J. Michael Jones

Thesis

Leading power generator company Generac Holdings Inc. (NYSE:GNRC) recently stunned the market with a prelim Q3 release that came well below the consensus estimates. Consequently, its full-year guidance has also been revised significantly, as the company underestimated the challenges to its backlog and field inventories for H2’22.

However, the market had already anticipated significant challenges to GNRC’s operating performance in 2022 after a record 2021 that saw its valuation surge to unsustainable levels.

Moreover, the market had also expected a weak Q3 earnings card, as GNRC’s recovery had topped out at its August highs before tumbling toward its recent October lows.

We assess that the market needed to de-rate GNRC significantly to account for its poor execution in H2. Furthermore, we postulate that the market needs to reflect higher execution risks through the coming recession, as management and the Street consensus could be too optimistic previously.

However, we noted that GNRC’s medium-term selling downside seems closer to its eventual bottom, even though near-term volatility could persist. We discuss the critical levels for investors to watch and explain how they can layer in their positions over time to capitalize on downside volatility.

Given its attractive valuations and a significantly de-risked operating profile, we rate GNRC as a Buy.

Generac Was Significantly Overvalued, But It’s Now Significantly Undervalued

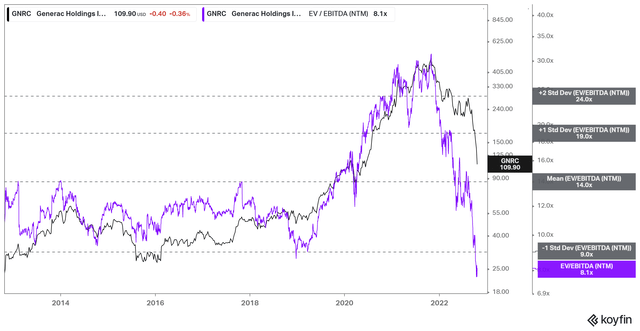

GNRC NTM EBITDA multiples valuation trend (koyfin)

As seen above, the market sent GNRC’s NTM EBITDA multiples spiraling toward the two standard deviation zone over its 10Y mean in 2021 before its massive bull trap (indicating the market rejected further buying upside decisively) in November 2021.

However, GNRC’s near -70% YTD total return has also de-risked its valuation significantly, as the market sent GNRC tumbling toward lows last seen in June 2020. As such, we postulate the rapid decline has already burst its unsustainable bubble surge, taking out weak hands along the way.

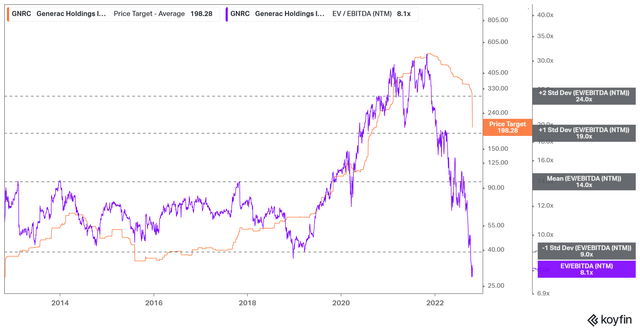

GNRC NTM EBITDA multiples Vs. Analysts average price target (koyfin)

Therefore, we urge investors to be wary about ascribing too much importance to the consensus price targets (PTs). As seen above, GNRC’s average PTs kept getting upgraded toward its November 2021 highs, even though investors should have turned cautious and started cutting exposure as GNRC crossed the two standard deviation zone over its 10Y mean in February 2021.

Even though GNRC continued rising toward its November bull trap, GNRC’s relative overvaluation suggests that such buying momentum was not sustainable. Therefore, it was only a matter of time before the day of reckoning came knocking on GNRC holders’ doors.

Hence, we urge investors to be wary about chasing consensus PTs. Instead, they should focus on fundamental valuation metrics to ascertain whether GNRC is undervalued or overvalued.

The Market Needed To De-Risk Higher Execution Risks

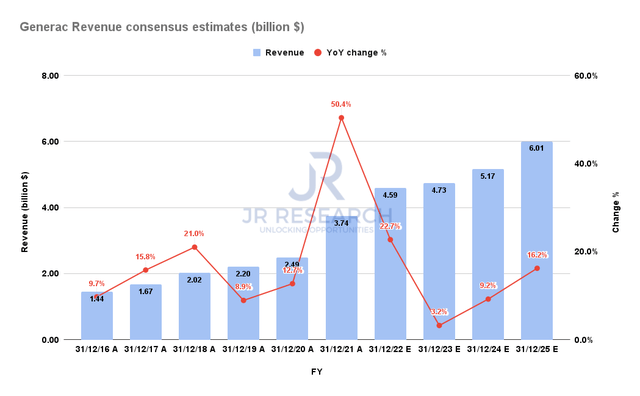

Generac Revenue consensus estimates (S&P Cap IQ)

Management revised its FY22 guidance markedly, as it expects significant headwinds in H2’22. As such, Generac is expected to post revenue growth of 23% (midpoint), down from its previous guidance of 38% growth.

The consensus estimates have also been downgraded, as it projects Generac to post revenue growth of 22.7%, within the bottom half of its guidance range.

Therefore, we believe the de-rating by the market is justified to account for poor execution and uncertainties through 2023.

Generac is projected to deliver revenue growth of just 3.2% in FY23 before recovering through FY25. Hence, the record surge in 2021 was clearly unsustainable, as it was well above its industry peers.

The S&P 500 electrical equipment industry grew its revenue by 13% in FY21, way below GNRC’s record surge. However, the revised analysts’ estimates through September indicate that the industry could still post revenue growth of 5.6% in FY23 (according to Refinitiv data).

Therefore, Generac is expected to post revenue growth below the industry’s average in 2023, behooving a de-rating. Accordingly, GNRC’s NTM EBITDA multiple of 8.1x is way below its peers’ median of 13.4x (according to S&P Cap IQ data). Therefore, we postulate that a significant level of pessimism has been baked into its current valuation.

Is GNRC Stock A Buy, Sell, Or Hold?

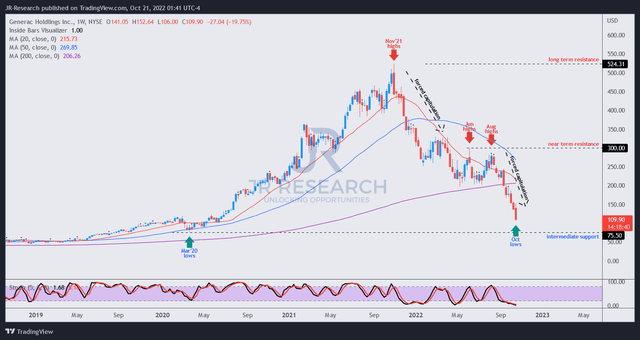

GNRC price chart (weekly) (TradingView)

One word of caution if you are considering adding at the current levels. We gleaned that GNRC had already broken below its final defense line, the 200-week moving average (purple line), suggesting the medium-term momentum remains decisively bearish.

The market forced GNRC into two rapid selloffs to trigger massive panic-selling (including the recent one), which have also de-risked its valuation significantly.

Therefore, we are leaning increasingly bullish, as we posit that the selling downside should subside moving ahead.

However, before staging a sustained bullish reversal, we cannot rule out a subsequent re-test of its COVID lows (down 32% from the current levels). Moreover, given its strong bearish bias and having broken below its 200-week moving average, the market could force GNRC to fill the gap, sending more weak hands fleeing before reversing the momentum.

Hence, we urge investors to consider layering in over time to take advantage of the potential downside volatility.

Accordingly, we rate GNRC as a Buy.

Be the first to comment