leminuit/E+ via Getty Images

Real estate ownership is one of the best paths to long-term income generation. However, as with any asset class, valuation matters as buying too high can chip away at years of income.

That’s why it may be worthwhile to layer into lesser followed REITs that have not yet been “discovered” by the mainstream market. This brings me to Gaming and Leisure Properties (NASDAQ:GLPI), which may be one such case. In this article, I highlight why GLPI is a worthy pick at current prices, so let’s get started.

Why GLPI?

Gaming and Leisure Properties is one of just 2 publicly-traded REITs that focuses on owning properties leased to gaming operators. At present, GLPI owns 55 properties diversified across 17 states, and gets more than 85% of its rent from well-known publicly-traded gaming companies such as Caesars Entertainment (CZR), Penn National (PENN), Bally’s (BALY), and Boyd Gaming (BYD).

GLPI continues to demonstrate accretive growth, with AFFO per share improving by $0.02. GLPI continues to be a net consolidator in the fragmented gaming segment with the recent acquisitions of Live! Casino & Hotel in Philadelphia and in Pittsburgh with the Cordish Companies, bringing the total number of acquired properties to 31 since GLPI went public in 2011. Both of these are high quality regional operators that come with very long lease terms of 39 years.

Looking forward, GLPI has plenty of opportunities to pursue development on its increased asset base, as noted in the recent press release:

We have also positioned GLPI for future growth opportunities with Cordish with our agreement to co-invest in all new gaming developments in which Cordish engages over a 7-year period beginning with the closing date of the PA properties.

Looking forward, GLPI is well positioned to drive further growth based on our growing broad portfolio of blue-chip regional gaming assets, close relationships with our tenants, our rights and options to participate in select tenants’ future growth and expansion initiatives, and our ability to structure and finance transactions that we believe will be accretive to rental cash flows. We believe these factors will support our ability to increase our cash dividends and further our goal of enhancing long-term shareholder value.

Risks to the growth thesis include higher interest rates, which raises GLPI’s cost of debt. However, this also increases the replacement value of GLPI’s existing asset base. Also, macroeconomic uncertainty presents a risk for tenants, but the gaming sector has proven to be rather resilient as demonstrated by its bounce back from 2020. Management also noted strengths in tenant rent coverage, as noted during the recent conference call:

As macro uncertainty persists and the capital markets volatility is evident, I want to remind everyone on the call today that GLPIs business model was built with an environment like this in mind. In fact, our reported four wall coverage has again increased across the portfolio with a number of leases now at all-time highs. This robust coverage reflects continued operating resiliency, while it also provides a buffer or margin of safety for our lease payments.

Meanwhile, GLPI maintains a reasonably safe amount of leverage, with a net debt to EBITDA ratio of 5.6x. The dividend was recently raised by 2% and currently yields a respectable 6.3%. It also comes with a safe 82% payout ratio, based on Q1’22 AFFO/share of $0.86.

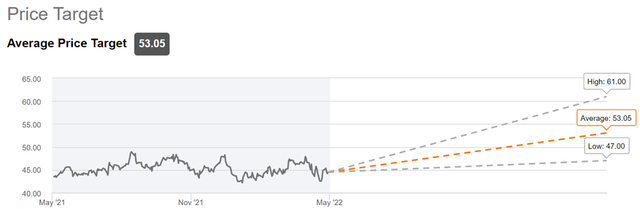

I also see GLPI as trading with a reasonable margin of safety, with price to annualized AFFO/share of 12.9. Sell side analysts have a consensus Buy rating with a price target range of $47 to $61, with $53 at the midpoint, implying a potential one-year 26% total return including dividends.

GLPI Price Targets (Seeking Alpha)

Investor Takeaway

Gaming and Leisure Properties is an interesting option for investors seeking a high yield combined with steady growth. The company has strong ties to some of the biggest names in gaming, and its long-term lease agreements provide stability and visibility. Meanwhile, GLPI has plenty of opportunities for both internal development and external acquisitions. GLPI appears to be attractive at the current price for high income and growth.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

Be the first to comment