Andres Victorero

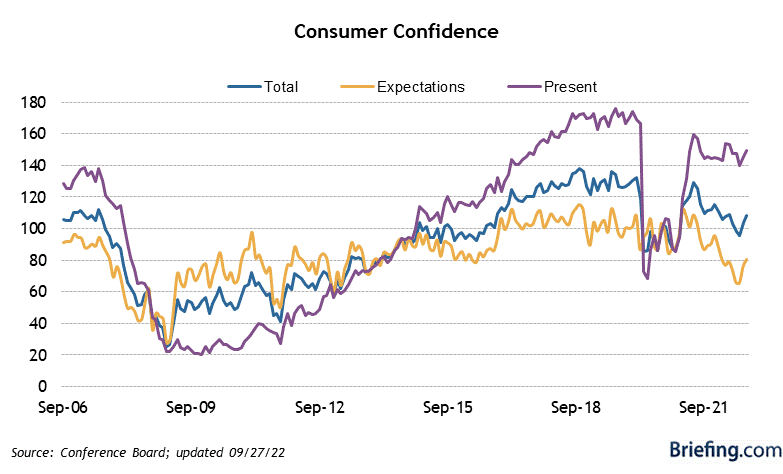

Stocks opened in the green yesterday with reports showing that the U.S. economic expansion continues. Durable goods orders for August reflected modest growth, while business spending remained surprisingly strong. We also had another increase in consumer confidence from the Conference Board’s survey to what was a five-month high driven by rising wages, job gains, and lower gas prices. Yet the party ended at noon when bond yields and the dollar resumed their uptrends on what seems like unrelenting hawkish rhetoric from Fed officials every day. Bond yields are now fully reflecting the Fed’s forecasted moves, so we should see stabilization in interest rates at current levels. What I find impressive is that with the 10-year Treasury yield now at 4%, the Nasdaq Composite and Russell 2000 have still not fallen below their June lows.

Finviz

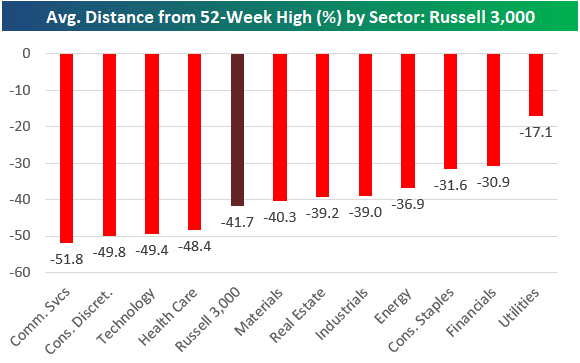

We have erased more than $13 trillion in stock market value this year with the average stock in the Russell 3000 down an average of 41.7% from its 52-week high, as shown in the chart below from Bespoke Investment Group. That is what I call deflation, but it has been masked to a great extent by the S&P 500 because of the relative strength of its largest market caps. The point here is that we have already priced in a tremendous amount of bad news, much of which isn’t supposed to happen until later this year or in 2023. What if upcoming developments over the next 12 months are not as bad as feared?

Bespoke

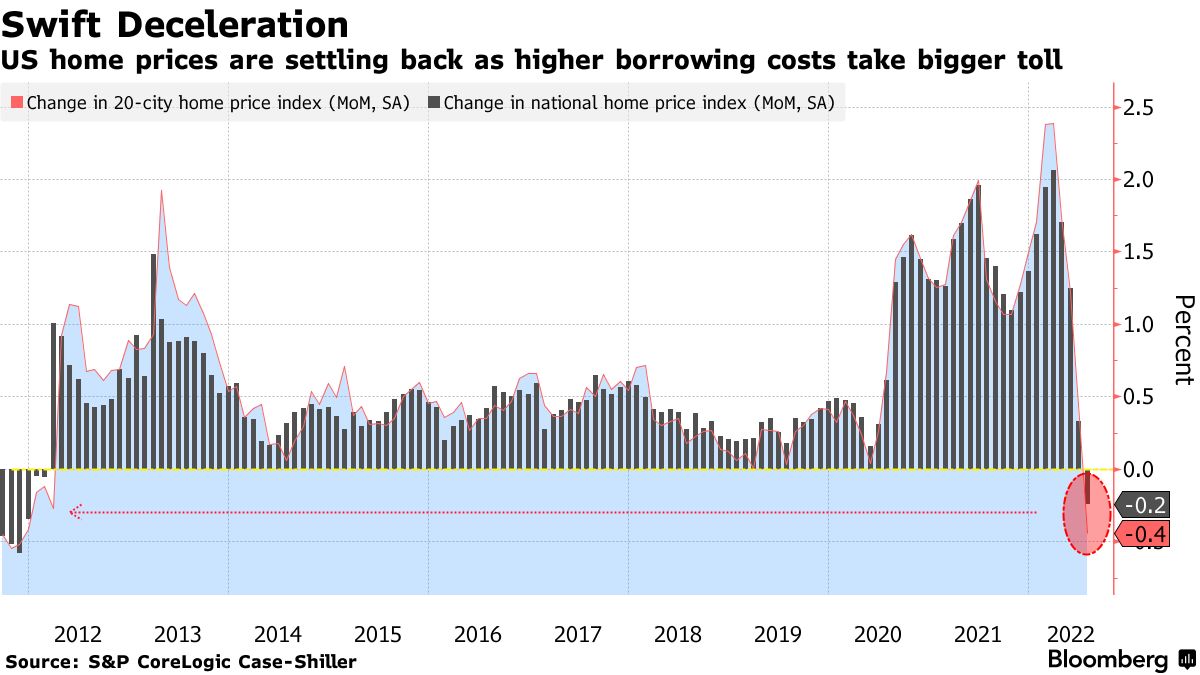

In another crucial sign that today’s inflation will likely be tomorrow’s deflation, the S&P CoreLogic Case-Shiller home price index fell for the first time in 10 years. This national measure of home prices in the 20 largest cities declined 0.44% in July, which resulted in the largest one-month deceleration in the annual growth rate in the history of the index. Critics will say that prices are still up double-digits over the past year, but it is the rate of change that matters most, and it has gone from increasing to decreasing. With mortgage rates doubling to what is now 6.3%, I expect we will see a modest decline in home prices by next summer on an annualized basis.

Bloomberg

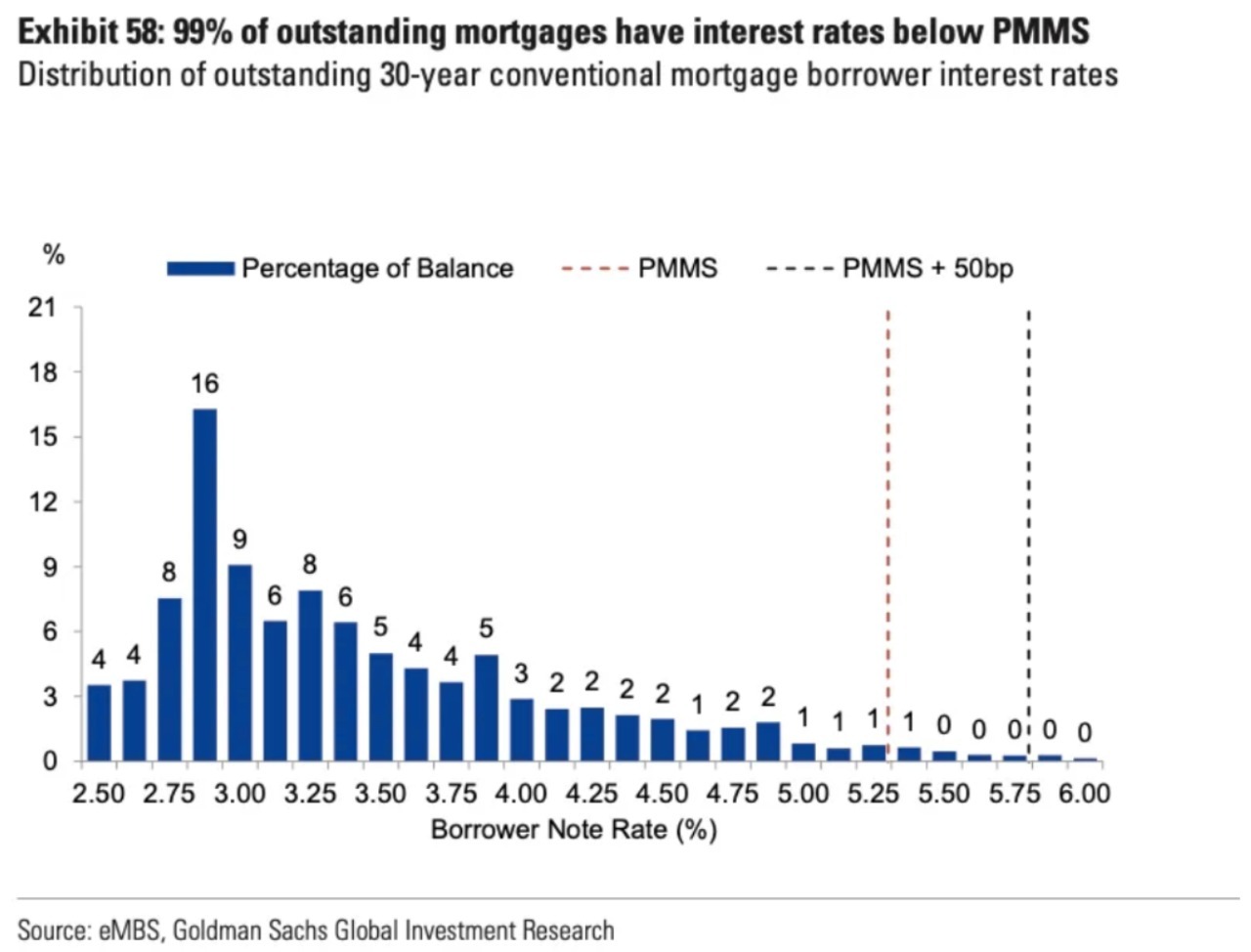

Rents should follow, which is exactly what the Fed wants to see, but that does not have to undermine the economic expansion, as nearly all existing homeowners hold incredibly low rates on their mortgages, and very few are adjustable rate.

Yahoo Finance

For those of us who look at the economy through the lenses of the market each day, it seems like an epic downturn is upon us, especially when we listen to pundits warn of doom and gloom ahead. The problem with this approach is that the market is the tail and not the dog. Stocks and bonds are selling off in reaction to Federal Reserve rhetoric, as much as Federal Reserve policy moves to date. The consumers who dictate broad economic activity have never even heard of the Federal Reserve and they certainly don’t hang on every word out of the mouth of Jerome Powell.

This is why consumer confidence has strengthened for several months in a row, despite the ongoing bear market in stocks. I have never seen a recession engulf the economy as consumers were gaining confidence, which is why I still see a soft landing ahead. Consumers in aggregate are in very good shape, and the economy should be able to withstand the pain of higher interest rates as a result.

If the rate of inflation falls in the coming 12 months as fast as it rose over the previous 12 months, as I expect, then it should ease the burden on consumers and pave the way for the soft landing I expect. Growth should slow significantly, but the strong wage gains combined with healthy balance sheets should keep consumer heads above water.

Briefing.com

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment