Times have been tough for industrial conglomerate General Electric (GE). After years of struggling and restructuring its underlying businesses, things started looking up for the enterprise when, at least, COVID-19 struck. While nobody knows what the future will hold for the firm, its latest earnings release reveals some interesting data points that show a company in pain that’s entering into the early stages of what could be a recovery. Globally, this has significant positive ramifications if true, but for the business it could be profoundly positive.

A look at the bad

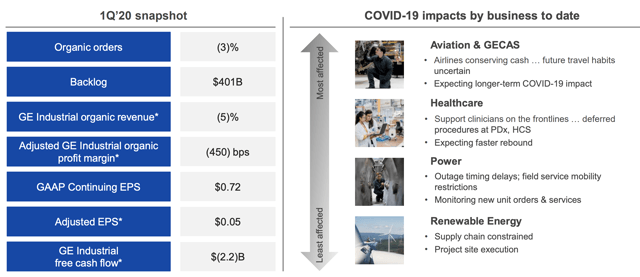

To begin with, let’s touch on the bad for General Electric. According to management, the latest quarter was anything but great. The defining negative feature for the firm for the quarter was its industrial level free cash flow. This metric came in at -$2.207 billion. This represents a significant deterioration compared to the -$1.216 billion the company reported for the first quarter of its 2019 fiscal year. This decline of nearly $1 billion was driven in large party by the firm’s operating cash flows falling from -$0.607 billion in last year’s first quarter to -$1.662 billion in this year’s first quarter. Excluding the business’s BioPharma unit, which was recently divested in a move that netted General Electric $20 billion in cash, industrial free cash flow was even worse at -$2.503 billion. By comparison, this adjusted figure was -$1.524 billion a year ago.

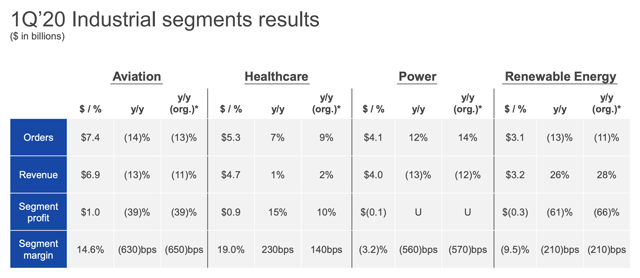

Pain wasn’t universal across the business, but it was pretty close to being that way. Organically, revenue for its Aviation segment fell 11% to $6.9 billion. Power’s organic revenue declined 12% year-over-year. Renewable Energy’s revenue actually surged 28% year-over-year, but the segment’s loss of $0.3 billion led to its segment profit margin totaling -9.5%. Power also lost money, but only $0.1 billion. Aviation still managed to be the firm’s cash cow, but during the quarter its profit came in 39% lower than it was a year ago, hitting just $1 billion. Its segment profit margin dropped nearly 31% to 14.6%.

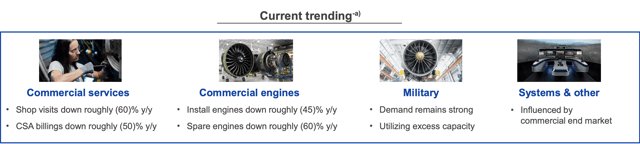

One bright side for Power is that orders did manage to rise nicely year-over-year, climbing 14%, but Aviation’s dropped 13% to $7.4 billion. Renewable Energy is also hitting a slow patch, with orders of $3.1 billion coming in 16% below where they were last year. Anybody who follows my work on General Electric closely knows that I see the company’s Aviation segment as its crown jewel. I still believe this to be the case, but management reported that shop visits for the segment fell 60% year-over-year, while CSA billings dropped 50% for the firm’s commercial services. Install engines activity and spare engines work fell 45% and 60%, respectively. The only strong point for Aviation came on the side of the military, which management touted as robust.

For the business as a whole, from an operational standpoint at least, there was only one strong segment. This was the firm’s Healthcare segment. Year-over-year, orders grew 9% to $5.3 billion, while revenue was up 2% to $4.7 billion. Segment profits were particularly impressive at $0.9 billion, up 10% compared to the same period last year, and its segment margin was up 140 basis points to 19%. Management cited significant weaknesses in some parts of this segment, particularly in the pharmaceutical diagnostics and other non-COVID related products (with sales of some products down as much as 50%). Even so, demand for products that are relevant to addressing the COVID-19 pandemic are up between 50% and 100% compared to pre-COVID levels.

Signs of improvement

A case could be made that since the COVID-19 pandemic began in China, that China will be a valuable place to watch when trying to guess a recovery time for the rest of the world. If what General Electric is saying is accurate, then this turnaround might be occurring as we speak. Although multiple segments at the firm have been slammed, it has said that its China supply chain and operations for its Aviation segment are back. Its fleet utilization rate, while still very low, is improving as well. At its worst, utilization was down 75%. Today, that figure is closer to 50%. For Healthcare, the company is seeing the same baseline operating levels as they did in 2019. Renewable Energy has also seen activity return to pre-COVID levels. Power remains the weakest here, with the supply chain operating at 80% capacity and business impacted by project and upgrade investment delays.

To navigate these tough times, management has also embarked on some significant cost-savings initiatives. Across the firm’s industrial operations, it has identified $2 billion in cost savings, which will convert to $3 billion in cash savings for the year. In addition to this, the company has a great deal of cash on hand. Thanks to the completion of its BioPharma sale, it has cash of $33.8 billion under its industrial operations. This is nearly double the $17.6 billion it had at the end of 2019. It also has $13.5 billion in cash under its Capital business, bringing total cash to $47.3 billion.

One area that I wouldn’t say is strong, but isn’t horrible either, is the company’s backlog. This truly is a measure of its future work. During tough times like this, you can generally expect some firms to cancel contracts. Between that and the slowdown that occurs in new orders, a decline in backlog is probable. It’s also likely a trailing indicator, falling after the negative event in question (in this case the global slowdown) is well underway and recovering only after a recovery has been staged. During the latest quarter, the company did see backlog decline a bit, but only by $3.5 billion from $404.6 billion at the end of last year to $401.1 billion now. It’s still early in the cycle and further declines could occur, but if they remain smaller like this then the company will be fine. To put today’s backlog in perspective, it is still 13.5% higher than the $353.3 billion seen the same quarter last year.

Takeaway

There’s no doubt that General Electric experienced some pain in its recent quarter. Investors should have been prepared for this. Absent a major recovery, even greater pain for the second quarter is probable. That said, when looking at the picture as a whole, investors should be happy. Sure, cash flows were down and that’s painful by itself, but signs of stabilization and even returning to prior activity in China is significant. The firm’s backlog is still very large and with cost-cutting plans in place the business can help to alleviate some of the issues plaguing it. Overall, General Electric still looks like an excellent long-term prospect to consider here.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment