kanawatvector

Introduction

As a dividend growth investor, I constantly seek additional opportunities to acquire income-producing assets. My portfolio contains several dozens of dividend-paying companies. Sometimes I add to my current holdings when I find them to be attractively valued. On other occasions, I start new positions as it helps me to diversify myself further and gain exposure to new industries and markets.

In the last several weeks, I covered several asset managers. I own T. Rowe (TROW) in my portfolio. I also analyzed BlackRock (BLK), Blackstone (BX), and SEI Investments (SEIC). I find this sector very lucrative as wealth grows together with the economy in the long run, and asset managers help clients manage their wealth. In this article, I will analyze another peer, Franklin Resources (NYSE:BEN), whom I have followed over the last several years.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Franklin Resources is a publicly owned asset management holding company. The firm provides its services to individuals, institutions, pension plans, trusts, and partnerships through its subsidiaries. It launches equity, fixed income, balanced, and multi-asset mutual funds through its subsidiaries. The firm invests in public equity, fixed income, and alternative markets. Franklin Resources, Inc. was founded in 1947 and is based in San Mateo, California, with an additional office in Hyderabad, India.

Fundamentals

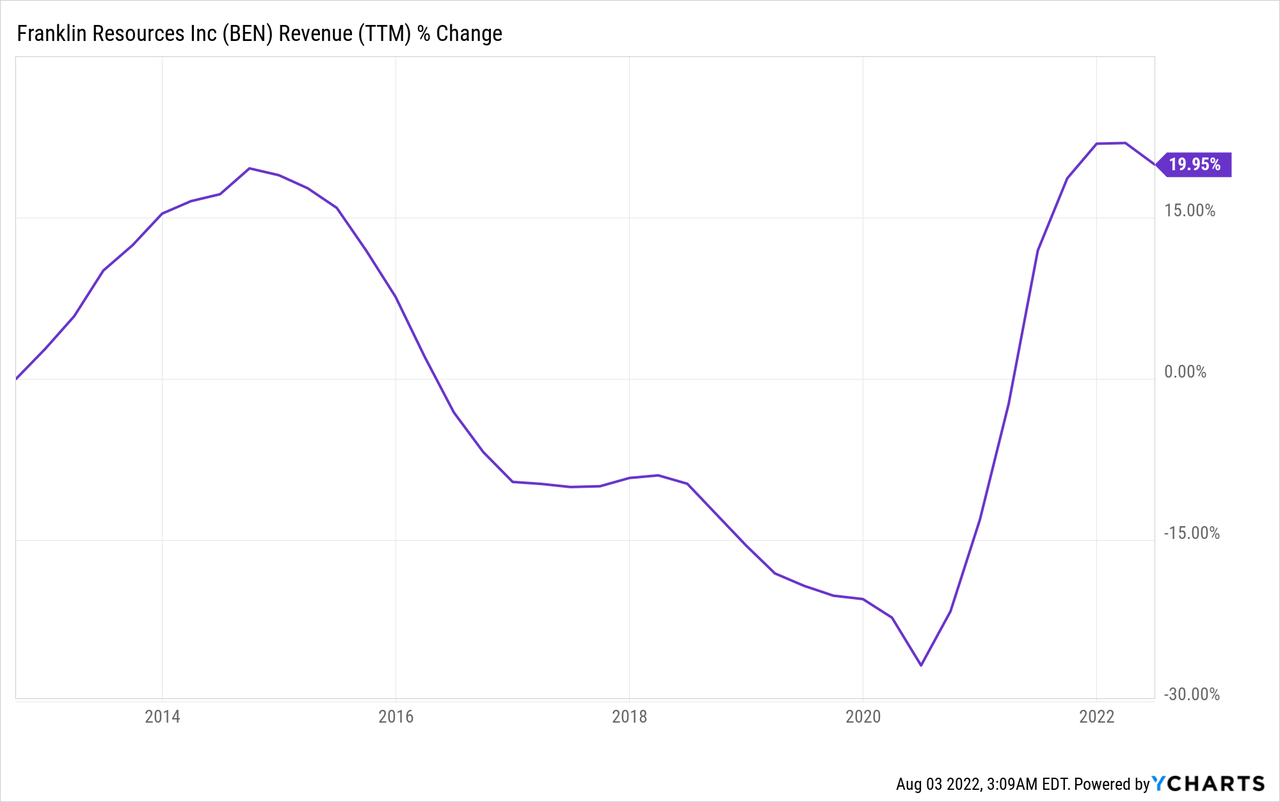

Over the last decade, sales of Franklin Resources have seen minimal organic growth. In the previous ten years, the revenues have been up 20%, mainly due to the company’s acquisitions that allow it to diversify further and increase its AUM (assets under management). Yet, the company should find an organic and sustainable path for growth. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Franklin Resources’ sales to decline at an annual rate of ~4% in the medium term.

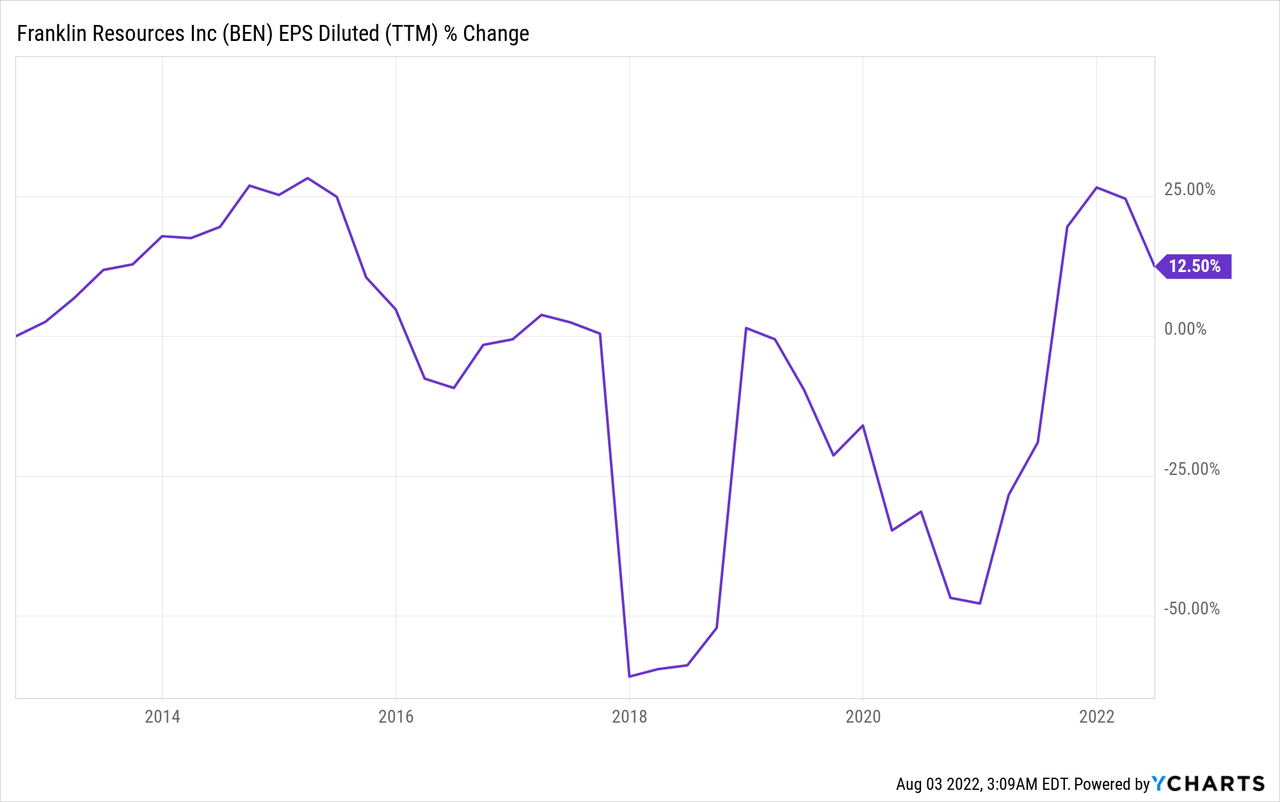

The EPS (earnings per share) has grown even slower than the revenues. It happened even though Franklin Resources have been buying back its stock. Over the last decade, the EPS has increased by 12.5%. The operating margin decreased in the previous decade. Thus, the EPS grew slower than the revenues. The company still seeks a path to organic growth. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Franklin Resources’ EPS to decline at an annual rate of ~5% in the medium term.

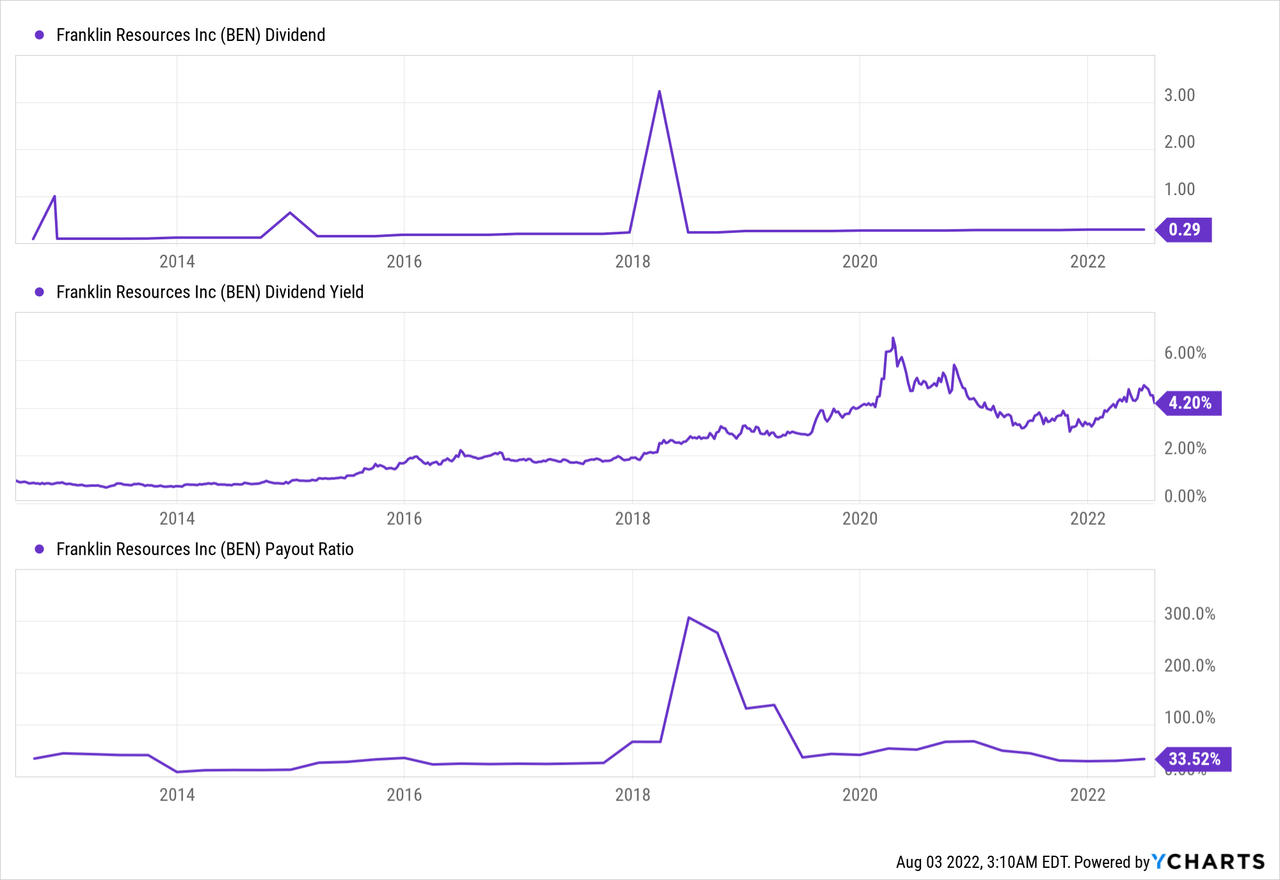

Franklin Resources is a dividend aristocrat that has been increasing its annual dividend for more than 40 years. The dividend payment seems safe, as the company is paying only a third of its EPS in dividends. The yield is attractive at 4.2%, the highest yield besides the brief moment during the pandemic’s beginning. Investors should expect low to mid-single digits increases as the company struggles to grow.

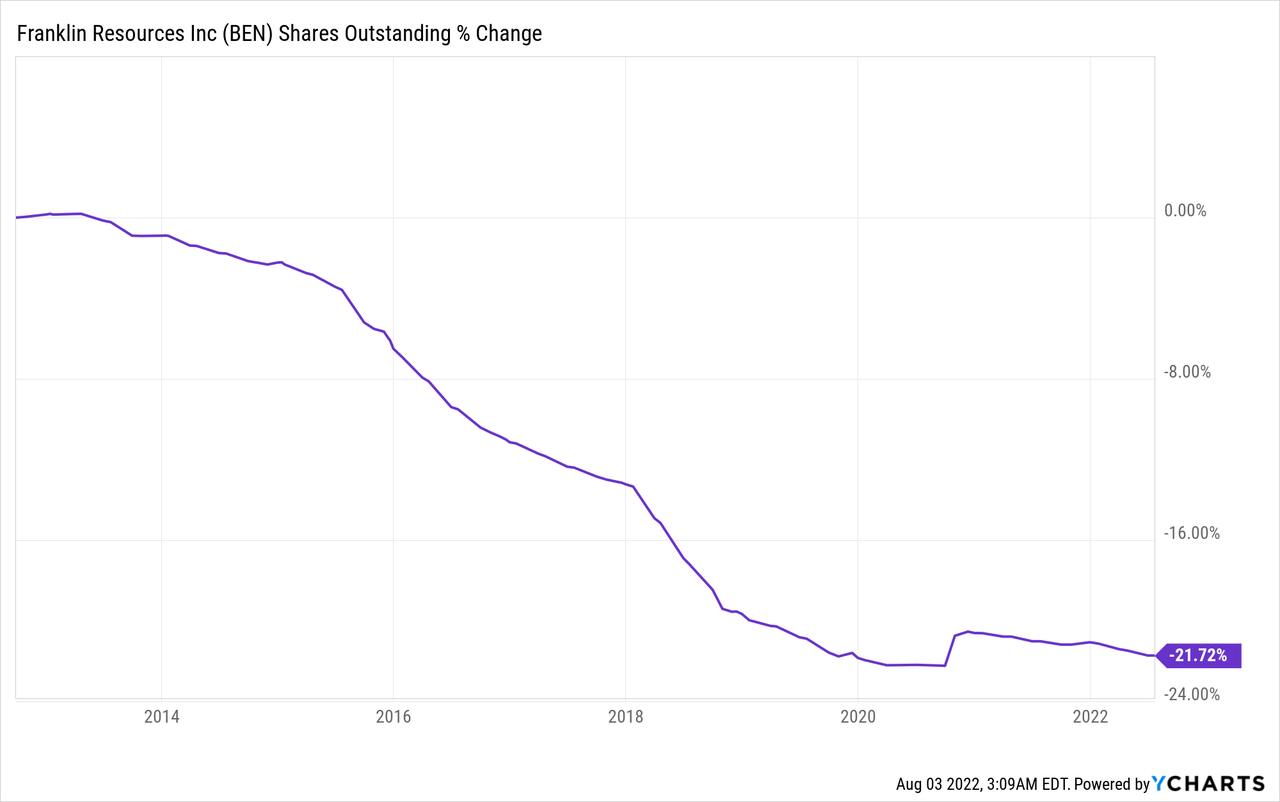

In addition to dividends, companies reward their shareholders with buybacks. Buybacks supplement EPS growth and are highly effective when companies are growing. The number of shares has decreased by more than 20% over the last decade. Without these buybacks, Franklin Resources would have suffered from declining EPS. However, when the company seeks growth and cannot deliver, the excess cash flow may be better used to ignite additional growth in organic and inorganic ways.

Valuation

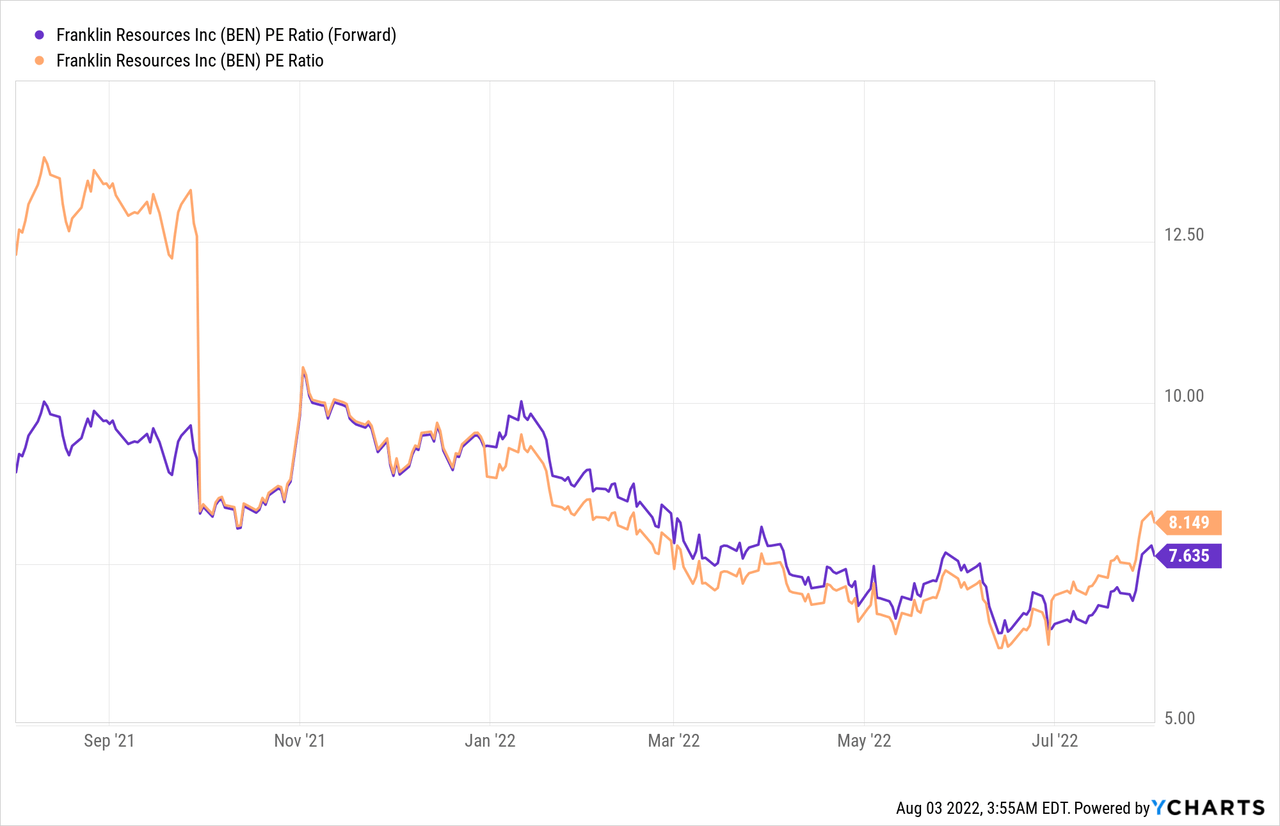

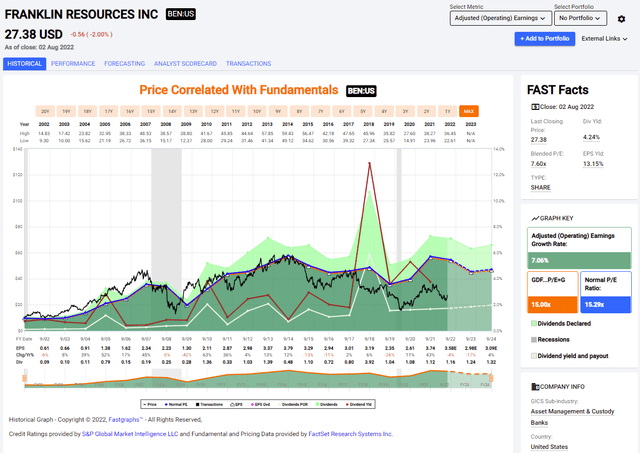

The P/E (price to earnings) ratio of Franklin Resources has been declining steadily. The current P/E ratio when looking at the 2022 forecasted EPS is 7.6, and when using the actual 2021 EPS, it’s 8.15. The company seems very attractive at the current price, with its valuation depressed. However, this may be a bit misleading as the EPS is forecasted to decline in the medium term, and the company struggles to grow.

The graph below from Fastgraphs tells the story well. Until 2014, when Franklin Resources reached its all-time high EPS, the company was trading for its average P/E ratio of 15. Since then, the company has struggled to find a path for growth. Therefore, it now sells for roughly half its average valuation. The reason is that Franklin Resources doesn’t achieve its average growth rate of 7%. As long as the company’s EPS continues to decline, there is a low likelihood of significant valuation expansion.

To conclude, Franklin Resources suffers from weak fundamentals that continue to deteriorate. The sales and the EPS barely grew in the last decade, and the forecasts are even grimmer as they expect them to decline further as the company seeks growth. The attractive valuation results from the high risks of deteriorating fundamentals, and the company has to prove it can reach growth to justify the investment.

Opportunities

Alternative assets are a path for growth for Franklin Resources. Competing with passive funds, which buy the entire index is challenging. The companies seek alternative assets that are less liquid and require more expertise. Through its subsidiary, Benefit Street Partners, Franklin Resources manages almost $40B in alternative assets. These assets are less correlated to the market and allow asset managers to offer added value.

The company announced the acquisition of Alcentra in May 2022. The company is a British asset manager focused on managing alternative assets in Europe, as only ~15% of its assets are in the United States. This acquisition will allow Franklin Resources further to increase its exposure to the alternative assets business. It will also enable the company to gain exposure to European assets and offer solutions to European clients.

Another growth opportunity for the company’s wealth management unit and mutual funds is another growth opportunity. According to the Q3 report, investment performance resulted in 35%, 49%, 69%, and 73% of the strategy AUM outperforming their respective benchmarks on a 1-, 3-, 5-, and 10-year basis. The stock market is volatile in the short term and unpredictable, but long-term investors capitalize on the company’s ability to pick stocks well.

Risks

The competition is a substantial risk for Franklin Resources, especially as it’s struggling to achieve growth. The company is competing with giant companies that offer cheap ETFs and index funds and with other asset managers such as Blackrock, T. Rowe, and Blackstone. Its inability to grow means it is losing market share, and recovering it may be costly as client acquisition takes time and money in this business.

The second risk is a short-term risk, the high market volatility we are experiencing right now. Market volatility scares investors, and they flee to safer assets. It also decreases the AUM as the market value of the assets is declining. Therefore, the market volatility is hurting the company’s EPS and revenues in the short term. The company struggled to grow when the markets were booming, making it even harder.

The last risk is another long-term risk, and it is the fact that investors prefer low-fee index funds over high fees actively managed funds. Like most of its peers, Franklin resources focus on actively managed funds. The company will have to perform exceptionally well and keep executing its investment strategy to beat the market and justify the current fees. It is a challenge as the passive competition pressures fees downward.

Conclusions

Investors in Franklin Resources will enjoy an extremely attractive valuation. However, this valuation comes due to weak fundamentals that are getting weaker. The company does have some growth opportunities for the future, but it also has several significant risks as the industry is highly competitive, and investors seek cheap reliable investments.

Franklin Resources must prove that it can execute its strategy well to become an attractive investment. It plans to focus on wealth management and alternative assets and must show an ability to reach some organic growth. If it manages to do it, it will be attractive, but I believe Franklin Resources is a HOLD until it stabilizes.

Be the first to comment