oatawa

Investment Thesis

Futu Holdings (NASDAQ:FUTU) is a digital brokerage and wealth management platform based in Hong Kong and China. Futu and its subsidiaries provide investment services to individual investors through its one-stop digital platform. Its platform is known for its social features, which offer users a network that connects them with users, investors, companies, analysts, media, and key opinion leaders. Its primary fee-generating services include trade execution for stocks, ETFs, warrants, options, and futures, as well as margin financing and securities lending.

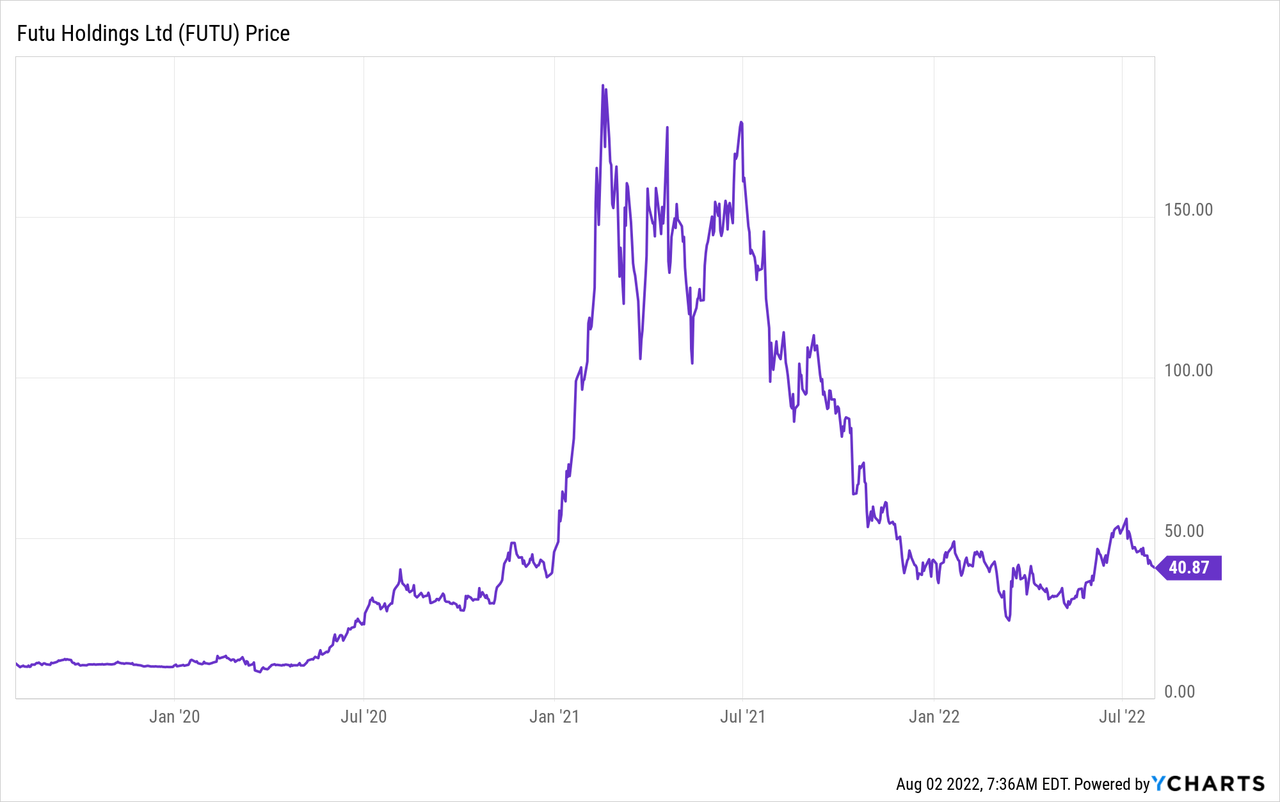

The company has been performing poorly since early 2021. It is currently down almost 80% from its all-time high, trading at $41.6 per share. The massive drop in share price is due to the broad decline of growth stocks, worry of the SEC delisting Chinese companies, and the Chinese government possibly imposing stricter rules on financial companies. Despite being down a ton, I believe Futu is still not investable. Besides political concerns, the current volatility in the market is posting strong headwinds on the company, and it is facing intense competition while the industry is getting increasingly saturated. Recent financial results are also very disappointing with revenue decreasing. Therefore I believe Futu is a sell at the current price.

Political Risks

Regulatory risks are always a big concern when investing in Chinese companies. Last November, the Chinese government imposed a new personal data privacy law, aiming to regulate the export of personal data and safeguard its national security. The new law is likely to impact Chinese online brokerages like Futu and Up Fintech, as they help locals invest in overseas stock markets such as the US, which could violate the law.

Futu is also facing de-listing risks from the SEC. In April, Futu was one of the latest five stocks that were added to the list of companies that may get kicked out of the US stock exchange. In late May, Chinese mobility company DiDi notified the NYSE that they are delisting from the US, and are planning to list elsewhere instead. The ongoing political issues are likely to keep posting unprecedented risks to the company, which creates huge uncertainty in the near term.

Dire Financial Market

The turbulence in the financial market over the last few months is significantly impacting Futu. The company heavily relies on trading volume, margin financing, and securities landing to make money, yet the recent volatility vastly reduced investors’ appetite for trading and investing. The massive sell-off in growth stocks, crypto, SPACs, and meme stocks also wiped out a lot of young investors, which is Futu’s core demographic. The overall market sentiment is very negative as we entered the bear market. A lot of investors are now inclined to stay on the sideline and wait till the dust settles before investing again.

Leaf Li, CEO, on the market’s impact

“Total client assets declined 16.5% year-over-year and 5.3% quarter-over-quarter to HK$386.0 billion due to sharp mark-to-market losses of our clients’ holdings. Meanwhile, market correction weighed on margin financing balance, though partially offset by increased securities lending activities.”

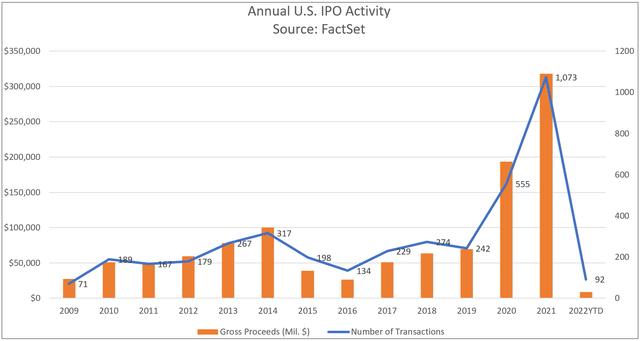

The gloomy sentiment is shown in the IPO market, which has been extremely quiet. According to FactSet data, 1,073 companies IPO’d in 2021, raising $317 billion, while in the first half of 2022, the total was 92 companies, raising just under $9 billion. This is the lowest since 2009, as shown in the chart below. The same thing is happening to SPACs. Total SPACs that went public in Q1 were down 57% year over year, the lowest in the last eight quarters. I believe the volatility is going to last for a while as inflation continues to persist at high levels while the economy weakens. This will continue to post headwinds on Futu as trading volume is likely to remain suppressed in the near term.

Strong Competition

As Futu shifts its focus away from China due to regulatory concerns, I believe the total addressable market for the company going forward is minimal. Its strong client number growth in Hong Kong (its primary market) is likely unsustainable as the country only has a population of 7 million people, which kneecapped its growth. It is worth noting that the increasing client number is likely just smoke and mirrors. A lot of the new users probably aren’t actually interested in investing and aren’t likely to contribute any revenue to the company. Most of these users are likely acquired through promotions and are only on the platform because the company is giving away free stocks. Therefore, in the latest earnings, we saw the number of new clients go up while quarterly revenue went down.

The company is trying to expand into countries like Australia and Singapore in order to expand its user base and revenue stream. However, the investment brokerage market in these countries is already very saturated with tons of competitors in the space. For example in Australia, it is facing competition from traditional banks like Commonwealth Bank, neobanks like Revolut, and brokers like CMC Market and Interactive Brokers (IBKR). In Singapore, it is facing competition from Tiger Brokers (TIGR), DBS (OTCPK:DBSDF), TD Ameritrade (SCHW), etc. I also believe Futu has no competitive advantage in this market. The company takes pride in its UI and UX but other companies are catching up quickly, now offering the same, if not better experiences for users. Traditional banks and neobanks also have a slight edge as it allows users to manage all their finances easily in one place, and transfers can be instantly done.

Weak Financials

Futu Holdings reported its Q1 financial earnings in June and the results are very underwhelming. The total number of paying clients was 1.3 million, up 67.9% YoY (year over year), total registered users were 2.9 million, up 48.7%, while total users were 18.1 million, up 27.1%. It is worth noting that the company’s definition of paying clients refers to users with assets in their trading account, rather than users that transact. As mentioned above, the growth in client base is likely due to promotional efforts, which include cash coupons or free stocks for newly deposited accounts. Therefore despite the jump in clients, trading volume and revenue were still down.

Total revenue for the quarter was $209.5 million, down 25.6% YoY from $282.6 million. Brokerage commission and handling charge income were $123.5 million compared to $169.2 million, a 27% decrease YoY. Interest income was $73.4 million, down 12.7% YoY from $84.4 million. This is attributed to decreasing AUM and trading volume. Total client assets were down 16.5% YoY to $49.5 million, trading volume decreased 41% YoY to $166.7 billion, while margin financing and securities lending balance declined 6.8% to $3.3 billion.

The company’s profitability also significantly contracted. Net income plummeted 50% from $149 million to $73 million. The net income margin was 34.8% compared to 52.7% a year ago. Diluted net income per share was $0.49, down 52.5% from 1.03. Despite the disappointing results, share-based compensation actually went up a whopping 299% from $2.2 million to $6.5 million this quarter. The balance sheet remains healthy with $769.3 million in cash and $642.4 million in debt.

Conclusion

In conclusion, I believe it is best to avoid Futu at the moment. The different political issues are creating a lot of unpredictable risks for the company that could hurt its fundamentals. The recent sentiment in the financial market has been really negative and trading volume is down significantly, which is substantially impacting the company’s top line. Its expansion into other countries is also really tough as the market is already very saturated with a lot of competitors in the space. The company’s financials are very disappointing with revenue and net income falling off a cliff, despite the number of users going up. I believe the numbers will continue to be weak as the company is facing multiple headwinds at once. Therefore I rate Futu Holdings as a sell.

Be the first to comment