Mihaela Rosu

An “ideal” bargain

At the end of this ugly year we want to look for bargains in the most unloved places, in the most unloved sectors. Even better, if this sector is facing more uncertain times than usual.

But our ideal investment candidate would obviously be isolated from all or at least much of the turmoil afflicting its sector and geography. Most ideally it would profit from prospected changes, while the market is not yet fully aware of these benefits.

I believe freenet (OTCPK:FRTAY) (OTCPK:FRTAF) perfectly fits the bill.

In times of high inflation, the telecom sector is unloved for good reasons: Telcos carry huge debt burdens, usually have enormous personnel and face gigantic investment needs, while interest rates are skyrocketing. In addition, their pricing power is limited. While customers don’t care much about a $100 price increase on the newest iPhone, a few additional dollars on top of monthly telco bills are usually met with an uproar of disgust.

freenet operates in the telecom sector, but with low fixed-rate debt, high returns on invested capital, little investment needs and with the capability to piggyback on the overall industry’s foreseeable price increases.

Last but not least, freenet operates in Germany, whose stock market has been hit by a nearby war, very justified recession and even de-industrialization fears, as the country depended on a mafia state for half of its energy needs and its economy is still depending quite a bit on an increasingly authoritarian China. A lot will have to change in Germany over the next few years, but a few things will probably remain stable: one of these is the need for telecom services.

Yet one massive change – totally unrelated to the political issues described – will come to the German telecom sector, as in 2024 the current three players will become four again, since United Internet (OTCPK:UDIRY) (OTCPK:UDIRF) is building a new 5G network from scratch based on the Open-RAN technology. Clearly, investors are afraid of a price war, given that the new player will want to fill its network as rapidly as possible by stealing market share from the established players.

I believe the market is wrong to project a price war, as the opposite is far more likely. Anyway, with stable or higher pricing, freenet will be able to profit from the changed environment.

Why freenet is special

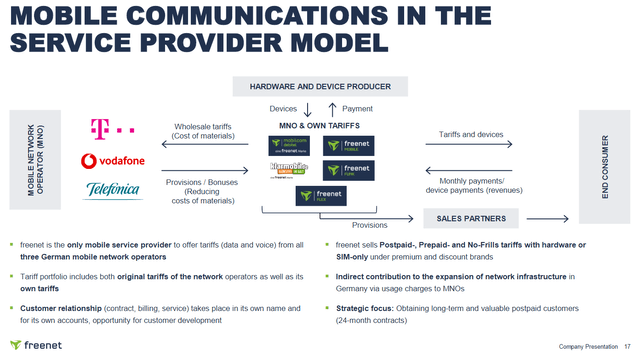

freenet has a unique business model: While it is often considered a MVNO – and this mistaken view is part of my thesis – it actually is a service provider. The differences are important: A MVNO pays wholesale prices for its telco partner’s network capacity and resells this capacity to its own customers. In contrast, freenet resells the “real” telcos’ own tariffs and also creates its own tariffs which use all networks. Importantly, freenet keeps all customer relationships in-house, services these clients through its own customer service and is seen as a marketing and servicing partner by the telcos themselves. In many smaller towns there is only one Main Street telco shop – which is freenet’s, as it would be uneconomical for the MNOs to keep their own shops in such places.

freenet business model (Company presentation)

For a quick overview, take a look at the recent company presentation. The most recent earnings release (Q3/22) is here, and the 2021 annual report can be found here.

Current key data:

|

Share price |

€19.40 |

|

Market cap |

€2.3B |

|

Shares outstanding |

118.9m |

|

EBITDA (2022e) |

€470m |

|

FCF (2022e) |

€245m |

|

Net bank debt |

€441m |

|

EV |

€2.7B |

|

EV/EBITDA |

5.7 |

|

Book value |

€12.20 |

|

Dividend (2022e) |

€1.65 |

|

Yield (2022e) |

8.5% |

|

ROE (4-year average FCF/equity) |

15% |

|

P/E (2022e) |

24 (due to a special, accelerated non-cash amortization charge) |

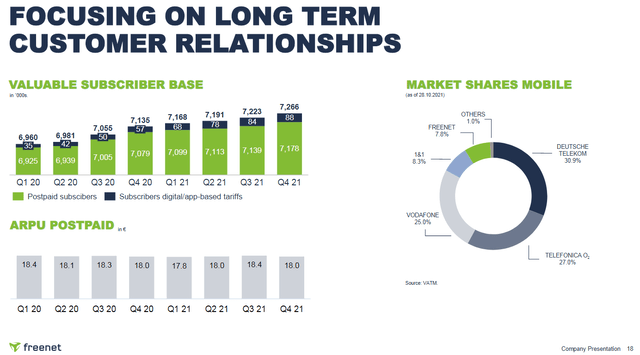

Customer relationships have been growing slowly, but steadily over the years (+10% total subscriber base over 4 years). freenet has currently an 8% market share of the German mobile communications sector.

freenet subscriber and market share data (Company presentation)

EBITDA has gone from €427m in 2019 to €470m (2022e).

FCF is usually north of 50% of EBITDA and is generally a bit higher than net income.

Gross profit margins have remained steady over the years at ~30%.

Capex requirements are usually low at around €40m/year.

Debt is below 2x FCF, largely fixed-rate and costs well below 2% on average.

There is a clear commitment to a dividend payout of 80% of FCF. The dividend will be paid out of a tax-specific deposit account, so the payment will be made without deduction of the otherwise annoyingly high German withholding tax and solidarity surcharge. freenet assumes that this will continue to be the case in the coming financial years as well. (Depending on your country’s tax laws, authorities might still consider the dividends as a reimbursement of acquisition costs when the position is sold, thus taxing the payout at a later point in time.)

Overall, freenet looks like a low-growth, stable, highly cash-generative business with limited reinvestment opportunities. This is why it pays out most of its profits or, from time to time, buys back its own shares opportunistically.

Current challenges and why they represent opportunities

1) Competition

Until a few years ago, Germany had 4 MNOs, then Telefónica (OTCPK:TELDF) and E-Plus merged, thus eliminating one player. However, as a condition for the merger, Telefónica had to sell 20% of its network capacity to a MVNO – Drillisch (now controlled by United Internet and called 1&1 Drillisch), which at the time was freenet’s only noteworthy competitor in the telecom service provider space. As a result, 1&1 started to market aggressively discounted tariffs and gained share. (It should be noted that this didn’t materially reduce freenet’s earnings, while 1&1 certainly stole some growth from it.)

As it turned out, the move was part of a larger plan: In fact, in 2018, United Internet shocked investors by announcing its intention to build a new 5G network from scratch, thus recreating a fourth network operator. Regulators looked favorably at the plans and made sure that, until the company will have completely built its network, it will be able to use Telefónica’s transmitters under a national roaming agreement.

1&1 crashed over 80% and is still drifting lower:

1&1 Drillisch price chart (Google)

This is what happens when a low-capex, high-dividend business similar to freenet changes its business model, becoming more or less a common mobile carrier. (I leave the question whether 1&1’s current price is justified to another article.)

United Internet’s strategy has confused markets and created enormous anxiety. Investors expect a price war, lower profit margins, and maybe even some bankruptcy in the sector. All competitive dynamics markets were used to are now up in the air.

Given that a smart operator like United Internet evidently feels it has to radically change its business model to stay afloat, even if this means the destruction of its market value, doubts regarding freenet’s business model mount. Yet freenet has always stated that it intends to keep its current, proven model and that it expects to do just as well as it did during the previous 4-player period in Germany.

So what are investors getting wrong?

Compared to freenet, United Internet is a much different business: Even before the 5G network initiative, it already owned a huge fiber optic network in Germany, operated web-hosting and cloud service providers and a highly profitable business software applications business. I can see why it believes it will need its own 5G network and cannot run its operations as efficiently by using another operator’s network capacity. (Let alone the fact that MVNO agreements are limited in time and renegotiated every now and then.)

Clearly, all network operators are currently converging: cable companies become wireless operators, wireless operators build fiber networks, everybody tries to bundle video streaming services on top, and there will be a bunch of additional services offerings to keep customers from churning to competitors. While United Internet can (or must) aspire to become a low-churn, integrated network operator, freenet has never been in this business.

United Internet acquired control of Drillisch in 2017 only as a means to access Telefónica’s mobile network capacity, which was just the first step of its long-term strategy to become an integrated multi-service network operator itself. It never intended to further develop Drillisch’s service provider business as a freenet-competitor. And in fact it will effectively destroy Drillisch’s legacy business, leaving freenet alone as the by far largest independent telecommunications service provider in Germany.

I highly doubt this will be bad for freenet.

2) Inflation and energy costs

Telcos have huge asset bases to maintain and expand (5G, fiber), while their debt costs are exploding. Especially in Europe, energy costs are skyrocketing and running a telco network requires a lot of electricity.

This will inevitably lead to higher service costs for customers. While price increases probably won’t be sufficient to maintain margins for the MNOs, freenet will have the benefit of a higher price level with little additional costs. It will face somewhat higher costs for personnel, but will largely avoid the effects of the energy crisis. Moreover, its debt is cheap, largely fixed-rate and comparatively low for the sector. Hence, it will also be mostly insulated from interest rate increases.

Finally, as a result of the MNOs’ price increases, tariff shopping will become more frequent, thus enlarging freenet’s opportunity to gain subscribers. This situation will become even more interesting once its only competitor in the service provider space, 1&1 Drillisch, will turn into a MNO. At the latest one year from now, 1&1 won’t be allowed anymore to resell other mobile operators’ tariffs, thus leaving the service provider market largely to freenet alone. (1&1 will still be able to resell other operators’ broadband tariffs, but this area has always been a minor contributor to freenet’s earnings and it remains to be seen how willingly the large telcos want to improve the bundle offered by an emerging competitor.)

As far as the much-feared price war is concerned, United Internet CEO Dommermuth himself already considered it to be unlikely before the recent inflationary pressure. It will be even more unlikely now that inflation has lifted all costs and he has learned how expensive his network construction will likely turn out.

Last but not least, 1&1 is expected to become one of freenet’s suppliers itself. First, because regulations require telcos to supply their tariffs to resellers. Second, most importantly, 1&1 will want to rapidly scale up and acquire subscribers. It won’t be able to afford losing freenet’s marketing channel and leaving it to its three main competitors.

As a result of all this, I expect freenet to acquire some additional bargaining power with all four telcos.

Waipu.tv

For a quick overview, see from slide 14 in the Q4/15 presentation and the 2017 CMD slide set.

Probably quite unique in the video streaming business, freenet managed to build a profitable streaming platform in very little time, while spending only a small amount of money. Its nascent TV/Media segment delivered €83m of EBITDA in the first 9 months of 2022 on €226m of revenues, while servicing 1.5m subscribers. freenet/Waipu.tv is the largest such platform in Germany alongside Deutsche Telekom’s (OTCQX:DTEGY) (OTCQX:DTEGF) Magenta TV/Magenta TV Sat. Telefónica has already decided to offer freenet’s platform instead of building its own. While the third competitor, Vodafone (VOD), offers its own platform, for technical reasons it can only be used by Vodafone customers. In contrast, everybody with an internet access can subscribe to MagentaTV and Waipu.tv.

Similarly to its approach to the telecom market, freenet tries a low-capex approach in the media space as well, trying to avoid large content spending, while leveraging its customer base and distribution muscle to collect retransmission fees from broadcasters. At the same time, it learns more about its customers which should provide a competitive advantage when it comes to marketing its phone tariffs or potentially other services (e.g. smart home, security).

freenet is upbeat about future growth and margins should be very attractive, as this is basically a software business. Whether the software runs on 1 or 3 million devices doesn’t increase the company’s fixed costs.

The market is clearly not attributing much value to this platform and, while not bad, growth has been slower than anticipated by management. Yet at the very least it represents an interesting lottery ticket, which won’t consume much capex, will contribute some earnings at least, and could become a huge long-term winner.

Risks

- Waipu.tv might fail to gain traction. While a “hockey stick” subscriber trajectory is certainly not priced in, a failure would still mean a loss of a cross-selling funnel and make it more difficult for freenet to grow. This issue is quite unpredictable, as multiple strong players are fighting for share and the technology itself is still developing.

- If one of the four MNOs loses to the others, it might fight a desperate price war before folding. This would clearly hit freenet as well. I would consider this risk to be rather unlikely, as the winning players would probably prefer to save, i.e. acquire, the losing one before destroying their profit base entirely. Since a 4-to-3 consolidation already has been allowed once by regulatory authorities, it would almost certainly be allowed again. Currently there is also a clear political interest in Germany to reduce network construction costs for operators as the existence of an efficient high-speed network is considered to be key to the German industry’s international competitiveness. (E.g. spectrum auction terms have been revised favorably.)

- Disintermediation: This is always an investor concern, but in my opinion shortsighted. Sure, MNOs might choose to boost their own special and discount tariff marketing. While annoying, this would not totally destroy freenet, as it would remain a marketing and resale partner for all MNOs. Moreover, the ~€200m of total profits from its activities are probably not worth the hassle for the bigger players. E.g. Deutsche Telekom might increase its German profits by ~1-2%, but only if it managed to take over all its customers from freenet and service them for the same cost. Yet in the process it would also risk market share losses, as competitors would likely profit from the occasion and offer freenet special tariffs to switch the Telekom customers to. (Remember that freenet owns all customer relationships.) Finally, on the recent Q3/22 call, freenet indicated that it now has a multi-year agreement with Deutsche Telekom, in contrast to previous agreements that needed to be renegotiated on an annual basis. This doesn’t seem like a huge disintermediation risk to me. Even the new Vodafone chairman apparently is

happy with the relationship. He thinks that we should not only continue, but also intensify, he is fully supportive to us having access to his cable network, we also spoke to whatever the plan in Fiber Corporation,… he will always want to include us there in the marketing and sales area.

Valuation

This year’s net income will be burdened by the accelerated write-down of a brand name acquired many years ago which freenet has decided not to use anymore. This is why this year the P/E looks high at first sight at 24x. Yet FCF is not impacted by the amortization.

freenet trades for less than 10x FCF(2022e) and a dividend yield of ~8.5% (2022e). This is cheaper than the average German small- and mid-cap which is trading for over 12x earnings. Moreover, what is special about this opportunity is the comparatively low downside potential: freenet is a far superior business, whereas the German small- and mid-cap space is full of highly cyclical industrials and real estate companies (following a price and construction bubble fuelled by the zero-interest-rate environment) that are facing tough choices given the upcoming recession and Germany’s need to decouple from cheap Russian energy and to some extent even from an increasingly authoritarian China. Especially considering that freenet will likely become a net inflation profiteer, while having zero Russia or China exposure, its multiple looks a bit unfair to me.

Sure it looks like a low-to-zero growth business at first sight, but in addition to my expectation of the explained benefits from likely higher pricing and the changing competitive environment, there also is waipu.tv that could provide some reason for improved growth expectations.

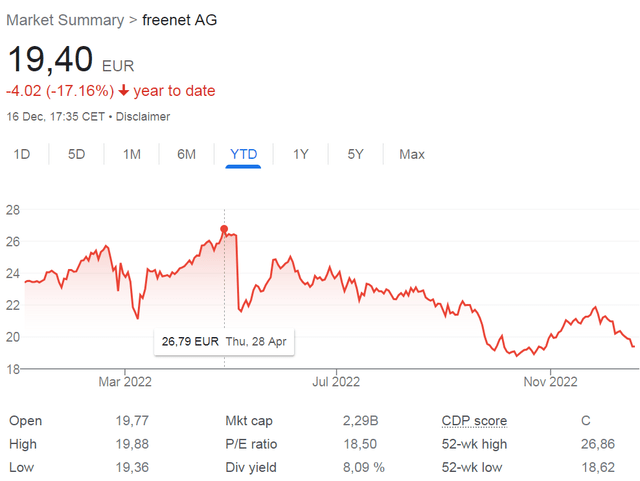

Before the dividend is paid out in May, we usually see a rally in the stock. As recently as seven months ago – which means well after the war/inflation/energy crisis had started – the stock traded for €27 – i.e. 37% above its current level, for a still modest FCF(2022e) multiple of 13x. I believe this kind of multiple expansion will be easy to achieve within a few months, since the Q3/22 conference call was pretty upbeat and 2022 results seem largely to be “in the bag”. Furthermore, the company said it was very much on track to reach its mid-term targets in 2025 (>€260m total / €2.19 per share of FCF in 2025). So there is no fundamental deterioration whatsoever compared to last May – quite the contrary.

From a fundamental point of view, it is hard to see much downside from here. Sure, markets can trade very erratically in the short-term and freenet is no exception. Trading is likely dominated by retail investors and dividend funds, which may try to “window-dress” their year-end reports, thus selling their “dogs” late in the year. This might provide an additional margin of safety for fundamentally oriented investors.

Short- and mid-term price movements aside, I can see much more upside for freenet if its streaming business gains traction or if the mentioned benefits from greater telco competition or higher pricing/more frequent tariff switching materialize. At that point, with improved growth prospects, the stock could completely re-rate to a 10x EBITDA multiple or higher (it traded for >13x EBITDA just four years ago), which would lead to a stock price of €36+ (84% upside + dividends).

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment