Hispanolistic

A Quick Take On Gambling.com

Gambling.com Group Limited (NASDAQ:GAMB) went public in July 2021, raising approximately $42 million in gross proceeds from an IPO that priced at $8.00 per share.

The firm provides performance marketing services to the online gambling and sport betting industries worldwide.

GAMB appears to be positioned for further growth in North America and has a clean balance sheet while generating free cash flow.

My outlook on GAMB is a Buy at around $8.40 per share.

Gambling.com Overview

St. Helier, Channel Island of Jersey-based Gambling.com was founded to develop a platform to refer gamblers to online gambling websites.

Management is headed by co-founder and CEO Charles Gillespie, who has experience in the sports betting industry.

The company’s primary offerings include:

-

Referrals

-

Online comparison websites

The firm seeks affiliate referral relationships with online iGaming and sports betting sites and apps.

GAMB operates the sites Gambling.com and Bookies.com (among others) and its revenue model is based on a revenue share model or a cost per acquisition model or a combination of the two.

Gambling.com’s Market & Competition

According to a 2020 market research report by Grand View Research, the global market for online gambling was an estimated $53.7 billion in 2019 and is forecast to reach $128 billion by 2027.

This represents a forecast CAGR of 11.5% from 2020 to 2027.

The main drivers for this expected growth are the continued penetration of internet usage and mobile phone usage by individuals at home or in public places.

Also, increased legalization of online gambling and a more culturally permissive approach is contributing to demand.

Below is a chart showing the historical and projected future growth trajectory of the U.S. online gambling market size by type:

U.S. Online Gambling Market (Grand View Research)

Major competitive or other industry participants include:

-

Better Collective

-

Catena Media

-

GAN Limited

-

Genius Sports

Gambling.com’s Recent Financial Performance

-

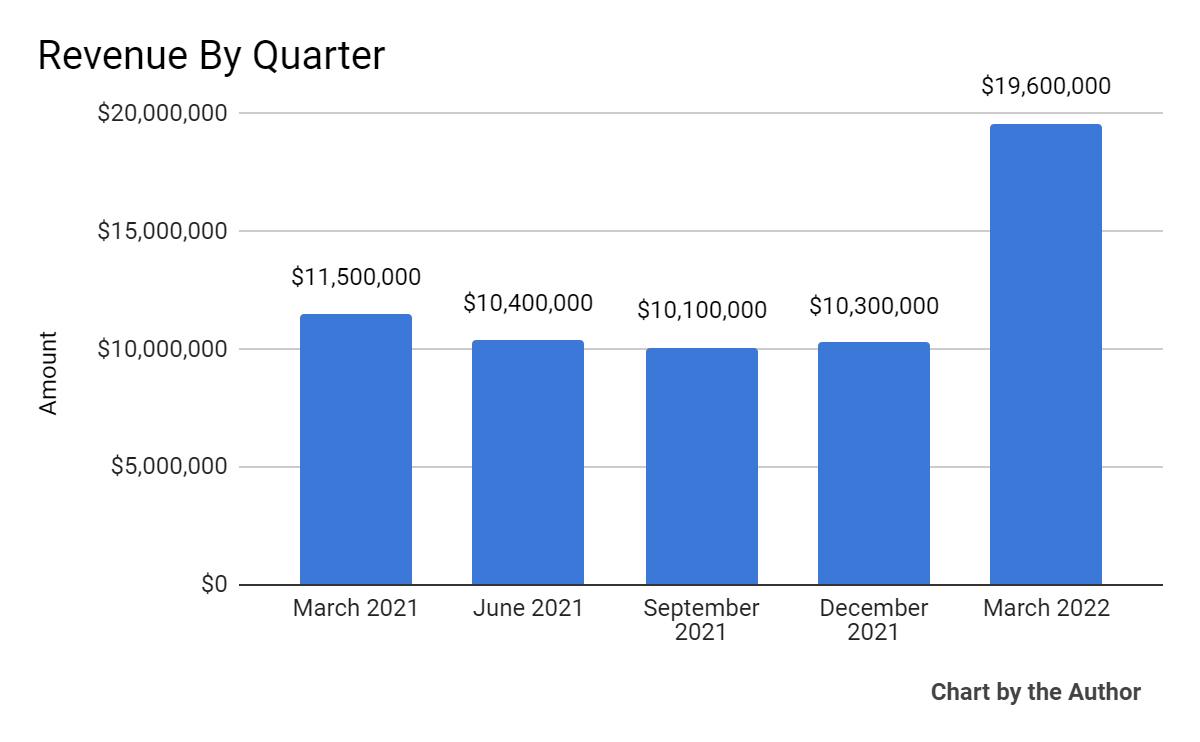

Total revenue by quarter has followed the trajectory shown below:

5 Quarter Total Revenue (Seeking Alpha)

-

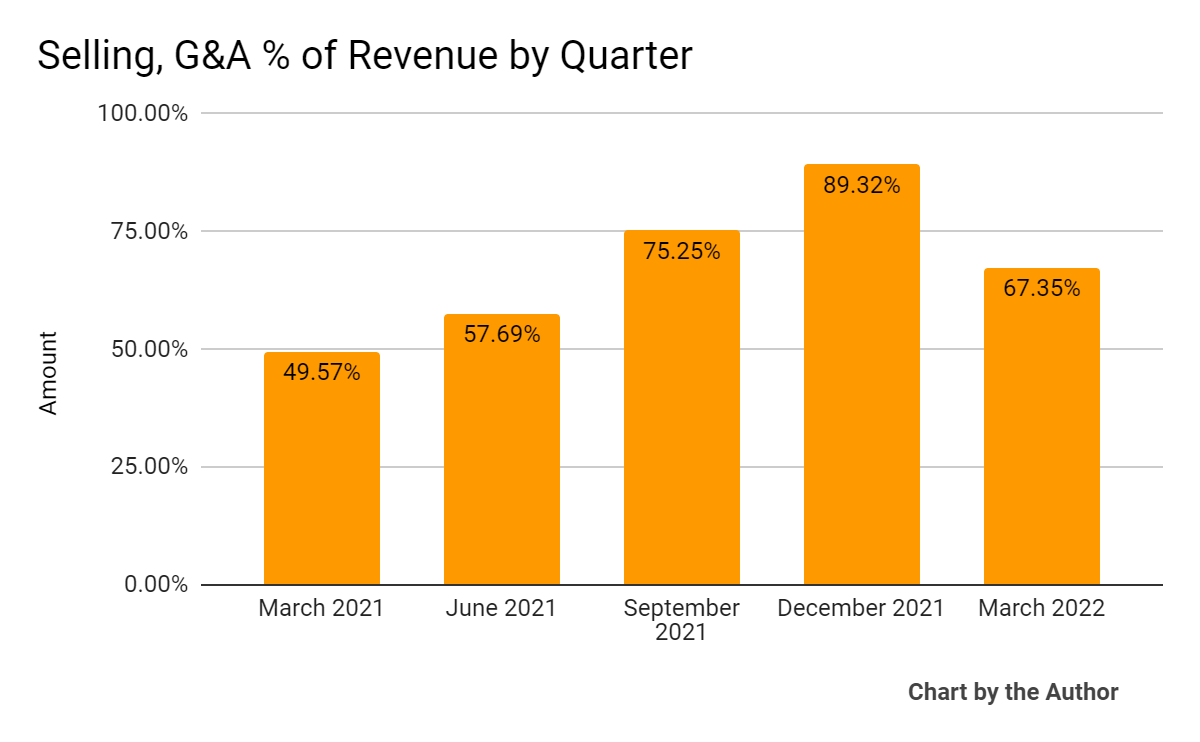

Selling, G&A expenses as a percentage of total revenue by quarter have fluctuated materially in the past 5 quarters:

5 Quarter SG&A % Of Revenue (Seeking Alpha)

-

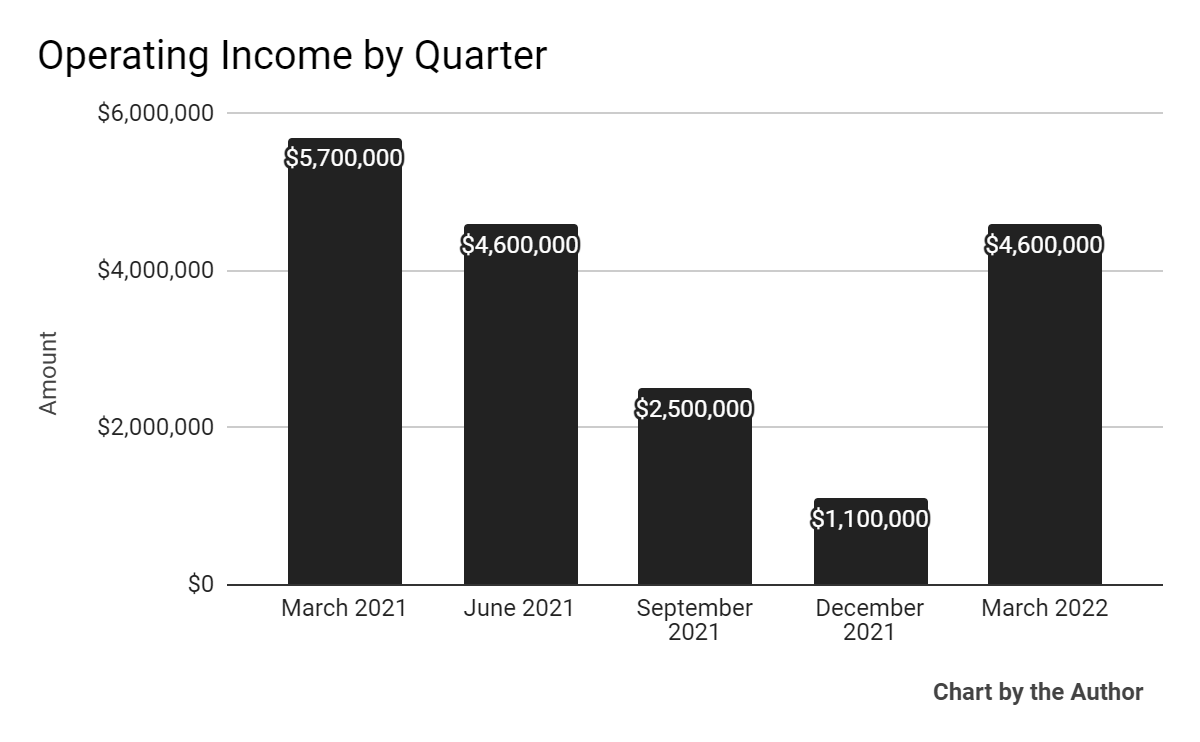

Operating income by quarter has remained positive in recent quarters:

5 Quarter Operating Income (Seeking Alpha)

-

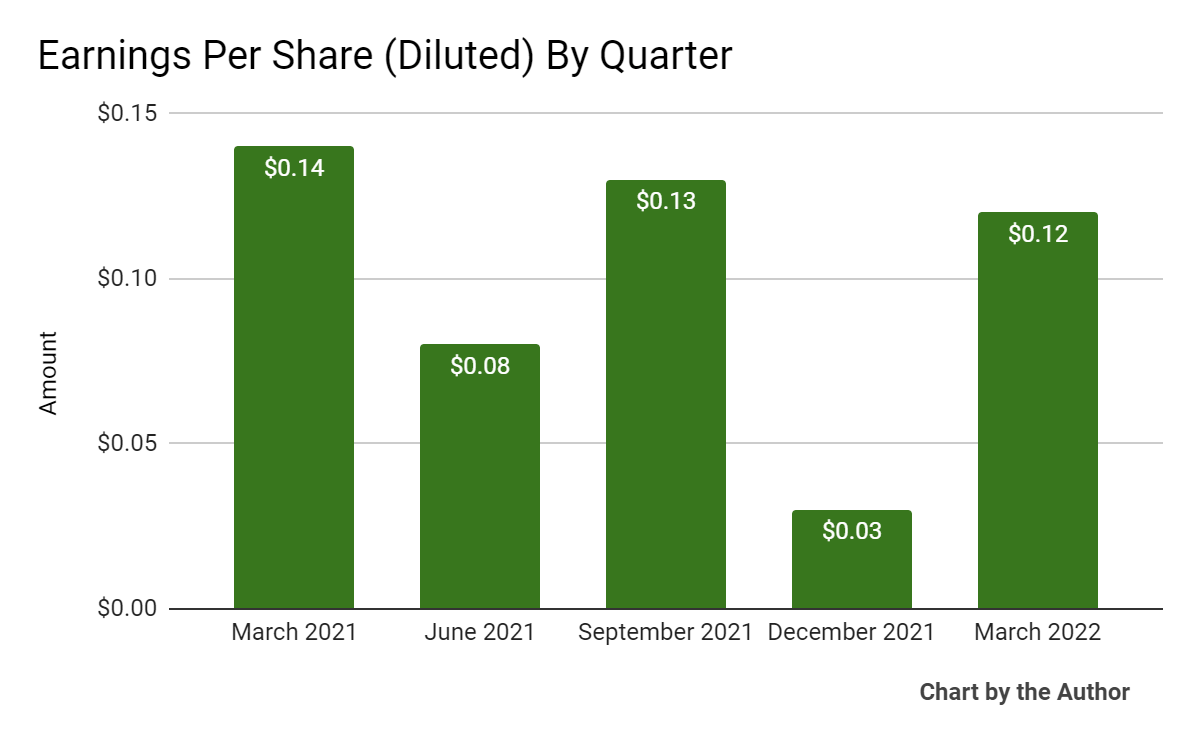

Earnings per share (Diluted) have performed as the chart shows below:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

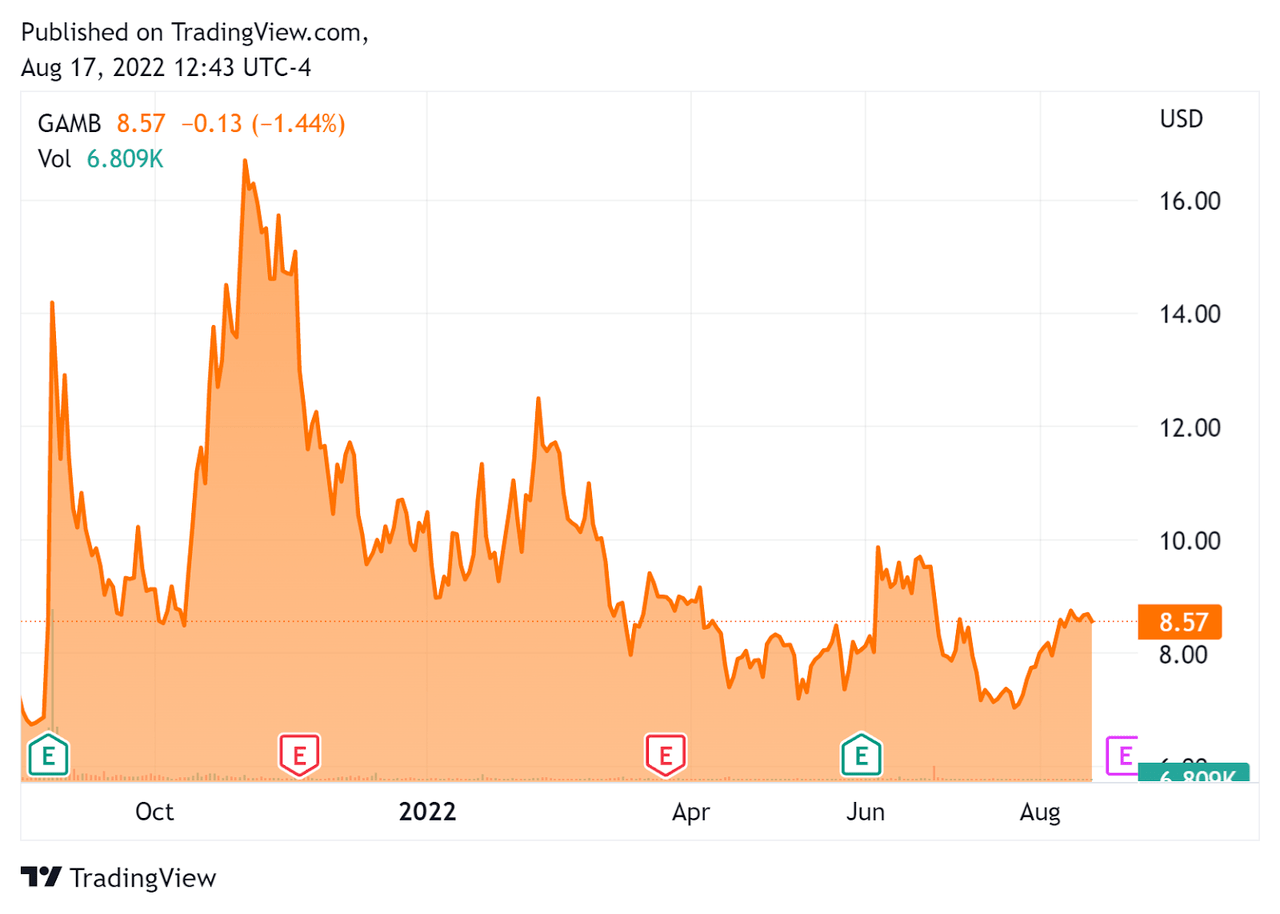

In the past 12 months, GAMB’s stock price has risen 15.7% vs. the U.S. S&P 500 index’ drop of around 3.9%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Gambling.com

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value |

$291,820,000 |

|

Market Capitalization |

$316,710,000 |

|

Enterprise Value / Sales |

5.79 |

|

Revenue Growth Rate |

42.4% |

|

Operating Cash Flow |

$10,840,000 |

|

Earnings Per Share (Fully Diluted) |

$0.36 |

|

Net Income Margin |

24.8% |

(Source – Seeking Alpha)

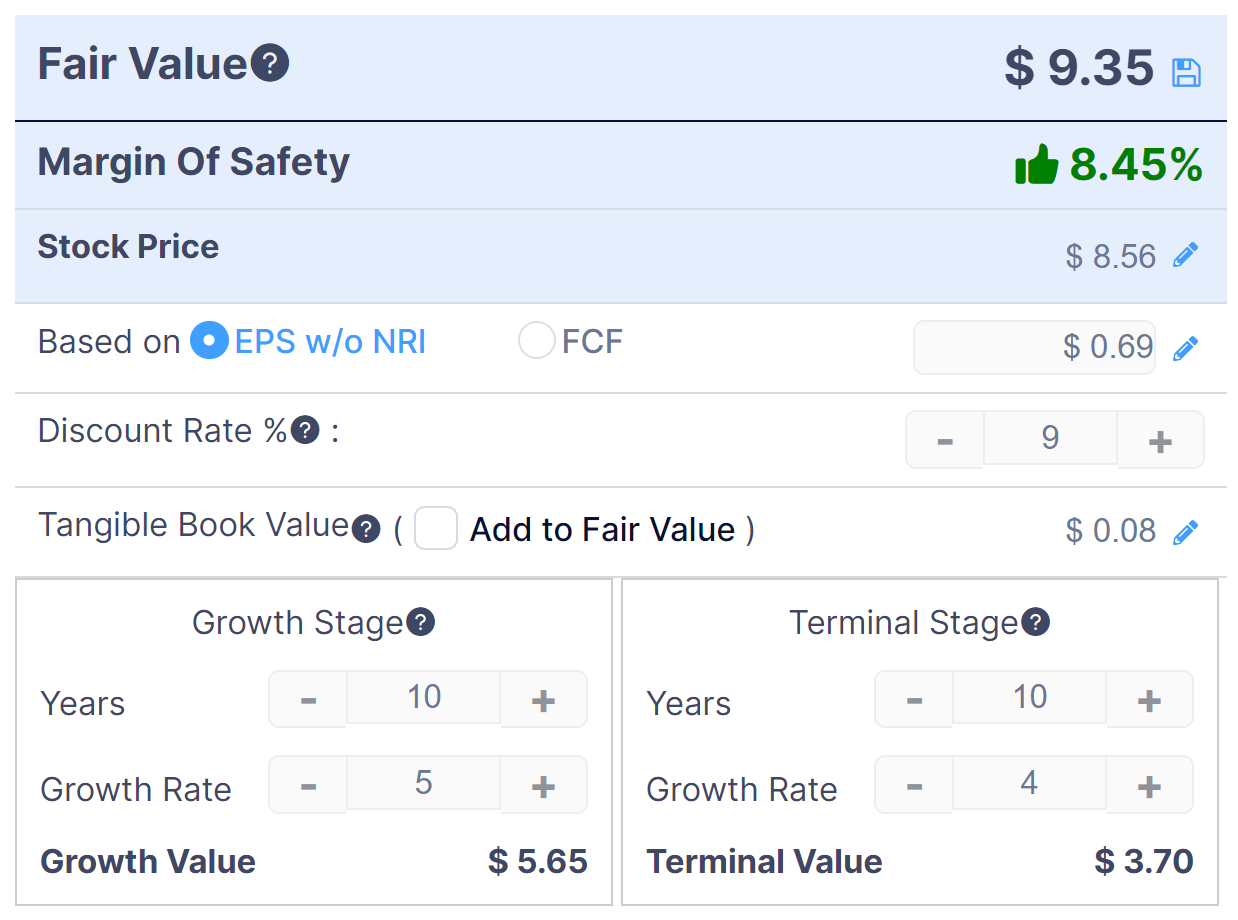

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

GAMB DCF (GuruFocus)

Assuming conservative DCF parameters, the firm’s shares would be valued at approximately $9.35 versus the current price of $8.56, indicating they are potentially currently undervalued, with the given earnings, growth and discount rate assumptions of the DCF.

Commentary On Gambling.com

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted record revenue growth, both organic and through recent acquisitions.

The firm delivered 67,000 new depositing customers to its clients, due to growth in its portfolio of domain names, partner sites and websites.

Revenue from N. America accounted for a majority of its revenue for the first time, as online sports betting launched in New York in January. The company also entered the Louisiana and Ontario Canada markets as it continues to add market coverage, especially in Ohio and Maryland.

As to its financial results, topline revenue grew by 70% year-over-year, or 84% on a constant currency basis and was ‘primarily organic complemented by growth’ from a recent acquisition.

Revenue grew from ‘new depositing customers primarily with North American Sports.’

While the company is seeing inflationary pressures, it is focused on expanding its market coverage to spread additional costs over a larger footprint.

For the balance sheet, the firm finished the quarter with $33 million, down due to recent acquisitions. However, the company produced $1.4 million free cash flow and expects to fund its organic growth plans while remaining free cash flow positive.

Looking ahead, the firm’s operations will be affected by ‘deeper natural seasonality patterns’ than the company has historically experienced, but management reiterated full year 2022 guidance for revenue growth of 74% at the midpoint and adjusted EBITDA growth of between 20% and 47%.

Regarding valuation, from a conservative DCF, the shares may be undervalued at their present level.

The primary risk to the company’s outlook is the uncertain launch dates of major markets such as Ohio and Maryland, which may be pushed back by one quarter into 2023.

A potential upside catalyst to the stock could include additional U.S. states legalizing online gambling or creating regulatory regimes for doing so.

GAMB appears to be positioned for further growth in N. America and has a clean balance sheet while generating free cash flow.

My outlook is a Buy for GAMB at around $8.40 per share.

Be the first to comment