Mlenny/iStock via Getty Images

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on June 12th, 2022.

I wanted to highlight a pretty straightforward potential opportunity for investors.

We will be highlighting why Gabelli Equity (NYSE:GAB) could be sold in favor of Liberty All-Star Equity (NYSE:USA). These are two funds I’ve written about previously on several occasions. They are both equity funds that invest in a fairly straightforward portfolio. Both favor mostly large-cap U.S.-based positions.

GAB Basics

- 1-Year Z-score: 2.43

- Premium: 28.6%

- Distribution Yield: 8.84%

- Expense Ratio: 1.37%

- Leverage: 24.34%

- Managed Assets: $2.101 billion

- Structure: Perpetual

GAB’s investment objective is “long-term growth of capital, with income as a secondary objective.” That’s the reverse of what we see in a lot of CEFs. Especially considering that the 10% managed distribution plan means that appreciation could be limited. The fund really isn’t constrained on what they can invest in. Though they can invest in high yield and other fixed-income investments, they most heavily invest in equity positions.

USA Basics

- 1-Year Z-score: 0.07

- Premium: 5.08%

- Distribution Yield: 10.88%

- Expense Ratio: 0.91%

- Leverage: N/A

- Managed Assets: $1.4 billion

- Structure: Perpetual

USA’s investment objective is to “seek total investment return, comprised of long-term capital appreciation and current income. It seeks its investment objective through investment primarily in a diversified portfolio of equity securities.”

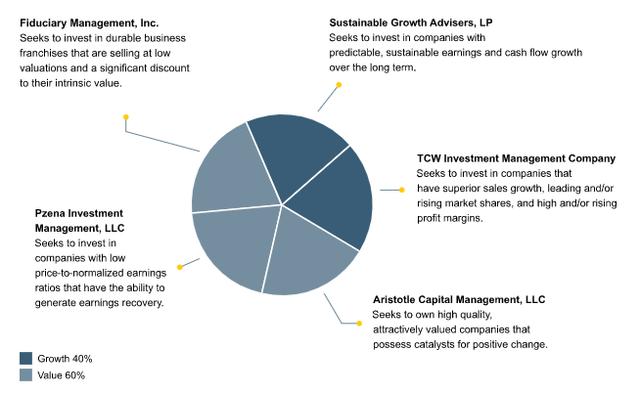

The fund takes a bit of a different approach than other closed-end funds. They don’t have just one advisor managing, but five different investment managers that take a sleeve of the fund to invest. They have three value-oriented managers and two growth managers.

USA Manager Structure (ALPS Advisors)

At the end of the day, though, ALPS Advisors, Inc maintains that they have the “ultimate authority to oversee the investment managers and recommend their hiring, termination and replacement.” So if the managers aren’t acting in a way that ALPS is happy with, they can be replaced.

GAB Vs. USA

Valuation

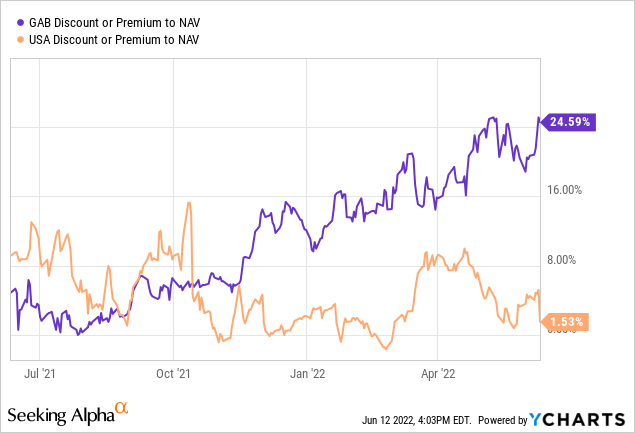

GAB is continuing to defy gravity. The fund is now pushing near a 25% premium. That’s why this potential opportunity exists. USA could be a much better opportunity at this time based on the valuation.

YCharts

NOTE: The actual premiums are 28.6% for GAB and 5.08% for USA. GAB’s closing NAV was $5.28 and a share price of $6.79. USA closed at $6.62 with a NAV of $6.30 for a 5.08% premium. The YCharts data appears to not have been updated properly, it still gives us a general idea of the difference between the two funds.

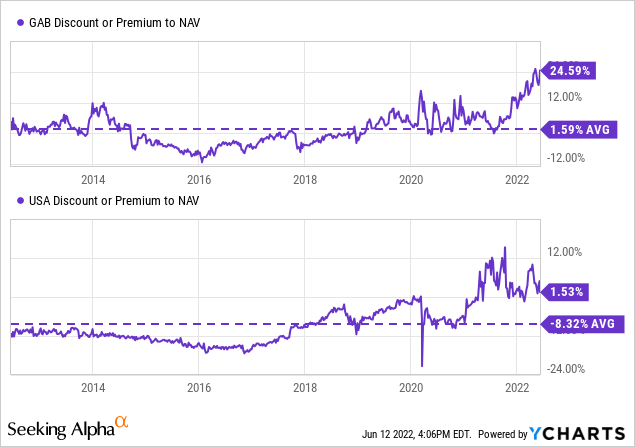

For some investors, any premium is too much. Admittedly, USA has been the fund that has tended to trade at a discount. GAB has historically been the fund that has traded at a premium. While both funds are quite elevated relative to their longer-term range, GAB seems to be the one at the most risk when things turn.

History has shown us time and again that when funds get elevated in premiums, they become at risk for significant losses. Not every time, but enough times to make it a trend worth paying attention to. We’ve highlighted this in funds previously, looking at Western Asset High Yield Defined Opportunity Fund (HYI) and Cohen & Steers Infrastructure Fund (UTF).

Here’s a look at the last decade of discounts/premiums for each of these funds.

YCharts

However, even relatively speaking, the premium for GAB is currently showing a heightened elevation.

Performance

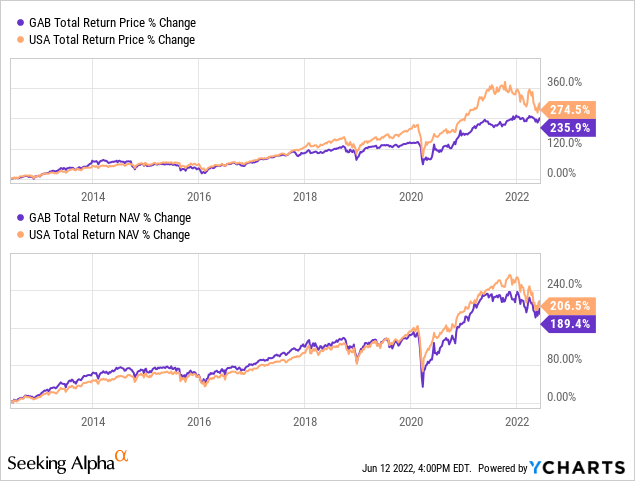

When looking at the performance between these two funds over the last decade, we also see USA has been the winner.

YCharts

This is both on a total return basis and a total NAV return basis, where USA comes out ahead of GAB.

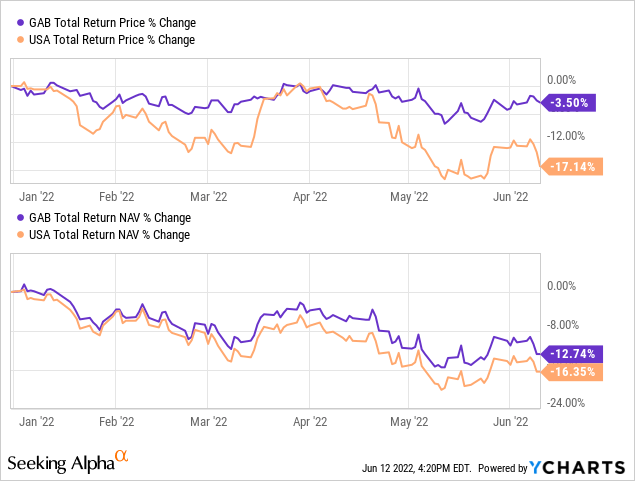

On a YTD basis, GAB has outperformed USA, even on a total NAV return basis. That’s the part that really counts because it is what the managers can really impact.

YCharts

That being said, going back to the valuation difference. If both funds went back to the typical premium/discount, we’d see GAB fall meaningfully further relative to USA. It would be an absolute change of 27% decline for GAB and an absolute 13.4% decline for USA to get back to its average discount. It would take the share price dropping to $5.36 for GAB and USA going to $6.07. In other words, declines of 21% and 8.3%, respectively.

That would require that the outperformance of GAB continues at a pace even stronger than we are seeing above to offset such a potential decline.

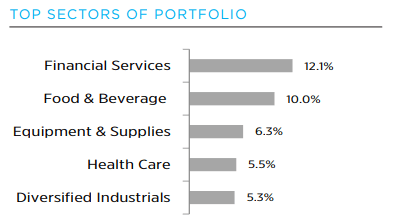

One of the reasons we see a difference in performance comes down to the holdings, of course. GAB holds a higher allocation to more value-oriented investments. Here’s a look at their sector breakdown.

GAB Sector Weighting (Gabelli)

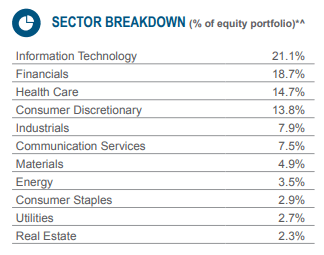

Now, looking at USA, we see that tech stocks take up the largest allocation. However, I would note that for a diversified fund, they aren’t as overweight tech as we typically see.

USA Sector Weighting (ALPS Advisors)

With this, it makes sense that USA has outperformed GAB historically, but GAB is outperforming YTD. This is all based on understanding sector performance more broadly in the 2022 market; the environment has been favoring value over growth.

However, one thing that should also be considered in this scenario is that GAB is leveraged and USA is not. Meaning that it pulled off outperforming just by being positioned better historically. I believe that also means that if you switched your GAB shares for USA, you’d be de-risking your portfolio.

Distribution

In terms of the distribution, that’s generally a strong considering factor for investors. They both implement a 10% managed distribution plan. However, the way it is employed is in two different ways.

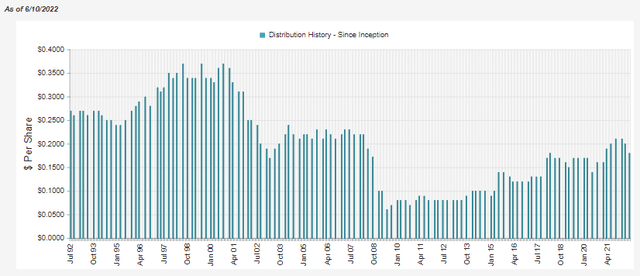

USA pays a variable distribution based on 2.5% per quarter. Every quarter this is calculated, so we see a different payout with each. As NAV heads higher, the distribution will head higher and vice versa.

USA Distribution History (CEFConnect)

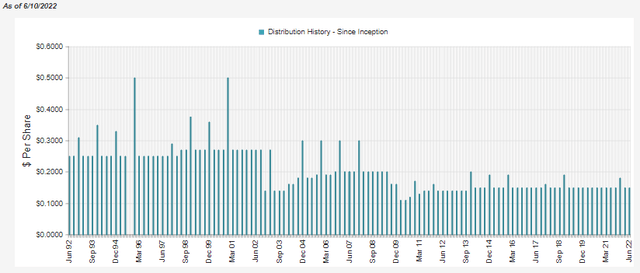

GAB, on the other hand, just simply runs the same distribution until they feel like adjusting it. At the end of the year, if they are short, investors will get a special to top it off.

Both funds have a similar trend in their distributions, which is lower over time. 10% is hard to achieve year after year, so this isn’t necessarily unexpected. Both funds made the most drastic changes in the early 2000s and then the 2008/09 GFC. Again, this makes sense for what we would expect to see.

GAB Distribution History (CEFConnect)

Based on the NAV distribution of 11.04% for USA at the moment, we know they will be cutting with the next distribution once again. Of course, that assumes we don’t get a quick rebound. They use the closing NAV on the Friday prior to each quarterly declaration date. Historically, the third quarter distribution was declared in mid-July. The prior Friday this year that they use should be July 8th, if history repeats itself.

GAB’s 11.01% could also mean it is again at risk for a cut. At the very least, investors shouldn’t anticipate an extra year-end special. If we are heading into a prolonged bear market, I believe that would put even more pressure on a chance for a cut. They maintained through 2020, despite the challenges that year brought. In my opinion, what helped was just how quick of a rebound we experienced in the COVID crash.

All this being said, a switch from USA to GAB would still net a higher distribution yield on your shares today. GAB’s distribution rate at this time is 8.84%. Based on the NAV right now, USA would declare a $0.16 distribution. That works out to a 9.67% distribution rate going forward.

Conclusion

Based on valuations, USA seems to be the clear choice at this time over GAB. This is assuming that an investor needs a 10% managed distribution plan. Other plain equity funds are showing fairly attractive values that could be better than both of these funds. The Gabelli Dividend & Income Trust (GDV) and Adams Diversified Equity Fund (ADX) come to mind.

Perhaps investors are worried that USA will continue to cut due to its distribution policy. That’s actually going to be the case. However, due to valuations, it still appears that USA is still the better option.

It would take several cuts or a significant drop-off in NAV from here to push USA to be the lower-yielding fund relative to GAB. The point is that the premium is elevated to the point that the distribution rate that investors can actually collect is limited. Investors aren’t actually getting the 10% distribution because of the premium.

At the same time, the added bonus is that USA isn’t leveraged and has performed better historically than GAB. This could be worth considering to de-risk one’s portfolio while we could be entering a recession.

The fact that USA will retain more of its assets for rebounding is another point worth considering. If GAB maintains the same distribution, they will pay out more of their NAV, meaning fewer assets to rebound with eventually.

My main point here isn’t to bash GAB because I like USA more. It’s simply to highlight the opportunity to swap one fund in favor of another that is more attractively priced. I’d be talking up GAB if it was the cheaper fund. Perhaps, in the future, there will be such an article if the roles reverse.

Be the first to comment