Norwegian wind turbines at sunset Viktor Serebriakov/iStock via Getty Images

Being realistic, renewable energy is not a perfect solution for all energy needs.

Being realistic, sometimes renewable energy costs every bit as much as what I have dubbed Nature’s Batteries – the compacted carbon of plant and animal life that we call oil and gas. These “batteries” are already highly condensed sources of natural energy.

Regrettably, Nature’s Batteries have a downside; they emit elements like carbon and compounds like methane that are significant contributors to greenhouse gases. On the other hand, do not be fooled by those who incessantly talk about renewables being “free energy.”

It costs money to build solar panels. There is a large environmental cost to these panels, as well, since the earth must be torn up (using fossil fuel power in many cases) just to get the materials to build the solar panel. Then there are maintenance costs. Finally, what do we do with these monstrosities once they reach the end of their useful lives? Some parts can be recycled, of course – at some expense for the energy needed to recycle them. Others must be taken to landfill or destroyed in some other way. Doing so may still emit fumes as toxic or more toxic than carbon.

The same is true of wind energy. Those massive leviathans are composed of raw materials that must be mined, then manufactured, using processes that often require significant fossil fuel energy. Since large wind farms create serious noise pollution, they are often placed in remote locations that require transportation by fossil fuel and, often, the building of roads using asphalt derived from oil. Wind farms are not maintenance-free, either. Regular maintenance is essential.

Add to this the hundreds of thousands of bird and bat deaths attributable to wind energy, the fragmentation of animal habitat, the high cost of construction, the even-more-than-solar question of what to do with some of the materials that are in the turbine blades, and, of course, the intermittency of wind in many locations. We can see, by looking beginning-to-end, that the costs, both in dollars and in potential devastation, can be so much more than advertised. Clearly, there are upsides and downsides to the rush to what are too often inaccurately called free renewable energy sources.

However, one company has brought the dream a little closer to reality.

Enter New York Stock Exchange-listed FREYR Battery (NYSE:FREY)

If you can locate your battery-producing manufacturing facility as close as possible to where the elements and materials needed for production are transported from, that brings you closer to the ideal.

If you can use energy that does not create carbon, methane, or any other dangerously polluting output in order to power your manufacturing process, that brings you closer to the ideal.

If you operate in an area that has been creating electricity in this clean manner for more than 100 years and has the infrastructure in place to ensure continuity – all at a very low cost – that brings you very much closer.

FREYR (the name is that of a major god in Norse mythology associated with fertility, prosperity, virility, and good harvests) does all the above. It has elected to site its first manufacturing facility in mid-Norway, in a town called Mo i Rana. Regrettably, on my last visit there, FREY had not yet been established well enough for visitors. I have an open invitation to visit FREYR my next time there, and I promise to report my findings when that happens.

For those who have never been there, you might think this is some tiny burg covered with snow most of the year. Nothing could be further from the truth. Mo i Rana is a city with one hundred years of industry already present. Billed as “the green industrial capital of Norway,” there are numerous restaurants, cafés, and shops. The mile-long main street is kept free of snow and ice in wintertime with surplus heat from local industry.

Because it is on the sea, the Gulf Stream pulses right by Mo i Rana, so the climate is more moderate than you might expect. This serendipitous climate has made it much easier for FREY to attract top engineering and manufacturing talent, not just from Norway or Europe, but from around the world.

Here is FREYR’s plan of attack – what it expects to accomplish and how

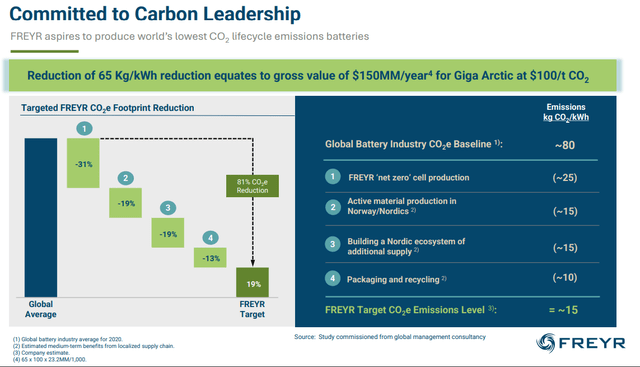

FREYR’s plan is to incrementally reduce the beginning-to-end, mine-to-recycle carbon emissions from the typical level at a battery manufacturing plant to just 20% of its competitors!

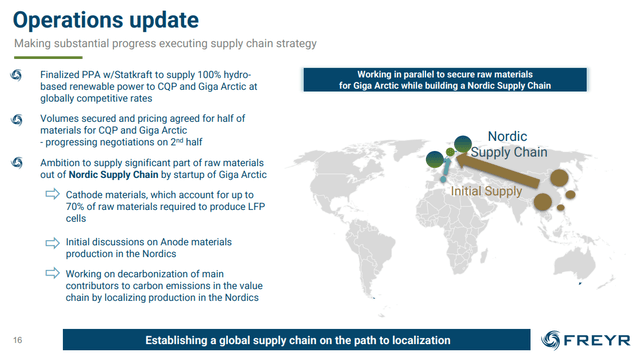

Currently, the initial raw materials will come primarily from Asia, especially China, just as much of the world (too much?) does today. But the plan is to source from much closer and from among allied or long-time-friendly neighbors.

How does FREYR plan to reach these goals?

First, by sourcing as many raw materials as possible from their closest Nordic neighbors. Finland, Sweden, Norway, and even Denmark can supply some of the metals and elements needed. Norway itself has some copper, cobalt, nickel, graphite and aluminum, and there is plenty more in the rest of the Nordic nations.

Each of the above metals are essential for utility-plant sized Battery Energy Storage Systems (BESS) home and business electricity storage, and Electric Vehicles ((EVs)).

All Norway lacks of the “Big Six” needed for Battery Energy Storage Systems and EV batteries is lithium. It is not a major producer of any of these, but it does have enough already for proof-of-concept. (Also, some very interesting research is currently being done to extract lithium from the oceans, where it is in more abundance, but so far it is impossible to retrieve.)

Next, by using hydroelectric and wind power for the electricity to build their products. Norway is blessed with massive runoff from thousands of waterfalls. More than 97% of the electricity in Norway is produced by hydro power. This is the cleanest renewable resource there is, and Norway has it in abundance. In Vestlandet, the West Country where FREYR is located, you will be hard pressed to drive or sail a mile without seeing at least one powerful waterfall.

Finally, Norway is now building five of the largest wind farms in Europe, two onshore and three offshore, with 36 more planned. Intermittent? Nope. The wind in the North Sea and the Norwegian Sea is quite dependable much of the year!

FREYR has already signed joint venture and sourcing agreements with companies like Glencore, the world’s largest metals and mining company by revenue. FREYR also has a relationship with Itochu, one of the world’s largest trading companies, as well as a recently inked $3 Billion supply deal with Nidec Corp., the world’s largest manufacturer of high-efficiency electric motors.

Very large, very old, very experienced companies have made the decision to do business with FREYR.

But is FREYR worth buying right now?

I believe it is. I purchased another renewables company, Lithium Americas Corp. (LAC), for our Investor’s Edge Growth & Value Portfolio at a similar stage in its development last year. As more investors have become aware of LAC’s potential, the share price has doubled during what is a “not particularly wonderful” market. I see the same potential with FREY. It just is not that well-known, but I expect great things as more investors learn about this company.

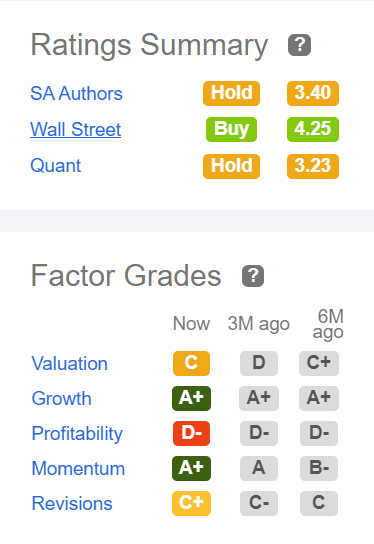

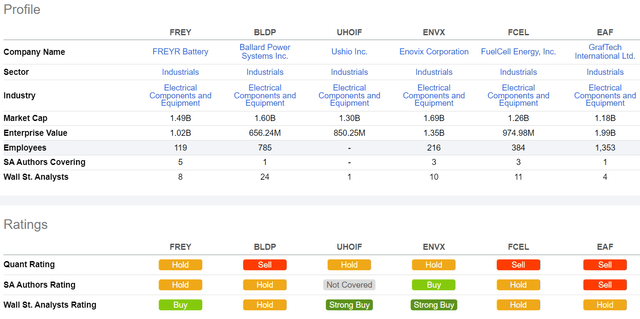

Seeking Alpha gives FREYR a Quant rating of “Hold” – but also rates it (barely!) in the top third of all companies in the Electrical Components and Equipment industry. Not bad for a company that is still in the development stage and has as-yet no revenue.

Seeking Alpha

Seeking Alpha also rates FREYR poorly for Profitability — since there are no profits — and gives it a middling rating for Valuation and Revisions. But take a look at the two areas I care most about for what I believe is an up-and-coming company still in its development stage. Seeking Alpha gives FREYR an A+, the highest rating, for Growth and an A+ for Momentum.

There is nothing to see in the usual headings of Earnings, Dividends and so on, but I would like to point out FREYR’s profile against selected Seeking Alpha peer companies:

Analyzing all these, and viewing them with a much closer inspection, I personally choose FREYR hands down.

Risks

Are there risks associated with investing in FREYR? Of course there are. The usual risk is present, as with any company, that things might not work out and you would sell at a lower price than you paid. But as for the company-specific risk often associated with development-stage companies, I do not see significant risk.

FREYR has $488 million USD in cash, they have agreements in place with some of the biggest companies in the world, and they have the complete backing of the Norwegian government. Plus, most recently, because they are planning a facility in the USA, they are in line to receive funds designated under the $1T bipartisan infrastructure law approved in Nov 2021.

I will close with this chart of the year-to-date performance of FREYR versus the S&P 500 (SP500) over the same period:

I see FREYR as a company with management and employees not yet fully in place. Of those who are, they are the crème de la crème, much respected in their field. I see a company that is ready to become a real force in its industry. And I see a company on the leading edge of a unique approach to filling an important need.

I am buying FREYR Battery.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment