MicroStockHub

I recently reviewed fuboTV Inc. (NYSE:FUBO) and considered it a sell primarily due to the business hardly achieving any meaningful operating leverage. FUBO’s cost structure is quite unhealthy, with margins consistently deteriorating despite the business growing both its user base and total revenue. Despite the management’s upbeat tone during the most recent earnings call, I believe the financial results for the third quarter 2022 recently published have added yet more worrying signs to an already bleak picture. For this reason, I reiterate my idea that the current risk-reward profile for an investment in FUBO is very unfavorable.

The bull thesis

I always find it useful to first address what is the bull thesis behind an investment, even when my general sentiment is negative toward the stock. That helps me understand both sides of the coin before deciding if it fits me or not. To put it simply, I think FUBO wants to be the Netflix (NFLX) of sports, taking advantage of the cord-cutting movement by offering customers a cheaper, more flexible but also more powerful solution to sports fans. Additionally, by leveraging data collected on its growing user base, FUBO wants to create new revenue streams not directly related to sports streaming itself: advertising revenue is for now the only successful endeavor on that front, currently representing about 10% of total revenue. The second would have been betting, however, the story is quite different than advertising since, for now, management was unsuccessful in building the digital infrastructure necessary for handling a gaming business in-house. The project has been officially shut down now and management is evaluating how to proceed further, most likely by onboarding an external partner.

The bull thesis revolves entirely on the success of ancillary revenue streams such as advertising and betting because FUBO’s core streaming business is quite literally a cash furnace. Gross margins are negative and operating leverage is consistently trending in the wrong direction. The failure of the gaming business was a hard hit to the bull thesis, but it will definitely come back in a different shape. However, with zero details available at the moment, this is very much pure speculation.

Q3 2022 review and FUBO’s problems

What worries me is that the company is terribly unprofitable in a time when raising capital is very costly. The market has already severely punished the stock for this exact reason, but as the current valuation implies, there is also a risk of permanent loss of capital that any investors should be aware of.

The headline numbers for the quarter were overall positive. Revenue rose 43% YoY to $224 million, while Ad revenue rose 21%. Subscribers in the United States grew 31% to 1.23 million, and consequently, subscription revenue grew 42% to $196 million. The rest of the world is still too small to make any meaningful contribution: despite ending the quarter with 358,000 subscribers, total revenue generated was only $5.8 million.

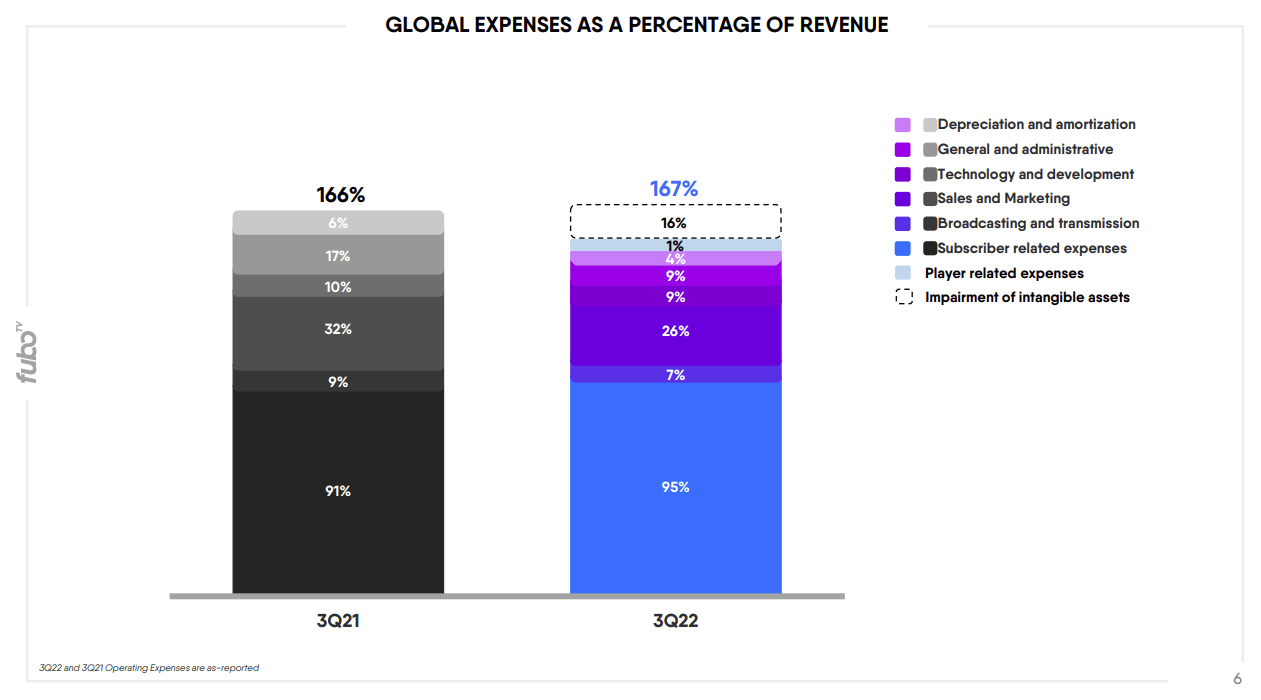

Still no improvement in sight for what I believe is the biggest red flag related to FUBO’s business model: in the third quarter, Subscriber related expenses grew in relation to total revenue, from 91% to 95%. This is a confirmation of what already happened in the previous quarter, when the subscriber related expenses moved from 92% in Q2 2021 to 99% in Q2 2022. This means that while fuboTV is attracting more and more users and generating higher total revenue, margins are not expanding but rather shrinking. Out of all the revenue generated by subscriptions paid from users in Q3 2022, 95% of it had to be immediately handed over to content owners; the remaining 5% was quickly devoured by all the other normal operating expenses. This effectively meant that in Q3 2022 FUBO operated at -2.78% gross margin and -51% operating margin, both GAAP figures. For context, the same metrics a year ago came in at -0.64% and -61.94%. On a Cash Flow basis, there was no improvement either: the company lost $76.6 million in cash from operations, down considerably from a loss of $55.6 million recorded in the same period a year ago.

FUBO Q3 2022 Earnings Presentation

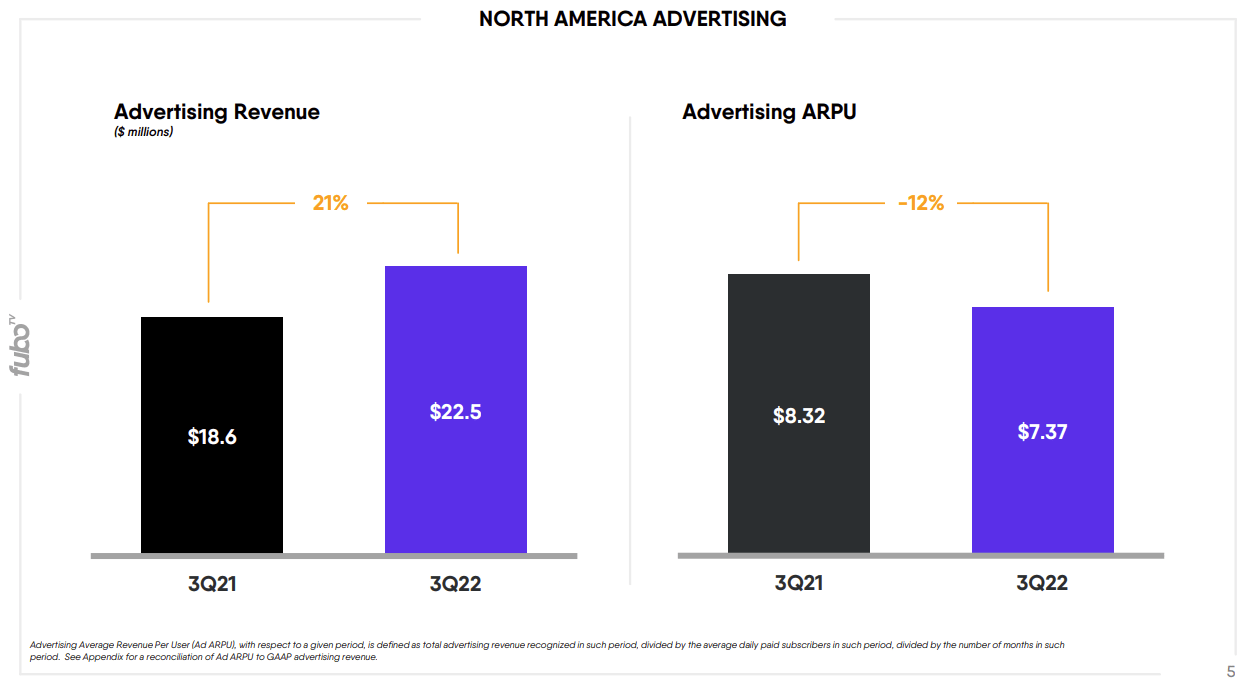

An important avenue of higher-margin revenue is advertising. Unfortunately for fuboTV, the advertising market is quickly drying up due to a very unfavorable macro environment. Plenty of companies operating both in traditional and digital advertising have been flagging issues recently due to declining ad spend from all sorts of corporations. This can be seen in FUBO’s case as well. In the third quarter the company increased 21% ad revenue to $22.5 million, however Average Revenue per User (ARPU) fell quite considerably, down 12% YoY to $7.37 per user. This is a further sign that advertising revenue is experiencing headwinds at the moment, which might be only temporary but nobody knows for how long that will be.

FUBO Q3 2022 Earnings Presentation

Given the poor state of the business model, the company’s balance sheet keeps deteriorating quite fast. The company ended the quarter with $301 million of cash available, down from $372 the previous quarter. Long-term debt is stable for the moment at $393 million, however as I highlighted in my previous article, FUBO will probably soon need to raise cash to save the business. Based on everything that happened recently and the pace at which the Federal Reserve is raising the cost of borrowing, the cost of the capital raised will be high. There are serious concerns about FUBO’s ability to withstand more costs for servicing its debt, considering that at the moment there isn’t much appetite for its stock and as such raising money through share issuance will be either not feasible, or extremely dilutive for shareholders. And this would be on top of an already existing crazily high dilution, with average shares outstanding growing more than 30% this year compared to 2021.

During the call, management has expressed confidence in the liquidity position of the company in light of a welcomed focus on operating more frugally from now on. First and foremost, FUBO closed down its gaming business and sportsbook project to preserve cash. This decision does not come out of the blue as the company already confirmed in the past that the project was put under review. Gaming was definitely part of the bull thesis for the stock when it was first announced, as it would have been yet another avenue for FUBO to generate ancillary revenue not directly connected to its core streaming business, which is structurally a money-losing model. Shutting down the gaming division is most likely a good idea: FUBO will still try to monetize from gaming by partnering with a dedicated business. If successful, revenue generated from it will be lower compared with an in-house gaming division, but at the same time FUBO does not have the capital at the moment to build it from the ground up. Hence, a partnership does sound like the only possible way to do it but will depend on finding a suitable partner.

FUBO is still a Sell in my opinion

Although FUBO’s stock was up on the day of the earnings release, it has quickly given up all the gains and now sits about 13% down from that point. From a fundamental perspective, I haven’t seen any substantial positive sign from the latest quarter; on the contrary, a negative trend persisted in terms of deteriorating gross margins on the core streaming business and expanded operating cash losses. Management had also officially shut down the internal gaming division, which originally was part of the bull thesis and now is back on the blackboard for an entire redesign, adding uncertainties to the entire picture.

Despite many negatives, there is of course a possibility that management will be able to turn the ship around and figure out a way to generate enough revenue from advertising, gaming or even future unknown avenues to balance the steep losses from the core streaming business; investing is always a balance between risk and reward: the risk with FUBO is substantial in my opinion and includes a possibility that the company will go out of business entirely, but on the other end if successful the reward could be enormous. Investors should evaluate if this risk profile suits them: my opinion is that the risks here far outweigh the potential benefit, even at the very low current valuation of Price to Sales of 0.54. I would much rather follow the stock, see if the business recovers, and evaluate then an entry point. That would obviously limit the upside of an investment if the company is successful, but would also lower its risk.

Be the first to comment