RiverNorthPhotography

Investment Thesis

General Motors (NYSE:GM) continues to develop the EV business and is committed to plans to capture the market with new models in various car segments.

Despite the crisis, GM will continue to inject significant investments into EVs, both in the opening of new plants and the development of a new product lineup.

However, the most important factor for GM now is the impending recession in the US and other major markets, which will neutralize the supply shortage in the market and normalize the abnormally high prices and the dollar-denominated margin per 1 car.

Based on the new assumptions on the car market, we give the company a BUY rating.

The situation in the car market

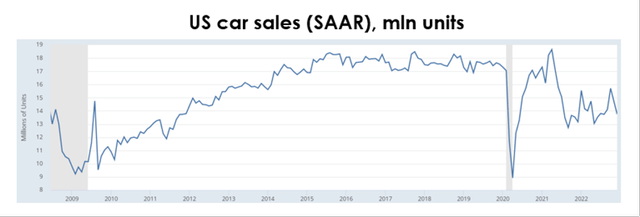

The auto industry continues to face a shortage of semiconductors, which creates a fairly large imbalance between supply and demand. According to FRED, US car sales consolidated near 14 mln units.

From 2014 to 2020, the usual US demand for cars was about 17 mln cars. In 2021, about 15 mln cars were sold. Starting in May 2022, that number has been slowly recovering and reached about 13.8 mln units (SAAR, the seasonally adjusted annual rate), which is much higher compared with December 2021 when it was 13.2 mln units but still is far off the local peak of 15.5 mln units in January 2022. Based on our calculations, the current annual unmet demand for cars in the US stands at 2-2.5 mln cars.

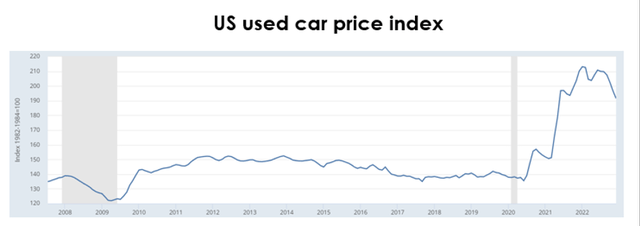

A similar situation is being observed in the US used car market, although the growth of prices is sharply decelerating.

The situation is different for the markets of new and pre-owned cars. While automakers are grappling with the shortage of semiconductors and production recovery, new players are emerging in the used car market. As US real incomes decline while utility bills, loan and mortgage interest rates, and fuel prices rise, individuals start to sell their cars.

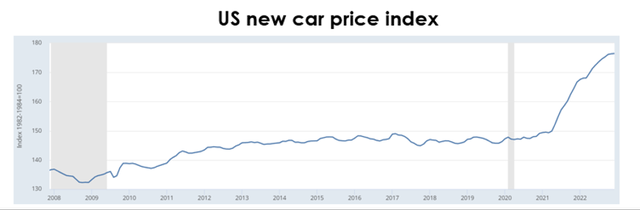

At the same time, the producers of new cars, such as GM, are making progress regarding the supply chain and the semiconductor situation. But as new cars are still in short supply in the market, auto makers continue to pass costs on to the consumer, albeit at a more moderate pace. So we anticipate that the dollar-denominated margin per 1 new car will continue to decline slowly until the semiconductor shortage in the industry is fully resolved.

GM’s financial results

Demand for cars in the US has increased, which is reflected in the decline of the car inventory to sales ratio from 0.666х in 3Q 2022 to 0.556х in 4Q 2022. But it wasn’t matched by the recovery of car production, which prompted car prices to rise further to a level above our expectations. Given the latest data, we have raised the average selling price for a car in 2023-2024 from $39.5 thousand to $41.5 thousand.

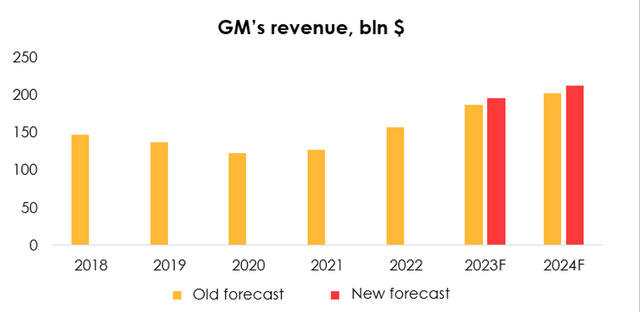

As a result, we are raising the forecast for GM’s revenue from $186.9 bln (+19.2% y/y) to $195.2 bln (+24.6% y/y) for 2023, and from $201.8 bln (+7.9% y/y) to $211.6 bln (+8.4% y/y) for 2024.

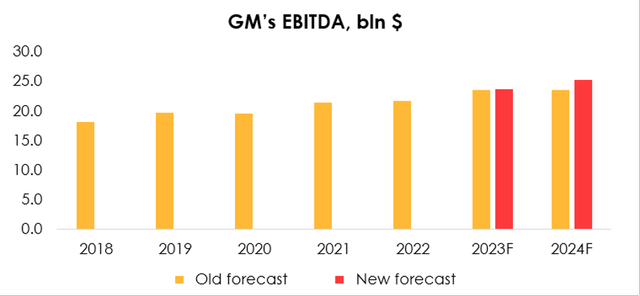

The adjustment of car prices and the reduction of the forecasts for the cost of materials have caused a revision of GM’s gross costs to revenue ratio from 83% to 81% for the forecast period.

As a result, we are raising the EBITDA forecast from 23.47 bln (+8.6% y/y) to 23.6 bln (+9.3% y/y) for 2023 and from 23.5 bln (+0.1% y/y) to 25.2 bln (+6.7% y/y) for 2024.

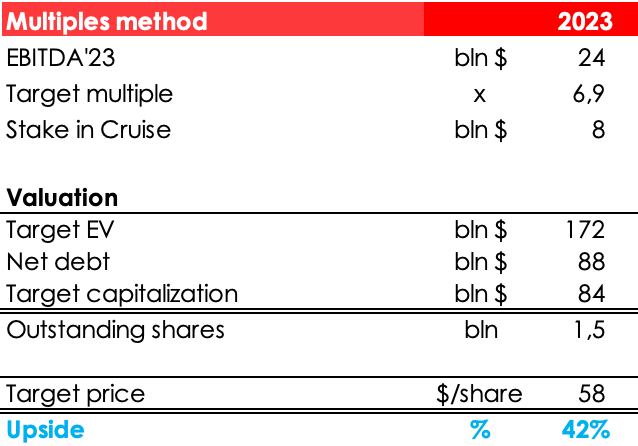

Valuation

The fair value price for the stock is $58. Based on the new assumptions, we are assigning the BUY rating for the shares. The upside is +42%. We evaluate the company based on the 2023 results with EV/EBITDA multiple method.

Invest Heroes

Conclusion

High car prices and lower steel prices are helping automakers increase margins per car. We expect these trends to continue in the future, as the gap between supply and demand is still extremely high.

A key risk for GM is a potential recession in the U.S., as well as a decline in buying activity amid rising borrowing rates.

Due to high market volatility, we recommend to form a position in several steps.

Be the first to comment