alphaspirit/iStock via Getty Images

fuboTV’s (NYSE:FUBO) stock is a touchy subject right now. When it fell to $15, I added. Then it jumped and crossed $30, then $35. At last, all looked to be in the clear. But then, even as the company performed above all expectations each quarter, the stock has taken a one-way trip to $6 without any relief rally or looking back. The company is headed for bankruptcy. Or, at least, that’s what the price action tells you. But if we roll back the curtain and look at the company’s performance and, more specifically, its cash burn and margins, it reveals a relatively upbeat picture.

The company is not at risk of running out of cash to operate the business, and its latest move – likely by the newly hired CBO – bolsters the margin improvement journey.

The Numbers Are The Numbers

The first metric to look at is the company’s net loss. This indicates the progress toward breaking even where the company doesn’t have to use cash on its balance sheet or raise capital via its at-the-market shelf offering or debt issuance to operate. Now, the trend in dollar terms appears to be trending a bit higher, but the net loss margin is getting closer to zero.

fuboTV’s Net Loss and Net Margin (Chart mine, data from fuboTV’s Shareholder Letters)

The problem is higher dollar amounts are what count. However, the company is not burning $112M (Q4’s net loss) off the balance sheet each quarter. This is because its operating cash flow is not nearly as bad as its net loss.

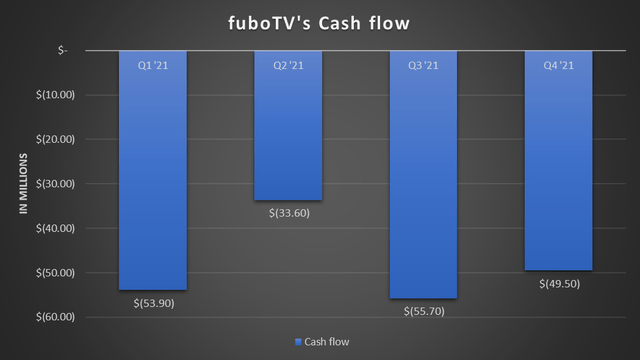

fuboTV’s Cash Flow Chart (Chart mine, data from fuboTV’s Quarterly Filings)

Because the company is utilizing its ATM offering, it has raised ~$70M in both the recent third and fourth quarters. This puts the cash burn into perspective, especially as the company’s cash balance is not depleting at alarming rates. Now, this doesn’t mean the company isn’t diluting itself to raise cash as its shares outstanding continue to increase, going from 138.9M shares in Q4 of 2020 to 153.9M in Q4 of 2021. However, the balance sheet has remained somewhat stable because of it, while the dilution isn’t atrocious.

| Q1 ’21 | Q2 ’21 | Q3 ’21 | Q4 ’21 | |

| Cash | $ 465.00 | $ 412.10 | $ 398.50 | $ 379.40 |

| % Change | – | -11.4% | -3.3% | -4.8% |

Therefore, the concern of running out of cash is not a near-term or medium-term threat. The long term depends on the company’s ability to turn profitable. As it continues to invest in the business, this may walk up to the line of breakeven. Still, it can afford to continue losing money to invest in products for future revenue and lessening acquisition costs. It can easily survive the next few years at the current burn rate. Granted, this includes further ATM cash raises. But, even if the company halves its ATM share issuance, it can still operate for seven-to-eight quarters.

Firming The Thesis

Recently, there has been a reinforcement of the cash burn argument for bulls, a topic I alluded to at the beginning of this article. On Monday, the company announced it would be dropping its Starter Plan and pushing all current Starter Plan subscribers to the Pro plan for $5 more per month. This is an immediate move toward higher ARPU (average revenue per user), something the market has pointed to as a weak spot for the company.

While the move may be small, it pushes margins in the correct direction as long as churn (subscribers dropping instead of taking the $5 hit per month) remains steady. This will build on the 16% growth in ARPU the company saw in 2021. It also will push contribution margins higher and free cash flow toward neutral over 2022. If the company allows its acquisitions to digest and slows its M&A, it can further reinforce the bullish argument it’s not going to burn through its cash in less than eight quarters.

The Disconnected Stock Price

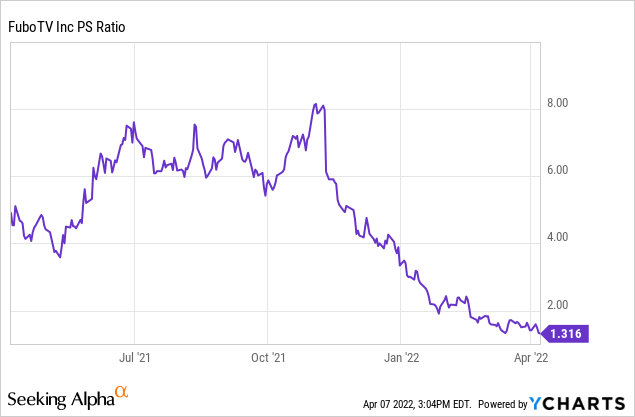

Over the last six months, this story has not been reflected in the ever-falling stock price. The valuation also doesn’t reflect the excellent execution and continued upward guidance the company has shown over the last two years. If this were a GoPro (GPRO) type situation where the company had dropped the ball and needed to attain investors’ trust again, I could understand it. But, a company whose valuation is nearing a one times price-to-sales level when it has outperformed expectations and has more potential ahead of it isn’t warranted.

The situation is a “show me” tale of Wall Street, but I contend it already is showing The Street it can execute and push toward its goals. The next most significant piece is for the wagering division to pan out. The company should have a plan with evidence to provide investors in the next month or so on this front. Right now, the market is pricing in a failure of this division with a loss on invested capital. However, I don’t expect this to be the case.

While the market sells off the great execution and furthering margin improvements, I continue to accumulate shares. I’m in the this-will-pan-out camp over the next year or so. It’s not a turnaround story of the business – it’s a turnaround of the perception of the business. The company has enough cash to see its plan through and will bleed less and less cash as ARPU grows and subscribers continue to be added. I’m a buyer at these levels.

Be the first to comment