8vFanI

We initially added FS KKR Capital Corp. II (FSKR) to the HDS+ portfolio back in late April 2021, as an undervalued play on its upcoming merger with sister BDC FS KKR Capital Corp. (NYSE:FSK) in Q2 2021.

The merger was completed in mid-June ’21, with the new entity trading under the FSK ticker. It has delivered a 7.27% total return, with its ample distributions making up for negative price gains. That compares well with the S&P’s -9.3% return during this period.

Hidden Dividend Stocks Plus

Company Profile:

FSK is a Business Development Corp., a BDC, that merged FS KKR Capital Corp. II with sister BDC FS KKR Capital Corp. in Q2 ’21, which gave it a much stronger platform.

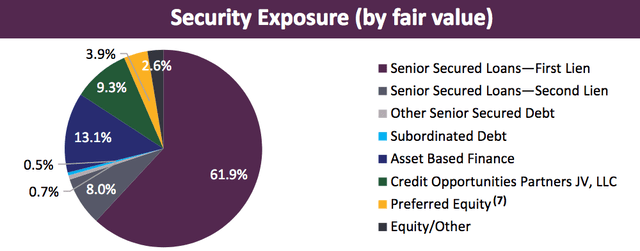

The merged company holds the No. 2 spot in the BDC industry, with a $5.2B market cap, behind Ares Capital (ARCC), and ahead of Owl Rock Capital (ORCC), FSK has a $16.2B portfolio, of which 70% was invested in 1st and 2nd Lien senior secured securities, as of 6/30/22.

87% of its debt investments are floating rate, which gives FSK an edge in the current rising rate environment.

“During the third quarter, we expect to benefit from the rising interest rate environment by approximately $0.04 per share as existing portfolio company interest rate contracts began resetting at higher levels.

For planning purposes, our high-level view is that every 100 basis point move in short-term rates could increase our annual net investment income by up to $0.26 per share, which equates to ~$0.06 per share per quarter.” (Q2 ’22 Call)

FSK also holds ~13% in asset-based finance investments, 2.6% in equity holdings, and 9.3% in a JV, Credit Opportunities Partners.

The median portfolio company has $81M in annual EBITDA, with 6.1X leverage.

FKR site

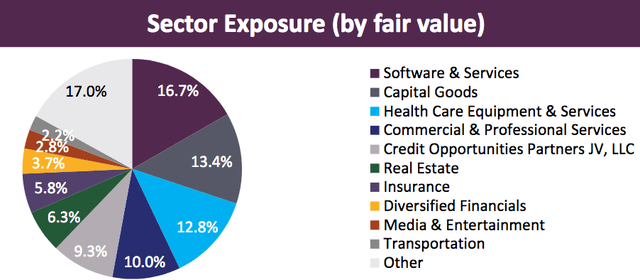

FKR is diversified across many sectors, with holdings in 192 companies. Exposure to its top 10 largest portfolio companies by fair value was 18% as of June 30, 2022, vs. 19% as of March 31, 2022.

FKR site

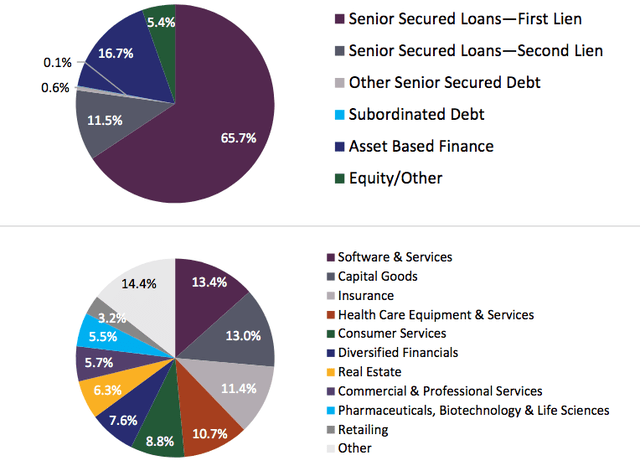

FSK’s JV, Credit Opportunities Partners LLC, is a partnership with the South Carolina Retirement Systems Group Trust – SCRS, with Equity ownership of 87.5%, for which FSK provides day-to-day administrative oversight. The Fair value of the JV’s investments was $3.6B, as of 6/30/22, with 93% in floating rate investments, and ~78% in Senior Secured Loans. FSK had $1.4B in equity in the JV. The Net Debt/Equity ratio was 1.09X, as of 6/30/22:

FSK site

Ratings:

As of June 30, 2022, investments on non-accrual status represented 2.9% and 4.9% of the total investment portfolio at fair value and amortized cost, respectively, vs. 1.5% and 3.2% as of March 31, 2022.

Management placed two small debt investments with a combined fair market value of $11.4M on non-accrual, and removed one small investment with a fair market value of $15.5M from non-accrual status.

Earnings:

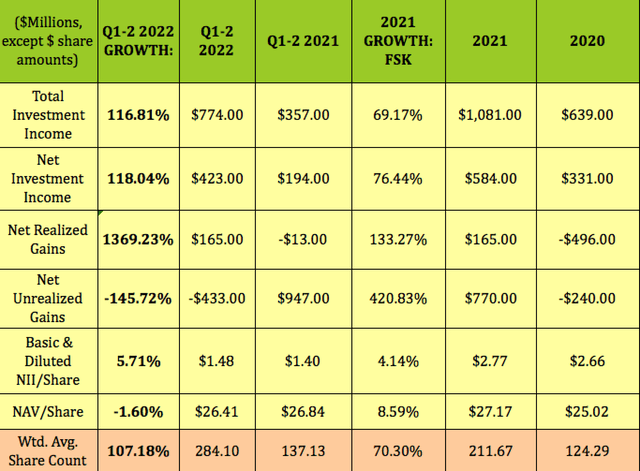

FSK had a strong second quarter. Total Investment Income surged to $379M, up 84% vs. Q2 ’21, while NII rose 75%, to $203M from $116M in Q2 ’21. Net Realized Gains rose to $191M, vs. $51M 1 year earlier, while Net Unrealized Gains were -$464M, vs. $698M in Q2 ’21.

“Consistent with the overall private debt market, the value of our investment portfolio declined marginally during the quarter due primarily to spread widening and market multiple contraction. The 1.6% decline in the value of our investment portfolio equated to a 3.4% decline in our net asset value quarter-over-quarter.” (Q2 ’22 earnings call)

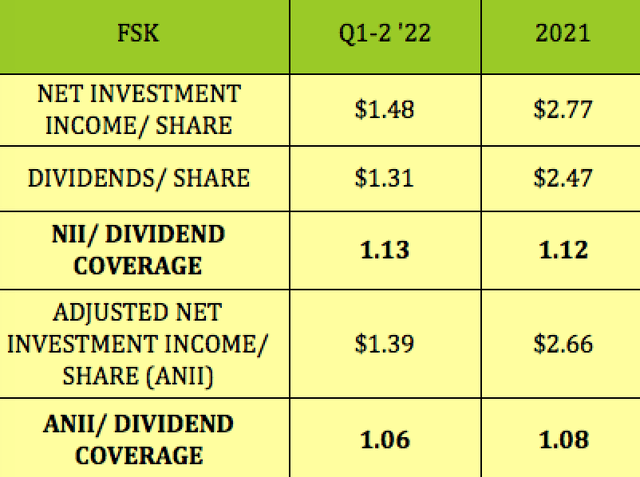

Growth has been exponential so far in 2022, with total and net investment income up by over 3 digit %’s. However, FSK also had 107% share count growth, due to the merger with FSKR in 2021, so NII/Share only rose 5.7% in Q1-2 ’22, vs. Q1-2 ’21.

Hidden Dividend Stocks Plus

Looking forward to Q3 2022, NII earnings/share should be up vs. Q2 ’22’s $.71/share: “We expect third quarter 2022 GAAP net investment income to approximate $0.76 per share, and we expect our adjusted net investment income to approximate $0.72 per share.” (Q2 ’22 earnings call)

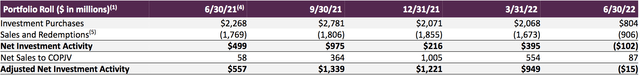

New Business:

In Q2 ’22, management originated $804M in investments, which were predominantly add-on financings for existing portfolio companies. It had $906M in Sales and Redemptions, bringing its net investment activity to -$102M. Net Sales to the JV were $87M, bringing adjusted net investment activity to -$15M.

FSK site

Dividends:

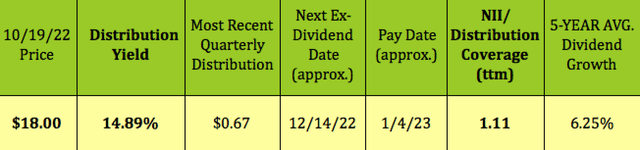

FSK pays variable distributions – its most recent distribution was $.61, plus a supplemental distribution of $0.06/share, for a total of $.67/share. At its 10/19/22 midday price of $18.00, FSK yields 14.89%. It should go ex-dividend next on ~12/14/22, with a ~1/4/23 pay date.

Hidden Dividend Stocks Plus

FSK’s NII/Distribution coverage in Q1-2 ’22 was strong, improving slightly to 1.13X, while Adjusted NII coverage was 1.06X.

FSK’s NII/Distribution coverage was solid in 2021, at 1.12X. Adjusted NII coverage was a bit lower, at 1.08X, but still good for the BDC industry, where some BDC’s experience sub-1X coverage.

Hidden Dividend Stocks Plus

FSK also has a $100M share repurchase program. Through August 6, 2022, they repurchased ~$41M of shares under this program.

Profitability and Leverage:

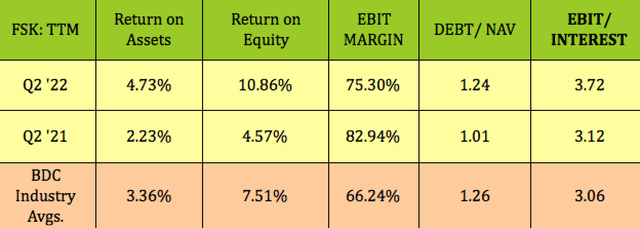

FSK’s ROA and ROE have both more than doubled over the past 12 months, and both metrics are also higher than BDC averages. Its EBIT Margin has slipped a bit, but remains higher than average. On the leverage side, its Debt/NAV is up, to 1.24X, about average for its industry.

Hidden Dividend Stocks Plus

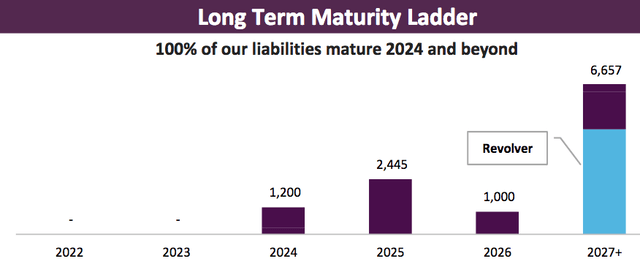

Debt and Liquidity:

FSK had a 3.51% weighted average effective rate on its borrowings as of June 30, 2022. Its debt is rated Rated Investment Grade by Moody’s (Baa3) Stable, Fitch (BBB-) Stable & Kroll (BBB) Stable.

Management amended and upsized FSK’s Senior Secured Revolver in Q2 ’22, to increase the total commitment by $455M to $4,655M, and extend the maturity from 2025 to 2027.

51% of drawn leverage is unsecured. As of 6/30/22, FSK had total liquidity of $2.21B, comprised of cash and foreign currency of $269M, and availability under its financing arrangements of $1,943M.

FSK’s earliest maturity isn’t until 2024, when $1200M comes due:

FSK site

Valuations:

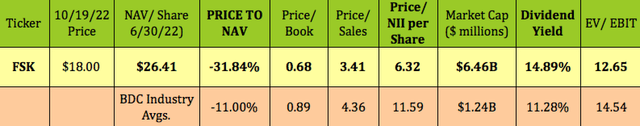

At its 10/19/22 midday price of $18.00, FSK was selling at a 31.84% discount to NAV/Share, nearly 3X the 11% average discount in the BDC industry.

More importantly, its earnings multiple, Price/NII was only 6.32X, vs. an industry average of 11.59X. Its 14.9% dividend yield also compares favorably with the 11.28% industry average, as does its EV/EBIT, and its P/Sales figures:

Hidden Dividend Stocks Plus

Performance:

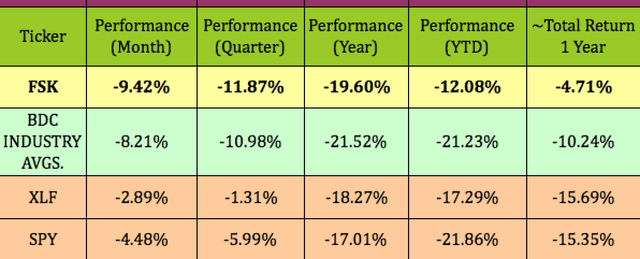

FSK has outperformed the BDC industry, the broad Financial sector, and the S&P 500 by wide margins so far in 2022. Over the past year, it has outperformed the BDC industry, but lagged the Financial sector, and the S&P 500.

However, if you add in the dividend yields to those 1-year price returns, FSK’s 1-year ~Total Return has greatly outperformed the BDC industry, the Financial sector, and the S&P 500.

Hidden Dividend Stocks Plus

Analysts’ Price Targets:

At its 10/19/22 midday price of $18.00, FSK was ~14% below analysts’ lowest target price of $20.50, and 24.7% below their $22.44 average price target.

Hidden Dividend Stocks Plus

Parting Thoughts:

We continue to rate FSK a BUY, based upon its undervaluations vs. the BDC industry, and its well-covered, very attractive dividend yield.

If you’re interested in other high yield vehicles, we cover them every Friday and Sunday in our articles.

All tables by Hidden Dividend Stocks Plus, except where noted.

Be the first to comment