gorodenkoff/iStock via Getty Images

It could be interesting to start accumulating some Grayscale Bitcoin Trust (OTC:GBTC) units. Bitcoin (BTC-USD) has performed poorly in recent history and the trend is down. GBTC specifically is down 66% year-to-date. Yet it is only down 6% over the past three months. In the last 5 days, it is up even. Fed interest rate policy is likely one of the key drivers of its declining price.

Another may have been all the money raised through SPACs. SPACs or special acquisition companies did incredibly well for a time in 2021 and 2020 and were able to raise billions and billions of dollars to enable venture-type companies to grow. Regulators have been hammering the SPAC market, and it’s currently hibernating.

One type of company that was regularly brought to market through SPAC vehicles was cryptocurrency mining companies. There’s only one virtually unknown one – that I like. These companies used the billions of dollars that were relatively easy to raise and plowed it into crypto mining machines and orders for crypto mining machines. This resulted in a wave of new machines getting hooked up. With the capital dried up and interest rates likely higher for longer, we should see the addition of new machines markedly slow down from prior years.

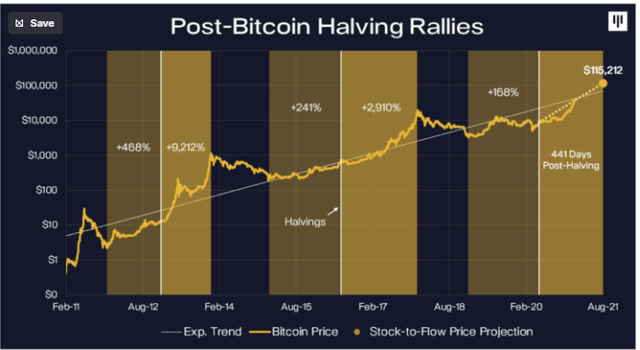

Meanwhile, the next Bitcoin halving is slowly approaching. The halving is an event where the remuneration for miners per verified block drops. Because the pay to miners goes down, the higher-cost miners are forced out of business. It is an event that requires a step-up in efficiency. If you look at a halving chart (many can be found on the Internet) there clearly seems to be a pattern:

Bitcoin halving rallies (Pantera Capital)

The price of Bitcoin tends to rise in the months after the halving. This makes some sense because supply is forced out of the market. Meanwhile, the halvings tend to generate a lot of attention and likely pull speculative demand in the market. The halving chart above also shows Bitcoin can be weak midway between halvings. That’s likely a point where the supply of hash power is adapting to the new reality while the speculative steam runs out, and there’s still quite a long way to go until the next supply constraining event.

If you’d argue, efficient market theory means speculators should buy before halving, this advance buying should get front-run again until we’re in a situation where halvings become a non-event. I would agree with you that’s the endgame. But this is an emerging asset, and few would claim crypto markets are among the most efficient. It would not surprise me if the buying happened earlier and earlier as the market more efficiently priced in the event.

Depending on who you ask, the halving could occur in February 2024 or a bit later in 2024. That’s potentially only one year and 125 days away. I tend to hold a core position but like to decrease and increase my holdings opportunistically because it is such a volatile asset. I’ve just increased my crypto exposure slightly (through GBTC). I’m inclined to believe the Fed headwinds will continue for some time. The halving is probably still too far away to get a lot of people excited but the descent of Bitcoin seems to have slowed down. I’m probably catching a falling knife but thinking about the upside/downside risk over the next 2 years, it looks good to me.

I’m specifically adding GBTC. A major downside of the GBTC is its annual management fee of 2%. However, every $11.41 unit has exposure to $17.88 worth of Bitcoin. Meanwhile, Grayscale is actively trying to convert GBTC into an ETF. The SEC has ultimately not been supportive of that endeavor so far. Grayscale has sued the SEC over the matter. This is how Grayscale describes their motivations for the suit:

To summarize, the SEC’s denial draws a distinction between Bitcoin futures ETFs and spot Bitcoin ETFs because it believes the exchange where Bitcoin futures trade – Chicago Mercantile Exchange (CME) – has regulation and surveillance sufficient to account for concerns such as fraud and manipulation. However, we believe these are distinctions without a difference in the context of Bitcoin ETF approvals because Bitcoin futures and spot Bitcoin derive their pricing from the same underlying spot Bitcoin markets. As a result, we believe that approval of Bitcoin futures ETFs, but not Bitcoin spot ETFs, is “arbitrary and capricious” and “unfair discrimination,” in violation of the Administrative Procedure Act (APA) and Securities Exchange Act of 1934 (“Exchange Act” or “‘34 Act”).

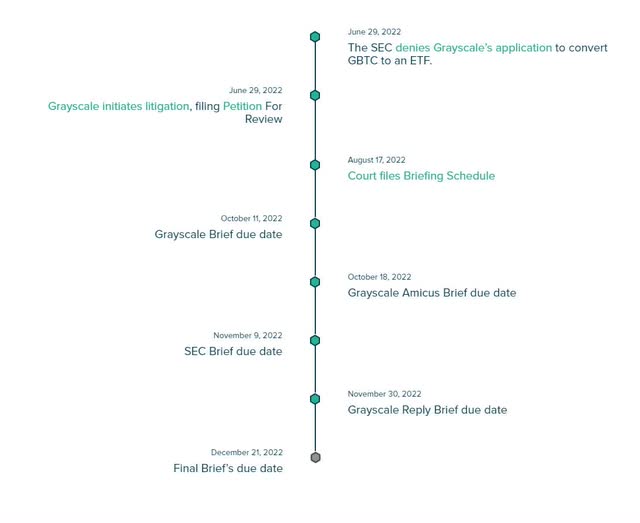

Whether Grayscale wins or loses, the matter could be appealed to the U.S. Supreme Court. The whole ordeal could take a few years. Some people are skeptical of Grayscale’s desire to turn GBTC into an ETF. I believe there are good economic reasons (besides ideological ones) for Grayscale to be highly motivated to convert GBTC into an ETF. GBTC would be the largest crypto ETF. In the ETF space, the largest ETFs tend to attract much of the capital. ETFs are also very much in vogue, and it would be much easier to attract capital. Inflows could very quickly dwarf the existing assets under management. So even though there are drawbacks from the operator’s perspective, like the loss of permanent capital and having to lower fees on AUM, the upside would be to attract hundreds of billions or even a trillion of capital (admittedly, that would take a while and a Bitcoin bull market). See the timeline below for the Grayscale lawsuit.

Grayscale SEC lawsuit timeline (Grayscale )

I believe there will be a Bitcoin ETF at some point. It may take a while. Perhaps the SEC has been wise to slow the process down. It simply doesn’t make a lot of sense to me that there would be lumber ETFs, cannabis ETFs and ETFs, including OTC derivatives, but no one would be able to launch one around Bitcoin. If one gets approved, GBTC should also be able to convert.

I don’t know when it is going to happen but under 4 years from now seems a reasonable guess given litigation timeframes. Buy buying Bitcoin worth $17+ at around $11 there’s a 56% upside if Bitcoin continues to bounce around this price level. Under a favorable scenario, the halving and the conversion of GBTC work together to magnify each other, and I could easily see my current investment triple or quadruple. All the above taken together, that’s why I’m carefully adding based on a multi-year timeframe.

Be the first to comment