Michele Tantussi/Getty Images News

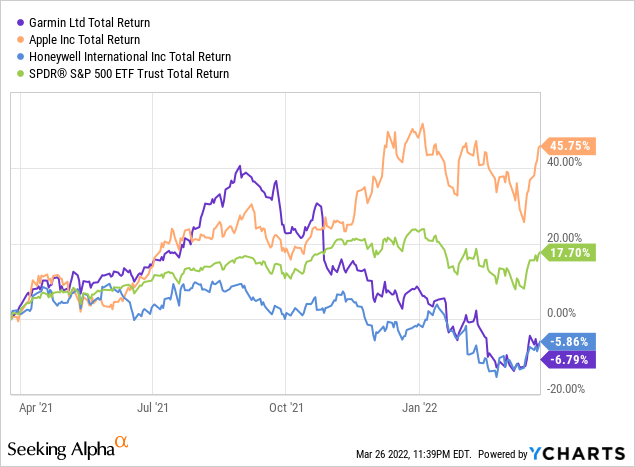

Over the last twelve months, Garmin (NYSE:GRMN) has seen 6% of shareholder value wiped out while the broader market S&P 500 was up 18% and Apple (AAPL) gained nearly 50%. This is particularly surprising given that Garmin grew revenue nearly 20% y-o-y to ~$5 billion, led by strong double-digit returns across all segments. While Garmin is well known for its GPS devices, it has underappreciated potential in wearable technology (think electronic watch) and fitness applications. Although Apple may be the leader in anything pocket-sized technology, Garmin is ready-made to further penetrate the wearable space. At 17.5x forward earnings, a dividend yield of 2.3%, and healthy gross margins of 58%, at first blush, it is a value play relative to Apple, which trades at 26.6x with only 43% gross margin. The margins between the two aren’t exactly comparable, but the fact that Garmin is able to generate superior gross margins to Apple certainly says something about the quality of its products in the marketplace.

According to Seeking Alpha data, the Street is generally optimistic on the stock. Nearly 75% rate the stock a “buy” or “strong buy”. This sentiment is considerably more bullish than back in June 2020 when only 25% put the stock in “buy” territory. Part of the shifting optimism has to do with strong tailwinds in smartwatches and the “better-for-you” fitness economy. Fourth quarter results were far better than anticipated due to solid margins, and the company managed supply chain challenges better than many others. Revenue CAGR since 4Q2019 is 12%, reflecting a business with solid fundamentals despite the discounted valuation. Management is now anticipating 20% y-o-y growth in 2022 for Outdoor, with significant traction in adventure watches

DCF Analysis Indicates Significant Upside

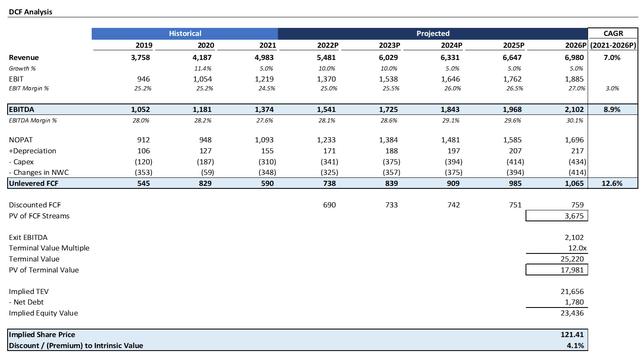

To get a sense of the company’s intrinsic value, I ran a DCF analysis. No DCF analysis can provide a perfect picture of future returns for shareholders; however, they can provide an illustrative “story” of the likelihood of different scenarios. In my DCF analysis, I assumed 10% revenue growth in 2022 staggering to 5% by 2026. I also assumed EBIT margins expanding modestly by 200 bps over the next five years. Capex, increase in net working capital, depreciation, and taxes were flat-lined for simplicity.

Source: Created by author using data from Yahoo! Finance

Assuming a terminal EBITDA multiple of 12x and a 7% discount rate, the stock is slightly undervalued. As much as I would love the stock to be undervalued to call it a “true” value play, the truth is that value is hard to come by in today’s market, period. Thus, at this point, I find it attractive to merely invest in a company that is not materially overvalued. It is important to note that Garmin’s multiple has ranged significantly over the past 15 years from 8x to 15x, so the 12x estimate I’m using is within range.

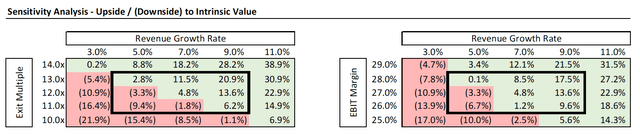

Source: Created by author using data from Yahoo! Finance

Taking a look at the sensitivity analysis, things look more rosy. Even if the stock were to contract to the low end at 10x and growth comes to a halt at GDP levels of 3%, there’s 20% downside here—not too worrisome given that this assumes “the worst” and is offset by the 7% annual returns inherent in the discount rate. If the stock were to grow at a 11% clip and see its multiple contract to 13x from today’s 16x level, the stock would have 30% overvalued. Accordingly, I believe Garmin has very favorable risk/reward.

Upside Catalysts

There are several catalysts that could get Garmin to close its discount to intrinsic value. First, decongestion of the supply chain is critical. The availability of electronic components is making this a challenging environment for everyone, although I suspect the market is discounting this cyclical issue too much into the long-term forecast. Fortunately, Garmin has a vertically integrated footprint that it can leverage to more agilely navigate the supply chain than some of its competitors can. Second, I am also bullish about the company’s Lily smartwatch product and the launch of the all-new Instinct 2 Series in two sizes. Demand for Garmin’s smartwatches have been significant thus far, and I believe it is positioned to further gain market share and eat away at Fitbit and Apple’s iWatch. In general, Garmin’s Outdoor segment benefits from the secular shift towards healthier lifestyles (or at least, attempts at them). The pandemic drove a lot of interest in active lifestyles and working out, and I anticipate this trend only continuing to grow.

I am also extremely optimistic about the company’s auto position. Full year revenue grew 26% last year, and every year more and more cars are featuring Garmin’s technology. BMW recently unveiled their vision for in-car entertainment, where Garmin will start production for later this year before ramping up significantly in 2023.

Why I Could Be Wrong

There are several factors that temper my optimism. Firstly, in today’s mega-cap tech craze, it will be hard for Garmin to garner much attention even if it did fire on all cylinders. Tough competition in the smartwatch space also hinder the ability to have much foresight in top-line growth. Management has also stated that it is looking to increase prices; in light of the competition, this won’t necessarily be a “check the box” kind of exercise. Finally, while the company’s long-run potential in auto looks promising, the short-term will be challenging given that it comes with lower margins. Given that much of the appeal of the stock is in its margins, it is therefore ironic that the high growth catalyst adds an adverse mix change from this perspective. Lastly, there may be a stronger-than-expected pullback in demand for cycling products as pandemic-fueled demand tempers.

Conclusion

It is hard to find any truly undervalued stock in today’s market. Nevertheless, Garmin stands out as a growth play at a reasonable valuation with a material upside story. With a shareholder friendly capital allocation policy and strong secular tailwinds in wearable technology, Garmin is well positioned to leverage its vertical integration to generate outsized returns. The stock’s underperformance relative to the broader market is out of line given that operational execution has generally been strong, margins remain solid, and growth opportunities continue to prove actionable. With large outdoor events like half marathons and 10Ks returning, you can expect to find a resurgence in Garmin’s products, which is fresh from some innovative launches. So, although Apple may continue to maintain the leading perception in the market, Garmin’s products remain top-of-line and poised for future outperformance.

Be the first to comment