jetcityimage

Before the market opened on October 25th, the management team at industrial conglomerate General Electric (NYSE:GE) announced financial results covering the third quarter of the company’s 2022 fiscal year. As a shareholder in the company, I would love nothing more than for the firm’s results to have been robust across the board. But speaking frankly, the figures reported were rather mixed. On the whole, I believe that investors still have a lot to be optimistic when it comes to the company, particularly after management reported these results. After all, across most of the important areas, the firm did fare quite well. But it’s also important to note that there were a few weak spots in the company that should justifiably reduce optimism by a modest amount. At the end of the day, I still view the company as a ‘strong buy’ candidate, indicating my belief that it should generate returns that significantly outperform the broader market moving forward. But it is possible that investors might need to be a little patient in that regard.

A look at key segments

Leading up to the company’s earnings release, I published an article detailing what investors should anticipate. One thing that I pointed out was that the two key operating segments of the company, Aerospace and Power, deserve special attention. In that article, I indicated that strength across both of these segments would go a long way to increasing investor optimism in the firm. And in most respects, we did see that come to pass.

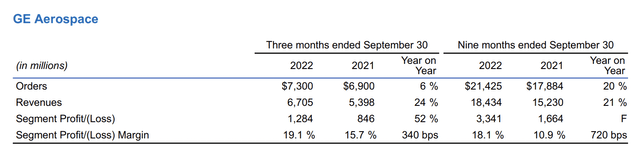

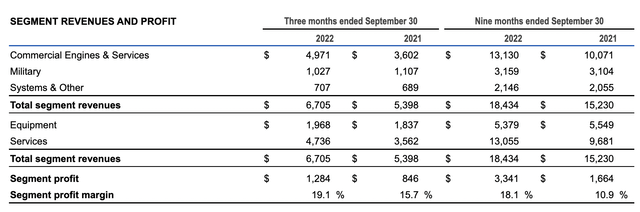

First and foremost, we should touch on the Aerospace segment. During the quarter, it generated revenue of $6.7 billion. That’s 24.2% higher than the $5.4 billion generated in the same quarter one year earlier. Although the company saw the number of military engines that it sells drop from 154 down to 151, the commercial engine category fared very well. All of this increase from 377 to 489 came from the LEAP engines that the company sold. The number of units there grew from 226 to 347. Given how strong air traffic data has been in recent months, this is not a surprise to me.

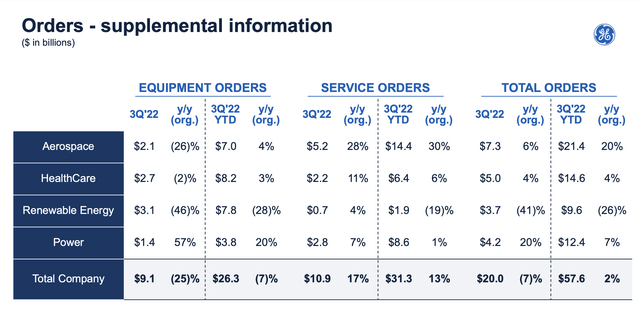

What’s really interesting though is that the majority of the company’s growth came not from the equipment it sells but instead from its services. Services revenue for this segment totaled $4.7 billion for the quarter. That’s 33% higher than the $3.6 billion generated only one year earlier. By comparison, equipment revenue grew just 7.1% from $1.8 billion to just under $2 billion. management attributed this increase to a variety of factors, including higher prices, increased shop visit volume, and higher volume of commercial spare part shipments. This is great because, generally speaking, profits are more robust for services provided they infer equipment sold. This was instrumental, in fact, in driving the segment profit margin up from 15.7% in the third quarter last year to 19.1% this year, taking total segment profits from $846 million to just under $1.3 billion. Backlog for the segment also came in strong at $130.1 billion. That’s up from the $125.3 billion reported at the end of 2021, but it’s flat compared to what it was at the end of the second quarter this year. While this may be disappointing, it is also imperative to note that orders for future work came in strong at $7.3 billion. That’s up from the $6.9 billion reported the same time last year. This is a good leading indicator for the company.

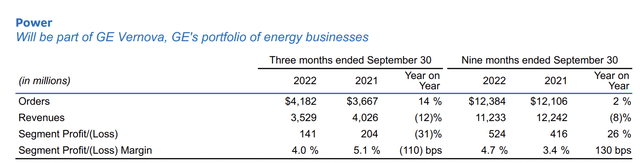

Although not as important in my mind as the Aerospace segment, the Power segment also warrants attention. During the quarter, sales for the segment came in at $3.5 billion. This represents an unfortunate decline from the $4 billion generated in the third quarter of 2021. Organic revenue though was down a more modest 5% year over year, driven largely by decreases in the demand for its Gas Power HA turbines and aeroderivative deliveries, as well as by planned contractual services outages at its Gas Power operations. A reduction in steam power equipment on the exit of new build coal, as well as other factors, negatively affected sales. Profits for the segment also dropped, falling from $204 million to $141 million. But considering how low margin this segment has been recently, I don’t consider this awful.

This is not to say that everything was bad when it came to the Power segment. There were some bright spots. For instance, total orders came in at $4.2 billion. This was up from the $3.4 billion reported the same time last year. On top of that, backlog for the company ticked up modestly from $67.4 billion to $67.5 billion. At the same time, backlog is still lower than the $68.7 billion it was at as of the end of the 2021 fiscal year.

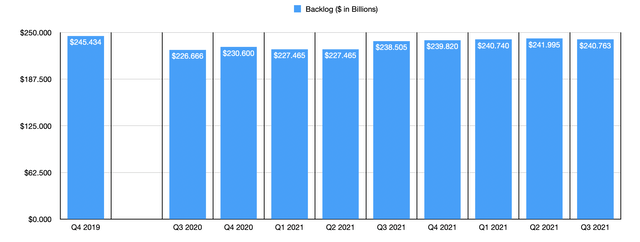

For the enterprise in its entirety, it’s also important to know where backlog ended up. By the end of the quarter, it came in at $240.8 billion. While this is higher than the $239.8 billion reported at the end of 2021, it is actually below the $242 billion the company reported in the second quarter of this year. The big weakness for the company here came from a 41% drop in orders under the Renewable Energy segment of the company. Given the economic conditions we are facing, this shouldn’t be a shock. Though it is definitely a disappointment.

Cash flow, debt, and more

Outside of the segment data, there is additional information we should discuss. First and foremost, we have the overall debt position of the company. On a net basis, this came in at $11.5 billion at the end of the quarter. That was actually down from the $12.6 billion reported just one quarter earlier. This is great news in and of itself, as management is focusing on reducing leverage moving forward. And as always, these numbers still exclude the $36.2 billion in long-term investment securities on the company’s books.

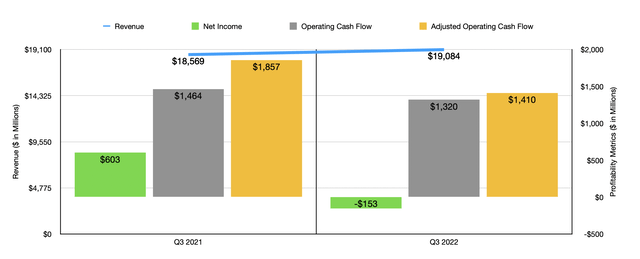

Related very closely to the amount of leverage a company has over time is the amount of cash flow that it generates. During the quarter, operating cash flow came in at $1.3 billion. That was down from the nearly $1.5 billion reported the same time last year. If we adjust for changes in working capital, then the metric would have fallen from nearly $1.9 billion to $1.4 billion. This is disappointing in and of itself, but the fact that the company was cash flow positive during these difficult times is a testament to management’s ability to weather a storm.

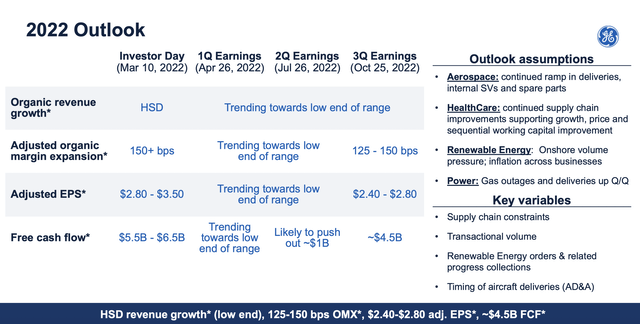

In terms of headline news, the company reported revenue of $19.1 billion. That was up from the $18.6 billion reported one year earlier and it beat analysts’ expectations to the tune of $330 million. Earnings per share, meanwhile, came in at negative $0.14, missing expectations by $0.14 per share. High inflation has negatively affected the company, causing it to reduce guidance for 2022 as a whole. For this year, earnings per share should now be between $2.40 and $2.80. That compares to prior expectations of between $2.80 and $3.50, with that prior guidance aiming near the low end of the scale. Previously, management had also said that free cash flow for the year would be between $5.5 billion and $6.5 billion, with $1 billion of that being pushed out into the 2023 fiscal year. However, that number has now been reduced to $4.5 billion in all.

To address some issues that the company has right now, management has decided to engage in further restructuring efforts. Through a plan that will result in at least $1.3 billion in charges, excluding potential severance costs, General Electric is now focused on cutting annual expenses by $450 million. This is in addition to $500 million in cost-cutting that the company is focused on under the Vernova entity that would include the struggling Renewable Energy segment of the firm. This makes a lot of sense when you consider that, for this year alone, Renewable Energy is slated to lose around $2 billion thanks to a combination of inflation, falling demand, and higher warranty pressure.

Takeaway

Based on the data provided, I understand why some investors may not be so happy with how General Electric’s data came out. But on the whole, I view the picture as more positive than negative. There were some issues that were not so great, such as the decline in backlog and declining revenue across some segments. But in most of the areas discussed, the company delivered improved performance year over year. Debt continues to fall and, while cash flow is not as high as it was last year, it’s continuing to grow also. Due to all of these factors, and how cheap shares of General Electric look, I have no problem keeping my ‘strong buy’ rating on the stock and may even increase my stake moving forward.

Be the first to comment