Phoenixns/iStock via Getty Images

When you have a company go from generating robust bottom line results to somewhat weaker bottom line results, it can have a deflating effect on how shares are priced. Ideally, when dealing with companies that are already trading on the cheap, you would expect this phenomenon to be less pronounced. But during these volatile times, that has not necessarily always been the case. A great example of this can be seen by looking at G-III Apparel Group (NASDAQ:GIII), a firm that specializes in the design and production of different types of apparel like outerwear, dresses, sportswear, and so much more. An undo amount of investor pessimism has led to shares of the company’s pulling back in recent months. But given how cheap the stock is, I believe that this was a mistake. So long as the company does not see a significant deterioration moving forward, I do think that it offers investors attractive upside from here, leading me to keep the ‘buy’ rating I had on it previously.

Shares can only get so cheap

Back in early April of this year, I wrote an article discussing whether it made sense or not to acquire shares of G-III Apparel Group. In that article, I found myself impressed by management’s ability to grow the company’s top and bottom lines over time. Yes, the company had been impacted negatively by the COVID-19 pandemic. But its recovery from that dark time was in progress and looking promising. And given how cheap shares were, I could not help at that time to rate the company a ‘buy’ to reflect my view that it should outperform the broader market for the foreseeable future. Today, that call has not played out so well. While the S&P 500 is down 11.4%, shares of G-III Apparel Group are down nearly double that at 21.4%.

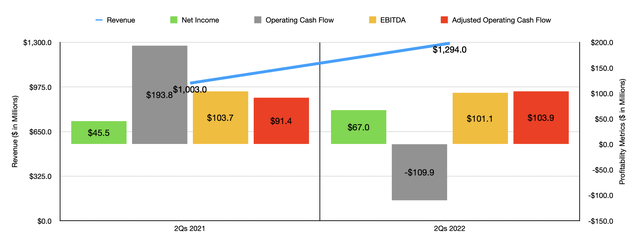

Author – SEC EDGAR Data

To be clear, some pain for the company might have been warranted. To understand why, we should cover the most recent data available from the company. This would be the data covering the first two quarters of the 2023 fiscal year. During that time, revenue came in at $1.29 billion. That’s 29% higher than the $1 billion the company reported only one year earlier. The largest portion of this sales increase came from the company’s wholesale operations, with revenue surging from $978.5 million to $1.27 billion. According to management, this was driven by a variety of factors. For instance, net sales associated with its Calvin Klein licensed products grew by $90.1 million year over year while net sales associated with its DKNY and Donna Karan products jumped by $60.2 million. Under the Tommy Hilfiger brand name, sales grew by $18.4 million year over year. Meanwhile, retail revenue for the company increased somewhat from $46.7 million to $59 million. This was driven largely by an increase in the company’s store count, with the number of units in operation growing from 50 to 59 year over year.

At first glance, it may seem surprising that this would not result in shares moving higher. This is especially true when you consider that net income for the company rose from $45.5 million in the first half of 2022 to $67 million the same time this year. The reason for the decline, then, had to do with cash flow figures. Operating cash flow, for instance, fell from $193.8 million in the first half of last year to negative $109.9 million the same time this year. If we adjust for changes in working capital, it would have increased only modestly from $91.4 million to $103.9 million. Meanwhile, EBITDA for the company fell slightly, declining from $103.7 million to $101.1 million. Some of the disparity between profits and cash flows had to do with ‘other income’ rising by $23.8 million this year compared to last year, with this being attributable almost entirely to a gain on investments the company has.

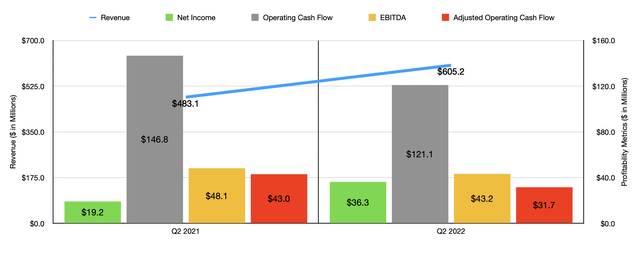

Author – SEC EDGAR Data

Mixed financial performance was similar if you zero in on just the second quarter of the 2023 fiscal year on its own. While revenue grew from $483.1 million to $605.2 million and net income jumped from $19.2 million to $36.3 million, other measures of profitability were mixed. Operating cash flow dropped from $146.8 million to $121.1 million, while the adjusted figure for this increased from $43 million to $31.7 million. Another area of decline was EBITDA, with the metric falling from $48.1 million to $43.2 million. It should be noted that this guidance came about even after management acquired, on June 2nd of this year, the remaining 81% interest that it previously did not own in Karl Lagerfeld in exchange for $214 million from the cash it had on hand.

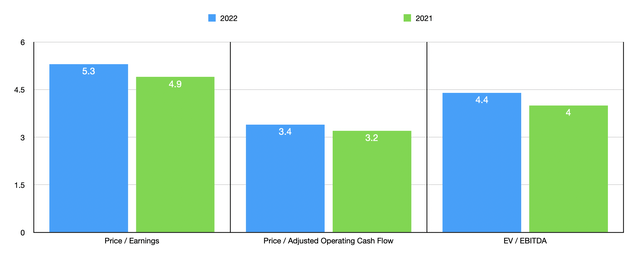

Author – SEC EDGAR Data

When it comes to the 2023 fiscal year in its entirety, management has become a bit bearish. Previously, they anticipated EBITDA for the year of between $360 million and $370 million. That would compare favorably against the three $50.2 million reported last year. Now, however, the company has revised this guidance down to between $318 million and $323 million. If we assume that other profitability metrics will follow a similar trajectory, then we should anticipate net income of $183.6 million and adjusted operating cash flow of $284 million. Given these figures, the company is trading at a forward price to earnings multiple of 5.3, at a forward price to adjusted operating cash flow multiple of 3.4, and at a forward EV to EBITDA multiple of 4.4. For context, using the data from 2022, these multiples would be 4.9, 3.2, and 4, respectively. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 3.7 to a high of 13.6. Only one of the five firms was cheaper than G-III Apparel Group. Using the price to operating cash flow approach, the range was from 9.1 to 22, with our prospect being the cheapest of the group. And when it comes to the EV to EBITDA approach, the range was from 3.9 to 7.4. In this scenario, two of the five companies were cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| G-III Apparel Group | 5.3 | 3.4 | 4.4 |

| Movado Group (MOV) | 7.7 | 9.8 | 3.9 |

| Ralph Lauren (RL) | 13.6 | 14.7 | 6.4 |

| Delta Apparel (DLA) | 3.7 | 19.6 | 4.1 |

| Capri Holdings (CPRI) | 9.3 | 22.0 | 6.8 |

| Tapestry (TPR) | 11.1 | 9.1 | 7.4 |

Takeaway

Based on the data at our disposal, it seems to me as though financial results for G-III Apparel Group may be mixed on the bottom line. However, it’s nice to see sales grow and the stock is trading at an incredibly cheap level on an absolute basis while trading near the low end of the scale compared to similar firms. Even with the bottom line for the company coming in mixed and the expectation that results for the 2023 fiscal year might be worse than previously forecasted, I do think that shares are cheap enough to warrant some nice upside from here. As a result, I’ve decided to keep the ‘buy’ rating I had on the stock previously.

Be the first to comment