Paras Griffin/Getty Images Entertainment

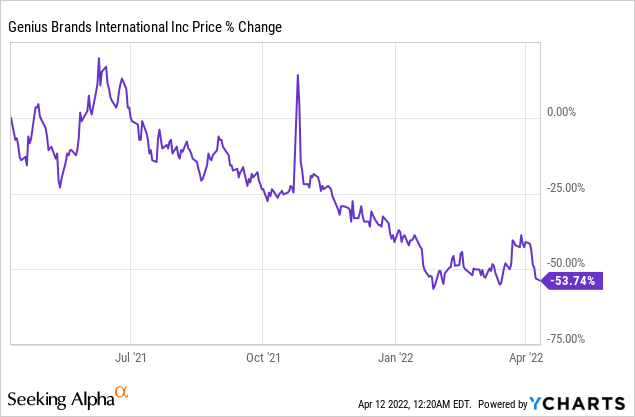

Genius Brands International (NASDAQ:GNUS) has been one of the biggest underperformers in my portfolio and many would call me crazy for still believing in this company despite its disappointing stock performance.

GNUS stock is down 50% over the last 52 weeks and may struggle with its NASDAQ compliance if GNUS shares remain under $1 for much longer.

My last Genius Brands article was published in 2020 so now is the good time to provide some important key updates on the company while GNUS stock remains at an attractive price level.

Higher inflation, rising bond yields, and the Russia-Ukraine war have contributed to the massive selloff in high-risk tech growth stocks like Genius Brands but the underlying business continues to improve despite all of the negative short-term headwinds.

In this article, I will provide some key insight into Genius Brands’ 2021 performance and explain why I remain bullish on the company.

Genius Brands’ Hit Record Revenue in 2021

Tech stocks have been crushed by rising bond yields, which makes future corporate profits worth less today and increases risk for companies with a lot of debt.

However, Genius Brands achieved record numbers across the company in terms of app downloads, watch time, and revenue. Genius Brands CEO Andy Heyward wrote his 2021 annual letter to shareholders and explained how the company is progressing despite a negative short-term stock market outlook.

Genius Brands earned $7.9 million in revenue (Up 217% YoY) in 2021.

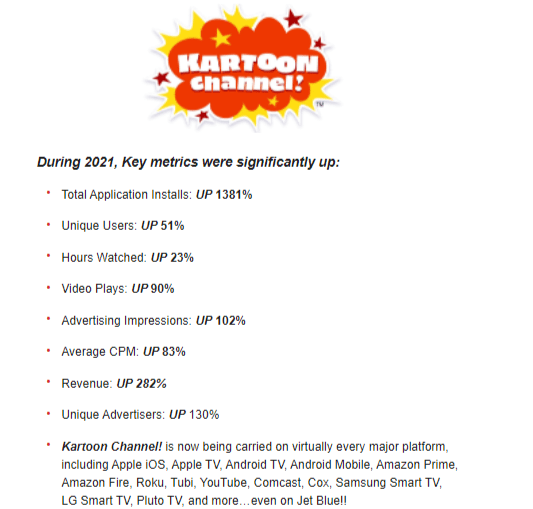

The Kartoon! Channel app hit records for every important key metric and should continue its impressive growth with the upcoming launch of SHAQ’s Garage in the 4th quarter of 2022.

Kartoon! Channel Key Metrics (Genius Brands)

WOW! Media Unlimited Acquisition Will Add Additional Revenue Growth

Genius Brands entered an agreement to acquire WOW! Media Unlimited on October 26th, 2021, for $38.4 million in cash plus 11 million shares of GNUS stock. That’s around 3 to 4% of the total outstanding shares so expect a minor dilutive effect to the shareholder count.

WOW! Media Unlimited achieved $64.2 million in revenue in 2021 and Genius Brands would have hit $71.2 million last year If we included the WOW! Media Unlimited acquisition into 2021 revenue numbers.

WOW! Media Unlimited’s MainFrame studios division is one of the 2 largest subcontract animation producers in the world and works with big players such as Disney, Hulu, Sony, and Peacock. WOW’s Federator Channel is a massive YouTube network with over 2,500 channels that does over 1 billion views per month.

This acquisition alone will help Genius Brands march towards a respectable $100 million in annual revenue milestone hopefully by 2023 or 2024 at the latest.

Ameba Acquisition To Be Rebranded As Kidaverse: New $3.99 Product Launches On April 15th

Genius Brands made a 2nd acquisition and acquired Ameba on January 14th, 2022, for $3.5 million in cash plus an additional $300,000 for the SVOD (subscription video on demand) software code.

Ameba was the first independent SVOD (Subscription Video On Demand) platform for kids with over 13,000 cartoon episodes under license.

Genius Brands will rebrand this content as the Kartoon Channel Kidaverse and charge $3.99 per month to subscribers. This is a big moment for Genius Brands because they will be entering the paid subscription model alongside competitors such as Netflix (NFLX) and Disney (DIS).

Genius Brands’ Kidaverse (Gnusbrands.com)

Paid subscriptions provide a steady, reliable income and increase the perceived value of content without distracting ads.

Kidaverse also serves as the first web 3.0 friendly platform for kids as consumers slowly transition into the 3D metaverse. Subscribers will be able to do the following under the new product launch:

- Create avatars and use emojis

- Watch content using VR goggles

- Collect NFTs

- Trade digital cards based on the channel’s popular characters

- Use KidaBuck$ (digital currency for kids)

- and much more

Major companies such as Meta Platforms (FB) have shifted gears towards the upcoming web 3.0 revolution and I believe launching a paid subscription product is a smart strategy in the long run.

The Kidaverse launches on April 15th, 2022, and it will be interesting to see if GNUS stock soars just like it did during the debt of the Kartoon! Network back on June 15th, 2020.

SHAQ’s Garage Will Launch In Q4 2022

I’m eagerly awaiting the launch of SHAQ’s Garage because Shaquille O’neal is a very famous NBA basketball legend with a massive 57+ million social media followers.

SHAQ’s Garage (Gnusbrands.com)

Genius Brands continues to postpone the launch of SHAQ’s Garage but this makes sense due to all of the recent acquisitions and paid product launches.

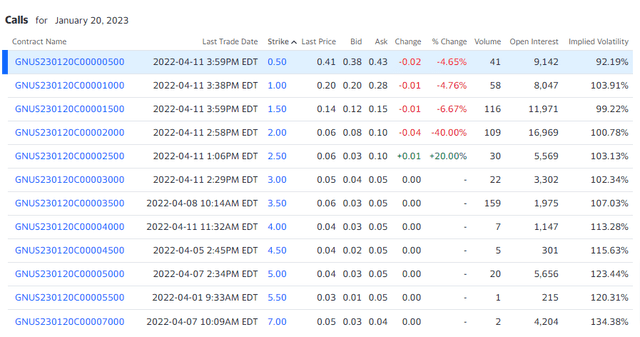

I predict Q4 2022 will be a major inflection point for GNUS shares and will consider loading up on some 1/20 2023 call options to take advantage of the volatility.

1/20 23 GNUS Call Options (Yahoo.com)

I’m hoping the SHAQ’s Garage launch buzz will provide some quick gains due to his huge social media following. I’ll buy some of these lotto tickets while holding my GNUS stock over the long term.

Risk Factors

Genius Brands has several risk factors such as failing to meet NASDAQ compliance and failure to reverse cash burn.

The company received a share price notice on March 4th, 2022, from the NASDAQ for failing to achieve a minimum $1 share price for 30 consecutive days.

According to Nasdaq Listing Rule 5810, companies will receive a 180 grace period to maintain a minimum $1 share price for 10 consecutive business days. Genius Brands grace period ends on August 31st, 2022, but GNUS stock could get delisted if it remains under $1 during this time period.

Delisted NASDAQ stocks get relegated to the OTC markets, which is bad for investor exposure and liquidity. This is arguably the biggest problem for GNUS shareholders right now but I’m still holding my shares over the long term.

Another legit risk factor is Genius Brands’ alarming cash burn rate. Genius Brands has racked up net losses of $126 million (-0.42 EPS) in 2021 while the company only has $115 million in cash on its balance sheet.

That’s a big improvement from net losses of $401 million in 2020 but the company is a few years away from profitability. Many investors are shifting towards value stocks during uncertain times, which could be bad for GNUS stock in the short term.

The good news is Genius Brands’ latest acquisitions, Ameba and WOW! Media Unlimited, are both cash flow positive. If Genius Brands doesn’t solve this cash burn problem then the company may further dilute shareholders and put selling pressure on the stock.

Conclusion

Many of you who follow me on Twitter laughed at me for being a GNUS bagholder. I’m still down 52% with an average cost basis of $1.73 per share.

Normally, I would cut my losses and move my funds elsewhere, but I still believe in this company despite all the near-term headwinds.

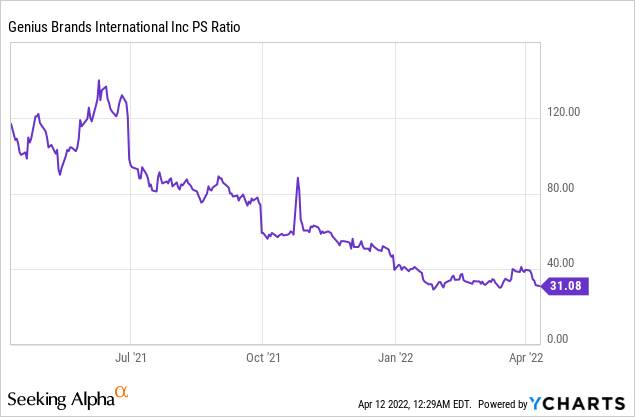

Revenue is increasing with several major product and content launches in the pipeline. Recent acquisitions will cause the GNUS Price to Sales ratio to fall from 31x to just 4x.

The current GNUS market cap is $243 million as of now but expect a bit of dilution from the acquisition to weigh on the stock price in the short run.

Being greedy when others are fearful is one of the best ways to make huge gains in the stock market. If you are looking for a cheap penny stock with huge growth potential then give Genius Brands a serious look.

Be the first to comment