baona/E+ via Getty Images

Introduction

It’s been over 3 years since I’ve covered Colombia-focused gold miner GCM Mining Corp. (OTCQX:TPRFF) on SA, and several of my readers have recently asked me about my opinion on this company.

GCM Mining is currently trading at just 6x P/E on a TTM basis, and its dividend yield is close to 5%. In my view, the company looks cheap at the moment, but it’s crucial for it to boost reserves at Segovia Operations this year. Toroparu is a good project, but any delays or cost overruns could cause issues. Let’s review.

Overview of the business and financials

GCM Mining, formerly known as Gran Colombia Gold, owns the Segovia Operations gold mining complex in Colombia, which consists of several high-grade mines including El Silencio, Sandra K, Providencia, and Carla. The company also owns the Toroparu gold project in Guyana.

GCM Mining

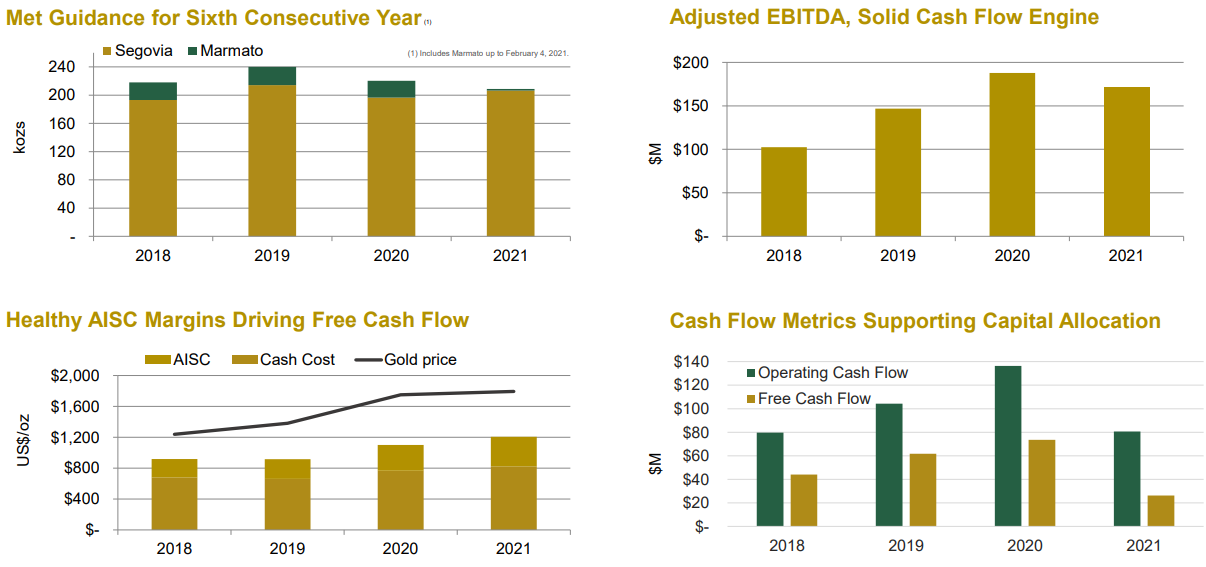

Segovia Operations covers an area of around 9,000 hectares, and more than 6 million ounces have been produced from its mining titles in over a century. The mining complex currently produces about 200,000 ounces of gold per year and is among the highest grade gold producers in the world, with head grades of over 12 g/t. However, all-in sustaining costs have been rising due to increasing material costs as well as investment in exploration, and mine development.

GCM Mining

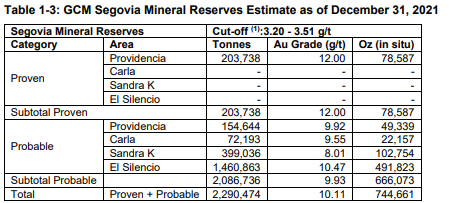

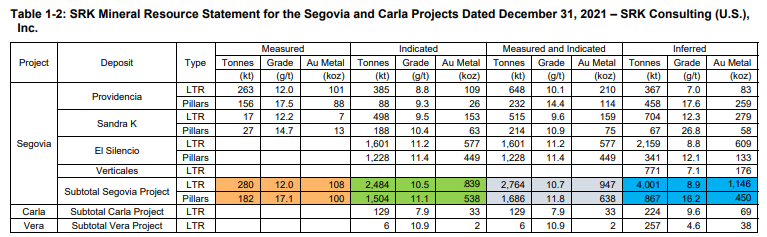

There are a total of 27 known veins at Segovia Operations, and GCM Mining is currently mining just 3 of them. The Achilles’ heel of this mining complex is its reserves and the company has been trying to boost them for years now. In 2021, GCM Mining completed around 97,000 meters of drilling at Segovia Operations and plans to drill another 91,000 meters in 2022. The latest technical report showed that the project has proven and probable reserves of just 744 koz of gold, which means that the mine life is below 4 years at the moment.

GCM Mining

However, the exploration potential is good as measured and indicated resources are 1.38 Moz of gold. In addition, Segovia Operations had an inferred resource of 1.6 Moz as of December 2021.

GCM Mining

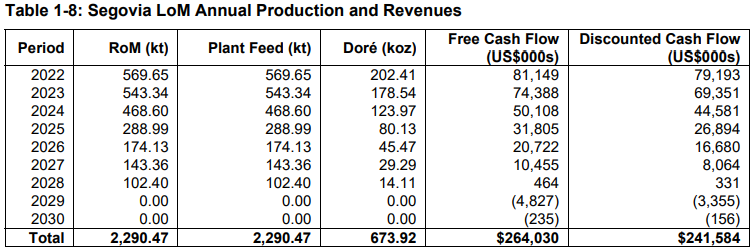

Yet, the project is not that valuable in its current state as the net present value stands at $241.6 million at $1,650 per ounce of gold. Also, gold production could drop significantly in 2023 unless GCM Mining manages to convert more resources into reserves soon.

GCM Mining

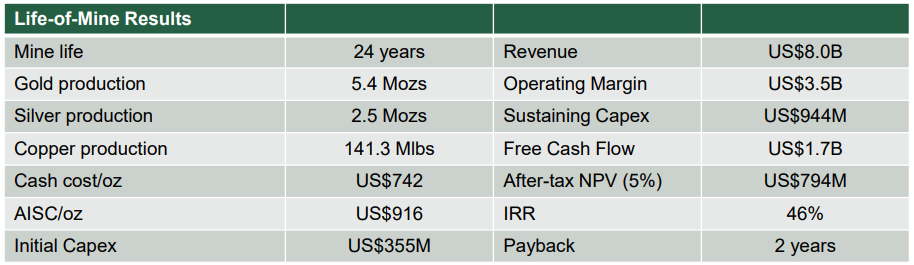

And keeping free cash flow high is crucial as GCM Mining has raised $300 million through the issue of 6.875% senior unsecured notes maturing in 2026 to finance the development of Toroparu. This is a major project that will require an estimated $355 million in initial costs according to a preliminary economic assessment (PEA) study released in January 2022. It will take about 2 years to build this mine, which means that any delays or cost overruns could create funding issues for GCM Mining.

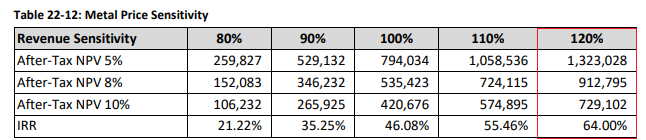

The key financial figures look good though as the NPV at $1,500 per ounce using a 5% discount rate is $794 million. I think that a conservative valuation for Toroparu at this stage would be 0.3x NAV, which translates into around $400 million at today’s price of gold.

GCM Mining GCM Mining

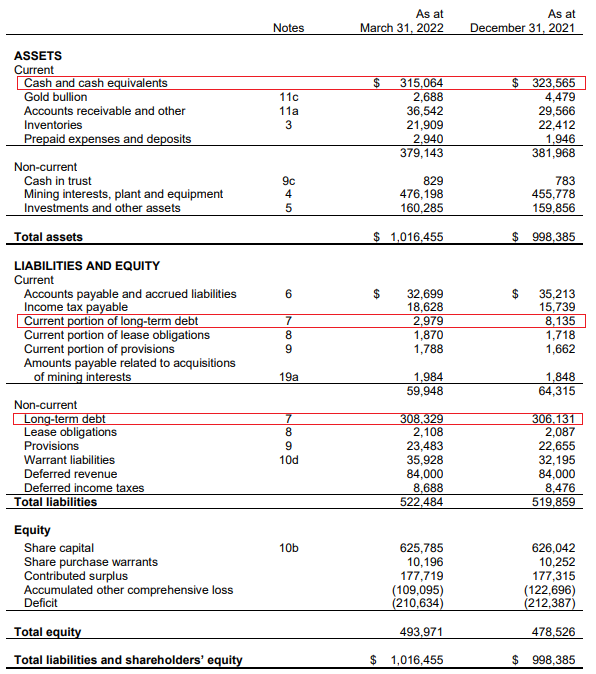

Turning our attention to the balance sheet of GCM Mining, the situation looks good as the company had $315.1 million in cash as of March vs. debts of $311.3 million.

GCM Mining

In addition, GCM Mining owns a 44.3% stake in Aris Gold (OTCQX:ALLXF) and a 28.6% stake in Denarius Metals (OTCPK:DNRSF). These stakes have a market value of $92.1 million as of the time of writing.

Overall, if you combine the full NPV of Segovia Operations, 0.3x of the NPV of Toroparu, and the value of the stakes in Aris and Denarius you’d get a valuation of about $730 million. This is equal to around $7.50 per GCM Mining share. And to top it off, the company has a monthly dividend of C$0.015 (0.012) per share, which means that it’s returning almost C$1.5 million ($1.2 million) of free cash flow to shareholders each month.

Turning our attention to the risks for the bull case, I think the major one is that gold prices could continue to slump due to interest rate hikes across the world.

Goldprice.org

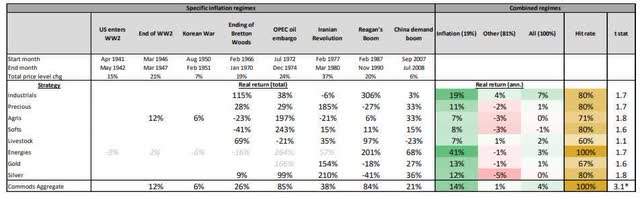

Yet, I think that gold prices are likely to perform well over the coming years – this metal usually does well during periods of high inflation. According to a 2021 study done by researchers from Man Group (OTC:MNGPF) and Duke University titled “The Best Strategies for Inflationary Times,” the yellow metal had an average annualized return of 13% in the 8 inflationary regimes in the USA since the start of World War II, during which annual inflation averaged above 5%.

The Best Strategies for Inflationary Times

Investor takeaway

In my view, GCM Mining looks undervalued today based on the NPV of its projects as well as the market value of its stakes in Aris and Denarius. I think that it’s likely that the mine life of Segovia Operations will increase significantly over the next couple of years and that Toroparu could become the new key project for the company. That being said, I think it’s crucial for the company to keep annual production at Segovia Operations above 200,000 ounces of gold in order to prepare for any potential delays and cost overruns at Toroparu.

Overall, GCM Mining looks cheap at the moment and I think that the company should be trading above $7.50 per share. However, it’s crucial that gold prices stop declining for the share price to pick up momentum. In my view, high inflation could to boost interest in gold investment and thus gold prices.

Be the first to comment