Marcos Silva

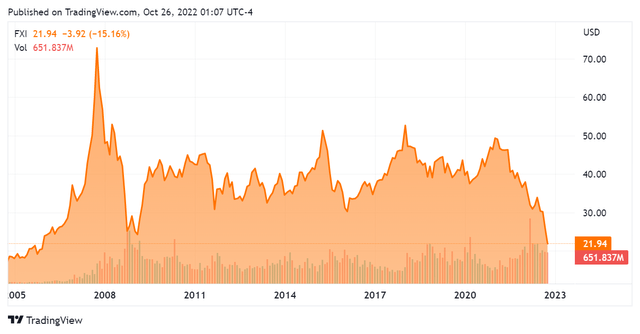

In the last few days, Chinese stocks, for which iShares China Large-Cap ETF (NYSEARCA:FXI) is a proxy, have crashed.

This happened after a long slide in Chinese stocks, with the market finally panicking upon Xi Jinping’s 3rd term as the Chinese Communist Party leader.

The actual performance is astonishingly dismal. For instance, this is an FXI chart going back to its inception:

As we can see, FXI has lost all gains since 2005. Things are even more dramatic for Hong Kong’s main index, the Hang Seng. There, the index has regressed all the way to levels last seen in 1997, 25 years ago.

This 3rd term was widely expected, but that didn’t stop the panic. There were many reasons put forth to explain the panic, including:

- There now being no reformers in the Politburo Standing Committee (7 members).

- A vague notion that China would now turn against private ownership and private enterprise in general, and more towards ideology.

- A vague notion that China would close on itself.

- The idea that Xi having a third term as the CCP leader is unprecedented since Mao and makes him a potential dictator.

- And so forth.

I obviously think that the risk of Xi Jinping trying to eternalize himself in leadership is real, since things could turn out that way in the future. However, in general, it seems to me that media has been misrepresenting what happened and what has actually been said by Xi as guiding principles for the next 5 years. I will explain why.

First, There Were No Term Limits For Being CCP Leader

The first issue I want to address, is that there were no actual term limits for being CCP Leader. This is often confused with other official positions in China, outside of the CCP.

Term limits have existed for many other positions, both official and somewhat ceremonial – like Chinese President, a post which Xi Jinping also occupies and where term limits were, indeed, abolished by him in 2018. But for the CCP leadership and the leadership of the military commission (the positions of power which really matter) there were no such term limits to begin with. So, taking a third term didn’t go against an existing rule, or require changing such rule.

Second, A Third Term After Mao Isn’t Unprecedented

This isn’t unprecedented, since Jiang Zemin was the CPP leader for 13 years and 144 days, which consisted of thus being elected through 3 different 5-year Central Committee of the Chinese Communist Party sessions (like Xi now). He didn’t serve the 3rd term completely, though, retiring from that position at the age of 76, and from the military commission leadership even later.

Thus, we already see that although Xi can certainly exceed Jiang Zemin’s tenure, he hasn’t so far and there’s nothing unprecedented (since Mao) so far.

Jiang Zemin’s career also shows that there isn’t an age limit for the party leader, at least not one which would require an unprecedented exception for Xi. Indeed, if Xi were to be the CCP leader until a similar age as Jiang’s, he’d still be in that position for a further 7 years, and another Central Committee of the Chinese Communist Party session.

Third, The Idea Of A Move Against The Private Sector Is Alarmist

It’s alarmist, because Xi’s own speech regarding what’s to be done by China in the next 5 years clearly spells out that the private sector’s role remains the same. This doesn’t seem to get any play on media, so here’s the relevant passage (bold is mine):

1. Building a high-standard socialist market economy

We must uphold and improve China’s basic socialist economic system. We must unswervingly consolidate and develop the public sector and unswervingly encourage, support, and guide the development of the non-public sector. We will work to see that the market plays the decisive role in resource allocation and that the government better plays its role.

…

We will provide an enabling environment for private enterprises, protect their property rights and the rights and interests of entrepreneurs in accordance with the law, and facilitate the growth of the private sector. We will improve the modern corporate system with distinctive Chinese features, encourage entrepreneurship, and move faster to help Chinese companies become world-class outfits. We will support the development of micro, small, and medium enterprises.

We will intensify reforms to streamline government administration, delegate power, improve regulation, and upgrade services. We will build a unified national market, advance reforms for the market-based allocation of production factors, and put in place a high-standard market system. We will refine the systems underpinning the market economy, such as those for property rights protection, market access, fair competition, and social credit, in order to improve the business environment.

We will improve the system of macroeconomic governance, give full play to the strategic guidance of national development plans, and enhance coordination between fiscal and monetary policies. We will work to expand domestic demand and better leverage the fundamental role of consumption in stimulating economic growth and the key role of investment in improving the supply structure. We will improve the modern budget system, optimize the tax structure, and improve the system of transfer payments.

…

We will improve the functions of the capital market and increase the proportion of direct financing. We will take stronger action against monopolies and unfair competition, break local protectionism and administrative monopolies, and conduct law-based regulation and guidance to promote the healthy development of capital.”

Of note, this passage even includes reinforcing the role of the capital market. That’s the stock market he’s talking about there…

Fourth, The Idea Of China Closing To Foreigners And Foreign Investment Is Alarmist

Again, it’s part of the intentions for the next 5 years to do the opposite. Here’s the relevant passage:

5. Promoting high-standard opening up

We will leverage the strengths of China’s enormous market, attract global resources and production factors with our strong domestic economy, and amplify the interplay between domestic and international markets and resources. This will position us to improve the level and quality of trade and investment cooperation.

…

We will make appropriate reductions to the negative list for foreign investment, protect the rights and interests of foreign investors in accordance with the law, and foster a world-class business environment that is market-oriented, law-based, and internationalized. We will promote the high-quality development of the Belt and Road Initiative.

…

We will promote the internationalization of the RMB in an orderly way, deeply involve ourselves in the global industrial division of labor and cooperation, and endeavor to preserve the diversity and stability of the international economic landscape and economic and trade relations.

Of note, these aren’t empty promises. When it comes to the “negative list”, this is a list of what activities foreigners can invest in, and to what extent. Already under Xi’s rule, these rules have (recently) been loosened up, for instance by allowing foreign car companies to own 100% of their Chinese subsidiaries. Or allowing foreign companies to enter China’s financial services industry.

Overall, China has shortened the negative list, limiting foreign investments, for 5 years in a row. And it states as official policy to keep on doing it. It’s even strange to have doubts about the direction of this opening process.

The Taiwan Issue

Again, the media has beaten the drum as if China is about to invade Taiwan. And references to what was spoken by Xi at the CCP gathering often reinforce the fact that China won’t exclude the use of force in resolving the Taiwan issue and nothing else.

Here, too, it’s best to refer to what was actually said by Xi on the matter, since it refers actual Chinese policy looking forward (bold is mine):

The policies of peaceful reunification and One Country, Two Systems are the best way to realize reunification across the Taiwan Strait; this best serves the interests of Chinese people on both sides of the Strait and the entire Chinese nation. We will adhere to the one-China principle and the 1992 Consensus. On this basis, we will conduct extensive and in-depth consultations on cross-Strait relations. and national reunification with people from all political parties, sectors, and social strata in Taiwan, and we will work with them to promote peaceful development of cross-Strait relations and advance the process of China’s peaceful reunification.

It’s clearly stated that China prefers to solve the reunification peacefully. It’s even said how China hopes to solve the reunification: by applying the same principle as with Hong Kong and Macau, where the incoming territory keeps its economic, administrative and legal systems, and enjoys a very large degree of autonomy (though not full autonomy, in the sense that it still must adhere to China’s authority).

The possibility of the use of force is kept only in the case Taiwan seeks full independence from China, which is seen as secession, and where other countries would apply (and have applied) the same logic.

There is nothing new here.

Conclusion

Both the coverage of what’s happening in China, and the market’s reaction to what is supposedly happening in China, are at odds with what’s been happening in China. The coverage and market reaction are at odds with the stated intentions for China over the next 5 years, when it comes to the stock market, to the private sector, and to China further opening up.

It’s not to say that Xi might not be in a grab for power which will warrant, at some point, concern. But so far, what he’s done is not unprecedented in length of time or age. And the measures defended by Xi aren’t aggressive towards the private sector, and are also not set to move China backwards in terms of opening.

In my view, what’s happened with Chinese stocks, is that a bad situation, with China showing an economic slowdown and also the self-inflicted COVID-zero potentially misguided policy (by Xi…), morphed into a market panic.

In my view, this panic may resolve itself by Chinese stocks returning to a positive performance, thus also driving FXI higher. Indeed, if anything and given the starting point (in valuation terms), I expect China to outperform most markets looking forward 5 years (as well as 1, 2, or 3).

I say this for several reasons, non-exhaustively:

- FXI holdings’ valuations, and Hang Seng’s in general, have fallen to absurdly low levels. For instance, FXI’s average Price/Earnings for its holdings is down to 8.3x, or less than half what the US market goes for. FXI’s average Price/Book Value is down to 1.11x, versus the US market at 3.8x.

- China will keep on growing at a faster pace, since it starts from a much smaller base (GDP per capita is now $12,600 vs the US at $69,300) and has the same intellectual potential as richer nations, for instance gauged by number of patents issued, as well as a much larger population. Also, China’s economic system doesn’t block this growth, since it allows reasonably free markets and private property.

- China has its own technological base in terms of indigenous companies. This is also seen in FXI’s holdings, with Alibaba (BABA), Tencent (OTCPK:TCEHY), Baidu (BIDU) among others being large holdings. The lack of these giants would otherwise create a barrier to growth, which is seen, for instance, in Europe, where the market is typically dominated by US tech giants. China does have a limitation in terms of semiconductor industry — which it will have to address domestically, because of the recent US sanctions on this sector.

- Shanghai-listed stocks trade at a very large premium to the Hong Kong-listed stocks which FXI typically holds. That is, when the same stocks are listed in Hong Kong and Shanghai, on average the Shanghai listing trades 50% higher. This anomaly won’t last forever, and its resolution would favor FXI.

Given these facts and expectations, and since FXI is a reasonably good proxy for Hong Kong stocks, I think it’s fair to expect that FXI will post very strong performance looking forward. That is, unless reality somehow conforms to the current (in my view wildly excessive) fears. I think I made it clear that at least from official guidance by Xi Jinping, it is not China’s intention to live up to these fears.

Be the first to comment