Eva-Katalin/E+ via Getty Images

Author’s Note: This article is an edited version of a longer article originally posted on iREIT on Alpha back in early April 2022.

Europe is home to storied cities and metropolitan areas with a history going back over 2000 years. Some of the cities and their histories are equaled only by sites in the Middle East and Asia, with some areas having had cities for as long as people really can remember. Several of these larger cities, such as Paris have been centers of culture for over 1000 years.

They have been inhabited since, and it seems very likely that they will be inhabited for a long time to come – perhaps as long as humans are settled the way we currently are on earth.

That makes space, land, and property in these cities valuable – and valuable real estate is the reason we’re looking at Gecina (OTC:GECFF). I recently wrote about Vonovia (OTCPK:VONOY). Today we’re looking at a French business not exactly at the same size, but still appealing enough in its own right.

Gecina – A presentation

Unlike most European property/real estate companies, Gecina actually has a bit of history.

The company/group was established back in the late 1950s, due to two French insurance companies developing residential properties. Its original name was typically European and long – Groupement pour le Financement de la Construction – and the original offering attracted capital from 60 insurance companies to finance these jobs. The name Gecina came about in 1998, when it grew to acquire Foncina, another RE company. The company continued to develop, build, and M&A, doubling in size when it took over Simco and became the largest real estate group in all of France.

Gecina became a so-called SIIC back in 2003 – the French equivalent of a REIT (société d’investissement immobilier cotée) in order to further expand its portfolio. As a result, Gecina does not pay corporate tax on rental revenue but is required to distribute 90-95% of its net recurring income from rental activities and 60% of its capitalized capital gains on property sales as dividends. This ensures a relatively high, consistent dividend, currently at over 4.7%.

Gecina M&A’ed in 2017 with Eurosic M&A, which put Gecina to Europe’s fourth-largest RE group and a market leader for office real estate.

When you look at Gecina, you need initially be aware of three things.

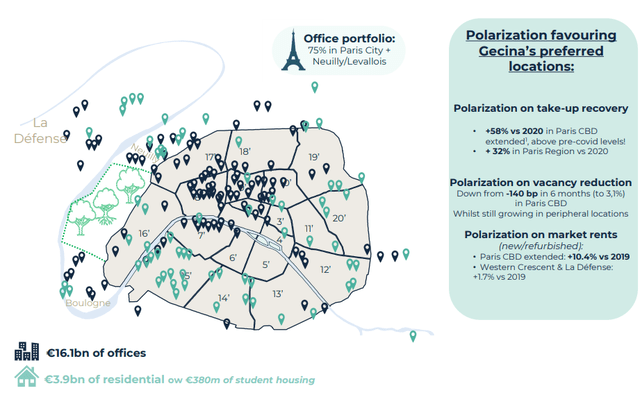

1. Gecina is Paris. The company’s portfolio is over 95% located in the French capital.

2. Gecina has large institutional Investors. This includes Ivanhoe Cambridge out of Canada, The Norwegian State Bank, and Predica. Together, these shareholders have almost 40% of the voting rights in Gecina.

3. Gecina manages a mixed Parisian portfolio. It consists of Office Space (which is most of it), Residential space, and “other” (though the other has been declining for years and is now almost 0%). This makes it almost into what I would consider a French Office REIT with Residential units on top.

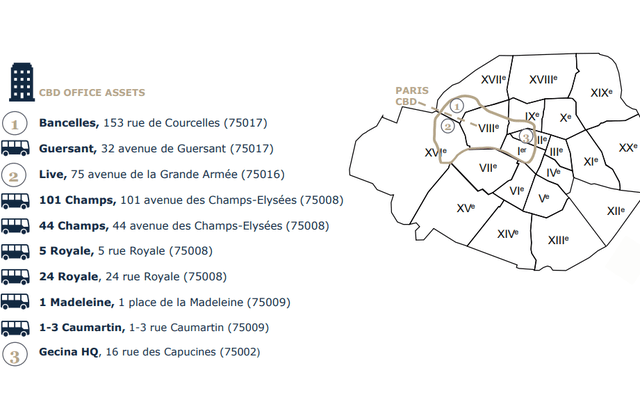

Gecina Office Assets (Gecina IR)

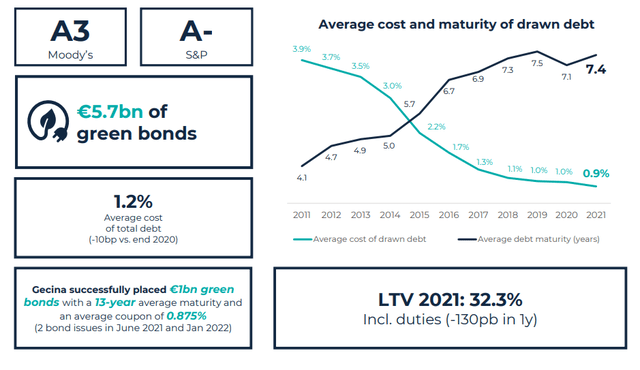

The company has a market capitalization of €8.5B and has an absolutely stellar A-rating from S&P, making it among the highest-rated European REITs available. This of course, apart from the debt, reflects the quality and attraction of the properties in the company’s portfolio.

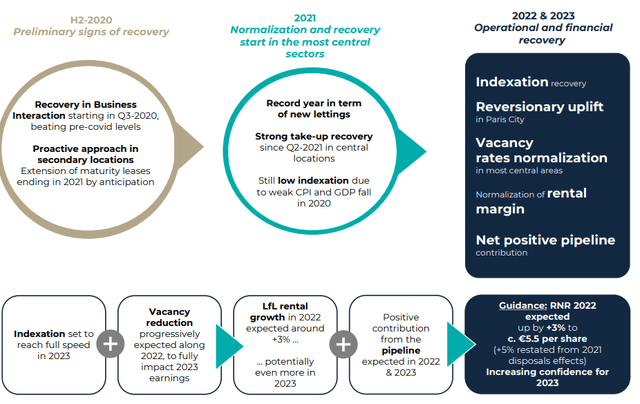

We’re talking about Paris. The combination of high demand and historically low supply of space in Paris has driven demand and vacancy numbers towards some very interesting trends. Vacancy numbers dipped below 1.5% in 2019, only to climb to 4.5% in COVID-19, and are now back almost below 3% again. There’s a massive new demand flow that’s driving increased leasing activity, with Gecina reporting FY21 leasing activity 9% above 2019 levels. 2021 was a record year of new letting with 180,000 sqm let, and 67% of its office projects for 2022/2023 already pre-leased.

Recent operational performance in Paris highlights the structural advantage of the capital. Take-up in office performance is driven by central locations, and there is a record-high level of rental transactions, with average maturities of 9 years.

Regarding the company’s residential Parisian portfolio, Gecina is able to drive rental income growth outperformance through optimizations, with growth of around 15% secured in 2021 through new units, rent increases and reversion potential after COVID-19.

The company also operates an impressive Student Housing portfolio – and vacancy rates here are back to pre-crisis levels with European Students and French students replacing pre-COVID Chinese student tenants.

The recovery for Gecina has been absolutely stellar in this post-COVID-19 world.

Gecina Office Recovery (Gecina IR)

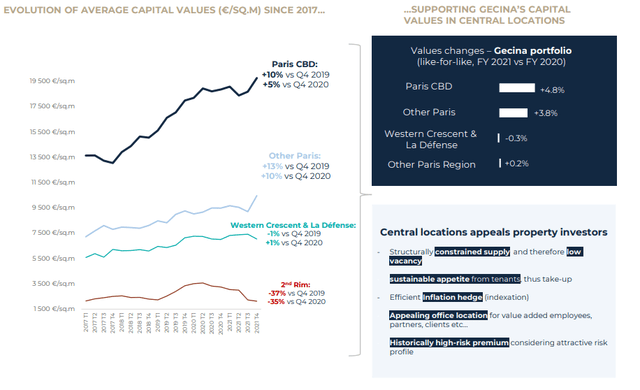

I know that many of our readers here at iREIT on Alpha might not exactly find Office REITs their cup of tea. I’d like to point out that offices in this particular geography have never, to an extended period of time, shown weakness. Paris hasn’t had the declines that some focused NA geographies such as NYC have seen, and forward trends are even in favor of Paris as a market (with the exception of a RE Bloodbath back in 1990-1995). Central Parisian locations have seen strength as opposed to decline, and the reversionary potential in this area is still massive. Values have been outperforming, not going down.

Gecina Value/Central Locations (Gecina)

Gecina is also an active manager and asset stripper, doing away with non-core assets with €512M of disposals in 2021, 92% of which were outside of the city. The company’s focus is crystal-clear. Paris city is their turf – anything beyond that is of limited interest to Gecina.

The company is also a very active developer and builder, with a pipeline of attractive rental assets coming online until 2025 – 700 new rental units and 7 new projects secured in 2021 alone, with a 2025E delivery date, ensuring significant growth.

Company debt has been a bit of a mixed story. Gecina’s debt used to be massive. After the financial crisis, Gecina dismissed its leadership in charge of this and moved on to a new strategy. It divested €3B worth of assets in 2011-2013, paying down debt, issued convertible bonds, and refinanced borrowings.

A sub-40% LTV is sort of a target number for most of the sector. This number has been achieved. The company’s cost of gross debt has gone from over 4% in 2011, to less than 1.6% in 2022E. 45% LTV is the mark to look at when it comes to Gecina, and the company is far from this at this time.

Due to its REIT status (the French SIIC), Gecina’s FFO pays for dividends. Such a company can’t save money from its recurring profit, which means that debt is usually rolled forward “forever”. Gecina is a strong beneficiary of the overall lower interest rates, and it has been able to up its cash flow due to this. When the interest rate environment reverses – as it seems about to do now – we’re likely to see some expense increases.

The company’s prime assets mean that it could easily deal with as much as a 20% value reduction in its assets (Core Parisian RE) without suffering too much. The company’s portfolio qualities mean that any major hit toward the real estate markets in Europe should hit Gecina significantly less than any other RE company, similar to RE companies with specific London, or Milan exposure.

Obviously, office vacancy is a lot more lumpy/volatile than residential vacancy. The company’s residential vacancy barely touched 4% during even the worst of COVID-19, and it’s already on its way down. Meanwhile, Student vacancy was as high as 18% during the worst of COVID, and Office went up to around 8%, but already lowering at this time.

On a high level, the Offices could be considered anchor assets. Given Gecina’s exposure, it’s important to understand Paris before trying to understand the appeal of the portfolio. Rents and office space availability have typically been stable and volatile respectively. While there is volatility in rent levels, they are nowhere near as high as the availability volatility in office space. Prior to COVID-19, vacancy in Paris was close to zero, at 1-3%. Out of 85% of the Paris-located RE assets, over 45% is located in the so-called Paris CBD, or Central business district. Its €9B portfolio makes Gecina the largest owner of Office Space in the Paris CBD. Outside of the CBD, we have the “first” and “second” inner rings of the city of Paris, where the company has around €5B worth of assets. It can be generalized that the farther out, the more volatile the assets have been, which explains the company’s focus on the CBD/inner rings of Paris.

These assets have the advantage that they are incredibly valuable, at least insofar as NAV/BV goes. This makes any refurbishment of these assets comparatively cheap when you put it into context to the book value, and the assets are the strength of the company. I would say management is another strength – but the previous management prior to 2011 wasn’t one I would consider “the best”. The current management seems to do a better job of handling this.

I believe it fair to say that no French RE company is “less risky” than Gecina, and this is doubly confirmed by the company’s fundamentals and the way it’s viewed on the debt market.

Gecina – Fundamental Safeties (Gecina IR)

The future is positive. The Parisian market, especially the CBD has a low expected vacancy, a shortfall of office space supply, and a continued momentum for increased market rents. I highly recommend that you also look at the company’s material, as they go into great detail about their various locations and plans for locations, making for an interesting deep-dive read.

Let’s look at risks.

Gecina’s Risks

I will go on record saying that I don’t believe Parisian Real estate, like London, Milan, and other popular cities, suffer that much from fundamental downturn risks. However, the company’s portfolio concentration does present risks, and even with COVID-19 reversion, there are signs of a slowdown in the Parisian market. The companies currently do offer some rent signatory incentives, and there’s a growing end-market vacancy for unfinished spaces (as mentioned, over 60% is pre-let, but this is somewhat below historical numbers).

Also, as mentioned, while market rents in Paris aren’t that cyclical, the actual office market is cyclical, with ebbs and flows in line with financial downturns. These were, for the past 30 years, in 1991, 2001 and 2007. The COVID-19 downturn was real, but the landing this time seems to be a soft one compared to crises we’ve seen historically.

There are also the legacy risks that every RE company has – interest rate fluctuations, return spreads for initial yields, and so forth. However, as long as you’re aware that what you’re investing in is essentially only Parisian real estate in the form of a 75%+ Office portfolio, then you’re fairly well prepared for what ups and downs may come.

Gecina’s Valuation

Gecina is, as we’ve established, a pure-play Parisian REIT with an anchor-type focus on extremely high-quality CBD/inner ring properties. These properties typically do not devalue much, even if occupancy shifts. The company has spent the past 10 years delivering its entire balance sheet to where credit institutions and banks see the company as extremely low risk, and they could not have chosen a better time for it to do so.

The REITs properties are at the very heart of Paris, one of the most expensive tenant markets in all of Europe, but also one of the most prestigious markets in the entire world. You’re buying extremely high quality.

And the thing is, you’re buying that quality pretty cheap.

The hardest part about valuing Gecina is factoring in voids, incentives, and rent cuts. With this seemingly mostly past for the time being, as recovery seems to be ongoing, it gives focus to the more book-oriented/NAV-oriented valuation methods to this REIT. Gecina has zero liquidity issues, though debt spreads may rise a bit going forward which could pressure the company’s dividend.

The company’s comparative peers are SEGRO (OTCPK:SEGXF), Landsec (no Symbol), Covivio (OTC:FNCDY), British Land (OTCPK:BTLCY), and Icade (OTCPK:CDMGF). Other peers lack the REIT’s focus on Office property, or aren’t REITs at all.

In the peer group, we see an average of 21-22X P/E, which puts Gecina at a significant discount at its current level. The company’s Book values are also being undervalued compared to the 0.93X average, and Gecina at around 0.6X. Gecina, meanwhile, also yields almost 4.8%, with peers on average at 3.7%. From a peer basis, the company is very attractive, and only Segro is larger in terms of overall market capitalization. I would apply a slight discount to the company’s book values to reflect the geographical concentration and vacancy volatility – but no higher than 10%.

Because of the company’s geographical concentration, a valuation loss in Paris of say, 25%, would essentially force Gecina to raise equity. The company is extremely exposed to this, and while it currently does not seem likely, we need to account for and discount for the assumption. Gecina could, if pressed, dispose of tranches of its residential business segments to prop down a re-evaluation-impacted LTV, and such a scenario would cover all but a 1991-1995 type scenario for Gecina.

Guidance for 2022 is optimistic, on the continued strength of pre-letting and the reduction of disposals from the €600M level in 2021. This should ensure that 2022-2024 come in at relatively positive levels. Paris has furthermore outperformed Japanese geographies, including Tokyo, when it comes to rent level stability and incentives for tenants. The company’s secondary locations seem under pressure, but the CBD/First-ring locations seem to be doing fine.

The Ukraine crisis has caused some uncertainty, but nothing major that should impact the company significantly. The major impacts for Gecina remain the interest rates, vacancies and re-evaluations of its properties. For now, these seem positive, given the situation we’re in.

S&P Global affords the company a high premium. The 14 analysts following Gecina give the company a range of €91 on the low side (my DCF target with GDP-like growth estimates) and €151 on the high side. I’m not sure what sort of premiums they applied to get that higher range target. The average comes to €134.58/share, with 9 out of 14 analysts holding a “BUY” or “Outperform” target on the stock. The undervaluation to this average is 20% at a share price of €111.

I tend to stick to a more conservative valuation, but I do weigh NAV/Book value very high and would consider anything below €120 to be “too cheap” for the company here.

The company’s assets have been historically proven resilient against virtually every other asset class or REIT subsector, including Malls, Lodging, and others, due to the strength of that specific portfolio.

Equity analysts like Alpha value come in above €120/share, if only slightly.

I’m more or less in line with these assumptions and targets for the company. The undervaluation to my target isn’t that high, as you can see, but it’s predicated on a relatively significant discount already applied to a set of luxury-quality real estate assets.

Because of this, I’m a “BUY” for Gecina and its mixed portfolio of attractive assets.

Thesis

I like buying assets I can touch – Real estate is no different, even though i may have to travel to Paris to touch these particular ones. I believe the current situation in the world is a good reason to double down on assets that are conservative in nature.

Food. Heat. Power. Property. Land.

All of these are things we need. I’m of the opinion that when crises do strike, we’ll care the least about supposed techno-innovations like cryptocurrency, NFTs and other things I would personally see as “pseudo-investments”. This is not to push down on investors buying this – invest what you like – but I’m extremely traditional in my personal approach, and it’s worked very well for me over the course of my investment career.

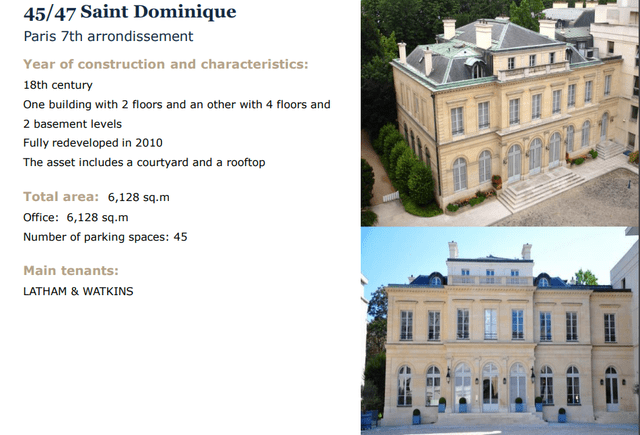

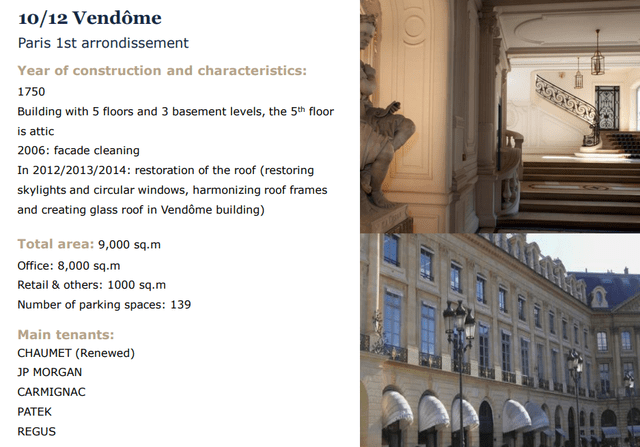

Gecina is investing in several hundred-year-old Parisian properties. Many of the company’s properties and assets are actually older than the United States in its current political form, such as 10/12 Vendôme. By buying shares in the company, you’re owning part of those assets, and the cash flows coming from them. That is appealing to me, at the right price.

This is one of the highest-rated REITs in all of Europe, and a high-yielder at almost 4.8%. You could deduct a high withholding tax and still come away with a good yield given an A-grade credit rating. Sure, risks do exist, but they seem manageable in the long term.

Gecina has an ADR called GECFF. This is a 1:1 ADR listing, and I view it as relatively illiquid with no available FactSet data for forecasts. If you’re interested in buying Gecina, I’d focus on the Parisian ticker GFC. This can be done using international brokers such as IBKR.

For myself, I like owning quality assets – and this isn’t some strip mall in the middle of nowhere, this is a set of some of the most storied buildings and assets in all of Europe. I’m happy to pay a good price, and even happier to pay a discount for them.

A discount is, in my opinion, what we have here.

So I’m a “BUY” at €120/share.

Be the first to comment