV regimens or bringing Filgotinib to the U.S., I‘m not certain. Regardless, I don‘t think Gilead is in any imminent danger now. The current valuation metrics, especially when compared to industry peers are favorable. Gilead‘s dividend is quite high with plenty of cash flow generation to cover it. The stock is down 18% from the start of the year and hasn‘t really seen much lower levels since before its cure of HCV. I‘m not saying Gilead is a grand slam, but I think it‘s worth consideration at current price levels.

Be the first to comment