Nerthuz

The First Trust Global Tactical Commodity Strategy Fund (NASDAQ:FTGC) is an actively managed ETF that provides investors with exposure to a broad basket of commodities.

While the fund has performed well in the past few years, it has underperformed a passive index fund like the Invesco DB Commodity Index Tracking Fund (DBC) as the manager chose to underweight energy due to the asset class’ higher realized volatility.

Looking forward, I expect the global energy crisis to continue, which would favour energy commodities for the next few years. Therefore, for commodity exposure, I prefer the passive DBC ETF.

Fund Overview

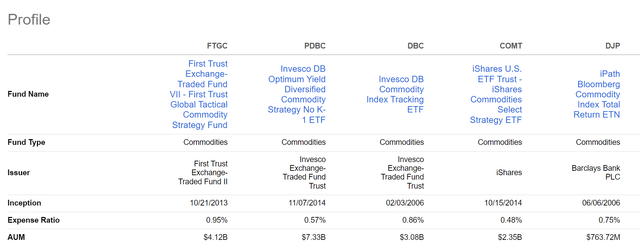

The First Trust Global Tactical Commodity Strategy Fund is an actively managed ETF that provides investors with exposure to a broad basket of commodities. The fund is popular with investors and has $3.3 billion in net assets. FTGC charges a 0.95% expense ratio, which is on the high side relative to peer funds (Figure 1).

Figure 1 – FTGC and peer funds (Seeking Alpha)

Strategy

Unlike index-based commodity ETFs, the FTGC fund is actively managed by a team of portfolio managers at First Trust. The fund managers select 10 to 35 distinct commodities based upon liquidity and realized volatility to create a portfolio that the manager believes will maximize returns while targeting a specific level of volatility.

Portfolio Holdings

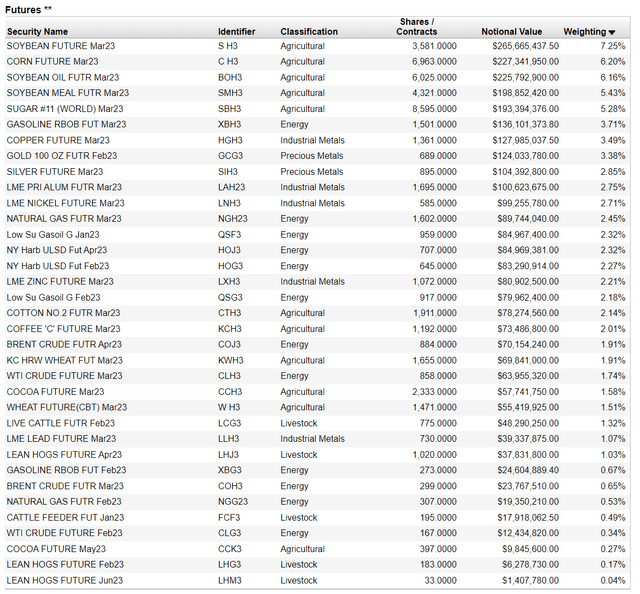

The fund currently has the futures position shown in Figure 2.

Figure 2 – FTGC futures holdings (ftportfolios.com)

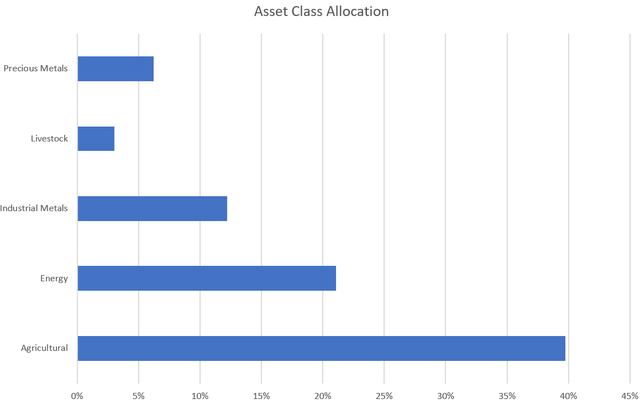

Figure 2 summarizes the commodity exposure by asset class. The FTGC ETF currently has 40% invested in agriculture commodities, 21% in energy commodities, 12% in industrial metals, 6% in precious metals, and 3% in livestock.

Figure 3 – FTGC’s allocation by asset class (Author created with data from FTGC website)

Returns

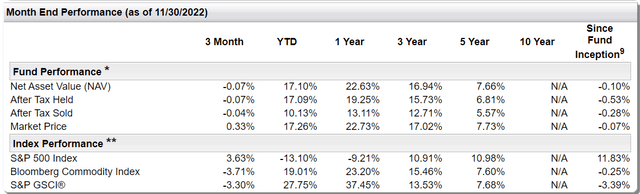

Due to supply / demand imbalances, the past few years have been an ideal time to be invested in commodities. YTD to November 30, 2022, the FTGC ETF has returned 17.1%. On a 3 and 5 year basis, the fund has delivered 16.9% and 7.7% annual total return (Figure 4).

Figure 4 – FTGC returns (ftportfolios.com)

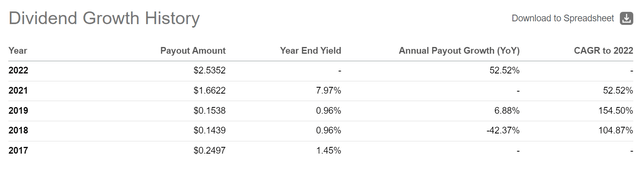

Distribution & Yield

The FTGC ETF has paid a trailing 12 month distribution of $2.54 / share, which is a 10.6% current yield. However, FTGC’s distribution is dependent on the fund’s performance, so when commodities perform poorly like in 2020, the fund does not pay a distribution (Figure 5).

Figure 5 – FTGC historical distribution (Seeking Alpha)

FTGC Vs. DBC

To investigate the fund’s claim that an actively managed portfolio maximizes returns vs. a vanilla commodity index fund, I have decided to compare the FTGC ETF versus the DBC ETF.

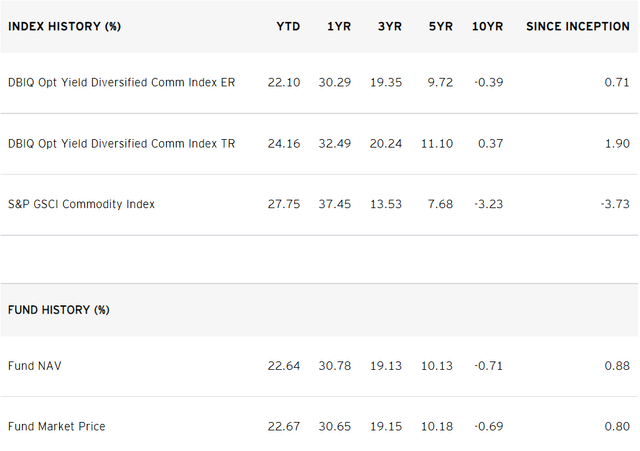

Figure shows DBC’s historical returns to November 30, 2022. Comparing DBC to FTGC, we can see the DBC ETF has outperformed FTGC on all time frames.

Figure 6 – DBC returns (invesco.com)

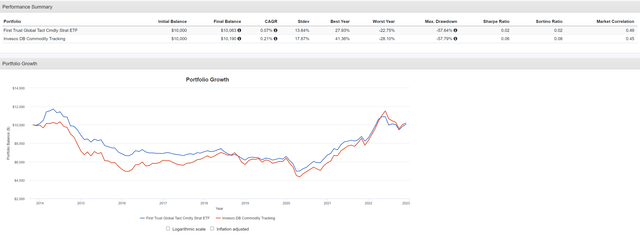

Looking at the two funds in more detail using Portfolio Visualizer, we see that their overall return CAGRs are very similar, with FTGC returning 0.1% CAGR from November 2013 (FTGC’s inception date) to November 2022 versus DBC’s 0.2% (Figure 7).

Figure 7 – FTGC vs. DBC (Author created using Portfolio Visualizer)

In terms of risk, FTGC has exhibited lower volatility, with StDev of monthly returns of 13.6% vs. 17.9% for DBC. However, DBC comes out ahead in terms of Sharpe Ratio, at 0.06 vs. 0.02 for FTGC.

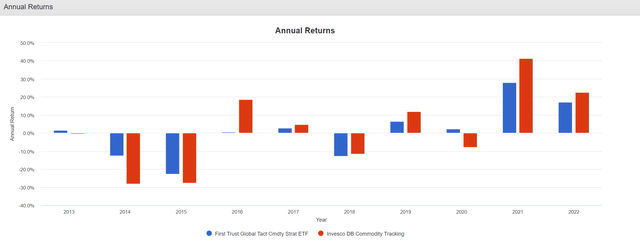

On an annual basis, DBC had worse from 2014 to 2016, while 2016 onwards, DBC has outperformed (Figure 8).

Figure 8 – FTGC vs. DBC annual returns (Author created using Portfolio Visualizer)

DBC Overweights Energy

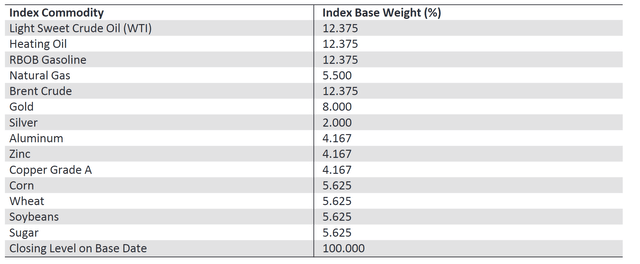

The main difference between the two funds is that the DBC ETF tracks the DBIQ Optimum Yield Diversified Commodity Index, which has the following base weight (reset annually in November) as shown in Figure 9.

Figure 9 – DBIQ Optimum Yield Diversified Commodity Index base weights (DBC Prospectus)

As shown above, DBC’s index has a 55% base weight in energy commodities, 10% weight in precious metals, 12.5% weight in industrial metals, and 22.5% weight in agriculture commodities. In contrast, the FTGC ETF’s commodity weights are at the discretion of the fund manager based upon maximizing returns vs. volatility.

FTGC currently only has a 21% weight in energy commodities vs. DBC, which has a 50.6% weight. I believe FTGC’s energy underweight is the main reason why it has underperformed the passive DBC ETF in the past few years.

FTGC is likely underweight energy because energy commodities have exhibited higher realized volatility than other commodities (for example, crude oil futures briefly dipped into negative territory in 2020 during the COVID pandemic before rocketing to over $130 early in 2022). Unfortunately, volatility can work both ways, and in the past few years, energy volatility has been on the upside due to geopolitical risk.

DBC Should Continue To Outperform In the Short- to Medium-Term

Given the ongoing global energy crisis caused by Russia’s invasion of Ukraine (sanctions on Russian energy commodities; disruptions to Russian natural gas exports to Europe, etc.), I believe energy commodities are likely to outperform for the next few years, which favours DBC over FTGC.

However, if the world is able to successful transition to a low-carbon energy regime, for example, through electrification of the global vehicle fleet or through increased low-carbon energy sources like nuclear, then in the long-term, DBC may underperform, as it has a 55% base weight in energy commodities whereas FTGC’s manager may choose to underweight or avoid investing in energy commodities altogether.

Conclusion

The FTGC fund is an actively managed ETF that provides investors with exposure to a broad basket of commodities. The manager chose commodity exposure to maximize returns for a targeted level of volatility.

However, the manager chose to underweight energy, due to the asset class’ higher realized volatility, which has caused underperformance in the last few years.

Looking forward, I expect the global energy crisis to continue for a few more years, which favours energy commodities. Therefore, for commodity exposure, I prefer the passive DBC ETF.

Be the first to comment