ssuaphoto

Despite strong oil prices in the last year and a half, most oil companies are still carrying substantial amounts of debt. However, there are some exceptions like Gear Energy Ltd. (TSX:GXE:CA, OTCQX:GENGF). After a record-breaking Q2’22, the Canadian company managed to achieve a net cash position and implemented a monthly dividend payment and a share buyback procedure. Although the spread between Western Canada Select (WCS) and West Texas Intermediate (WTI) has widened in the past few months, a normalization is expected to follow soon. Meanwhile, the depreciation of the Canadian dollar against the USD is also beneficial for the company. Currently, the shares are trading at above 9% gross dividend yield, and I estimate that the company is trading around 4x projected earnings, which looks like an attractive opportunity.

Company overview

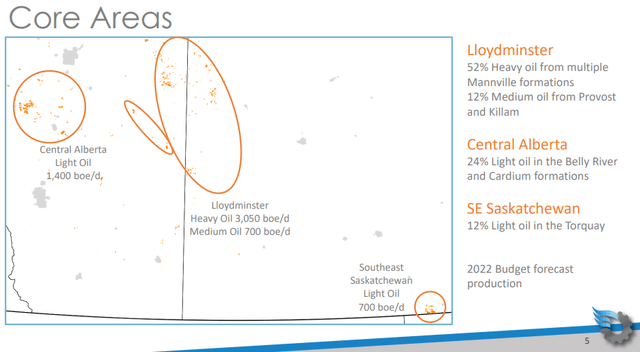

Gear Energy is an energy company, engaged in exploration and production of primarily oil and some gas, with assets located in Canada. Average daily production has fluctuated around 6kBOE, with the number for 2022 expected to be around 5% below that. Heavy oil, which is generally traded at a discount, amount to roughly half of the production while the rest is light and medium oil, NGLs, and natural gas.

Gear Energy’s assets (Gear Energy)

The shareholder structure is simple, comprised of around 258.5M shares, as of September 2022, with insider ownership at 8% of the current share count, or 11% diluted, which is quite substantial. In addition to that, most of the management’s members have been buying shares in the open market in Q3’22, which I find as a positive sign. There are no outstanding warrants and around 17.1M of outstanding options.

2022 performance so far

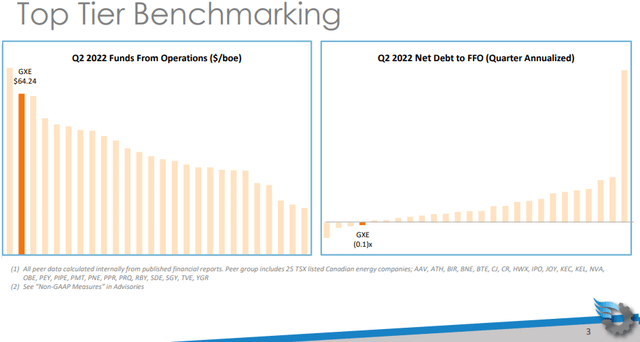

In the first six months of 2022, Gear Energy achieved a production rate of 5,739BOE/day (+7% YoY) with around half of it being heavy oil. The average realized price of the latter was CAD$105.73/barrel (+85% YoY) or US$83.25/barrel, when converted using the average CAD/USD exchange rate for the period of 1.27. For reference, WTI average price for the period was US$101.35/barrel. As a result, H1’22 revenue surpassed CAD$103M (+91.5% YoY). The outstanding performance was partially dragged by CAD$7.7M of realized and CAD$2.8M of unrealized losses from hedging, as the realized price surpassed the upper band of the hedging corridor. Funds from operations for the first 6 months came at CAD$52.6M or CAD$50.59/BOE (+140.9% YoY). The Q2’22 numbers alone were even more impressive as the FFO/barrel amounted to CAD$64.24 (+160.2% YoY), which was a lot higher than the vast majority of competitors.

Q2’22 performance relative to peers (Gear Energy)

Due to the strong cash flow generation, the company managed to completely turn its balance sheet and go from a net debt position of CAD15.8M to a net cash position of CAD9.8M. This allowed for the implementation of a monthly dividend of CAD$0.01/share. Also, in Q2’22, a total of 3.6M shares were bought back and subsequently cancelled, reducing the share count.

Forward guidance

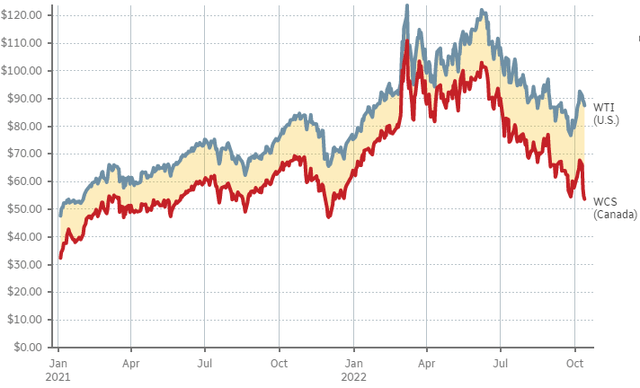

Although the full Q3’22 results are yet to be released, the September monthly update offers a glimpse of how the business has been developing. Given the falling oil prices and the increase in the WCS Heavy Oil Differential from around US$13 to approx. US$20, I expect the results to deteriorate, compared to the second quarter. However, on the positive side, the depreciation of the CAD to the USD should partially offset this, as some of the expenses of the company are paid in CAD.

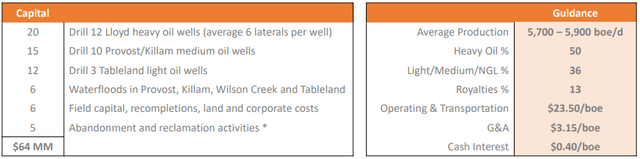

2022 CAPEX and production guidance (Gear Energy)

Until the end of 2022, the company plans an aggressive capital spending as CAPEX guidance was raised from CAD$55M to CAD$64M. According to the September monthly update, for the first nine months, CAD36.5M were spent, with about half of them in July-Sept. This implies that CAPEX in Q4’22 should amount to CAD$27.5M. While this could be challenging in the current price environment and given the expected dividend payments, Gear Energy has on top of its net cash position up to CAD$42M available in credit facilities, only 4.6M of it utilized as of the end of Q2’22. At current WTI and WCT prices, I estimate around CAD$25.5M CFO during Q4’22, which assuming CAD$27.5M CAPEX outflows and CAD$7.7M of dividends will turn the net cash position of CAD$7M as of 30 September to a net debt position of around CAD$2.7M. However, this looks manageable, since the large CAPEX outflow will likely not persist and decrease in the following quarters.

Share price and valuation

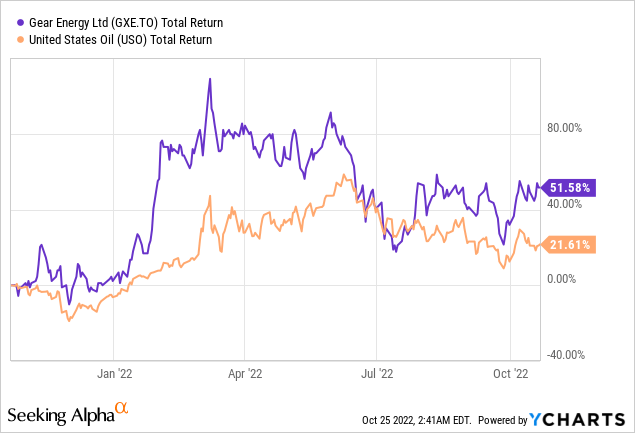

Since the beginning of the year, Gear Energy has yielded a total return of 51.5% to its shareholders, compared to the 21.6% YTD return of the United States Oil ETF (USO).

So could the outperformance continue? There are a few key factors that could turn things upside down, which I will discuss in the Risks section below, but for now, let’s stick with the current price environment. The increased CAPEX in H2’22, according to management’s guidance, is expected to lift production in Q1’23 to 6.4kboe/day, which I apply to the full year. Assuming average realized price of US$70/boe and CAD/USD exchange rate of 1.33 I get revenue of about CAD$218M. After increasing a bit the OPEX guidance of CAD$23.5/boe to CAD$25/boe and G&A expenses to CAD$4/boe, I expect the company to generate around CAD$120M of CFO, which to be used for CAPEX and shareholder return policies. Note that if the current dividend rate is maintained, the annual outflow related to it will be around CAD$31M. In terms of earnings, I project around CAD$80M for 2023, which will put the 2023 P/E at around 4. At US$60/boe scenario, the estimated CFO and 2023 P/E would be around CAD$94M and 6, respectively. For reference, the median FWD P/E of the industry is around 8. I see Gear Energy’s projected figures as a good opportunity, especially for income-oriented investors.

Risks

WCS spread risk

Since July’22, the WCS Heavy Oil Differential has widened significantly from the US$12-US$14 range in the last four quarters to around US$20 in Q3’22 and towards the high US$20s area in October.

WCS spread to WTI (Pete Evans/CBC; Bloomberg)

For a company like Gear Energy, which has heavy oil as 50% of total production, this is definitely a challenge. One of the reasons for the widening of the WCS spread most likely is the release of oil from the U.S.’s SPR. As refineries in the U.S. could get the product from these releases, the demand for Canadian oil declines. Fortunately, the releases are expected to stop in October-November of this year. What’s more, there are signals that if oil prices fall, the U.S. government could start refilling the SPR, which could also contribute for tightening of the spread. Another reason that has negative impact of the spread likely is the lower levels of the Mississippi River, which makes it more challenging for refineries to ship products as barges are one of the ways for delivery. I see the shipment challenges more as a temporary factor as well, which should normalize in 2023.

Political risk

With all of its assets located in Canada, Gear Energy has an advantage in terms of political risk, compared to peers in LATAM or Africa, for example. While it’s true, that Canada has ambitious climate goals, which could negatively impact the oil industry, the country is currently skeptical to the idea of windfall taxes on oil and gas companies. Something that couldn’t be said about other developed and presumably market-oriented countries, such as those in the EU.

Conclusion

Gear Energy offers investors a monthly dividend, which seems sustainable at current oil prices. At current stock prices, the annual gross dividend yield is above 9%. On top of that, the company has shown willingness to reduce the share count through buybacks, when extra cash is available. The current net cash position makes Gear Energy resilient to short-term market turmoil and gives management operational headroom. The widening of the WCS spread is definitely challenging, but I expect it to normalize in 2023.

Be the first to comment