alvarez/E+ via Getty Images

Introduction

When last discussing the indebted LNG shipper, GasLog Partners (NYSE:GLOP) saw their deleveraging running ahead of plan and interestingly, they also stood to benefit in the coming years as a side-effect of the container ship shortage, as my previous article discussed. Whilst already a promising indicator to help their very low distribution yield of 0.78% return to its former glory, when looking ahead, they also now see a stronger outlook following the Russia-Ukraine war as Europe looks to secure their gas supplies elsewhere, as discussed within this follow-up article that also reviews their fourth quarter of 2021 results.

Executive Summary & Ratings

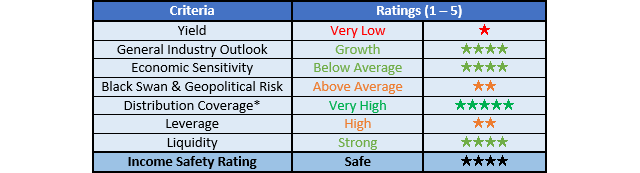

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

Author

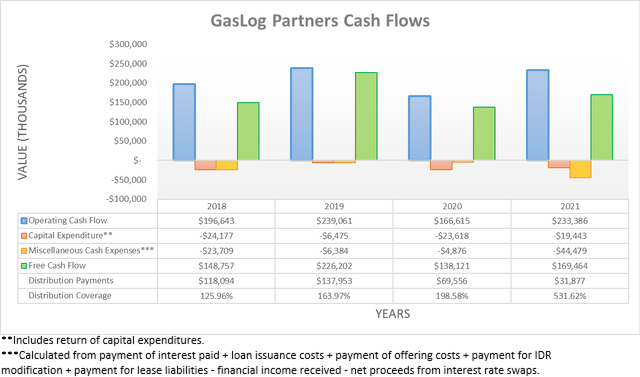

On the surface, it appears that their operating cash flow surged a very impressive 40.08% year-on-year during 2021 to $233.4m versus their previous result of only $166.6m during 2020, although this merely stems from accounting changes that now see their interest expense included as a financing activity versus an operating activity on their cash flow statement. If also removed from their 2020 operating cash flow, it increases to $218.4m and thus shows their 2021 results were actually only 6.89% higher year-on-year, which is still a decent result but essentially business-as-usual. Since my analysis now allocates their interest expense to miscellaneous cash expenses, it does not ultimately impact their free cash flow, which was a solid $169.5m during 2021 thanks to their only minimal capital expenditure, thereby leaving $137.6m directed towards deleveraging after their $31.9m of common and preferred distribution payments. When looking ahead into 2022, their focus upon deleveraging stands to continue, as per the commentary from management included below.

“As noted on our last call our capital allocation for 2022 will continue to focus on debt repayment, and reducing the breakeven rates of our fleets will improve its cash flow capacity.”

-GasLog Partners Q4 2021 Conference Call.

When looking further ahead into the medium to long-term, the outbreak of war in Eastern Europe sees a stronger outlook that stands to boost their financial performance, despite the otherwise tragic loss of life. Whilst this geopolitical event is highly uncertain and still evolving, if nothing else, it remains certain that Europe now wishes to expedite sourcing their energy and thus gas supplies from outside of Russia, thereby reducing their vulnerability from a national security perspective, as was discussed in detail within my other article. Despite only being early days, this is already evident with Germany pushing ahead with two new LNG import terminals.

Even though this transition is not a simple flick of a switch, it should see additional LNG demand and thus by extension, additional demand for their LNG vessels to transport said fuel to Europe during the coming years. It remains too early to ascertain the extent the boost their financial performance would see but the backdrop stands to further build upon the potential medium to long-term help they were already likely to see as a result of the container ship shortage that has significantly delayed the build times for any new LNG vessels, as my previous article discussed in detail.

Author

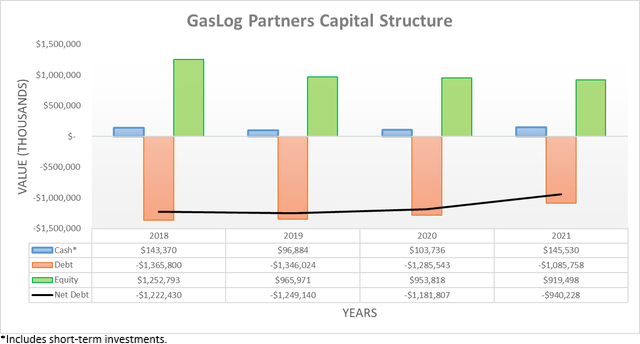

Whilst their cash flow performance was essentially business-as-usual throughout the fourth quarter of 2021, thankfully their net debt still saw a solid improvement and ended the year at $940.2m, which is down a solid 13.59% versus its level of $1.088b when conducting the previous analysis following the third quarter. Although positive and helped along by their free cash flow, this decrease was mostly due to a further $117.6m of divestitures and notwithstanding its otherwise positive improvements, it has not dramatically changed their leverage nor their liquidity with their cash balance of $145.5m still close to its level of $110.2m when conducting the previous analysis.

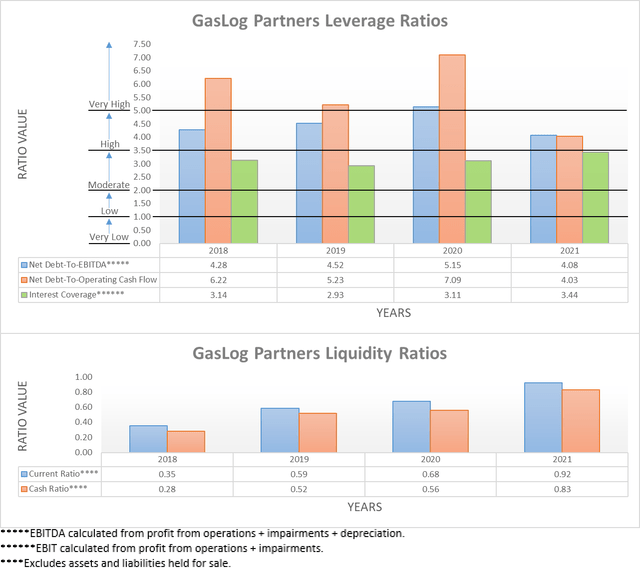

Since these aspects of their financial position have not changed significantly since conducting the previous analysis, it would be rather redundant to reassess either in detail but if any new readers are interested, please refer to my previously linked article. The two relevant graphs have still been included below for reference, which shows that their leverage remains in the high territory with a net debt-to-EBITDA and net debt-to-operating cash flow of 4.08 and 4.03 respectively, whilst their current and cash ratios of 0.92 and 0.83 respectively show that their liquidity remains strong.

Author

Conclusion

Even though war is nothing to celebrate nor to necessarily place a positive spin upon, it nevertheless objectively stands to boost demand for their LNG vessels in the medium to long-term as Europe looks to secure gas supplies elsewhere from outside of Russia, thereby seeing a stronger outlook. Since they have continued deleveraging even without any potential medium to long-term boost from new European LNG demand, I believe that maintaining my buy rating is appropriate with risks steadily subsiding every quarter.

Notes: Unless specified otherwise, all figures in this article were taken from GasLog Partners’ SEC Filings, all calculated figures were performed by the author.

Be the first to comment