Adam Pretty/Getty Images Entertainment

G-III Apparel (NASDAQ:GIII) did not have a great time after earnings, losing a bulk of its value in one stroke. The key issue with them is that they have the license to manufacture and sell apparel under the Calvin Klein and Tommy Hilfiger brands. The margins are still pretty good on these products even after royalties, but the licenses are coming to a definite end in 2027 and this accounts for a heap of the company’s revenues, more than 50%. Still, owned brands are higher margin, and there’ll be mix improvements to the margin even if profits fall as TH and CK revenues disappear in a few years. The multiple more than accounts for that. The company appears cheap.

Q3 Earnings

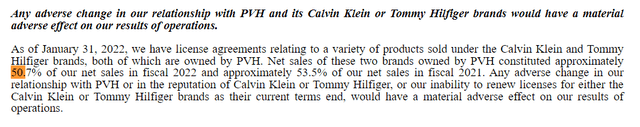

Let’s quickly discuss the happening around G-III. They are going to have to grow their own brands with some new pushes into Europe with DKNY and US focused brands because PVH Corp (PVH) has every plan to in-house Tommy Hilfiger and Calvin Klein after 2027. Until then, things are apparently going to go as normal, but it’s a huge event because these brands account for more than 50% of GIII’s revenue.

Revenue-at-risk (sec.gov)

The only saving grace comes from the margin front. Because of royalties, operating margin on these brands that they don’t own like TH and CK are a lot lower. About half of the company’s revenues are from owned brands, a.k.a everything that isn’t covered by CK and TH. This includes some really well known stuff like Karl Lagerfeld and Vilebrequin. Operating margins are quite a bit higher on these products, actually they’re about twice as high at around 15% compared to 5% for the CK and TH brands post-royalty. So only about 33% of the net income is actually at risk here.

Yes. With respect to the operating margin going forward, look, we’ve commented on this before. The brand that we own traditionally will run an operating margin that we would expect to be in the 15% to 20% zone. Our blend is down in the high – in the low double digits, around 10%. And of course, that’s after we pay a royalty.

Neal Nackman, GIII CFO

This is all that really matters from the Q3 earnings. Otherwise gross profit and revenues were flat YoY on a 3-month basis. The staggered license agreements, which technically get renewed in 2024 until 2027, should be at basically the same terms as before. GIII is on the clock if it wants to sustain profits.

Bottom Line

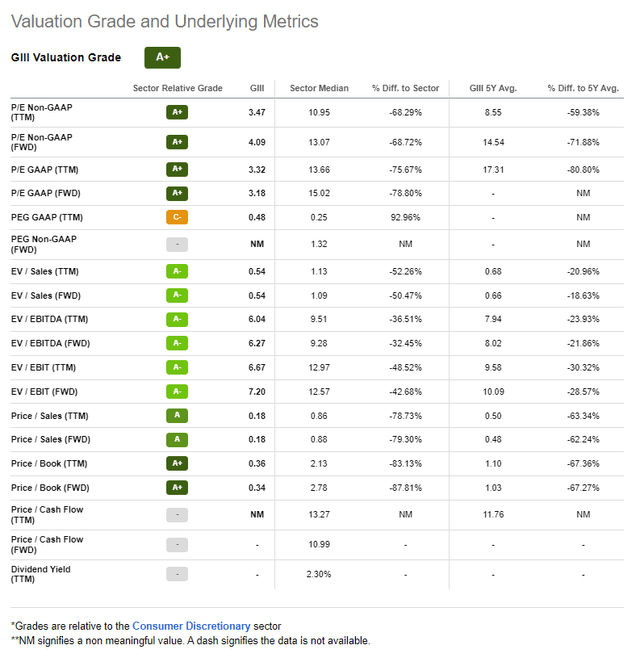

The thing is it really doesn’t have to. The company trades at a 3x PE on a run-rate basis. This should basically stay the same until 2027. Yes, there’s some belt-tightening among consumers, especially in European markets that only account for 15% of the revenues, but overall the stock is very cheap. Take a look at the Seeking Alpha Factor Ratings.

Valuation (SA Factor Ratings)

Sector medians go way higher than GIII’s even adjusted PE multiple. 33% of net income is at risk, which comes from the 50% at risk revenue for CK and TH licenses, if that falls out then the multiple only rises to less than 5x, around 4.5x actually. That’s still below a 7x multiple that you might see among more discount apparel players, and certainly a lot lower than the 10x sector median that would include higher end elements as well, of which GIII has plenty. It’s a buy.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment