J. Michael Jones/iStock Editorial via Getty Images

Author’s Note: This is the free version of an article posted on iREIT on Alpha on the 8th of June.

Fresenius (FSNUY) (NYSE:FMS) is a company I’ve been writing about for some time, with the stance that the business is significantly undervalued to any sort of conservative perspective. Now, the business comes with a degree of uncertainty and risks. Despite a resilient overall business model, Fresenius hasn’t been doing all that well – but I argue that the issues are very manageable (even if company could have more transparent and better management).

In any case – the company has seen some decline, so let’s revisit the business and see what we have here.

Revisiting Fresenius

In some of my basic articles, I go through very clearly just what Fresenius is, and why you should consider the company fundamentally appealing. I also go through exactly what makes the FMS symbol different from the FSNUY symbol, and how these should be considered as investments.

These are things that need to be understood if you’re interested in investing in the business.

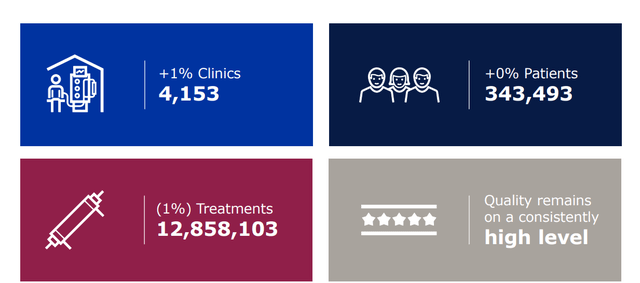

Fresenius FMS 1Q22 Presentation (FMS IR)

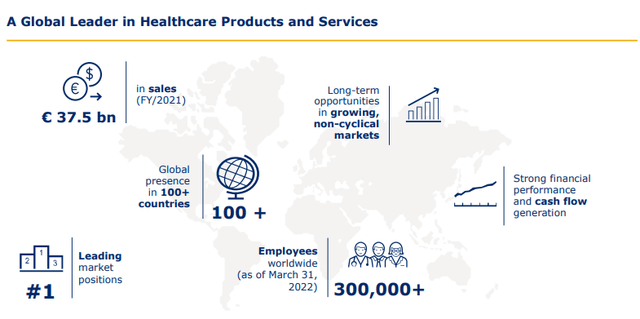

Fresenius, if looking at the basic company, has a number of different branches – and if you’re just looking at the FMS symbol, meaning the Medical Care company, has one appealing branch that’s US-specific.

If we focus on the Medical Care branch (The FMS symbol), the company is a fully-integrated dialysis service provider with lifetime patient relationship expectations. The company has been significantly expanding its offerings by including home dialysis services, and its market position makes it possible for FMS to essentially set industry standards in cooperation with local authorities and the US government, its biggest market by far. In addition, Fresenius brings with it decades’ worth of experience to the table.

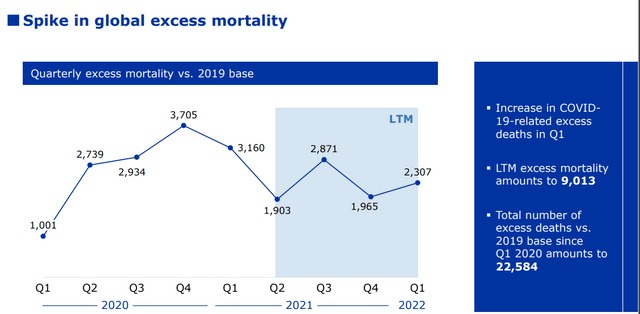

The basic issue with this business has been the pandemic. COVID-19 really pushed things into the negatives, and despite some ongoing recovery, we’re not back to normalized levels – this is also part of the reason we’ve been seeing weakness in the company’s valuation for some time.

On the fundamental side, FMS also comes laden with a decent amount of debt at around 4X net debt/EBITDA due to its M&A-heavy past growth strategy. The timing of this, considering the interest rate environment we’re now moving into, could, of course, have been somewhat better.

However, now that COVID-19 is slowly fading, the recovery is technically a long-term benefit to FMS, even if recent 1Q22 mortality rates are slightly up (though down from 4Q20). Because of the high degree of patient vaccination in the company’s patient demographics and groups, relatively limited Omicron mortality has positively impacted FMS forecasts and expectations.

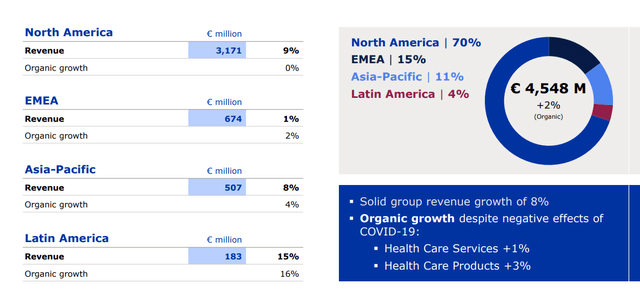

Fresenius FMS Presentation (FMS IR)

This excess mortality from pre-Omicron COVID mortality had seen operating cost impacts for the company, and 4Q21 saw improvements with revenue ticking up in NA, EMEA, and APAC. Revenue is up, though profit impacts are not insignificant. The best way to describe Fresenius Medical care is recovery in profitability/upside is postponed.

The start to 2022 has recently been confirmed as “somewhat impacted”. There was a mix of profitability impacts for the first quarter, including somewhat increased mortality, isolation clinics for clients, and labor shortages resulting in higher wage costs. Higher input costs make this a negative mix of impacts to an otherwise increased YoY revenue.

Management confirmed the full-year 2022E guidance which continues to call for sales and net income to grow at low- to mid-single digit percentage rates. The consensus may have some slight downwards revision potential, illustrated by the company’s significant EBIT decline of over 25% YoY for the 1Q22 period, not to mention margin drops of 3.7% due in large part to increased OpEx.

The market expected a negative 1Q22 for the most part, and these numbers are actually slightly better than expected. Still, I believe it is fair to say that the company’s risks can be considered in three parts. The profitability (which is currently seeing risks), the company’s massive exposure to dialysis, with most of the company’s non-core activities still too new to provide any risk diversification, and the high amount of goodwill on its balance sheet, as well as the relatively high gearing due to the company targeting M&A driven growth.

I’ve never made any secret about the fact that I consider Fresenius to be the more attractive investment compared to Fresenius Medical Care.

The compared, broader business mix with appealing things such as building hospitals, managing hospitals, a biosimilar business, and other branches provide additional value. To me, the question of what company to invest in has never been a significant one – I’ve always invested in Fresenius above the medical care wing.

I view the recovery of medical care as postponed. Despite the company trading below my PT, I’d say there are better alternatives for investing here, and FSNUY is one of them.

FSNUY 1Q22 Presentation (FSNUF IR)

Fresenius, meanwhile, had a much better 1Q22 than the smaller FMS.

For 1Q22, the company’s Helios wing reported significant profitability increases, despite admissions being below pre-pandemic levels in the core market such as Germany (though admissions are growing here as well). Kabi suffered from some of the expected slowdowns, but the real negative was, as we discussed above, the FMS performance, which also weighed down the parent company. Despite this weighing down, FMS beat consensus handily by more than 2.3% in top-line growth, and over 3% in terms of profitability expectations.

FSNUF 1Q22 Presentation (FSNUY IR)

Aside from Helios (which is very positive) and FMS (negative), the remaining segments are stable and slow recovery. Vamed saw recovery towards normal operations, with the service business, in particular, acting as a growth segment. Order intake for the project-based business remains at high levels, with order intakes up 91% and a backlog of close to €3.7B.

The company’s outlook remains positive for the full year, despite some of the 1Q22 weaknesses in EBIT.

The company’s starting patterns to 2022 were more or less as expected, with Helios generating significantly higher margins than analysts (including myself) were expecting. Kabi suffered from challenges in North America and Europe. North America faced high levels of staff absenteeism due to Omicron and higher competitive pressure. Europe mainly suffered from higher input costs (e.g., raw materials and freight) – but all of these headwinds were fully expected.

Despite higher levels of gross profit on a broad basis, EBIT actually declined to below €1B due to operating cost increases. If we look closer at the company’s financials, the impact came from higher SG&A, which were up 17%.

If you mean to impact Fresenius negatively as a result of 1Q22, my opinion is that such impacts should be very limited – because fundamental upside once things normalize is very much around. Things would have been much worse if the company had gone for the Akorn M&A considering the current market and interest rate environment.

As things stand, the company expects growth in all segments and businesses for 2022.

Fresenius Valuation

So, Fresenius is always a question of what you want to be investing in. Do you want the Medical Care wing, which is only for Dialysis and associated businesses?

Or do you want the full investment, which includes the above-mentioned Kabi, Helios, and Vamed as well as the FMS business?

For me, this has always been an easy one to answer – but I will nonetheless guide both companies in this article.

It can be argued that the upside for Medical care, in light of 2022 EPS growth of only 1-2%, is significantly lower than Fresenius, and for 2022E as a year, is less than 10% given the 15X P/E of around $30/share, to the current price of $28.7/share.

The company’s upside is entirely based on the reversion of the company’s operations and profits to pre-pandemic levels. Because the actual visibility for this is so low though, despite a theoretical upside based on current 2024E profit expectations (Source: FactSet), we should be careful when investing in FMS here.

At current levels, the FMS upside in 2024E is around 16.46%, or 48% in less than 3 years. However, FMS does not provide a divisional breakdown of operating performance, and the historical performance, including for FMS, is based in part of a strong M&A performance, which for FMS is likely to be limited going forward due to the company’s higher leverage.

FMS has a high upside based on book valuation compared to peers like Coloplast (OTCPK:CLPBY), Sonova (OTCPK:SONVY), Getinge (OTCPK:GNGBY), and others. Aside from that though, perspectives such as DCF upside, P/E valuation, NAV valuation – all of those factors call FMS to be either fairly valued or even slightly overvalued. My PT for FMS after 1Q22 is one that I lower to $40/share, but I must make it clear that this price target is for the longer term, and the visibility for this upside could be 3-5 years going forward.

Overall, I view FSNUY as being in a much better position.

FSNUY has a postponed recovery, much like FMS, but the company’s business mix is far more diversified and far more attractive than is FMS alone. The company’s revenue base is based on three cushions, and recent results have sort of confirmed, to me, the upside of having this mix with Helios providing excellent outperformance during a recovery period. The mix of Helios and Kabi are likely to provide growth that outperforms, over the mid and longer-term, the prospects of the dialysis/FMS branch alone. From a valuation perspective, the company has also declined more than has FMS.

Significantly more compared to a 15X P/E multiple.

I know many of you own FMS instead of FSNUY (or the German native ticker). Let me very clearly state that the base company, in my view, has an upside in the triple digits, or 110% until 2024E.

I base this on the current valuation, which is less than 8.5X P/E even on 2022E, and the expected top- and bottom-line growth in recovery in 2023E as well as 2024E. It’s my firm stance that recovery to 15X P/E – much like with FMS – should drive returns of no less than 30% annually.

DCF valuation for FSNUY takes into consideration a long-term sales growth of no more than 1.5-2% per year, as well as expense increases at the same level. For NAV, I apply market-accurate 10-16X EBIT multiples to the various segments. Unlike with FMS, it doesn’t matter through which lens you view FSNUY.

If you look at FSNUY instead of FMS, you’ll see that the valuation, in any case, is better for the former than the latter. PE upside is over 45%, and on a NAV basis, the upside is close to 70%, even when I value Vamed at a very conservative 9.5X EBIT, and with the FMS wing as low-valued as it currently is.

Generally speaking, other analysts agree here. S&P Global considers FMS slightly undervalued with an average target of $35/share, meaning an upside of around 23%, but with only one “BUY” recommendation, reflecting the near-term uncertainty for the company’s prospects.

FSNUY?

Very different.

For the native FSNUY ticker FRE, the upside based on S&P global analyst averages is more than 43%, based on a current average of €44.5/share, with 8 out of 16 analysts either considering the company a “BUY” or “Outperform”. While we might quibble back and forth on the specific impairments, growth rates, multiples and other details, I believe the gist of this difference is accurate.

FSNUY is far more conservative than FMS due to the company’s appealing diversification. FSNUY provides you with more growth vectors than does FMS, and you also get to own FMS as part of the deal. FMS doesn’t have a significant dividend yield argument over FSNUY. In fact, for the native share, Fresenius yields a near-3% at the current €0.92/share for 2021 fiscal, which is at least 0.45% higher than the current yield for the FMS ticker.

Based on that, I see no reason to go for FMS instead of Fresenius, given that even though FMS doesn’t look like it based on its three-letter symbol, it’s actually a 0.5X ADR.

I personally invest in the native FRE ticker, and it would be my stance that other investors could consider doing the exact same.

The basic issue with both tickers is the same – we’re waiting for normalization.

But I believe that FRE offers a better avenue for you as an investor to wait for that normalization, given the substantially better diversification of the company’s top and bottom line.

For those reasons, I rate FRE/FSNUY higher than I do FMS.

Thesis

I hope, therefore, that this has been a somewhat illuminating article for you, if you were looking for a bit of a recent 1Q22 update on this great business.

FMS? Great business, 16-20% potential upside in the case of normalization, but overvalued on 2021-2022E results, and currently experiencing significant impacts in the top line, mortality and other avenues. Despite this, the share price is still around that 15x P/E line.

FRE/FSNUY? The overarching “parent” business that owns FMS, but comes with three separate and profitable segments, from biosimilar giant Kabi, to hospital managers/builders, Helios and Vamed. A decent dividend and solid diversification. Most importantly of all though, it’s valued almost 6-8X P/E lower than FMS. The upside, even just on the basis of normalization to forecasted results and a 15X P/E multiple in 2024E comes to over 110%.

Therefore, this is the better choice.

Fresenius is a tale of two tickers. I own both (but my position in FMS is minor).

Be the first to comment