USD, GBP/USD, Oil Analysis & News

- GBP Boosted as BoE’s Bailey Downplays Negative Rates

- US 10 Year Yields Breaks Higher

- Oil Prices Hit Fresh Multi-Month Highs

QUICK TAKE: GBP Boosted as BoE’s Bailey Downplays Negative Rates

European indices attempted to make a comeback from Monday’s sell-off, however, the move has retraced as we head towards the Wall Street open. Reports out of Germany (Bild) had stated that the country could consider 10 more weeks of lockdown to the end of March, compared to the current end of January.

That said, US futures are showing marginal gains despite the continued surge in US yields with 10s now at 1.17%. On a sector-specific note, energy names are the outperformer as oil prices hit multi-month highs. Of note, Goldman Sachs recently upped their Brent crude oil forecast to $65 after Saudi Arabia’s surprise decision to cut oil production by 1mbpd throughout February and March. Going forward, all eyes will be on a plethora of Fed speakers, particularly Brainard and Governor Powell (14th) in response to the recent surge in bond yields.

Euro Stoxx 50 Sector BreakdownOutperformers: Energy (+0.9%), IT (+0.5%), Industrials (+0.2%)Laggards:Real Estate (-1.4%), Utilities (-1.3%), Consumer Staples (-0.8%)

US Futures: S&P 500 (+0.3%), DJIA (+0.3%), Nasdaq 100 (+0.01%)

FX

FX: The GBP is trading well this morning despite the worsening COVID outlook. The main factor behind this morning’s gains had been BoE Bailey’s push back against negative rates, with the Governor stating that it is a “controversial” issue, which was enough to see a slight pullback in money market pricing of a BoE rate cut. In turn, as GBP/USD tests 1.36, near-term resistance sits at 1.3620-25.

Elsewhere, the USD is consolidating around recent highs in what has been a rather subdued session for the greenback. Fedspeak is in focus for the USD, with particular attention likely placed on commentary from Brainard regarding tapering of QE purchases. That said, with the USD remaining in recovery mode, the key pair to watch will be USD/JPY, which faces several topside levels from 104.50 to 104.80.

Commodities: Across the commodity complex, Brent and WTI crude futures trade at multi-month highs. It is worth noting that in the weekly oil report I mentioned that commodity index rebalancing could provide a tailwind for oil prices in the short run.

Recommended by Justin McQueen

Download our fresh Q1 2021 GBPForecast

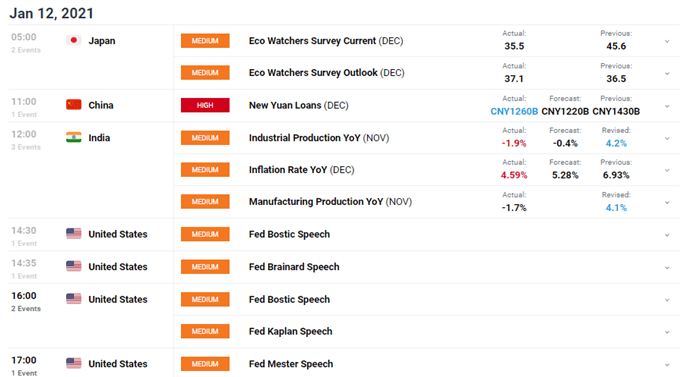

DailyFX Economic Calendar Events

Source: DailyFX

Be the first to comment