kontekbrothers

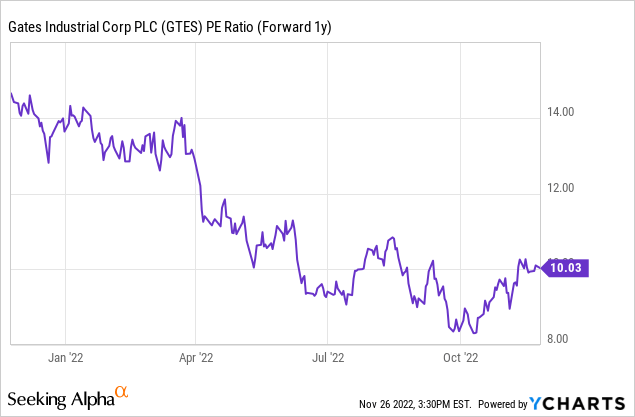

Global power transmission and fluid power solutions manufacturer Gates Industrial Corporation (NYSE:GTES) recently missed consensus numbers and revised its guidance lower on input cost inflation (mainly energy and petrochemical material related), as well as one-off FX headwinds. While the supply-side and macro concerns are valid over the near term, GTES commentary indicates underlying demand trends remain as strong as ever across its key end markets. The growing backlog, with the book-to-bill now >1x, validates this view, and once the company gets around its supply chain issues, earnings should outperform again. In the meantime, the strong cash conversion provides growth optionality, from accretive acquisition opportunities to capital return (likely via share buybacks). The stock currently trades at ~10x fwd earnings despite its outsized aftermarket exposure and recurring revenue stream, presenting ample room for re-rating down the line.

Navigating a Challenging Operating Environment

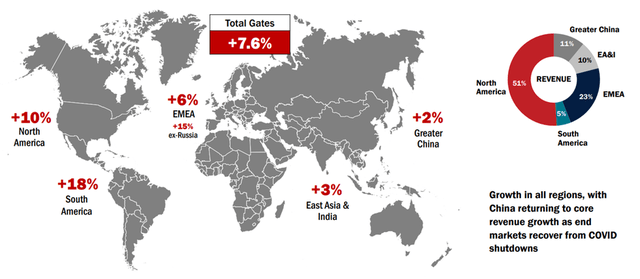

GTES ended its latest quarter with below consensus sales growth of +7.6% (on a core basis) amid supply chain challenges. The key positive from the sales number was that GTES’ pricing power remains intact – despite inflation running at a higher-than-expected pace this quarter, the company’s pricing allowed it to exit the quarter with a price-cost neutral outcome. Given the outsized contribution from aftermarket sales and the intact market leadership, there could still be room for further price increases should the logistical inefficiencies persist. Another positive is the strength of underlying demand trends across key end markets, most notably in industrials, with the book-to-bill now at >1x. As this increase was largely backlog driven, a gradual easing of raw material and labor supply tightness should translate into higher sales down the line.

Meanwhile, the adj EBITDA margin reached 20.6% (+70 bps QoQ) but was impacted by ~250bps of operational disruptions. Much of the disappointment was in the power transmission segment, which posted core growth of +5% but saw adj EBITDA margins contract significantly to 19.5% (down from 22.4% last year). On-time order inconsistency, particularly with polymers, led to 300-350bps of headwinds from production inefficiencies this quarter, while labor shortages remain strained (albeit improving from prior lows) in distribution centers. These margin headwinds will likely persist near-term, but as the supply side adjusts, GTES should see a recovery to prior highs.

Near-Term Guidance Revised Lower; Mitigation Measures in the Pipeline

Following the earnings miss, it was perhaps unsurprising that GTES lowered its core revenue growth guidance to 5.5-8.0% (down from 6-9% prior) on similar supply chain issues limiting production volumes. Management deserves credit for its response, though, with the company stepping up long-term supply chain mitigation efforts by developing single-source polymers. Not only does this create a viable alternative to existing raw material inputs, but it also reduces supply chain dependencies going forward. Meanwhile, demand remains as robust as ever, as evidenced by GTES’ expectations for another quarter of elevated backlog numbers heading into FY23. The company will also tap into its pricing power to protect margins in the coming quarter, with management commentary implying an impressive >10% price acceleration in Q4.

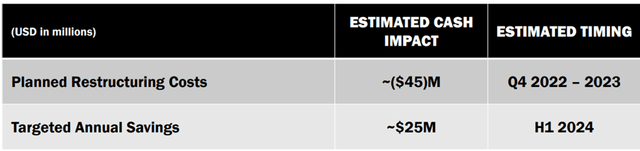

In tandem, the adj EBITDA guide was also lowered to the $660-$690m range (down from $705-$755m prior), reflecting more FX headwinds and input cost inflation (mainly energy and petrochemical materials). In particular, the volatility of polymer supply remains an issue, driving expectations of continued operational and logistics challenges ahead. GTES will offset some of the impact via near-term price increases, while over the mid to long-term, streamlining of the cost base and operational workflow will play a key role in supporting margins. To achieve the latter, GTES has earmarked ~$45m of restructuring costs through late 2022/early 2023 to unlock ~$25m in annual savings going forward. The full run rate is only expected to flow through to the P&L in H1 2024, but given the attractive <2-year cash payback, the restructuring makes a lot of sense, in my view.

Strong Cash Generation Supports Capital Deployment Optionality

Perhaps the key positive from the quarter was that free cash generation remains intact. To recap, FCF came in at ~$73m at a conversion rate of >80%, a significant QoQ increase. The headline result was helped by stabilizing working capital investments, though, so the lowered FCF conversion guidance at ~50% of adj net income is still strong. Plus, this conversion rate is well above historical levels and comes despite expectations of higher inventories, as well as an unchanged ~$100m capex guide. Importantly, with net leverage already down to 3.2x (from 3.3x in Q2), more cash generation should allow GTES to drive net leverage below 3x by year-end. The added balance sheet capacity not only de-risks the company but also paves the way for M&A opportunities, particularly in European industrials, where management previously expressed interest at the analyst day.

A Quality Industrial Name with Re-Rating Potential

GTES may have missed the mark in its latest quarter, but most of the headwinds, including supply issues related to polymers and energy costs, as well as incremental FX headwinds, were transitory rather than structural. Of note, the company’s pricing power is intact and should support profitability improvements as operating conditions normalize over time. Looking out to the mid to long term, GTES also remains a leader in its key end markets and should benefit from secular industrial growth trends, as well as ongoing initiatives to protect against future supply shocks. Relative to the quality growth and margin profile, the current ~10x fwd P/E valuation still leaves room for a further re-rating.

Be the first to comment