golfcphoto

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on November 16th, 2022.

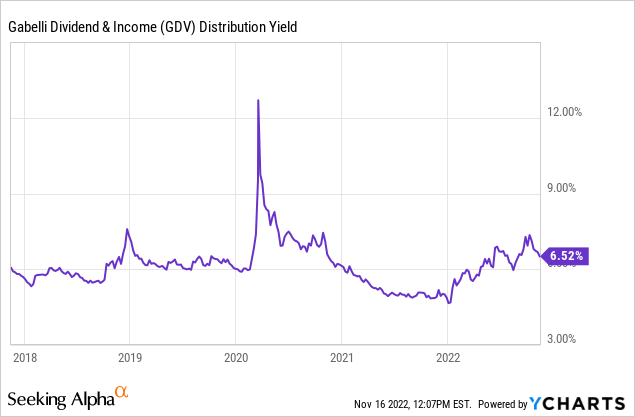

Gabelli Dividend & Income Trust (NYSE:GDV) pays a rather conservative distribution yield relative to other closed-end funds. The fund’s deep discount means that investors today receive a 6.22% distribution rate, and the fund only has to earn 5.34%. Even as equities have slipped meaningfully this year, it means this conservative payout should remain in place.

This is definitely a different approach than the sister fund, Gabelli Equity Trust (GAB), which implements a 10% managed distribution. In that case, GAB pays out at least 10% annually. This is usually hit with the regular quarterly distribution, but it sometimes requires a larger year-end payout.

They’ve maintained the same quarterly payout on GAB for years, but this year’s decline has pushed the distribution rate on NAV to over 11%. That means that while GAB will likely continue to payout the same rate, it could be eroding capital to do so. That isn’t the case with GDV. GDV also pays monthly, which some investors prefer. It trades at a deeper-than-usual discount relative to GAB’s premium, which can make it a more attractive proposition as well.

We have a new semi-annual report to look at since the last time we covered this fund. Overall, the fund has performed similarly to the broader market since our prior update as well.

GDV Performance Since Previous Update (Gabelli)

The Basics

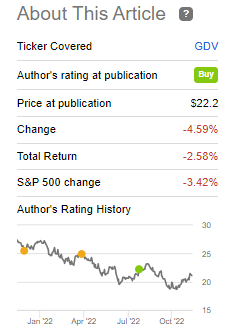

- 1-Year Z-score: -1.49

- Discount: -14.20%

- Distribution Yield: 6.22%

- Expense Ratio: 1.34%

- Leverage: 13.61%

- Managed Assets: $2.584 billion

- Structure: Perpetual

GDV is described as “a diversified, closed-end management investment company whose objective is to provide a high level of total return.” Their investment policy is “under normal market conditions, the Fund invests at least 80% of its assets in dividend-paying or other income-producing securities. In addition, under normal market conditions, at least 50% of the Fund’s assets will consist of dividend-paying equity securities.”

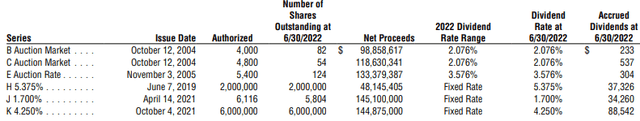

Overall, they are pretty free to invest how they see fit, with a tilt towards owning a fairly substantial dividend-paying stock weighting. The fund uses a mild amount of leverage; this is through both fixed and variable-rate Cumulative Preferred Shares.

GDV Preferred Leverage (Gabelli)

Of course, this is an important point of the fund. The auction rate is subject to a variable dividend means that as interest rates rise, the rate of the dividend will also rise. The auction rates were lower when interest rates were lower, that was their benefit. Now, that makes them less attractive, as it can mean interest rate costs are going to be rising.

Being split between both means that GDV is in a better relative position compared to funds that are at the mercy of their borrowings being entirely floating. Leverage also amplifies both downside and upside moves, which can make a fund more volatile overall.

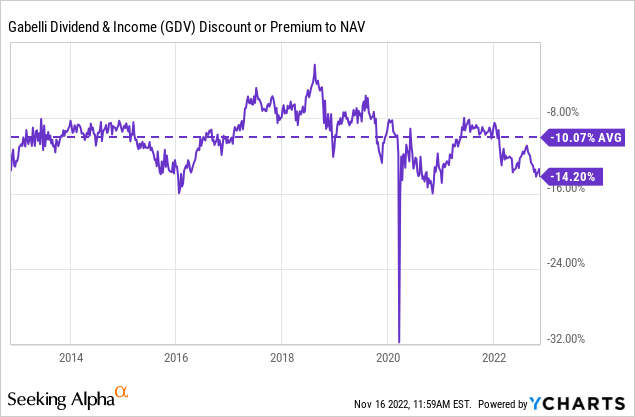

Performance – Deeper Than Usual Discount

GDV typically trades at a discount, so that isn’t anything new. However, the latest discount is larger than usual. Which was something I noted in the previous update, but the discount has just moved even wider since that time. This is near the widest discounts we’ve seen in the last decade – excluding the sharp COVID spike.

Ycharts

This could indicate an attractive time to be considering a position. This can also be considered with the overall market declining through 2022, which could potentially add further upside going forward.

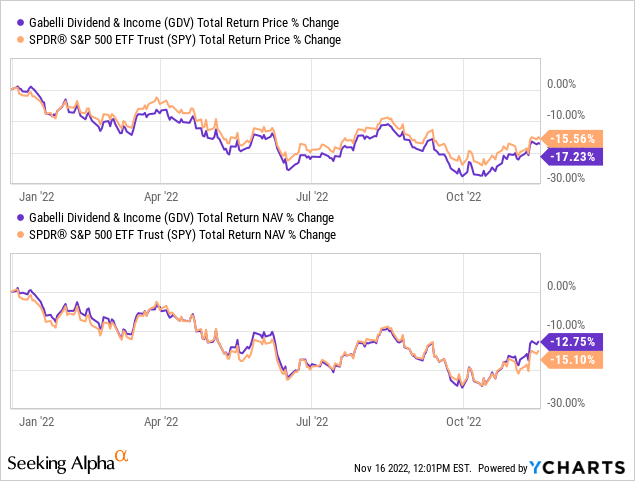

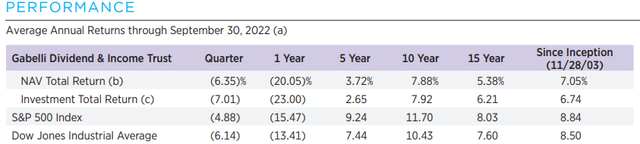

On a YTD basis, GDV’s total NAV return has outperformed the S&P 500 ETF (SPY). Due to the fund’s widening discount through the year, on a total share price return basis, it has come up short.

Ycharts

One of the reasons, probably the main reason, for this outperformance is that GDV is invested quite differently than the S&P 500. They are not overweight tech stocks. That has certainly been beneficial in 2022, as tech has been a big underperformer compared to other sectors. It also means that the S&P 500 might not be a great benchmark, but it can provide context for the moves we are seeing.

On the other hand, not being overweight in tech investments in the last decade+ has meant a longer-term underperformance.

GDV Annualized Returns (Gabelli)

Distribution – Attractive Monthly Payout

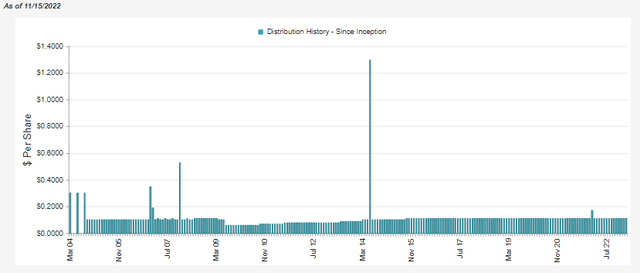

The fund’s payout had been cut twice around the GFC. They had raised the payout on several occasions following that but had then remained paying the same monthly distribution since 2015.

GDV Distribution History (CEFConnect)

Over the years, that’s meant this fund’s distribution yield has been relatively lower than what we could get elsewhere. Even after the declines this year, the fund’s distribution yield is higher but not shockingly high. This is a look at the distribution yield of the last five years.

Ycharts

It is even still on the lower end compared to other CEFs, but it can also mean more sustainability during this downturn. I wouldn’t expect the fund to cut its distribution while it’s currently paying out a reasonable distribution rate on the NAV.

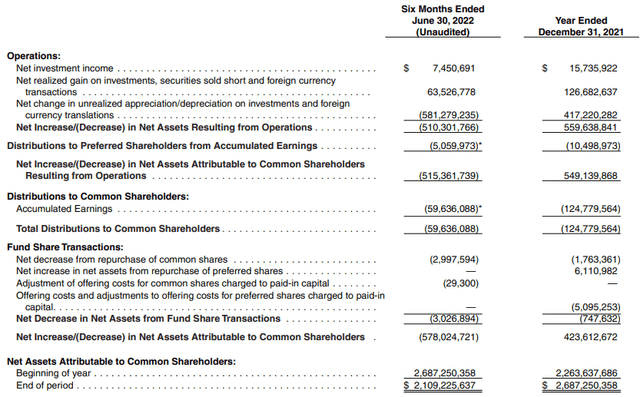

That being said, the fund still requires capital gains to fund the payout to shareholders. In fact, we can see that net investment income after the preferred shareholders are paid is quite minimal at less than $2.4 million. That means NII distribution coverage comes to just 4%, with the remainder needing to be paid from gains.

GDV Semi-Annual Report (Gabelli)

In the first six months of the year, we can see that they were easily able to find realized gains to cover the distribution. The significant unrealized appreciation had wiped away all the realized gains from the prior year. That’s something we should continue to watch, but as long as the NAV rate stays below 8%, I’m not expecting a cut.

GDV’s Portfolio

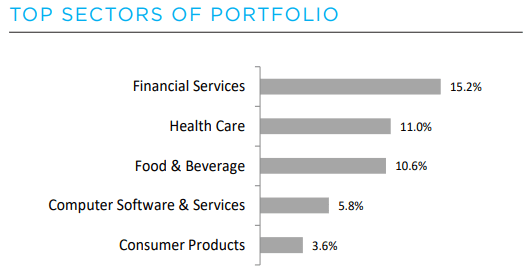

The portfolio turnover for GDV is quite low, which means that between each update, there is relatively little movement to discuss. The last report shows a turnover of 5%, with the highest turnover in the last five years at 16% in both the 2020 and 2019 years. That means there should be little to surprise us when looking at the portfolio. Overall, the fund’s largest sector allocation remains financials, followed by healthcare and then food & beverage.

GDV Top Sector Allocations (Gabelli)

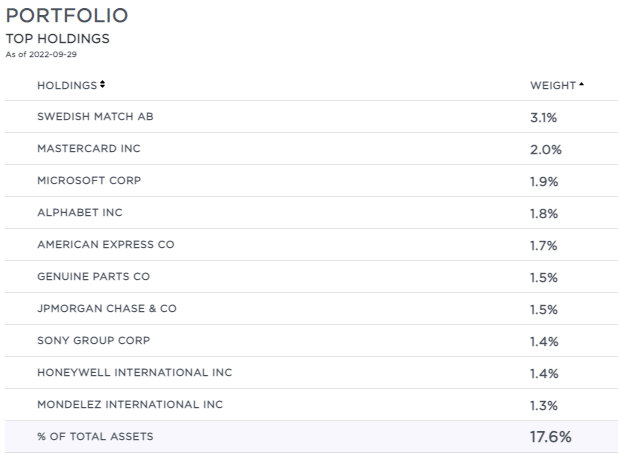

Computer software & services comes in at a rather low 5.8% weight and this would be some of the tech industries showing up. In the top positions, the tech companies that show up are Microsoft (MSFT) and Alphabet (GOOG). Mastercard (MA) is also a tech play. All three of these names were holdings in the fund in our previous update.

Neither Amazon (AMZN) nor Apple (AAPL) show up in this fund and those two frequently make their way into CEFs.

GDV Top Ten (Gabelli)

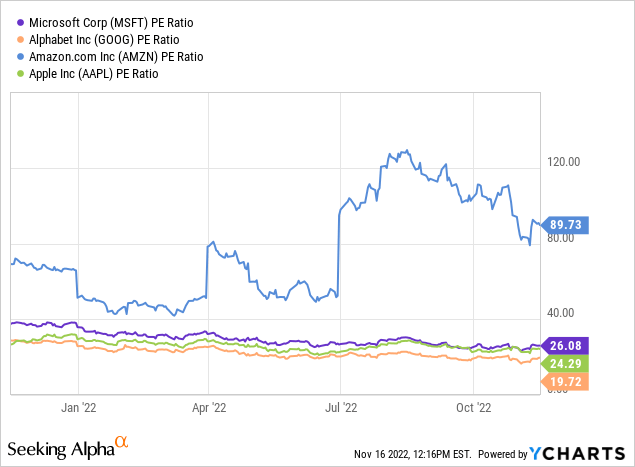

On a P/E basis, this could make sense too. AMZN is trading incredibly richly; its growth prospects are arguably what can justify such a level. With slowing growth in 2022, that thesis is being tested. Admittedly, the trend towards e-commerce becoming increasingly prevalent is unlikely to break. Additionally, AAPL isn’t insanely valued and is even a bit cheaper than MSFT at this time.

Ycharts

One name that was also in the top ten holdings that has fallen out was PayPal (PYPL). This would’ve been another tech play, but a more unusual one that doesn’t frequently show up in other CEFs. Replacing it was Mondelez International (MDLZ). MDLZ also isn’t a very common name in the top position of funds. This can highlight why GDV can provide more diversification to one’s portfolio overall.

The other top ten names are more unusual, too, not the names we often see in other diversified equity funds. Swedish Match (OTCPK:SWMAY) is a position that shows up in several Gabelli funds. This has been a top position for a considerable amount of time. However, with Philip Morris (PM) looking to acquire this name, it may not be the top holding for much longer.

Conclusion

GDV generally trades at a fairly wide discount; however, the latest discount is even wider than usual. We are seeing some of the widest discounts of the last decade at this point. The fund requires capital gains to fund its payout to shareholders. That being said, since they’ve paid out a relatively conservative distribution, the distribution rate on NAV doesn’t seem to be flirting with the danger zone. That should mean the fund can continue to maintain its current payout.

Be the first to comment