Mario Tama/Getty Images News

The following segment was excerpted from this fund letter.

General Motors (GM)

Despite my enthusiasm for GM’s competitive positioning in the years to come, it’s the decidedly unsexy legacy operations that keep GM’s cash registers ringing in the here and now. On that front, investor enthusiasm for the current manufacturing – and financing – of internal combustion engines remains pretty muted by most measures. And understandably so:

- GM’s operations are capital intensive,

- GM’s marketplace is highly competitive (and with excess capacity to boot),

- GM’s supply chain is super complex (e.g., semi shortage, tariffs, etc),

- GM’s labor force is (VERY) unionized,

- GM’s liabilities are aplenty and long-dated (e.g., warranties, recalls, lawsuits, etc),

- GM’s operations have ample – and unavoidable – commodity exposure (in both raw materials & the resulting impact on product demand/mix), and

- There’s no shortage of debt to consider.1

Although that hardly represents a comprehensive accounting of the risks that crowd GM’s disclosures, it’s more than sufficient to obscure the many positives to be found under GM’s hood. Of particular note is GM’s strong showing across seemingly every facet of the changes looming over the broader automotive industry:

- Internal Combustion Engines (ICE): If you think all the talk about electric and/or autonomous vehicles is either total hogwash or still decades into the future . . . GM’s legacy business has you covered. For as long as consumers continue to demand ICE powered vehicles, GM will capably meet said demand. In fact, despite the many headwinds faced by the entire automotive industry in 2021, GM still capably sold ~6.3 million vehicles, and generated ~$113.6 billion of automotive-related revenues.

- Electric Vehicles (EVs): If you believe that the net result of the coming transformation is 1) a switch from hydrocarbons to electrons, 2) without any meaningful deterioration in global vehicle demand (in units) . . . GM is once again favorably positioned to leverage its Ultium battery technology, impressive scale, and considerable manufacturing chops towards everything involved in achieving the company’s stated goal of adding 30+ EVs to their vehicle portfolio by 2025.

- Transportation as a Service (TaaS): If you think it’s obvious that 1) the future of transportation will be both electric and autonomous, and 2) that the resulting “convergence” of those technologies will nullify the long-standing necessity of vehicle ownership . . . GM – via their acquired Cruise segment – appears to be shockingly well positioned.

Given the mountain of uncertainties that the automotive industry must navigate in the coming years, GM’s adaptability/flexibility is both advantageous, and simply without comparison among its peers. Nowhere is that competitive distinction more apparent than with respect to their Cruise subsidiary – the primary driver of my bullishness for GM’s future.

Cruise

In contrast to the speed dating and partnerships galore that has dominated the autonomous plans of its peers, GM’s plan of attack has been unique in at least two notable respects. Not only did GM not partner with any of the new companies started by the original DARPA participants, GM didn’t actually partner with anyone at all.

Instead, GM paid handsomely to acquire a relatively unknown startup. Although a mere three years old at the time of acquisition, Cruise’s ~40 employees had already wisely abandoned their initial efforts to sell self-driving kits – presciently concluding that:

a full software-hardware integration would be paramount.

While access to GM’s financial might has certainly helped to fund Cruise’s efforts, the acquisition’s real differentiator was the access it granted to GM’s formidable manufacturing and logistical capabilities. Accordingly, under GM’s wings, Cruise was able to iterate concurrently on both the technology and the vehicles to deploy it on. To further leverage that unique advantage, and in sharp contrast to the sanitized testing grounds preferred by its competitors, Cruise accelerated their learning curve by deploying their vehicles to roam the very busy/complicated streets of San Francisco.

By just about every measure, the Cruise acquisition was a bold belt. Whereas most of GM’s peers continue to eagerly frame autonomy as a premium feature, an upsell of sorts, that will be added to vehicles of the future, Cruise has always -and unabashedly – been a bet on TaaS.

In fact, despite the widely held view that a TaaS-like future – where vehicles are something we use rather than own – is likely to transform (possibly even decimate) the entire existing automotive ecosystem . . . GM is still the only major automaker that has committed to build a TaaS-specific vehicle in volume.

The Cruise “Origin” is that vehicle – a boxy-looking, fully autonomous vehicle, purpose-built for a future where TaaS is the prevailing norm. Rather than the sense of adventurism, romanticism, and/or status that the automotive industry has historically relied on to market their otherwise expensive hunks of metal, the squat Origin is quite the contrast – seemingly custom designed to embody Cruise’s broader mission: better transportation at lower cost.

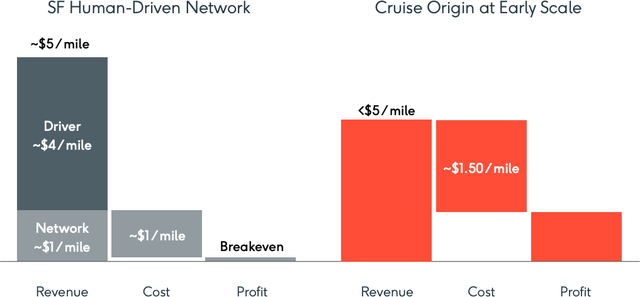

On the cost front, compared to vehicles that have been retrofitted with autonomous technologies, the Origin is expected to begin life with a per-mile cost advantage of more than 60%. And, as the below graphic makes clear, without the need to compensate human drivers, the Origin will enjoy at least one other significant cost advantage vis-à-vis its ridehail peers:2

As is always the case with all new technologies, widespread adoption will both depend upon, and help facilitate, a significant reduction of the technology’s cost curve. On that front, because every aspect of the Origin has been vertically integrated under just one roof, GM/Cruise are uniquely positioned to materially widen their cost advantage in the years to come, and reap the benefits of doing so.

Although it certainly won’t happen overnight . . . there is little doubt that the costs of autonomous offerings will eventually fall below – probably far below – today’s considerable costs of vehicle ownership. And, as those costs begin their years-long descent, the resulting “total addressable market,” as calculated by GM, becomes almost laughably large:3

Since increased scale is likely to be an important driver in reducing the technology’s costs in the years to come . . . the Origin officially left the prototype stage when the first-batch went into pre-production in June of 2021. Looking forward, GM is now guiding for full(er) production to begin sometime in early 2023, and scale rapidly in the years thereafter. Some delays are probably inevitable, but scaling should play to GM’s strengths. With that in mind, here’s how GM describes the expected quick scale up:4

“In [2023], we’ll be building [Origins] measured in thousands. In 2024, we’ll be thinking about things measured in tens of thousands, and it can ramp-up pretty quickly to hundreds of thousands from there.”

In the meantime, Cruise is hardly idling in neutral:

- 9/2021: California’s DMV granted both Google’s Waymo and Cruise a “DMV Driverless Deployment (paid)” permit. While Cruise was approved to give rides in its AVs without a safety driver, Waymo is only allowed to deploy its AVs with a human monitor behind the wheel.5

- 11/2021: Cruise’s Co-Founder and CTO, Kyle Vogt, became the first passenger of the very first fully autonomous taxi to (legally) drive the streets of San Francisco.6 In recognition of this milestone, and as obligated by their initial investment, the Softbank Vision Fund increased their Cruise investment by an additional $1.35 billion.

- 2/2022: While Cruise is still waiting for California’s bureaucrats to grant the final permit needed to charge for autonomous taxi services,7 Cruise has nonetheless announced that members of the public can now sign up for its autonomous taxi service, and ride for free.8

Just days before Cruise invited members of the public to start hailing driverless rides, GM’s CEO hailed a ride of her own. In the ~3 minute video posted to YouTube, Ms. Barra and other GM executives appear almost giddy as Cruise’s technology safely navigates the nighttime streets of San Francisco. As Ms.

Barra says in the video:9

“. . . I can’t stop smiling . . . it’s like a highlight of my career because we know what this technology can do . . .”

Realizing Cruise’s full potential will undoubtedly come at the expense of existing segments of the current automotive ecosystem. As a considerable participant/beneficiary of that very ecosystem . . . GM will not only have to resist the urge to protect its legacy operations by throttling Cruise’s progress, but also defly minimize any resulting financial carnage along the way.

The transition is unlikely to be easy or comfortable . . . but GM’s unique positioning warrants much more optimism than is currently evident in its anemic stock price. Now that Ms. Barra “[knows] what the technology can do,” the only remaining unknown is if GM’s management will stay out of Cruise’s way, and do so with the gusto a new technology demands.

Footnotes

1 Yes, the bulk of GM’s total debt is related to GM Financial, and the bulk of GM Financial’s debt is collateralized. Better yet, some of GM Financial’s debt is ring-fenced (via VIEs). Even so, there is no shortage of liabilities that warrant consideration here.

2 10.2021: GM Analyst/Investor Day

3 10.2021: GM Analyst/Investor Day

4 2021 GM Analyst/Investor Day

5 TechCrunch – “Cruise, Waymo Get OK To Launch RoboTaxi Service In SF:” Cruise received permission “to use its fleet of autonomous Chevy Bolt-based vehicles for commercial services on public surface streets within certain parts of SF between 10 p.m. and 6 a.m., at a maximum speed of 30 mph. Waymo can use its fleet of light-duty AVs within parts of SF & San Mateo counties, on public roads with a speed limit of up to 65 mph, with no apparent time restrictions. Both [companies] can operate in rain and light fog.”

6 The milestone was dutifully documented on both Twitter and YouTube.

7 The California Public Utilities Commission is the gatekeeper for the final permit that Cruise needs to charge for its autonomous taxi rides.

8 Cruise: “Welcome, Riders”

9 YouTube: GM CEO Mary Barra Takes Her First Driverless Ride

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment