Michael Vi/iStock Editorial via Getty Images

From a valuation perspective, Amazon (NASDAQ:AMZN) has been my favorite big tech play for quite a while. As I previously detailed, Amazon was cheaper than Microsoft (MSFT) on many metrics, including EV/EBITDA and P/OCF. Since then, which was January 25th, it has rallied 9% and at one point was up 20%. It’s still cheap but might not appear so after they report what will seem like disastrous 1st quarter earnings.

Why? Well, it goes back to what I mentioned in my February 7th piece about their buyback and stake in Rivian (RIVN):

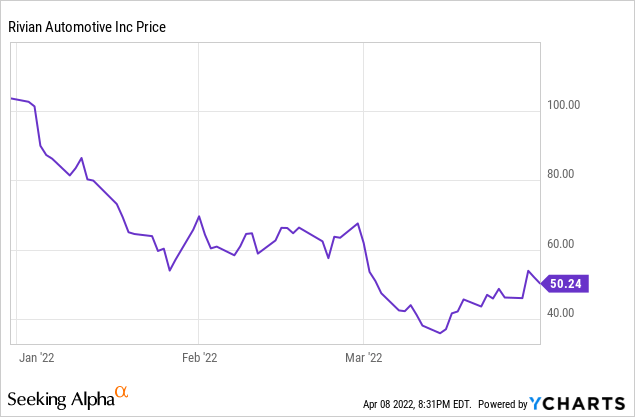

After Amazon released 4th quarter earnings on February 3rd, most of the commentary you saw was related to things like the 40% growth for AWS, the price hike on Prime, and the $11.8 billion gain on Rivian stake. The latter of which were unrealized gains, using mark to market pricing as of December 31st when Rivian stock was north of $100. Assuming Rivian is below that on March 31st, it will actually have the opposite effect on 1st quarter’s numbers, contributing negative EPS on a GAAP basis.

How mark-to-market accounting works

Each quarter public companies must adjust the valuations they list for any securities owned, based on their most recent trading price. For stocks, that means whatever price they ended the day at, per the last trading day of the quarter.

In the case of their Rivian stake, Amazon will need to use the price as of Thursday, March 31st. That will be $50.24. Contrast that to December 31st of last year, when it was $103.69. That’s almost 52% lower.

Even though it was an unrealized gain, Rivian contributed 82% of Amazon’s GAAP profits for 4th quarter. $14.3 billion total, with $11.8 billion coming from Rivian. If it weren’t for this, the headline EPS would have better reflected the fact that their overall operating income was down nearly 50%; $3.5 billion vs. $6.9B for the 4th quarter a year prior. Yet, the stock rallied hard post-earnings.

So how bad will 1st quarter be?

For starters, 4th quarter’s 50% decline in operating income was of zero concern to me. They intentionally suppress taxable earnings by reinvesting in growth. Ignore the depreciation and amortization. Follow their cash flow. As previously outlined, my favorite metrics for valuing Amazon are EV/EBITDA and P/OCF.

However, if focusing on operating income, what we should expect is something between $3-6 billion, as that is what the company guided. Though I would wager on the lower end of that, given the continuously worsening macro headwinds.

Consumer sentiment is at an 11-year low. The Russian invasion, surging interest rates, and out-of-control inflation no doubt play a part. As for me personally, who remembers every number but never a name, I have been shocked at the series of recent price hikes at Whole Foods. I know I’m not in the mood to spend more there when many 365 brand staples I’ve been buying for years are up 25-40% since last summer.

Supply chains and labor shortages aren’t helping. Jassy had already warned about “several billion of additional costs” related to that manifesting in 4th quarter. Will we see a similar in Q1?

Let’s just hypothetically say the operating earnings come in at $3-6 billion. Now we have to factor in the mark-to-market of their Rivian stock.

The nosedive in Rivian

Amazon’s 158 million shares were worth $16.4 billion as of December 31st. They counted the fair value as $15.6 billion. Per their 10-K, this reflects a discount of $800 million “due to regulatory sales restrictions” on some shares (about 5%).

If we assume the same 5% discount for Q1, we get a value of $7.54 billion for their Rivian stake. Subtract that from the December 31st value of $16.4 billion. It results in a mark-to-market loss of $8.86 billion.

Based on the company’s own guidance of $3-6 billion in operating income for Q1, it implies a quarterly loss of $2.86 to $5.86 billion.

With 509 million shares outstanding, that will be an EPS in the neighborhood of ($5.62) to ($11.51). Non-adjusted of course.

Yes, they have other investments, so it’s possible – but unlikely – there will be a mark-to-market gain elsewhere. As of December 31st, their equity and equity warrant investments in public companies totaled $20.3 billion. Of that, Rivian represented around 80%. As you can guess, any mark-to-market right now on the other 20% is more likely to harm than help.

Amazon’s biggest quarterly loss in history

Aside from this upcoming quarter, their biggest loss in history was 22 years ago. In the 4th quarter of 2000, they had a net loss of $545 million. This quarter’s loss will be 5-10x larger.

Of course, on a relative basis, losing up to $5 billion or so is pocket change for the $1.6 trillion market cap which the company is today.

What should you expect when earnings hit the tape?

While they have not yet announced the date for earnings, it is predicted to be Thursday, May 5th. That makes sense. Amazon always releases on Thursdays, after market close, and it’s usually that number of weeks into the new quarter.

As an investor of over 20 years, I’ve often found that earnings reactions seem to have more correlation with the mood of the market that day, rather than the fundamentals being reported by the company.

Even though this upcoming quarterly loss is well known, so was the case with Q4’s gain from Rivian. Yet when Q4 earnings came out, pundits seemed to be more focused on the blowout headline numbers, rather than how they were constructed.

In short, it’s anyone’s guess as to how the after-hours action will play out, as well as the days that follow. If it results in significant weakness, I certainly will be adding. Yes, it’s easy to get burned in AH buying, because it will often drop even further the following day and thereafter. Facebook (FB) is a recent example of that.

On the flip side, sometimes you make out like a bandit from a temporary algorithmically driven dip. I acquired my entire Coupa (COUP) stake in after-hours on March 14th for $65 when they reported earnings. From what I recall, that was about a 30% drop in after-hours. It never even hit that print the next day and now, it’s $104.

Coupa is a $7 billion company. Amazon is over 200x larger. Obviously, the market is more efficient at scale. When I talk about a potential buying opportunity for Amazon in after-hours, I’m thinking more like a decline of one or two hundred. If I get burned with an AH purchase of Amazon, I have zero concerns, as I believe it’s the strongest among FAAMNG for the rest of the year.

Be the first to comment