Michael M. Santiago

First of all, and obviously, GameStop (NYSE:GME) hasn’t been trading on fundamentals for a while. Instead, it’s been a battleground between longs and shorts since nearly 2 years ago. A battleground where most positive progress is based on short squeezes.

That said, it still helps the long side to have the veneer of a fundamental thesis on its side. This is often accomplished by the thesis that GameStop is going to turn into an online powerhouse, or that it’s going to lever its customer base into blockchain-related activities. On top of this, it’s always helpful to be printing some revenue growth, and GameStop itself pushes this line (bold is mine, the quote is from the Q1 2022 earnings call transcript):

Let me now turn to our financial results for Q1. Net sales increased 8% to just under $1.4 billion compared to approximately $1.3 billion during the same period in 2021. As indicated in the past, long-term revenue growth is a primary metric by which we believe stockholders should assess our execution.

A recent console cycle, along with the software cycle it drives, have helped GameStop get back to revenue growth. On top of that, GameStop’s move to have a lot more available inventory has also helped.

Of course, the bearish thesis on GameStop is that GameStop is on a structural decline, as gaming software migrates more and more to straight downloads and away from physical retail. For the bearish thesis to play out, any revenue growth ought to be temporary.

It’s herein that Microsoft’s (MSFT) recent Q4 FY2022 earnings report becomes relevant. Remember, this Microsoft report pertains to the quarter ended on June 30, 2022.

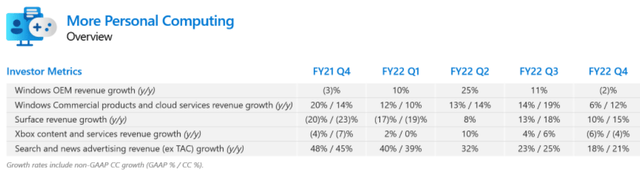

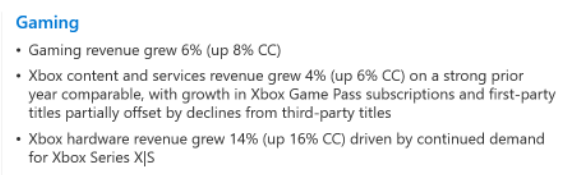

What’s so relevant about what Microsoft reported? Focus on the following table, as well as the associated commentary:

Microsoft Q4 FY2022 Report Microsoft Q4 FY2022 Report

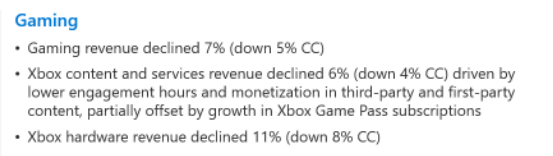

As well as Microsoft’s commentary from the previous (Q3 FY2022) quarter:

Microsoft Q3 FY2022 Report

What do we see here? We see:

- From Q3 FY2022 to Q4 FY2022 gaming revenues took a nosedive, both on hardware and software/services.

- Growth went significantly negative for both Xbox hardware and software/services.

- And even worse, Q3 FY2022 compared to a strong Q3 FY2021, while Q4 FY2022 compared to a weak base!

All in all, this Microsoft earnings report speaks of a deep, negative and recent turn lower in gaming.

As for GameStop, how did it do in the previous quarter, and what are expectations for this one? Remember, GameStop’s previous quarter ended on April 31, so the next quarter GameStop reports will actually share 2 months with the quarter Microsoft just reported. And on top, GameStop being 1 month delayed, means it will have had more time to reflect the downturn!

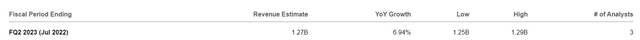

So, in the previous quarter (Q1 2021), GameStop reported +7.8% revenue growth. And for Q2 2022, expectations are as follows:

Seeking Alpha MSFT Earnings Estimates

So, GameStop’s consensus is for a full +7% revenue growth on the current quarter!

Therein lies the problem. Microsoft works as canary in the coal mine, showing that gaming had an extremely unfavorable recent turn to the worse. Hence, that makes it likely that GameStop itself will have some trouble meeting its own consensus expectations.

One Problem For Shorts

From what I just described, it would seem GameStop is an easy short. It has both a strong long-term bearish thesis (the drive towards digital downloads) and, now, also a reason to believe it will disappoint in the short-term, when it comes to revenue growth.

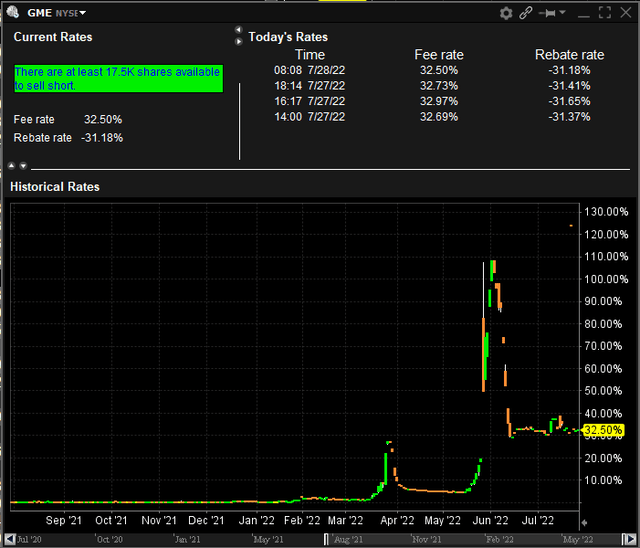

However, there’s one problem for shorts. GameStop remains a short squeeze battleground stock. As such, there are precious few free shares available to borrow, and the short borrow fee remains extremely high at 32.5%:

Interactive Brokers, GME Short Fees

Of course, I still think that GameStop is an obvious short, made even more obvious by this recent development reported by Microsoft. However, one should be very aware of both the risk of further short squeezes, and the extremely high cost of keeping a short position open.

Conclusion

Microsoft’s just reported quarter increases the likelihood that GameStop’s next earnings report will be disappointing in terms of revenue growth – the very metric the company decided to highlight as most relevant.

Of course, GameStop can trade on all kinds of dreams, but still this development is extremely ominous and negative.

Be the first to comment