claffra

Investment thesis

Generation Mining (OTCQB:GENMF) (TSX:GENM:CA) owns 100% of the Marathon Pd/Cu project in Ontario, Canada. I think the company offers an attractive investment in a potential palladium mine in a tier-1 jurisdiction with excellent management. The 2021 feasibility study and ‘cheap’ streaming deal of Wheaton Precious Metals (WPM)(WPM:CA) resulted in robust economics with short payback of 1.7 and C$M 1,07 NPV (6%). In my view, Gen looks undervalued as it currently trades at just 0.09x NPV. Let’s review.

Marathon project

The Marathon project is a Pd/Cu/Pt project located in North-western Ontario, Canada. The Marathon mine is one of the few large-scale palladium development projects outside Russia and South Africa. The project was bought from Sibanye Stillwater because they sold all their development projects after they acquired Stillwater. They thought the project was not economic at that time when palladium was around $1350 per oz. However, the 2021 feasibility study shows an increasable mine plan and economics.

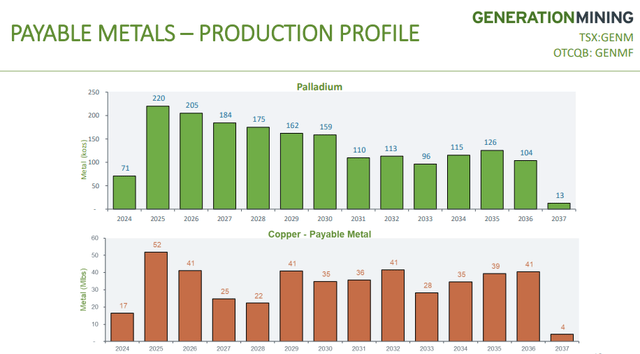

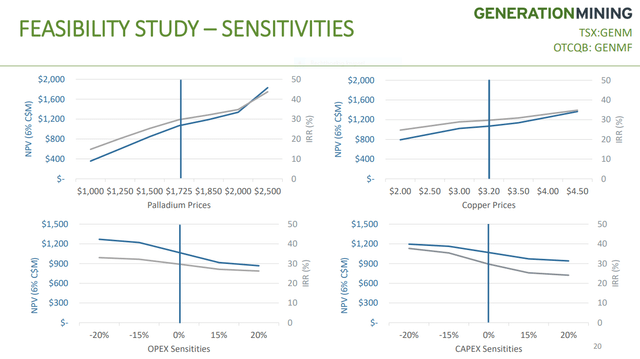

The 2021 FS study envisioned a 13-year mine life, mining 2.03M oz of Pd, 500M lbs Cu and 634 Koz of Pt. The mine plan of the project is unique because it has one high-grade palladium core and one high-grade copper core. The envisioned mine plan will first focus on mining 70% of the palladium within the first five years. After that mine the focus shifts to the high-grade copper core. The thesis of this mine plan is to reduce the risk of decreasing palladium demand in the future (I describe this concern in another paragraph). The distribution of revenue is 58% palladium, 26% copper, 9.6% platinum and some gold and silver. The 2021 feasibility study showed excellent economics using a base case price of US$ 1,725 Pd and US$ 3.20 Cu price. The NPV (6%) is estimated to be C$M 1,068 and has an IRR of 30%. I consider the payback period to be short with ‘only’ 2.3 years. It is important to remember that the NPV can change much because of the leverage to palladium in the first five years and the leverage on copper price thereafter.

The location of the Marathon project provides excellent infrastructure, which reduces much of the upfront CAPEX, which is estimated at C$665 million. The feasibility costs are calculated in the envisioned CAPEX. Unfortunately, I think the real CAPEX is higher due to inflation. Another advantage of the excellent nearby infrastructure is that it could provide carbon-free power resulting in unique ‘green’ palladium and copper. Gen even argues that the Marathon mine could be one of the lowest carbon intensity mines in the world per tonne of copper equivalent.

Wheaton Precious Metals streaming deal

The current market is very competitive for the royalty and streaming industry. Gen took advantage of this situation with the Wheaton deal announced on March 2022. Wheaton Precious Metals will pay Gen a total cash consideration of C$240 million in return for a stream on all gold production and 22% of the platinum production from the Marathon project. The net stream cost is 4.8% of mine revenue at FS base metal prices. The ‘cheap capital’ of the Wheaton deal resulted in an improvement in economics. The payback to 1.7 years and the IRR improved from 30% to 38%.

Gen already got C$40 million to fund the detailed engineering and to obtain the required working capital for the next year. The management did not want to issue shares and dilute shareholders. The fact that Gen got upfront capital from a streaming deal is very unique and proves both the trust from Wheaton and excellent execution from Gen’s management team.

I think that the completion of streaming deals is a good sign for investors. Royalty and streaming companies like Wheaton conduct extensive research before they offer capital. These teams of experts often have more knowledge about geology and mining projects than most investors. The fact that Gen got such attractive deal terms shows that Wheaton’s team liked what they saw.

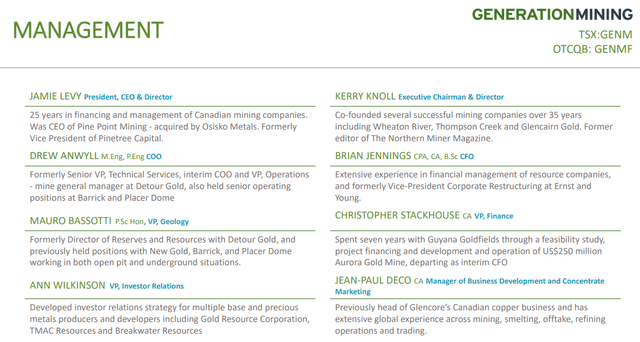

Management

The management is of high quality for a development company with a market capitalisation of only C$ 97 million. The team has built and operated many mines. Management already impressed me with their rapid advancement of the Marathon project because they conducted a PEA and FS study within three years with an excellent streaming deal. Furthermore, are they advancing the environmental assessment process at a rapid pace. Insider ownership is 7%, so management and board are aligned with shareholders to create shareholder value.

Palladium demand

An important element of the investment thesis for Gen is the future demand for palladium. 87% of the supply is used in auto catalysts to reduce emissions. Governments require car companies by law to use palladium and some governments even increase the load of palladium per vehicle to reduce the emissions in big polluted cities. This reliance on catalytic demand makes some investors worried about investing in Gen because they believe that palladium demand will fall as all the cars go electric. I certainly think that the demand for electric driving will increase, but that will not cause the demand for palladium to fall drastically. Certainly not before 2029 when 70% of the palladium has already been mined. If palladium demand would fall because people are going to drive electricity, then the copper demand would increase much to conduct the required electricity. In that case, the increase in copper revenue would mainly offset the decrease in palladium revenue.

Risk

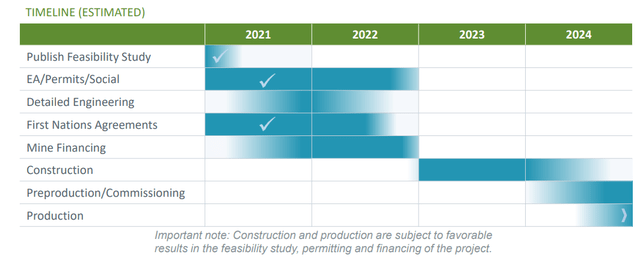

The main risk for Gen is permitting risk. The company does not have the approval of the environmental assessment and construction permits. Stillwater did extensive work on permitting, so Gen only needs to update it. This shortened the permitting process by approximately two years. The Ontario movement has been positive about permitting efforts, they even allowed Gen to apply for the permits before the environmental process has been approved. The results of the environmental assessment are planned to be published in November/December of 2022. Management expects to receive the construction permits in early 2023. The Marathon project is surrounded by other mines, so the local communities have much experience with mining. However, there is always a considerable risk that Gen does not receive the environmental permits by the end of 2022. A potential delay in the permitting process would also result in more share dilution because they have to use more cash before they can start production.

Gen does not generate any cash so they have to go to the market to raise money. As a result, shareholders run the risk of equity dilution. The cash reserve at the end of Q2 was almost C$ 19 mln. The average expenses since 2021 were C$ 8.5 mln and C$ 8.2 mln in Q2 of 2022. Therefore, Gen has to raise cash before Q2 of 2023.

Another risk is the financing risk of the CAPEX. Gen has not secured the required debt to build the Marathon mine. The debt package is estimated to be C$400 to 500 million. Financiers often require to raise some equity capital to protect their loans, so shareholders could expect some share dilution. I think there is some considerable risk that the CAPEX is higher than expected due to inflation. In that case, Gen might have to raise more capital by either more debt or more equity capital. The ongoing detailed engineering should answer this question by the end of 2022.

Valuation

The shares of Gen can be called cheap based on a price to NAV valuation. The P/NAV is only 0.09x, which is based on a market capitalisation of C$ 97 million and C$ 1.07 billion NPV (6%). The charts below show how the NPV is affected by different prices of Pd and Cu. The current price of one oz of Pd and one lb of Cu are $2,075 and $3.35, respectively. So, the real NPV is even greater than the projected NPV of C$ 1.07 billion. The current valuation is very low value for a company holding an advanced-stage palladium development project in a Tier-1 jurisdiction with such an excellent management team.

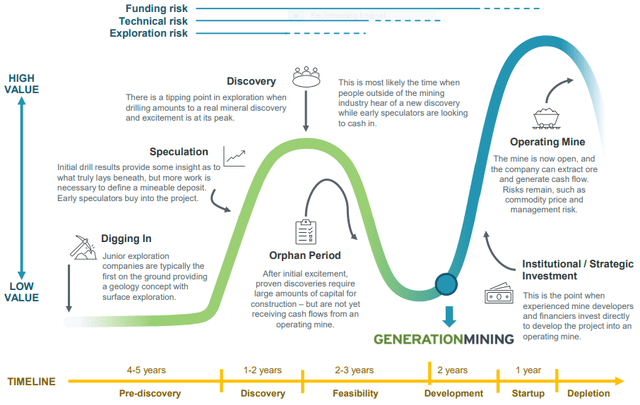

Many investors in the mining industry are familiar with the Lassonde curve. Gen is negotiating debt financing to develop the mine and expects to receive all permits by the end of 2022. This should result in to start of production in 2024. The transition from a cash-burning development company to a cash-generating company should result in a significant re-rating.

Conclusion

The excellent management team has accomplished considerable achievements in the short time they possess the Marathon project. The 2021 feasibility study shows very robust economics with short payback and 38% IRR. However, the valuation is only 0.09x on a P/NAV valuation. The main risk for Gen shareholders is not receiving the environmental permits. I think the current cheap valuation is an excellent first entry price for long-term investors. I would buy a small position at the current share price. Gen could receive the environmental approval and complete the construction decision at the end of the year. This would resolve the permitting risk and provide clarity about the possible cost increase to build the mine due to inflation. Therefore, I would evaluate to add additional shares to my position after 2022.

Be the first to comment