mrak_hr/iStock via Getty Images

Investment thesis

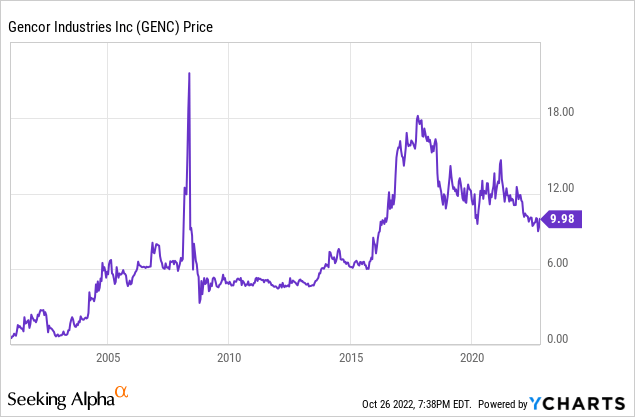

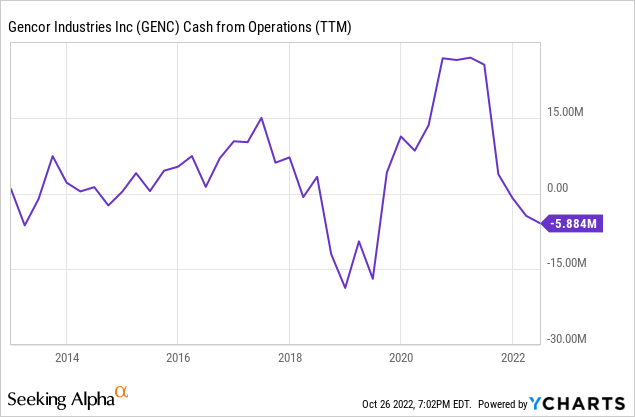

Gencor Industries (NYSE:GENC) is going through a relatively difficult time, and proof of this is the 45.76% drop in the share price experienced in the past 5 years. The coronavirus pandemic crisis and now the war between Russia and Ukraine are making things more difficult for Gencor. In this sense, supply chain issues and increasing labor, freight, and energy costs are having a significant impact on margins, but the company’s operations are holding up very well considering how complex the current macroeconomic landscape is becoming. The company has reported negative cash from operations in the current trailing twelve months, but increased inventories and receivables offset it despite abnormally low margins due to currency headwinds.

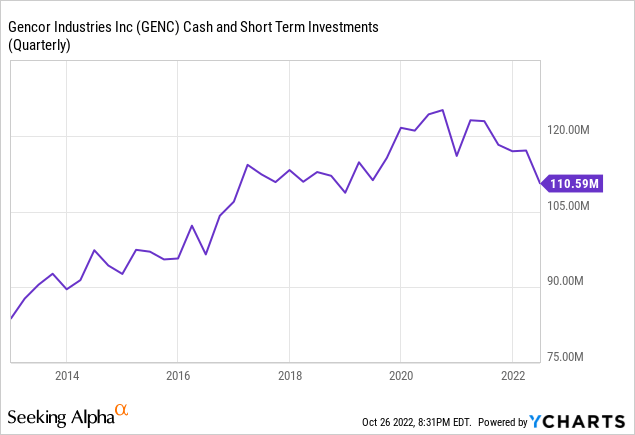

Over the past decade, cash and short-term investments have grown steadily while debt remained at zero, showing that the company is profitable over the long term despite experiencing periods of low margins. Therefore, I consider that the current fall in share prices represents an opportunity to buy shares at a reasonable price while waiting for the macroeconomic landscape to improve.

A brief overview of Gencor Industries

Gencor Industries is a leading manufacturer of heavy machinery used in the production of highway construction equipment and materials and environmental control equipment. The company manufactures machinery and related equipment for the production of asphalt and highway construction equipment and materials, including asphalt pavers, hot mix asphalt plants, combustion systems, fluid heat transfer systems, storage silos, specialty storage tanks, fabric filtration systems, cold feed bins, and other plant components. The company manufactures its products within the United States and sells them via its own sales representatives, independent dealers, and agents.

Gencor Industries image (Gencor)

Gencor Industries was founded in 1894 and its market cap currently stands at $145.26 million, employing around 380 workers. Insiders own 28.93% of the shares outstanding, which means that they are the main beneficiaries of the company’s good performance. This means that the same management of the company actively participates as shareholders, with which their interests are aligned with the interests of investors.

Currently, shares are trading at $9.98, which represents a 45.76% decline from the highs of $18.40 reached in October 2017. Despite the drop in share prices, revenue has continued to rise since the current price discount is due more to a problem related to profit margins as a consequence of the current macroeconomic landscape.

Revenue keeps growing

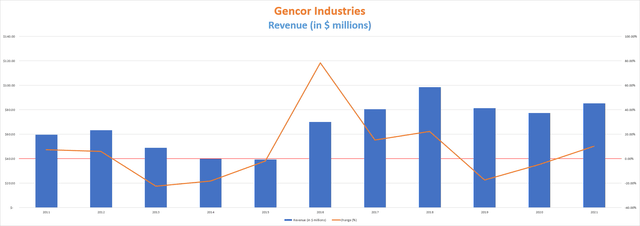

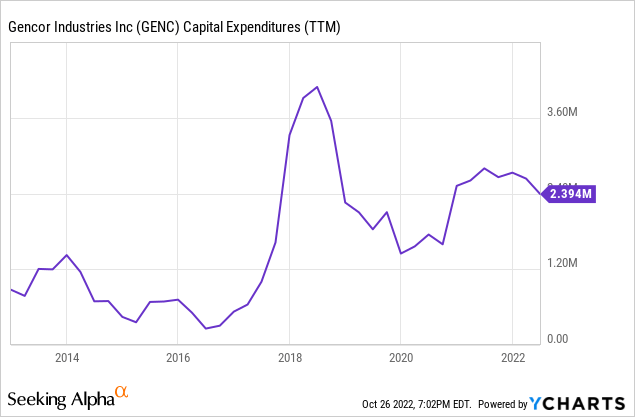

Although somewhat unstable, the company has managed to increase its revenue by 85.71% over the past decade until fiscal 2021, which is an acceptable sign that the business is growing. This has been possible without making use of debt and through a CapEX low enough to allow cash to be accumulated. Furthermore, revenue increased by 6.02% year over year during the first quarter of fiscal 2022, 43.57% during the second quarter, and 18.97% during the third quarter.

Gencor Industries revenue (10-K filings)

Certainly, the company’s revenue has historically been directly linked to government infrastructure spending and its operations have a highly seasonal nature as demand for its products is very low during the summer and fall months. Most orders take place from October to February, and a significant volume of shipments usually takes place prior to June.

After many years without acquisitions, in October 2020, the company finally acquired the Blaw-Knox paver business and associated assets from Volvo Construction Equipment North America, which was founded in 1917 and includes a manufacturing production facility in Shippensburg, Pennsylvania, for $13.8 million ($10.4 million in inventory and $3.4 million in fixed assets). The company didn’t need to make use of debt to make the purchase, and it should certainly give a boost to the company’s sales, although the current issues related to profit margins are having a very large influence on market sentiment as investor sentiment is becoming increasingly negative.

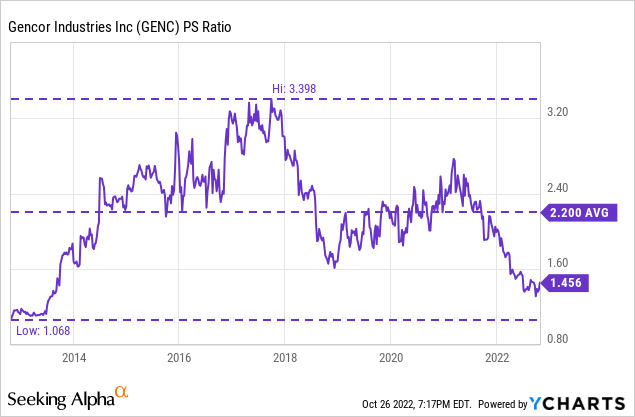

In this sense, the current price-to-sales ratio stands at 1.456, which means the company generates revenues of $0.69 for each dollar held in shares by investors, annually. This ratio is 36.33% higher than the lows from a decade ago, but 57.15% lower than the highs of 3.398 reached at the end of 2017 and 33.82% lower than the average of the past decade. This means that during the past few years investors have been placing less and less value on the company’s sales, a trend that has accelerated in 2021 and so far in 2022, despite the increase in sales, in part due to the fact that profit margins are lower.

Margins are (temporarily) depressed

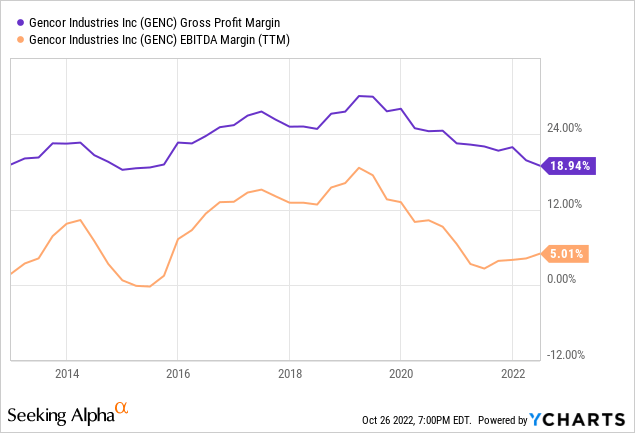

Actually, profit margins have been more than acceptable in the past decade except for the 2014-2015 period and after the coronavirus pandemic and the subsequent effects on the economy including supply chain issues and increased costs of energy and labor, as well as freight pressures. In fiscal 2021, gross profit margins declined from 24.5% to 21.3% as a consequence of unabsorbed manufacturing labor, increased labor costs, overhead expenses related to the paver line, and higher steel and OEM parts prices.

In this sense, the current trailing twelve months’ gross profit margin of 18.94% and EBITDA margins of 5.01% are significantly lower than the gross profit margin of over 20% and EBITDA margins of over 10% before the pandemic, which explains the recent drop in the PS ratio. This has created difficulties in generating positive cash from operations.

Looking at the chart above, the company reported -$5.88 million in cash from operations during the past twelve months, although the numbers are not as disastrous as they seem at first glance. First, inventories have increased by $7.4 million in this period and account receivables by $2.5 million. And secondly, account payables only increased by $0.6 million in the same period, which means cash used in operations should decline soon if margins don’t continue to tighten further as the increase of both inventory and accounts receivables are offsetting cash used in operations even taking the increase of account receivables into account.

A robust balance sheet

The company enjoys a very robust balance sheet without debt, which allows all its profits to stay within the company. This has two main benefits for the shareholder. In the first place, it places the company in an advantageous position by not having to face interest expenses at the end of each period, increasing thus its profitability. And second, nonexistent debt reduces bankruptcy risks to virtually zero considering that the industry for which the company operates is essential for the correct functioning of the country.

After the acquisition of Blaw-Knox for $13.8 million and the following turbulent times in terms of margins, the company has $110.59 million in cash and short-term investments (from which $19.5 million is in form of cash on hand) compared to $125.1 million reported in the fourth quarter of fiscal 2020. In this sense, the company has managed to improve its balance sheet continuously over the past decade without resorting to debt, and this is thanks to the fact that it has not needed large capital expenditures in order to increase its revenue.

In this sense, the company has shown that its operations are profitable in the long term, that it has the capacity to grow, and that it does not need large cash investments to make it possible. Furthermore, the recent acquisition of Blaw-Knox demonstrates that it has sufficient means to expand operations without resorting to debt.

Risks worth mentioning

- The company’s operations are directly related to government spending for infrastructure maintenance and expansion, and therefore, these may be subject to periods of high volatility as a consequence of changes in government purposes or economic downturns.

- Also, current profit margins are bearing increased labor and energy costs, as well as supply chain issues, so the company could lose money if these headwinds intensify in the coming quarters.

- Finally, I would like to mention that the company does not currently pay dividends or have a share buyback policy, so any potential return must be achieved through capital appreciation. In my opinion, this means that investors should have no motivation to hold shares of Gencor Industries other than to profit from the improvement in their current situation since its operations have a big cyclical component to take into account.

Conclusion

Gencor Industries’ current situation is not bad enough to justify a ~46% drop in the share price. Profit margins have fallen and with it the company has reported negative cash from operations in the past twelve months, but if we take into account that inventory and receivables have increased in the same period thus offsetting the cash usage, the numbers are not so bad after all if we consider how complex the current macroeconomic landscape is and the headwinds that the company is having to go through as a consequence.

The company has no debt, which greatly reduces the risks associated with its shares, and cash and short-term investments have increased steadily over the past decade, showing that its operations are profitable in the long term. Therefore, I believe this is a good opportunity to buy shares of Gencor Industries and wait for current headwinds to ease as the macroeconomic outlook improves.

Be the first to comment