Laser1987/iStock Editorial via Getty Images

Frontier Airlines (NASDAQ:ULCC) and Spirit Airlines (NYSE:SAVE) agreed to combine operations in February 2022. The transaction would create the fourth largest airline in the US and increase the weight of the combined airline in the ultra-low cost segment. However, not long after JetBlue (JBLU) attempted to take over Spirit Airlines as well. With Spirit Airlines remaining in favor of a combination with Frontier Airlines, JetBlue chose the hostile path to acquire Spirit Airlines and changed the bid various times.

On June 10th, I published a report marking the offer from JetBlue more compelling. Since the publication of the article, shares of Spirit Airlines gained 14% compared to less than 3% for the broader market. So, the bidding war between Frontier Airlines and JetBlue has already resulted in higher share prices for Spirit Airlines shareholders. In this report, I will have a look at the most recent developments as Frontier Airlines and JetBlue both try to acquire Spirit Airlines.

The Combination Cases

Overall, a combination with either airline will be difficult. The Spirit-JetBlue combination generally is regarded as the most complex one and with reason. Spirit Airlines and JetBlue have a significantly different mindset when it comes to cabin products and passenger services. Spirit Airlines is an ultra-low cost business while JetBlue is a low-cost airline. So, integrating those services and different cabin products is going to be a significant challenge. On top of that there are anti-trust concerns, which Spirit Airlines has often pointed at to keep JetBlue out of the door. Combining with JetBlue could ultimately result in an improving cabin product for Spirit Airlines.

A combination of Spirit Airlines and Frontier Airlines does make more sense as both airlines operate an ultra-low cost model. However, there also is a certain degree of overlap in the networks of Frontier Airlines and Spirit Airlines and the creation of the ultra-low cost carrier does not necessarily add to a drive to provide low fares and acceptable services. So, the reality is that a combination with both airlines has pros and cons.

Overall, while the offer from JetBlue might be superior as measured by dollar value. Antitrust concerns do discount some of the premium that JetBlue offers over the Frontier Airlines offer, even more so when considering it might take years for an approval to be obtained for a Spirit-JetBlue combination if at all.

Sweeter Offers From Both

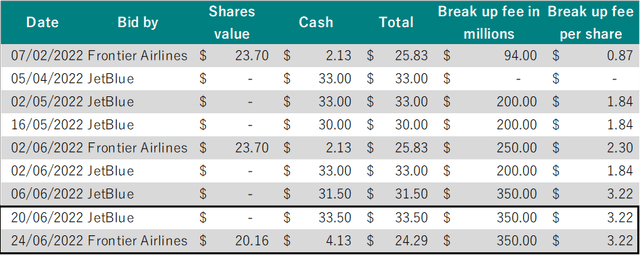

Timeline Spirit Airlines acquisition battle (The Aerospace Forum)

As the shareholder vote on the Frontier Airlines transaction came closer, JetBlue airlines increased the offer for Spirit Airlines offering $32 per share plus a $1.50 per share pre-payment if shareholders would approve the acquisition by JetBlue. Frontier Airlines had to do something and did so four days later. It increased the reverse break up fee to match that of JetBlue eliminating the break up fee as a watch item for investors and the Spirit Airlines board. On top of that, the cash part of the bid was increased by $2 per share to $4.13. However, one can wonder what this really is worth because it is basically taking $1 per share out of Frontier Airline’s stock price and distributing that to Spirit Airline shareholders who actually get 1.9126 shares of Frontier Airlines. Multiply the two figures and you would be inclined to say that Spirit Airlines shareholders will be paying $1.9126 per Spirit share converted to Frontier shares for this $2 per Spirit share cash offer bump. The cash bump feels a lot like taking money out of the left pocket only to put it in the right pocket. The big difference that puts Frontier Airlines firmly in the top spot to acquire Spirit Airlines is its pre-payment of $2.22 per share compared to $1.50 pre-payment that JetBlue offered.

$50 Per Share: Realistic or Not?

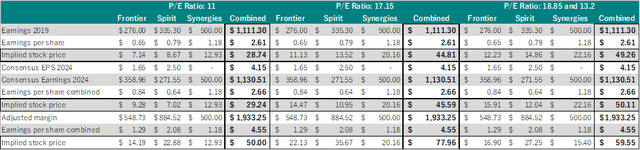

Valuation matrix Spirit-Frontier combination in 2024 (The Aerospace Forum)

Frontier Airlines has dangled the prospect of a $50 per share value for the combined company. Frontier Airlines had a $276 million profit in 2019 on a 11% adjusted margin while Spirit Airlines had adjusted margins of 10.5%. Spirit Airlines said that the combined company could have a $50 per share valuation based on 2024 earnings based on a 11 price-to-earnings multiple. I processed a range of price-to-earnings ratios as well as EPS estimates and margins-revenue estimates. The first three lines in the table provide 2019 numbers as a reference with $500 million in synergies added. What can be seen is that pre-pandemic performance isn’t going to get the company to $50 based on a 11x earnings multiple. I also applied the Spirit Airlines average multiple of 17.15, which would give us a share price of $45 per share.

I also used the 2024 EPS estimates as found on Seeking Alpha for Spirit Airlines and Frontier Airlines and transformed those numbers into earnings and then implemented the synergies to come up with a pro-forma share price. This would give a $29.24 share prices on a 11x multiple and $45.9 on a 17.15x multiple. It was found that an 18.85x earnings multiple is needed to realize the $50 per share value that Frontier Airlines and Spirit Airlines believe in.

The difficult thing about using the price multiple is that we don’t know which share count the earnings per share price is based on. So, we also modeled a different approach using revenue estimates in combination with adjusted margins as previously seen. On the 11x multiple that Frontier Airlines and Spirit Airlines use that gets us to $42 per share, $65.43 per share on the Spirit multiple and a 13.2x multiple needed to reach a value of $50 per share. Put differently: The combined company would need margins of 18% to reach the $50 valuation at a 11x multiple. That is something that I simply don’t see happening.

Conclusion

I believe that with the most recent bid, Frontier Airlines is back in the game to acquire Spirit Airlines. The company has matched JetBlue’s reverse break up fee and thereby eliminated any concern regarding that differential. What puts Frontier Airlines in a better spot as well is that it will pre-pay $2.22 per share upon shareholder approval, which compares favorably to the $1.50. As said previously, both combinations are subject to regulatory scrutiny but in that framework of potential antitrust concern Frontier Airlines now offers a 48% higher pre-payment which is significant. While I believe this pre-payment is part of the total cash consideration it still implied a significantly more attractive offer from Frontier Airlines. It is indeed the case that JetBlue’s offer is still 35 to 40 percent better than Frontier’s but with the feared antitrust scrutiny that premium isn’t worth much.

Overall, I believe that Frontier Airlines will end up acquiring Spirit Airlines given the pre-payment and reverse break up fee but I still believe that the bid barely values Spirit Airlines as a company with a recovery trajectory ahead. Instead, the potential recovery of both airlines is used to support a prospective $50 per share valuation which according to my calculations would either require a significant margin expansion or a price multiple expansion.

Shares of Spirit Airlines are currently trading at $24.50 higher than the consideration of $24.29 from Frontier using the airlines current share price, but lower than the initial $25.83 bid. I believe that from current levels there is no upside left assuming a Frontier Airlines take-over as the base case. As a result, I am changing my rating on Spirit Airlines from Buy to Hold.

Be the first to comment