Justin Sullivan

Introduction

I first covered Gilead Sciences (NASDAQ:GILD) in early April, pointing out that the stock had fallen victim in large part to the company’s success with its hepatitis C virus (HCV) therapeutics. Many are calling the company a one-trick pony – a view I do not share, even though Gilead remains overly reliant on antivirals in general and HIV therapeutics in particular. The antiviral portfolio accounted for over 90% of revenues in 2021, and setting aside Veklury – Gilead’s SARS-CoV2 treatment – for a moment, the three top-selling treatments in 2021 were all human immunodeficiency virus (HIV) therapeutics: Biktarvy (32% of total product sales), Genvoya (11%) and Descovy (6%). In addition to the company’s over-reliance on HIV therapeutics, current sentiment is fueled by Gilead’s recent acquisitions in the oncology space, which have yet to generate significant sales, let alone profits.

In this follow-up, I discuss Gilead’s Q2 2022 earnings, which were released on August 2, 2022. I highlight recent developments related to acquired assets and the performance of key revenue drivers, as well as potential upcoming blockbusters, and conclude with my thoughts on whether the stock should command a higher earnings multiple than it currently does, contrary to current market sentiment.

Gilead’s HIV Portfolio Remains Its Money Printer

Sales of Gilead’s HIV portfolio increased 7% year-over-year in the second quarter of 2022. Biktarvy (bictegravir/emtricitabine/tenofovirafenamide combination treatment) accounted for one-third of Gilead’s product sales in 2021, with strong year-over-year growth of 19%. Demand for the therapy has increased in recent months: First-quarter 2022 sales were up 18% year-over-year, and second-quarter sales were up 28%. Most recently, Gilead announced promising results from its ongoing Phase 3 ALLIANCE trial, which began in Q2 2018. Biktarvy is highly effective and has been shown to be able to help people with HIV/hepatitis B virus (HBV) co-infection. In addition, based on five-year data from two studies, no cases of treatment failure due to Biktarvy resistance have been identified. For the foreseeable future, and notwithstanding potential major acquisitions that Gilead could certainly afford, Biktarvy will remain the company’s cash cow. Biktarvy continues to gain market share. By the second quarter of 2022, the treatment could claim 44% of the U.S. market share, up 4% year-over-year (slide 9, Q2 earnings presentation). Therefore, the associated cash flows are expected to continue to increase, also in part because the treatment’s patent protection does not expire until 2033 (n.b., losses of exclusivity (LOEs) can be found on p. 8 of Gilead’s 2021 10-K). Also, Biktarvy continues to gain market share.

Genvoya (tenofovir, for the treatment of HIV-1 infection) is currently Gilead’s second best-selling drug, with sales of $582 million in Q2 2022 and $1.2 billion in the first half of the year, down more than 15% year-over-year. Given the drug’s LOE in 2029, this is somewhat surprising, but the most likely reason for the decline is that an increasing number of patients are being switched to Gilead’s top treatment, Biktarvy.

Descovy is another treatment for HIV-1 infection that is also used as pre-exposure prophylaxis and is administered in combination with Gilead’s emtricitabine and tenofovir alafenamide. Sales increased by approximately 6% and 5% year-over-year on a quarterly and half-year basis, respectively. Full-year sales are expected to be slightly above 2021 levels (i.e., $1.7 billion) as demand increases due to the lessening impact of the pandemic. However, management indicated that inventory dynamics are temporarily impacting sales. Sales growth of Descovy is fairly limited due to the treatment’s LOE in 2025, but could be impacted even earlier due to litigation related to pre-exposure prophylaxis (p. 87, 2021 10-K).

Lenacapavir is a new, long-acting injectable HIV therapeutic that has not yet been approved by the FDA. Personally, I think it is premature to hypothesize about its long-term sales potential, but given the estimated sales of injectable HIV therapeutics to reach $2 billion in 2022 and several emerging competitors, it probably should not be considered a potential blockbuster. Investor sentiment suffered when a clinical hold was placed on the investigational New Drug Application due to storage vials. In May 2022, however, the FDA lifted that hold, and the study of lenacapavir’s therapeutic effect against HIV infection and as a potential pre-exposure prophylaxis can proceed.

Gilead’s Hepatitis Franchise

Combination therapies with sofosbuvir continue to generate significant sales and cash flows, but of course competitors such as Mavyret (glecaprevir/pibrentasvir, AbbVie (ABBV)) are putting pressure on Gilead’s HCV franchise. In 2021, the segment generated $1.9 billion in product sales, down 9% year-over-year, primarily due to lower demand related to the COVID-19 pandemic. In the first half of 2022, the company generated $847 million in product-related revenue (6.7% of total product sales), a 20% year-over-year decline, clearly indicating that Gilead’s former cash cow is a thing of the past – but that is obviously common knowledge and certainly priced into the stock.

On June 23, the company announced results from a Phase 3 study of Hepcludex (bulevirtide) for the treatment of chronic hepatitis delta virus (HDV) infection, highlighting the drug’s efficacy and safety. It was added to Gilead’s portfolio following the acquisition of Myr GmbH, and has already been conditionally approved by the EMA for said infection in 2020, so it does not seem unlikely that the FDA will follow suit. Understandably, sales are hardly significant yet and are not even reported individually. Hepcludex should be seen as complementary to Vemlidy and Viread (tenofovir preparations, treatment of chronic HBV infection) because of its more specific use. Vemlidy and Viread contributed less than $1 billion to Gilead’s 2021 top-line, and 2.8% growth in the first half to $470 million year-over-year (including Hepcludex) certainly doesn’t inspire much confidence. Gilead’s hepatitis franchise as a whole generated half-year sales of $1.32 billion, down 13% year-over-year.

Veklury Performed Seasonally As Expected And Received A New Approval

Veklury (remdesivir), Gilead’s SARS-CoV-2 treatment, has been a significant contributor to sales since its launch in 2020. That year, the company generated $2.0 billion in product-related sales, while in 2021, sales increased 98% to $5.6 billion – thanks to a drug originally developed to treat HCV infections.

With the pandemic finally appearing to end, it is not surprising that sales declined in the first half of 2022. Sales fell 13% year-over-year, from $2.3 billion to $2.0 billion, with a much steeper -46% year-over-year decline in the second quarter.

In late April, Veklury was approved for the treatment of pediatric patients under 12 years of age at high risk for progression to severe COVID-19. Of course, the associated number of use cases will certainly be very small.

Frankly, I did not expect Veklury’s sales to reach nearly $6 billion in 2021 – and neither did management, in its first-quarter 2021 conference call, which expected full-year sales of $2 billion to $3 billion. I’ve always viewed Veklury as a windfall profit for Gilead that partially offset so far overly expensive and far from profitable acquisitions.

For 2022, Gilead expects product-related sales of $2.5 billion – $500 million more than previously forecast. That said, I personally see Veklury’s days as numbered – in part due to alternative antiviral treatments – and the second quarter results seem to confirm that observation, but of course sales could pick up in the winter should we find ourselves in the unfortunate situation of new strains causing a large number of severe cases. Obviously, SARS-CoV 2 is a very seasonal virus. In any case, I applaud Gilead’s unwavering strength in bringing successful antivirals to market.

Trodelvy – A Potential Future Blockbuster Cancer Therapy

Trodelvy (sacituzumab govitecan) was acquired through the Immunomedics acquisition in 2020. It is expected to reach peak sales of $2 billion to $3 billion. Gilead collaborates with Merck (MRK) to test the drug in combination with Keytruda (pembrolizumab) as a first-line treatment for metastatic non-small cell lung cancer. In April 2021, the drug was approved as a third-line treatment for metastatic triple-negative breast cancer. In the second quarter of 2022, the company announced results from a Phase 3 study of Trodelvy in patients with HR+/HER2-metastatic breast cancer who had received strong pretreatments. Compared to physician’s choice chemotherapy, Trodelvy showed improvement in progression-free survival. The Phase 3 ASCENT trial is evaluating Trodelvy as a third-line therapy in metastatic triple-negative breast cancer, and recently published final data show an increase in overall survival compared to chemotherapy.

In the first six months of the year, product-related sales increased 89% year-over-year, suggesting the treatment is on track, but estimated peak sales are still some way off, considering that full-year sales in 2022 are unlikely to exceed $700 million. Of note, the main patent protection for Trodelvy in the U.S. is expected to expire in 2023, but Gilead has filed a patent term extension request that would extend the protection to at least 2028. Patent protection in the EU is valid until 2029, but should not be overstated due to weak sales in the Union ($10 million in 2021).

Yescarta and Tecartus Require Patience

As described in my previous article, Gilead has made major (financial) efforts to diversify in the oncology space. However, the CAR T-cell therapies acquired through the Kite Pharma acquisition (2017, $12 billion), namely Yescarta (axicabtagene ciloleucel) and Tecartus (brexucabtagene autoleucel), together accounted for only a little more than 3% of the company’s sales in 2021.

Yescarta was approved several years ago for the treatment of relapsed or refractory ((r/r)) large B-cell lymphoma following two or more lines of systemic therapy. In 2021, it received approval for the treatment of follicular lymphoma, and in the second quarter of 2022, it was approved as a second-line treatment for large B-cell lymphoma. It received European approval for the aforementioned indication in late June. It is therefore not surprising that sales in this quarter increased by 65% year-over-year and it appears increasingly likely that Yescarta will become a blockbuster therapy in 2022.

Tecartus has been approved for the treatment of r/r mantle cell lymphoma since 2020. In October 2021, the FDA approved the cell therapy for the treatment of r/r acute lymphoblastic leukemia, which likely formed the basis, in part, for a June 2022 positive opinion from the European Medicines Agency (EMA). Longer-term follow-up results from a Phase 2 and a Phase 1/2 study presented in early June showed high rates of durable response and a median overall survival of more than two years. In 2022, product-related sales increased by 78% and 89% year-over-year on a quarterly and half-year basis, respectively. However, with full-year sales projected to be less than $300 million, Tecartus’ share is still hardly worth mentioning.

Overall, only Yescarta seems to be heading towards significant revenues in some way, while it is too early to say that Tecartus is actually a valuable asset. However, Tecartus’ looming LOE in 2027 does not inspire much confidence. Yescarta’s runway is much longer with a projected LOE in 2031, suggesting that the price paid for Kite was mainly associated with this therapy.

Magrolimab – Still At An Early Stage, Studies Can Be Continued

Magrolimab is an experimental antibody for the treatment of, for example, myelodysplastic syndrome, which was added to Gilead’s portfolio through the acquisition of Forty Seven (2020, nearly $5 billion). In January 2022, the FDA placed a partial clinical hold on Phase 2 and 3 clinical trials of magrolimab due to suspected unexpected serious adverse events. However, three months later, the hold was lifted following a review of comprehensive safety data, and the studies evaluating Magrolimab for the treatment of myelodysplastic syndrome and various forms of blood cancer can continue. At this time, however, it can only be speculated whether Magrolimab will be commercially successful.

Gilead’s Full-Year Guidance Update – Hardly Worth Mentioning

The strong U.S. dollar understandably impacts the company’s results, but I would not overstate the exchange rate effects, as Gilead typically generates more than 70% of its revenues in the United States. Conversely, the significant U.S. exposure makes Gilead’s earnings vulnerable to the potential impact of upcoming changes in drug pricing policies. According to investment services firm Morningstar, the entire sector is likely to be affected, but cost reductions and higher launch prices are expected to mitigate the negative impact.

Management updated its guidance and now expects total product sales of $24.5 billion to $25.0 billion, compared to $23.8 billion and $24.3 billion previously. The slight increase is mainly due to higher expectations related to Veklury sales ($2.5 billion versus $2.0 billion previously). Accordingly, non-GAAP earnings per share guidance was also raised to $6.55 from $6.50 previously, translating to a forward price-earnings ratio of 9.2.

Concluding Remarks

Q2 2022 results showed a steep decline in Veklury sales – this was no surprise, and investors should continue to view the drug as a windfall given its original development as a treatment for HCV infection. Gilead’s HIV portfolio performed well, with Biktarvy seeing further market share gains (currently 44% U.S. market share, up 4% year-over-year) and an acceleration in sales growth as demand increased due to the fading pandemic-related impact. The treatment continues to “steal” revenue from Genvoya. The company’s oncology segment is showing signs of improvement, driven by Yescarta (which was likely the basis for Kite Pharma’s somewhat high price) and Trodelvy. The latter will soon become a blockbuster drug, but the thesis that the drug will reach peak sales of $2 billion to $3 billion is subject to considerable uncertainty.

Gilead’s robust HIV portfolio, the somewhat unexpected gains from Veklury, and slowly but surely declining HCV revenues result in an overall fairly stable free cash flow of $8 billion to $10 billion per year. This currently translates into a free cash flow yield of 11% to 13% – signaling deep value territory. Gilead’s balance sheet is robust, and it does not seem unreasonable to expect strong dividend growth going forward. In 2021, the company paid out 40% of its normalized free cash flow.

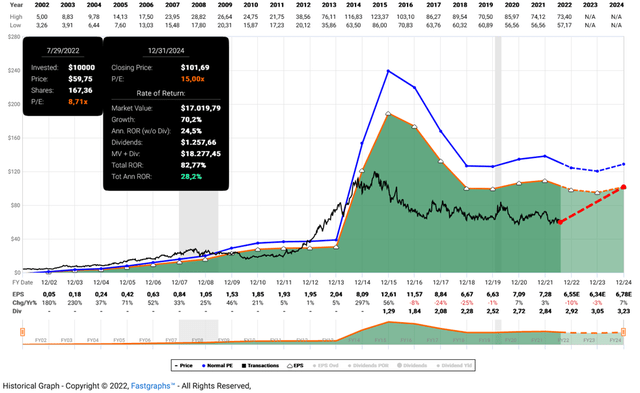

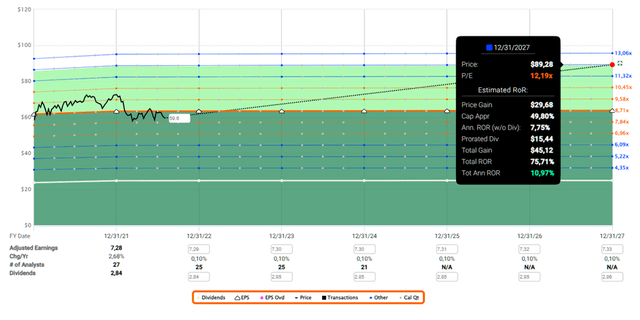

I still see Gilead as a straight-forward investment case. Investor sentiment is very negative and the stock is priced accordingly (Figure 1). Looking at the company’s long-term average price-earnings ratio of 19, the current ratio of 9 appears unreal. However, the long-term average earnings multiple is due in large part to Gilead’s success with its HCV treatments, and it currently seems very unlikely that the company will return to its former glory anytime soon. Nor, in my opinion, is it necessary, and at the current multiple, the margin of safety seems more than adequate. Even a return to a market multiple of 15x seems quite unreasonable given the early stage and uncertainties surrounding Gilead’s oncology portfolio, but a return to a multiple of 12x by 2027 does not seem far-fetched and would result in an annualized rate of return of 11% based on quasi zero earnings growth (Figure 2). Therefore, management just needs to keep the company in its current state – any form of positive surprise should provide plenty of further upside.

Figure 1: FAST Graphs chart for GILD, based on the 20-year adjusted operating earnings history and a market price-earnings ratio of 15 (obtained with permission from www.fastgraphs.com, Copyright FAST Graphs)

Figure 2: FAST Graphs’ forecasting calculator for GILD, based on 2.7% growth in 2021 and 0.1% per annum thereafter, and a reversion to a price-earnings ratio of 12 by the end of 2027 (obtained with permission from www.fastgraphs.com, Copyright FAST Graphs)

With Gilead’s oncology portfolio showing early signs of improvement, I do not mind being a patient investor – especially since I am compensated with a dividend yield of nearly 5% currently – and the dividend seems very safe indeed. However, since I write my articles here on Seeking Alpha to chronicle my personal journey, I do not mind sharing that Gilead is a comparatively small position in my pharma portfolio, where I focus on industry giants Johnson & Johnson (JNJ), Merck, AbbVie, and Bristol Myers Squibb (BMY) (which I recently covered).

Thank you very much for taking the time to read my article. In case of any questions or comments, I’m very happy to read from you in the comments section below.

Be the first to comment